US Economy Surges as CW Index Issues Investor Strategy Warning

- Authors

- Name

- MarketVibe Team

- @1marketvibe

US Economy Surges as CW Index Issues Investor Strategy Warning

The U.S. economy has experienced a remarkable surge, growing at its fastest pace in two years with a GDP increase of 4.3%. This robust growth is a testament to strong consumer spending and economic resilience. However, amidst this economic upswing, MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, currently reads 5.9. This level, while below the critical 7.0 warning threshold, suggests moderate risk, urging investors to remain vigilant.

Learn more about how CW Index works at 1marketvibe.com.

Current Economic Landscape

The current reading of 5.9 on MarketVibe's Enhanced CW Index indicates a cautious optimism in the market. While the index is not yet at a level that signals imminent correction, it serves as a reminder of potential volatility. Historically, when the CW Index reached 7.1 in March 2023, markets subsequently fell 8.3%. This predictive capability, particularly with its gold flow component, offers investors a strategic advantage by providing early warnings of market shifts.

MarketVibe's CW Index suggests that while the economy is currently robust, investors should watch for any upward movement in the index. A rise above 6.5 could indicate increasing risks, warranting a reevaluation of market positions.

Consumer Trends Impact

Consumer behavior continues to play a pivotal role in driving economic growth. According to insights from The Wall Street Journal, unexpected consumer trends are shaping market dynamics, with implications for future economic performance. These trends underscore the importance of monitoring consumer sentiment as a key economic indicator.

MarketVibe tracks these shifts closely, integrating them into its Enhanced CW Index to provide a comprehensive view of market conditions. As consumer spending remains strong, it supports the current economic expansion, but investors should remain aware of potential shifts in consumer confidence that could impact market stability.

Trade Relations Context

The ongoing trade dynamics between the U.S. and China add another layer of complexity to the economic landscape. Recent reports from the Financial Times highlight the Trump administration's stance on tariffs and trade practices, which could influence future economic policies and market reactions. These geopolitical factors are integral to MarketVibe's analysis, as they can significantly affect market breadth and investor sentiment.

Historical Context

Looking back, the current GDP growth rate of 4.3% is a significant improvement compared to previous periods of economic expansion. This growth aligns with historical patterns where strong consumer spending has driven economic upswings. However, past cycles also remind us of the potential for corrections, as seen when the CW Index previously signaled downturns.

MarketVibe's proprietary system, built by investors for investors, leverages these historical insights to provide actionable intelligence. By understanding past economic cycles, investors can better navigate current market conditions.

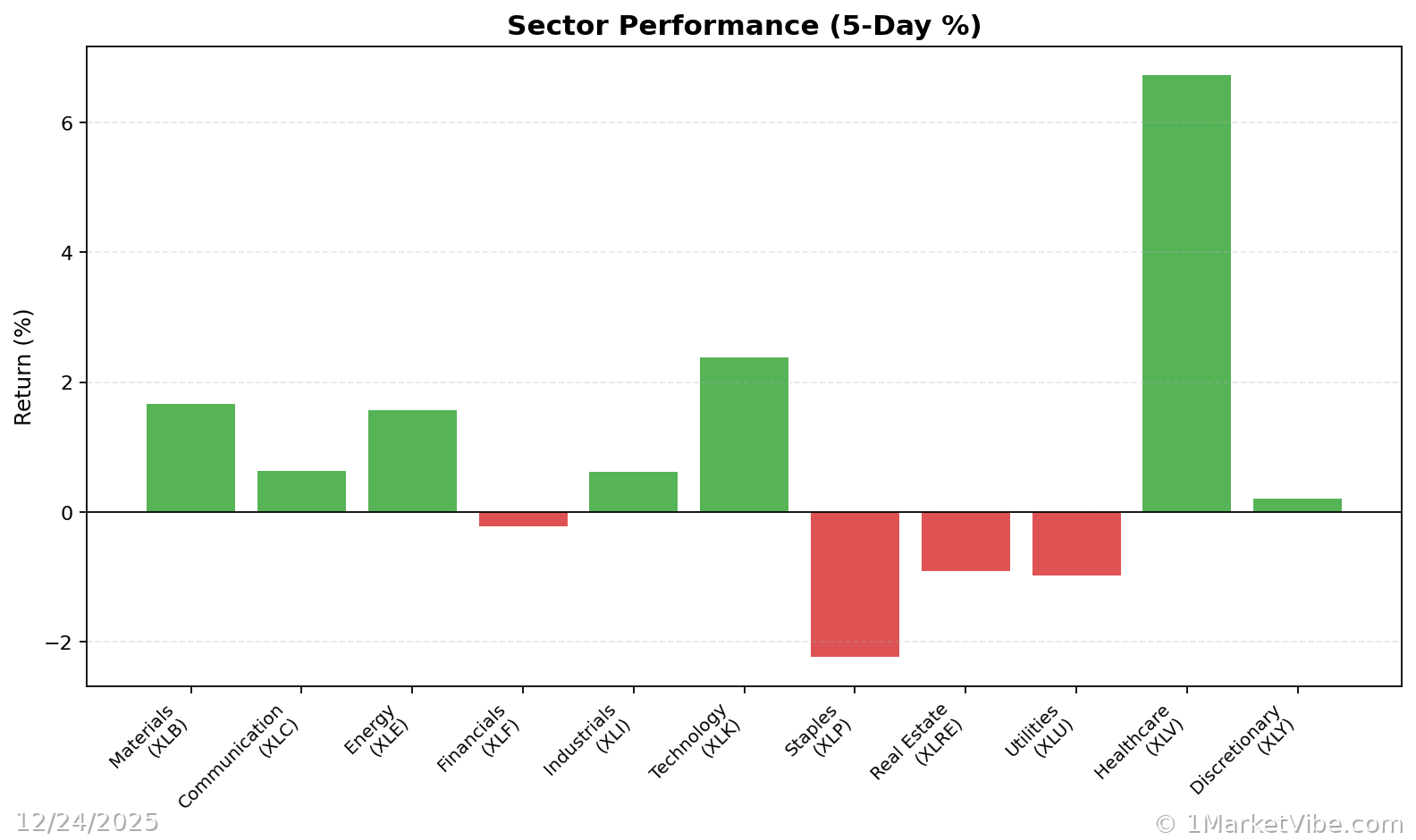

Market Implications

The recent GDP growth may bolster investor sentiment, but it also introduces potential risks. MarketVibe's CW Index at 5.9 suggests that while the market is not in immediate danger, investors should consider strategic adjustments. The index's gold component offers a unique early warning, allowing for proactive risk management.

Investors should remain cautious, particularly if the CW Index trends upward. Monitoring position sizes and adjusting risk exposure in affected sectors can mitigate potential losses. MarketVibe's data-driven insights empower investors to make informed decisions in this dynamic environment.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- CW Index Reading: 5.9, indicating moderate risk

- Market Status: Yellow flag

- Key Metric to Watch: CW Index movement above 6.5

📚 Learn (2-Minute Deep Dive)

The current economic surge, driven by consumer spending, presents both opportunities and challenges. While the GDP growth of 4.3% is encouraging, the CW Index's moderate risk level suggests caution. Historical parallels, such as the market correction following a 7.1 index reading in 2023, highlight the importance of vigilance.

Investors should monitor geopolitical developments, particularly U.S.-China trade relations, as these could impact market conditions. The Enhanced CW Index's gold component provides a 4-6 week early warning, offering a strategic advantage in anticipating market shifts.

⚡ Act (Specific Steps)

- Diversify Portfolios: Allocate no more than 20% to high-risk sectors.

- Monitor CW Index: Increase hedging strategies if the index approaches 6.5.

- Review Positions: Adjust holdings in response to geopolitical developments.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The U.S. economy's impressive growth offers a promising outlook, but MarketVibe's Enhanced CW Index at 5.9 serves as a strategic warning. By leveraging MarketVibe's proprietary tools, investors can navigate these complex market conditions with confidence. Monitoring economic indicators and adjusting strategies accordingly will be crucial in the coming weeks.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts