Nvidia's $20 Billion Groq Acquisition: Transforming AI Technology Dynamics

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Nvidia's $20 Billion Groq Acquisition: Transforming AI Technology Dynamics

Nvidia's recent acquisition of Groq for a staggering $20 billion marks a significant shift in the AI technology landscape. This deal, the largest in Nvidia's history, is set to redefine competitive dynamics in the AI sector. As investors digest this monumental transaction, MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, currently stands at 5.7. This level is below the 7.0 warning threshold, indicating moderate risk in the market environment.

The acquisition is a strategic move by Nvidia to bolster its AI capabilities, integrating Groq's low-latency processors into its AI factory architecture. This integration aims to enhance Nvidia's platform to support a broader range of AI inference and real-time workloads. As Nvidia continues to expand its footprint in the AI domain, MarketVibe's CW Index suggests investors should remain vigilant, especially if the index approaches the critical 7.0 level. Learn more about how CW Index works at 1marketvibe.com.

Deal Details

The Groq acquisition involves a non-exclusive licensing agreement, allowing Groq to continue operating independently while its key personnel join Nvidia. This strategic move is designed to advance and scale Groq's technology, positioning Nvidia to leverage Groq's innovative AI solutions. The $20 billion cash deal underscores Nvidia's commitment to maintaining its leadership in the AI sector, following previous acquisitions that have strengthened its technological arsenal.

This acquisition is not just a financial maneuver but a calculated step to integrate cutting-edge AI technology, ensuring Nvidia remains at the forefront of AI innovation. MarketVibe's proprietary system highlights the importance of such strategic acquisitions in maintaining competitive advantage, as seen when the CW Index hit 7.1 in March 2023, leading to an 8.3% market decline.

Market Reactions

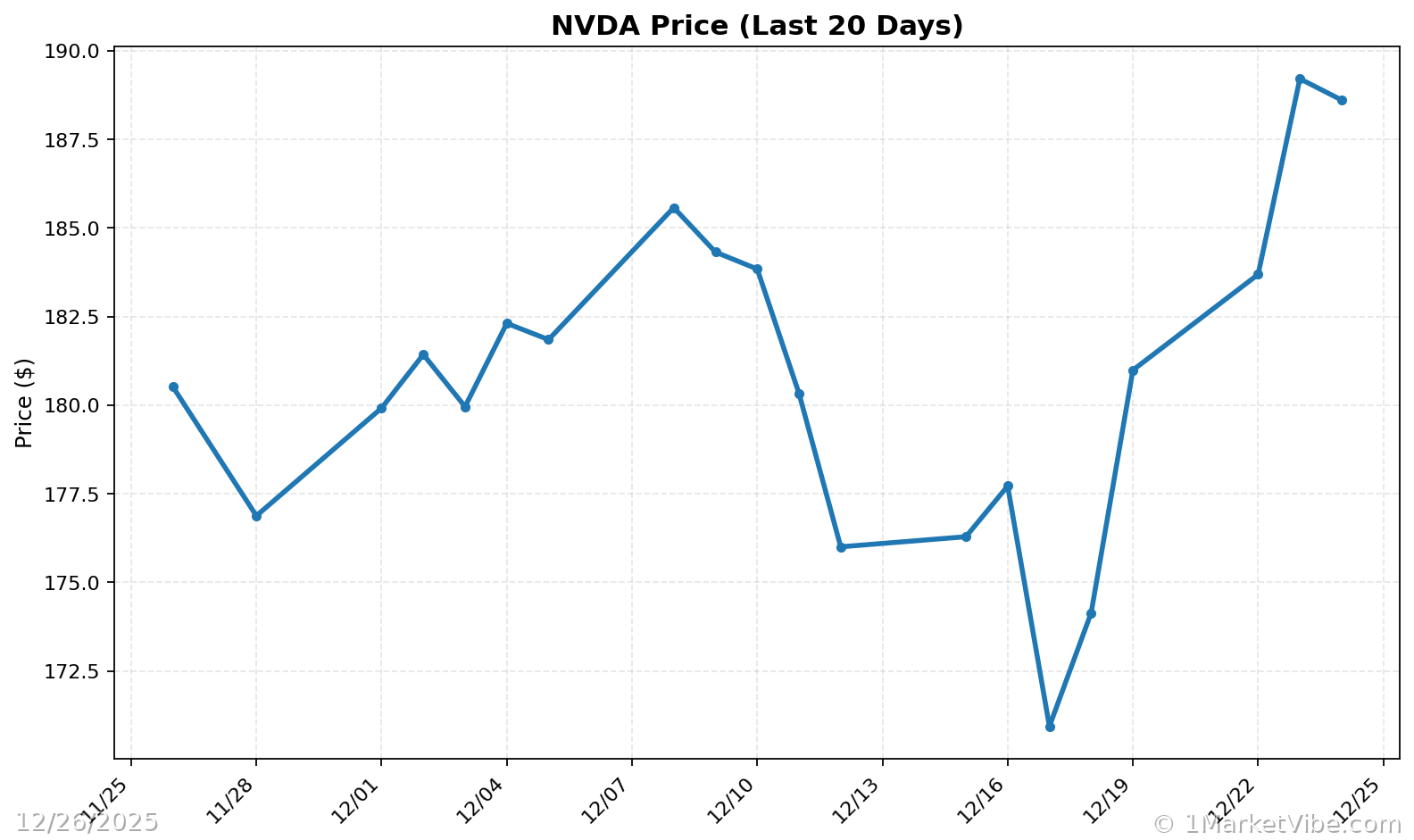

Investor response to the Groq acquisition has been cautiously optimistic. Nvidia's stock experienced a modest uptick following the announcement, reflecting confidence in the company's strategic direction. Analysts predict that this acquisition will solidify Nvidia's market position, potentially driving further stock appreciation.

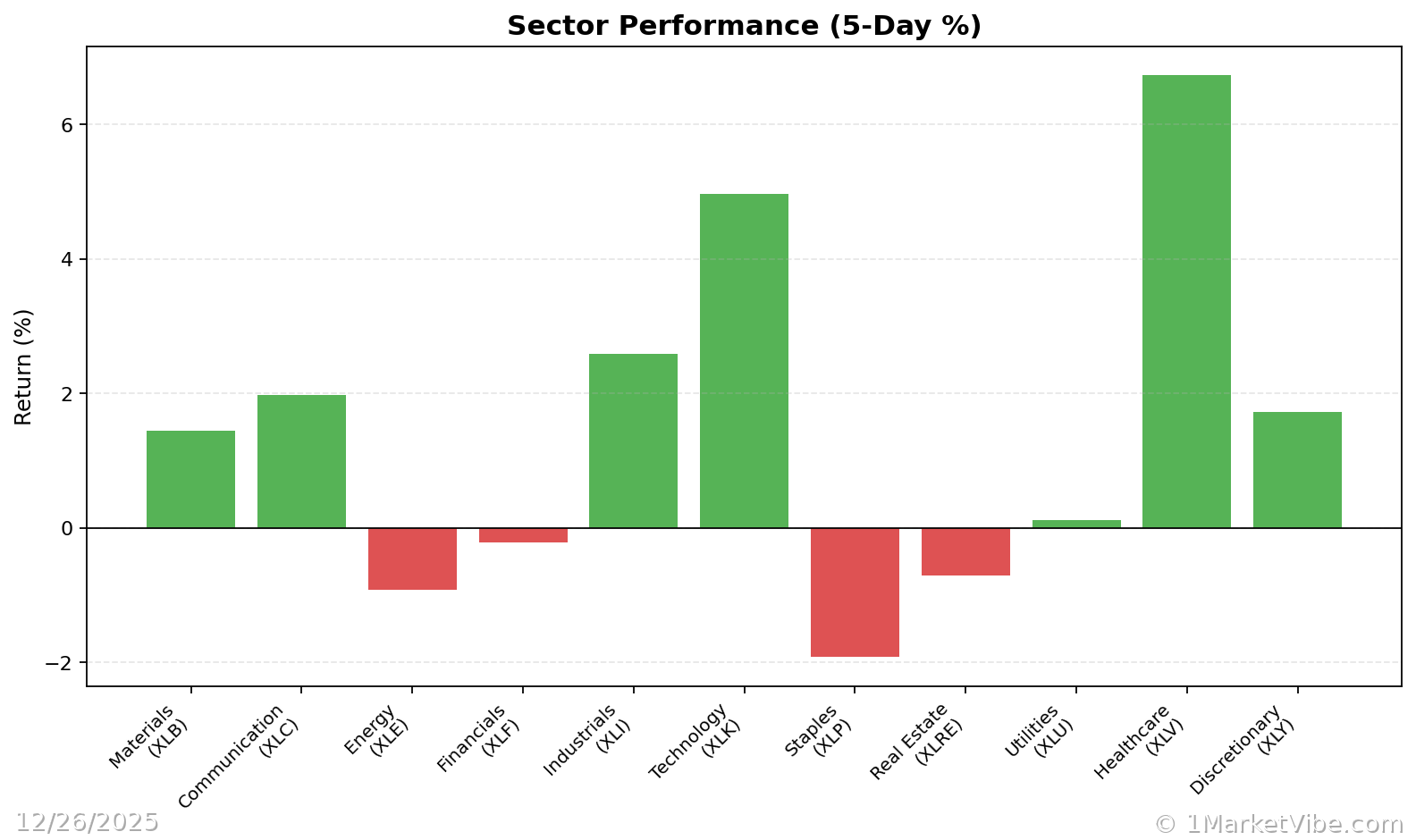

However, MarketVibe's CW Index at 5.7 indicates that while the market is currently stable, investors should monitor any fluctuations closely. Historical patterns show that significant acquisitions can lead to volatility, especially if the CW Index trends towards the 6.5 threshold, which could signal increased market risk.

Competitive Landscape

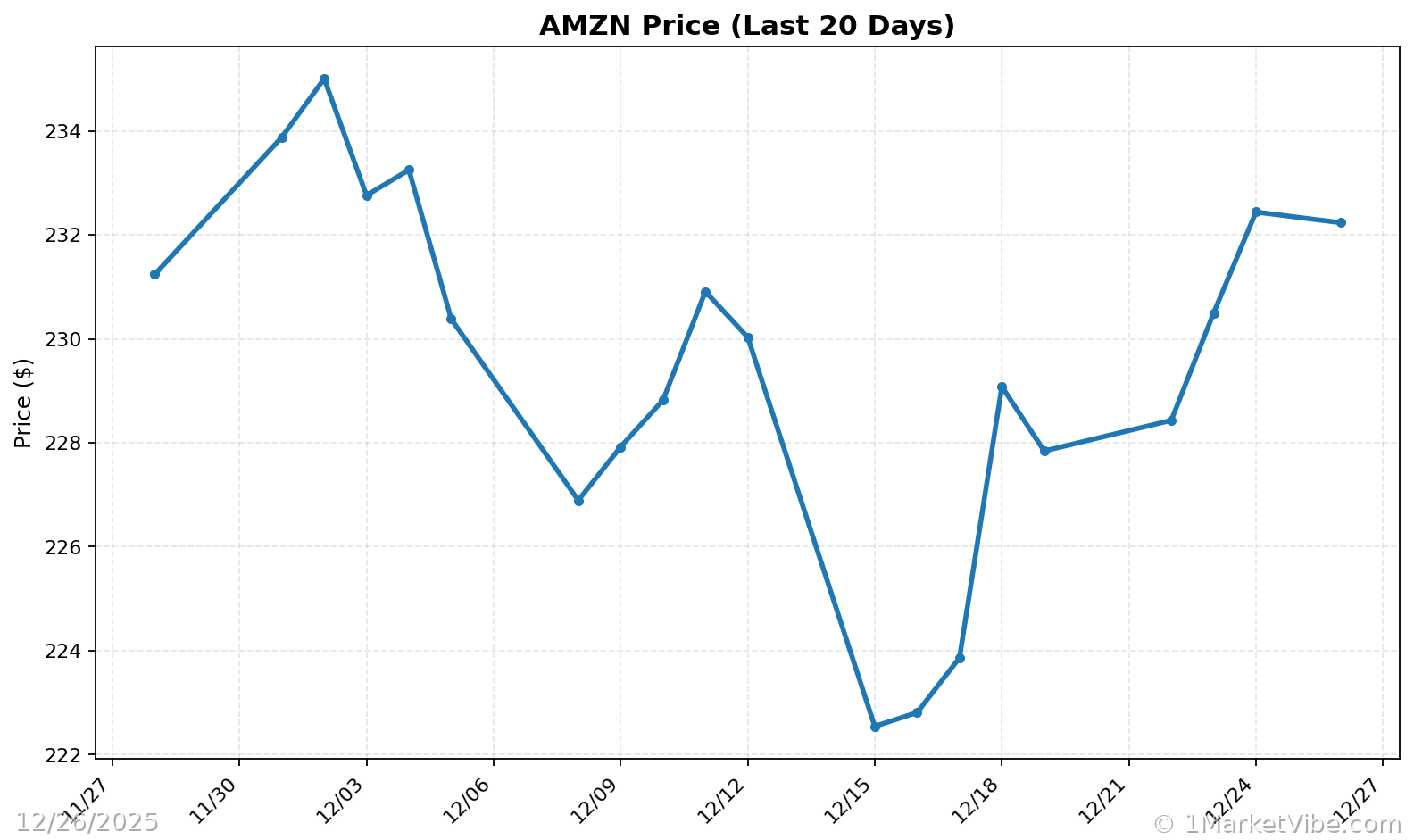

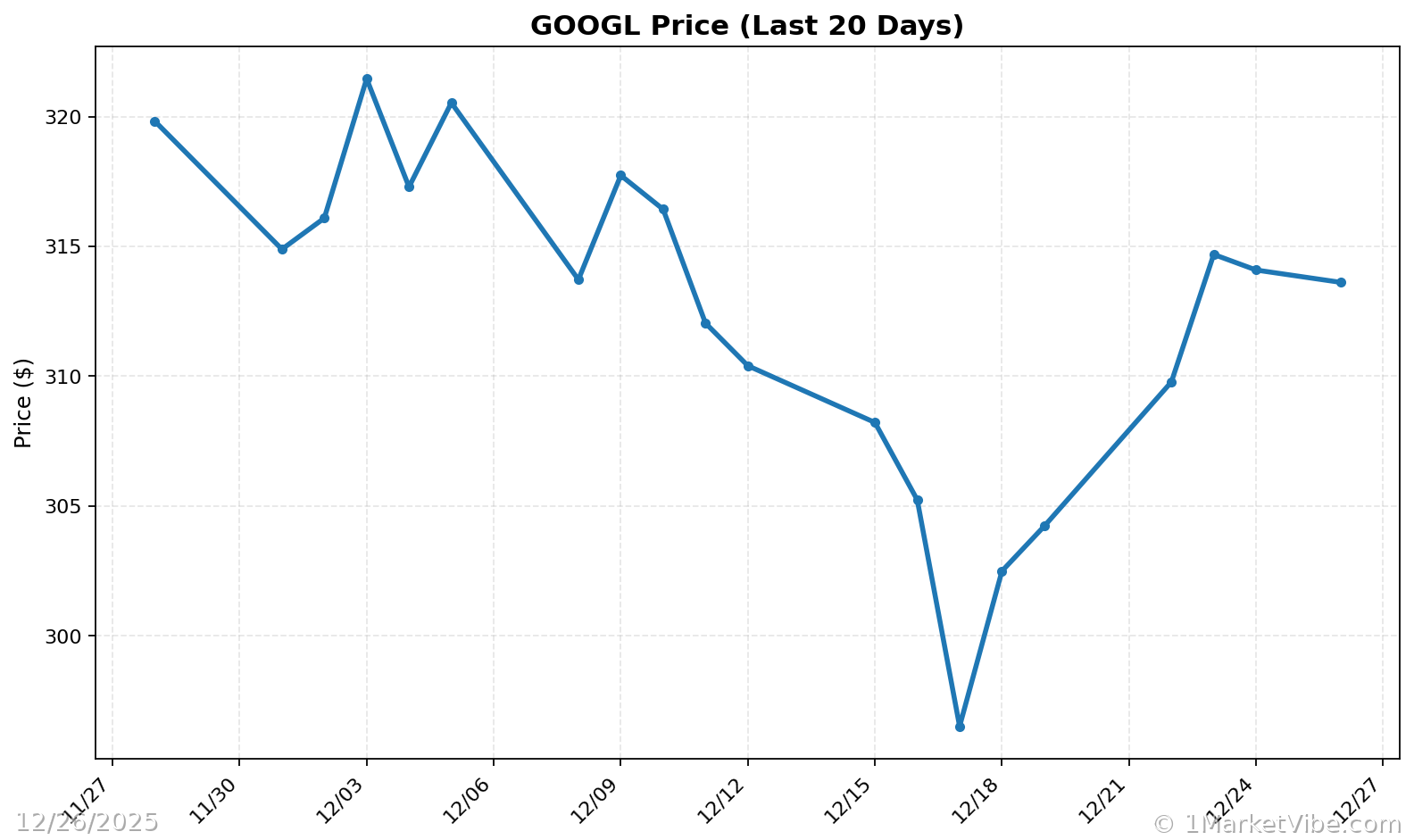

The acquisition of Groq positions Nvidia to further dominate the AI market, challenging rivals like Google and Amazon. By integrating Groq's technology, Nvidia aims to enhance its competitive edge, although some analysts argue that the deal maintains the "fiction of competition" in the AI sector.

According to MarketVibe data, the competitive landscape in AI is rapidly evolving, with major players continuously seeking technological advancements to outpace rivals. The gold component of the CW Index provides a crucial early warning, allowing investors to anticipate potential shifts in market dynamics.

Long-term Implications

In the long run, Nvidia's acquisition of Groq could lead to significant advancements in AI technology development. This move is likely to influence investor sentiment, fostering market optimism as Nvidia continues to innovate. However, the risks associated with market dominance, such as regulatory scrutiny and competitive pressures, remain.

MarketVibe tracks these developments closely, providing investors with actionable insights through its Enhanced CW Index. As Nvidia integrates Groq's technology, the potential for shifts in AI technology dynamics becomes increasingly significant, warranting careful monitoring by investors.

Expert Opinions

Industry analysts offer diverse perspectives on the impact of Nvidia's acquisition. Some view it as a transformative move that will drive AI innovation, while others caution against potential pitfalls, such as over-reliance on a single technology or regulatory challenges.

Built by investors, for investors, MarketVibe's tools are designed to help navigate these complexities. By leveraging the CW Index and Decision Edge™ Method, investors can make informed decisions in the face of evolving market conditions.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk.

- Overall market status: Yellow flag, suggesting cautious optimism.

- Key metric to watch: CW Index approaching 6.5.

📚 Learn (2-Minute Deep Dive)

Nvidia's acquisition of Groq is poised to shift AI technology dynamics significantly. Historically, large-scale acquisitions in the tech sector have led to market volatility, as seen when the CW Index reached 7.1 in March 2023, resulting in an 8.3% market decline. The current CW Index reading of 5.7 suggests a stable market, but investors should remain vigilant.

The integration of Groq's technology into Nvidia's AI architecture is expected to enhance its competitive position, potentially leading to increased market share. However, the deal's non-exclusive nature and the continued operation of Groq as an independent entity highlight the complexities of maintaining competitive balance in the AI sector.

⚡ Act (Specific Steps)

- Monitor CW Index levels: If the index approaches 6.5, consider adjusting risk exposure.

- Diversify investments: Allocate a portion of your portfolio to sectors less affected by AI market dynamics.

- Implement hedging strategies: Use options or other derivatives to mitigate potential downside risks.

- Stay informed: Regularly check MarketVibe for updates on CW Index movements and AI sector developments.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Nvidia's $20 billion acquisition of Groq represents a pivotal moment in AI technology dynamics. As the company integrates Groq's innovative solutions, the potential for significant advancements in AI technology is substantial. MarketVibe's Enhanced CW Index provides investors with a crucial tool for navigating these changes, offering early warnings and actionable insights.

By leveraging MarketVibe's proprietary systems, investors can make informed decisions, balancing opportunities with potential risks. As the AI landscape continues to evolve, staying informed and proactive is essential for maintaining a competitive edge in the market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts