US Stocks Reach Record Highs Amid Hidden Risks

As the holiday season unfolds, U.S. stocks have reached new record highs, with the S&P 500 rising by 0.3% and the Dow Jones climbing 0.6% on a holiday-shortened trading day. However, beneath these celebratory figures lie potential risks that investors should not overlook. MarketVibe's proprietary Enhanced CW Index, a critical tool for gauging market stability, currently reads 5.7 on its 0-10 scale. This level is below the 7.0 warning threshold, indicating moderate risk but suggesting vigilance is warranted.

Market Overview

The recent uptick in stock indices reflects a buoyant market, yet the light trading volume—just 1.8 billion shares on the NYSE—suggests that many investors have already closed their positions for the year. This could mask underlying vulnerabilities. Historically, when the CW Index approached higher levels, such as 7.1 in March 2023, markets experienced an 8.3% decline. The current reading of 5.7 suggests a stable environment, but the gold flow component of the CW Index provides a 4-6 week early warning of potential corrections, urging caution.

Key Drivers

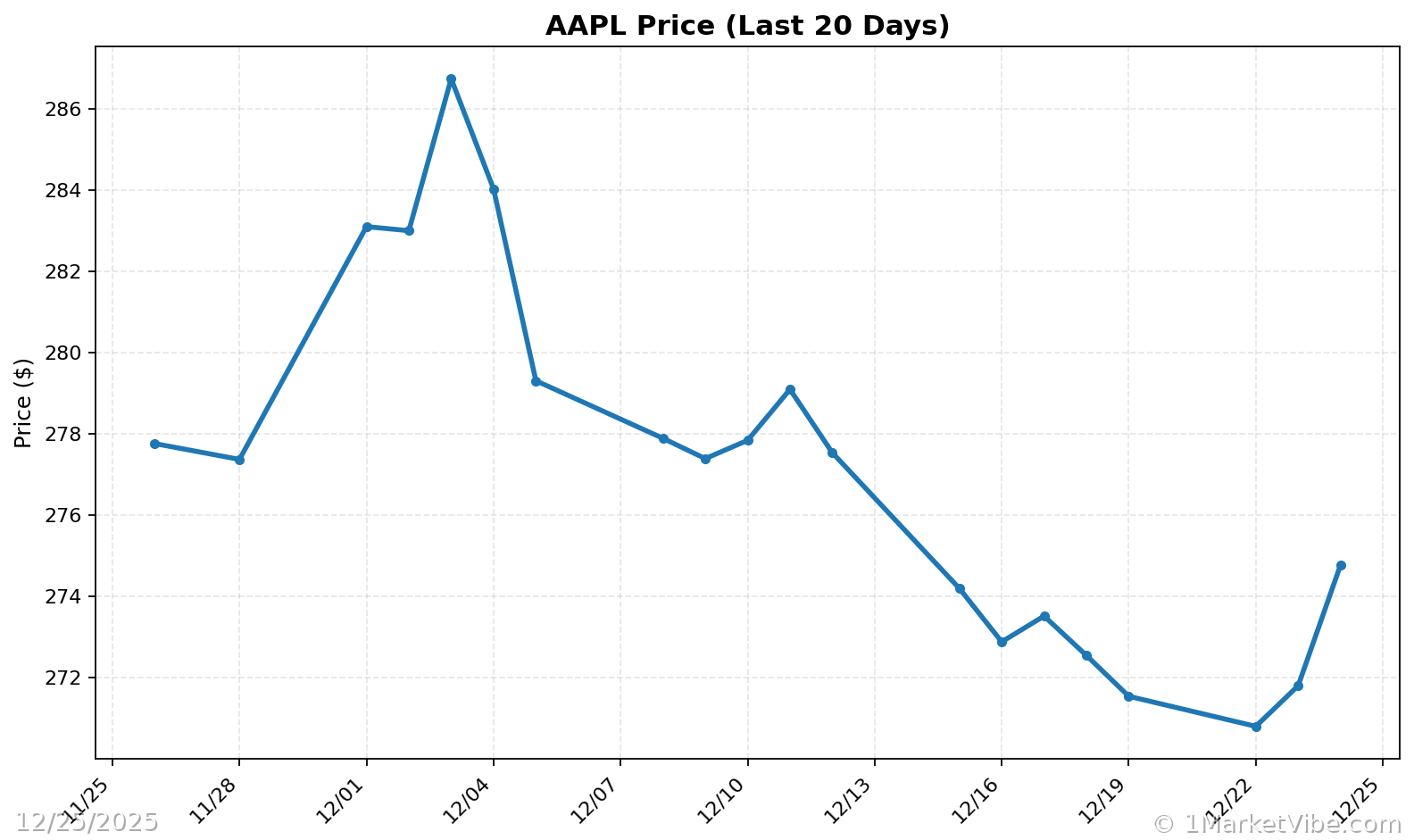

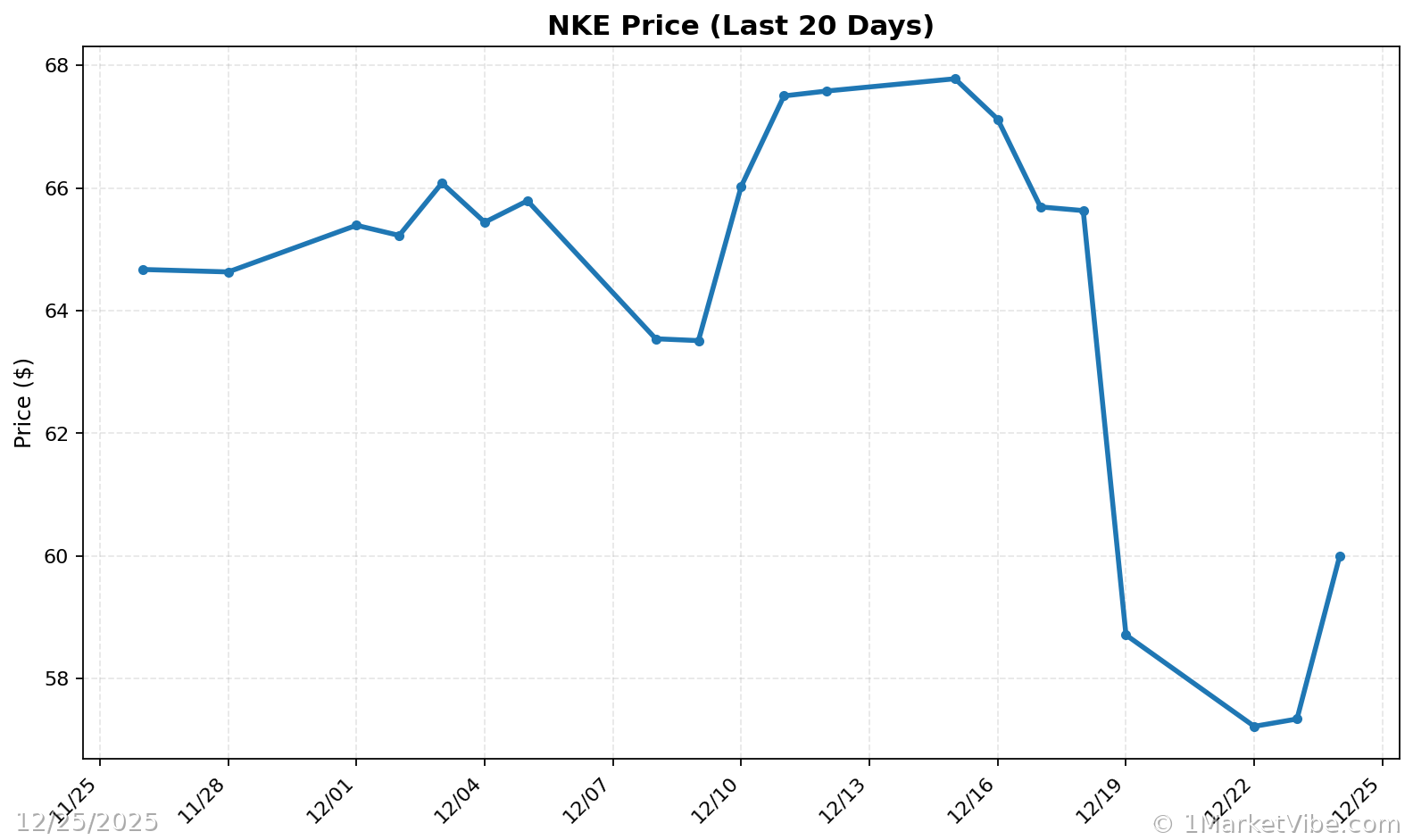

Recent insider buying, notably Apple CEO Tim Cook's $3 million investment in Nike, indicates confidence in select sectors. However, these moves may reflect seasonal patterns rather than fundamental strength. The CW Index suggests that while current market conditions appear stable, the potential for volatility remains, especially as economic indicators send mixed signals.

Economic Context

Despite record stock prices, consumer confidence is waning, with concerns about inflation and economic stability. The U.S. economy grew at a robust 4.3% annual rate in the third quarter, yet this growth is juxtaposed with a slowing labor market and weakened retail sales. These mixed signals align with MarketVibe's CW Index, which tracks institutional gold flows to provide early warnings of market shifts.

Investor Sentiment

Current market sentiment is neutral, reflecting uncertainty. This aligns with CW Index signals, which have historically predicted market movements with precision. Investors are advised to monitor the CW Index closely; a shift above 6.5 could indicate increased risk.

Risks Ahead

The holiday trading environment may obscure deeper market vulnerabilities. As economic conditions evolve, potential volatility could arise, particularly if the CW Index trends upward. Investors should remain vigilant and consider the broader economic landscape when making decisions.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework helps investors turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- CW Index reading: 5.7, indicating moderate risk.

- Market status: Yellow flag—caution advised.

- Key metric to watch: CW Index movement above 6.5.

📚 Learn (2-Minute Deep Dive)

The current market highs are tempered by underlying risks. Historically, similar CW Index readings have preceded market corrections. For instance, when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month. The gold component of the CW Index provides a crucial 4-6 week early warning, suggesting that while immediate risks are moderate, vigilance is necessary.

Investors should monitor economic indicators closely, particularly consumer confidence and labor market data. These factors, combined with the CW Index, can offer insights into potential market shifts. Understanding these dynamics is essential for informed decision-making.

⚡ Act (Specific Steps)

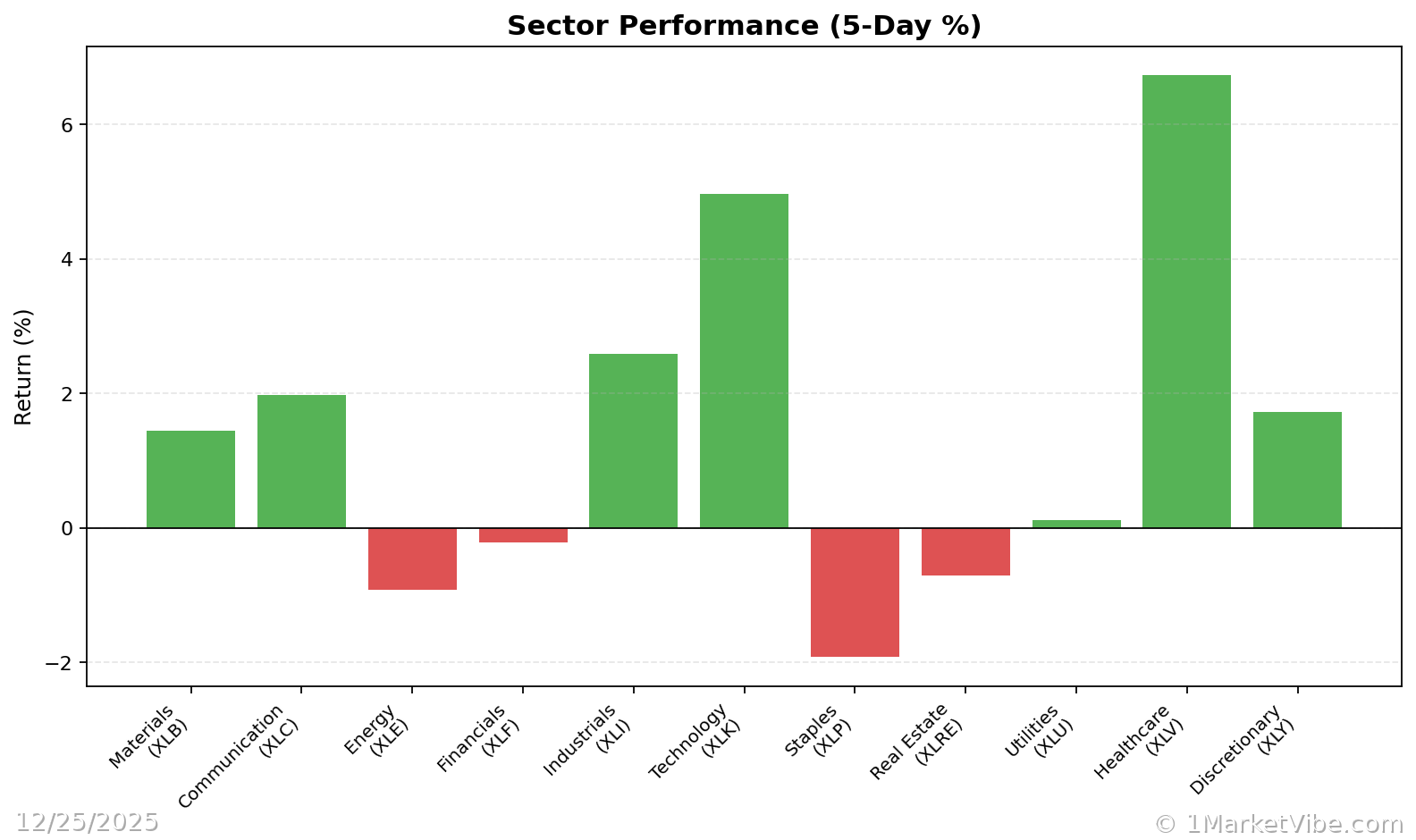

- Reassess Portfolio Allocations: Consider reducing exposure to high-risk sectors if the CW Index trends upward.

- Implement Hedging Strategies: Use options or inverse ETFs to protect against potential downturns.

- Monitor Economic Indicators: Pay attention to consumer confidence and labor market reports for signs of economic shifts.

- Stay Informed: Regularly check the CW Index updates for early warnings of market corrections.

For real-time alerts and comprehensive insights, access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

While U.S. stocks celebrate record highs, the underlying risks highlighted by MarketVibe's Enhanced CW Index should not be ignored. Investors are encouraged to remain vigilant and leverage MarketVibe's tools to navigate the complexities of the current market environment. Understanding the broader economic landscape is crucial for making informed investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts