ECB Policy Shift and Its Impact on Market Stability

The European Central Bank (ECB) plays a pivotal role in shaping the economic landscape of the Eurozone. As the central bank for countries using the euro, its monetary policy decisions are crucial for maintaining market stability. Recent policy shifts by the ECB have sparked significant attention, especially as investors seek to understand their implications on market dynamics.

Recent Policy Changes

In its latest monetary policy statement, the ECB announced adjustments to interest rates and asset purchase programs. These changes are aimed at addressing persistent inflationary pressures and supporting economic growth within the Eurozone. The ECB's decision to modify its policy stance reflects an adaptive approach to evolving economic conditions, with a focus on stabilizing prices and fostering sustainable growth.

Market Reactions

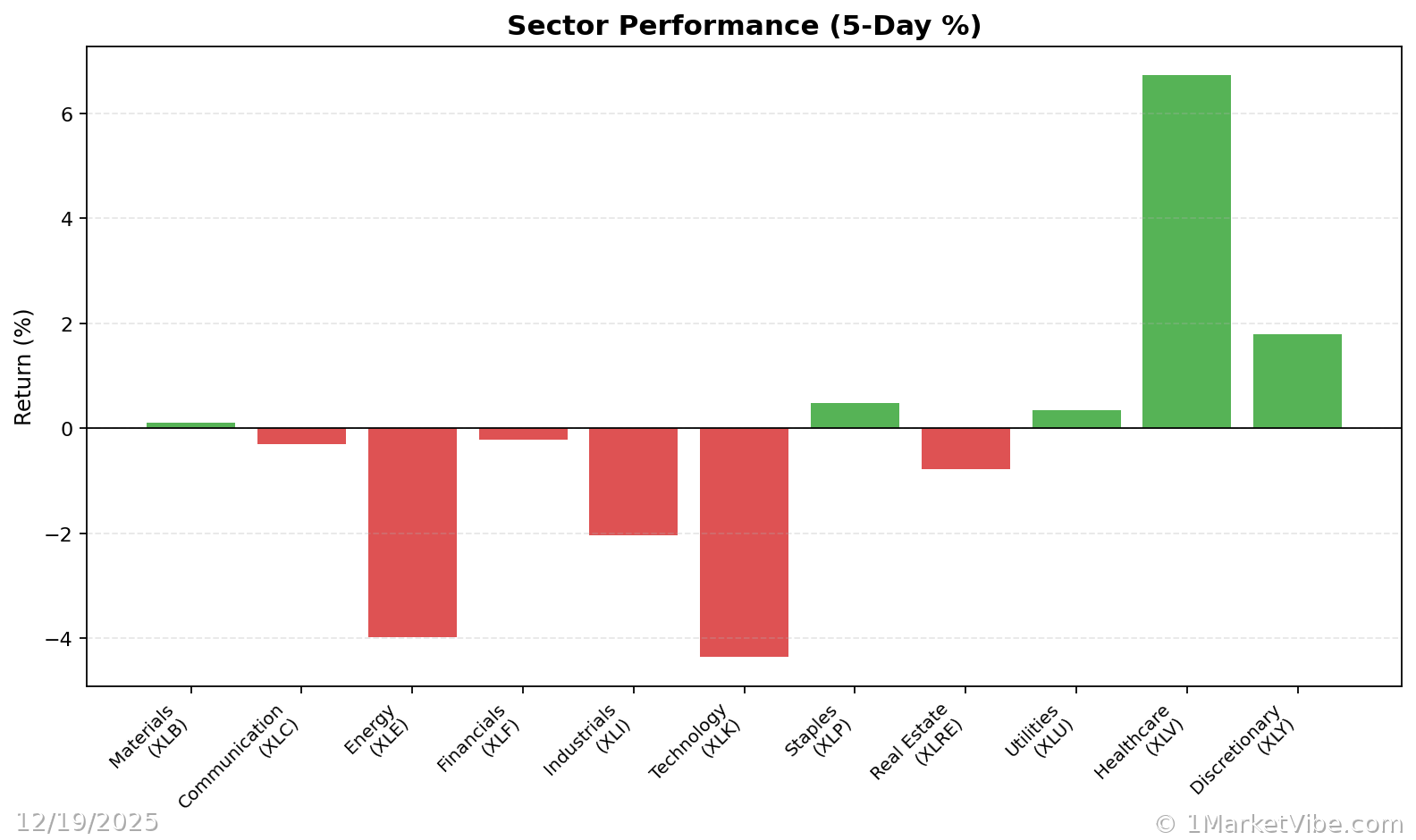

The immediate market response to the ECB's announcements was mixed. Equity markets showed volatility, with some sectors experiencing gains while others faced declines. Investor sentiment appeared cautious, reflecting uncertainty about the long-term impact of these policy changes. Trading patterns indicated a shift towards defensive assets, as market participants reassessed their risk exposure in light of the new monetary landscape.

Economic Indicators

Current economic conditions, including inflation rates and growth forecasts, have heavily influenced the ECB's policy decisions. Rising inflation has been a significant concern, prompting the ECB to take measures to curb price increases. Additionally, growth projections have been adjusted to reflect the potential impact of these policy shifts on economic activity. These indicators underscore the delicate balance the ECB must maintain between controlling inflation and supporting growth.

CW Index Insights

MarketVibe's proprietary Enhanced CW Index, currently at 6.21, provides a crucial lens through which to assess these developments. This index, on a 0-10 scale, offers a 4-6 week early warning of potential market corrections by tracking institutional gold flows and market breadth. With the current reading below the 7.0 warning threshold, it suggests a moderate risk environment. Historically, when the CW Index reached 7.1 in March 2023, markets experienced an 8.3% decline, highlighting its predictive power. Investors should monitor the CW Index closely, particularly if it trends towards the 6.5 level, which could signal increased market volatility.

Learn more about how CW Index works at 1marketvibe.com.

Risk Considerations

The ECB's policy changes introduce several potential risks. Market volatility may increase as investors adjust to the new monetary environment. Additionally, the possibility of further inflationary pressures or economic slowdowns could exacerbate market instability. Investors are advised to exercise caution and consider diversifying their portfolios to mitigate these risks.

Expert Opinions

Economists have offered varied insights into the ECB's direction. Some view the policy shift as a necessary step to combat inflation, while others express concerns about its potential impact on economic growth. Predictions for future monetary policy adjustments suggest a continued focus on balancing inflation control with economic support, albeit with a cautious approach.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions for investors.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 6.21, indicating moderate risk.

- Overall market status: Yellow flag, suggesting caution.

- Key metric to watch: CW Index movement towards 6.5.

📚 Learn (2-Minute Deep Dive)

The ECB's recent policy shift is a response to persistent inflation and evolving economic conditions. By adjusting interest rates and asset purchases, the ECB aims to stabilize prices while supporting growth. Historical parallels, such as the March 2023 scenario where the CW Index hit 7.1, demonstrate the potential for significant market corrections following such policy changes. Investors should monitor key economic indicators, including inflation and growth forecasts, to better understand the implications of the ECB's decisions. The current situation matters because it reflects a broader trend of central banks adapting to global economic challenges, which could influence market stability in the coming months.

⚡ Act (Specific Steps)

- Diversify Portfolio: Consider reallocating assets to include defensive sectors that may benefit from increased market volatility.

- Monitor CW Index: Pay close attention to the CW Index, especially if it approaches the 6.5 level, which could indicate heightened risk.

- Adjust Risk Exposure: Reduce exposure to high-risk assets and consider hedging strategies to protect against potential downturns.

- Stay Informed: Regularly review economic indicators and ECB announcements to stay ahead of market trends.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The ECB's policy shift underscores the dynamic nature of monetary policy and its impact on market stability. By understanding the implications of these changes and utilizing tools like MarketVibe's Enhanced CW Index, investors can better navigate the evolving economic landscape. As always, maintaining a balanced approach and staying informed are key strategies for managing risk and optimizing investment outcomes.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a financial advisor for personalized guidance.

Charts