Understanding Europe's $8 Trillion Trade Strategy and Its Market Implications

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Understanding Europe's $8 Trillion Trade Strategy and Its Market Implications

As Europe navigates its $8 trillion trade strategy, investors are keenly observing the potential market implications. This strategy, designed to bolster economic resilience, comes amid rising geopolitical tensions that could trigger significant market shifts. MarketVibe's proprietary Enhanced CW Index, currently at 5.7, serves as a critical tool in assessing these developments. This index, on a 0-10 scale, provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth. With a reading below the 7.0 warning threshold, it indicates moderate risk, yet investors should remain vigilant.

Current Market Context

The current CW Index reading of 5.7 suggests a stable yet cautious market environment. Historical patterns show that when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month. This underscores the importance of monitoring the index closely. Recent market reactions to geopolitical tensions, particularly in Europe, highlight the need for such foresight. As trade dynamics evolve, MarketVibe's CW Index provides a crucial early warning system, helping investors anticipate potential market corrections.

Learn more about how CW Index works at 1marketvibe.com.

Geopolitical Tensions

Europe's trade strategy is not occurring in a vacuum. Key geopolitical events, such as Brexit's ongoing ramifications and tensions with major trading partners, pose significant risks. Potential triggers for a trade war include tariff disputes and regulatory changes. These factors could disrupt trade relations, impacting market stability. MarketVibe's CW Index, with its gold component, offers a unique advantage by providing early warnings of such disruptions.

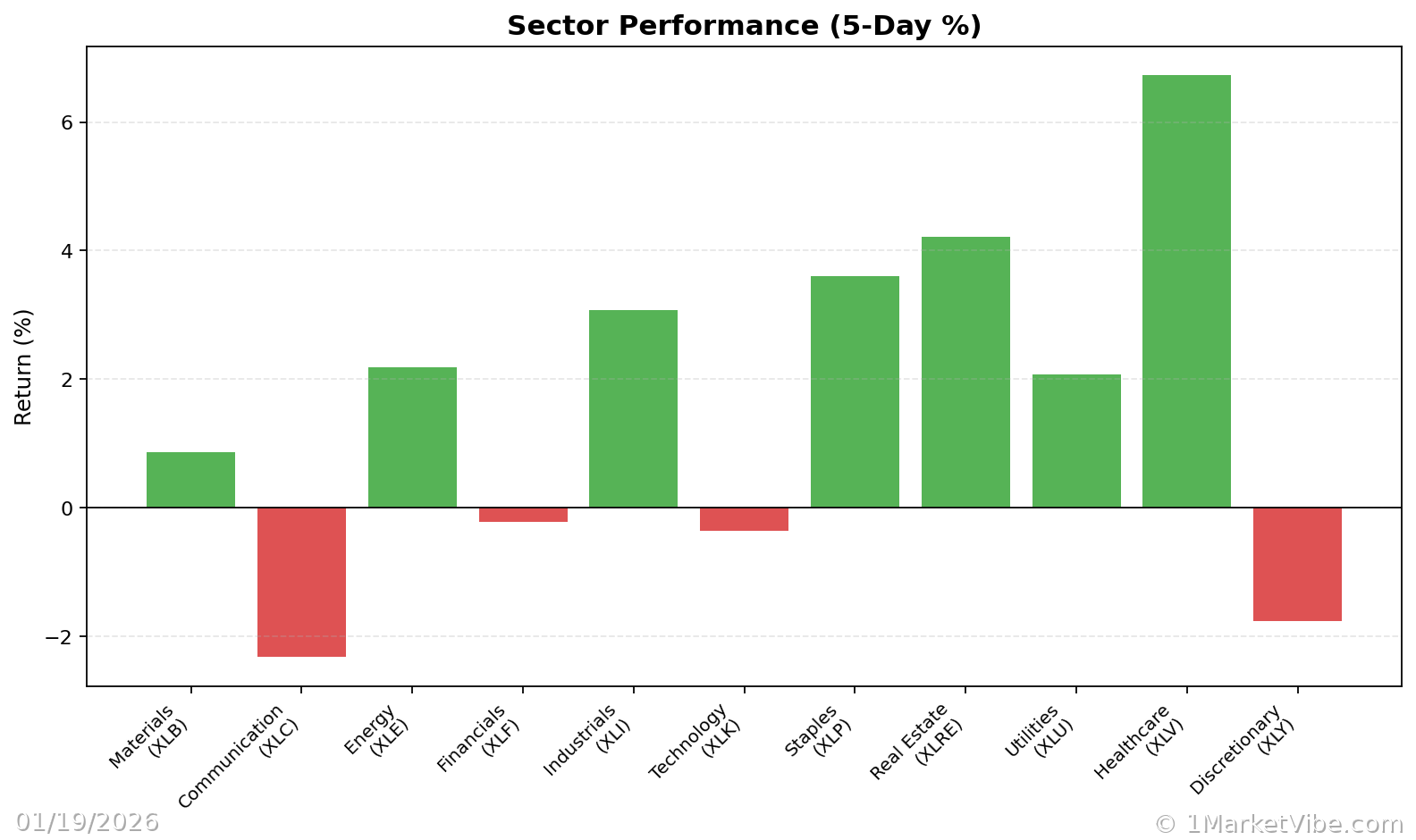

Impact on Industries

Certain sectors are particularly vulnerable to trade disruptions. Industries reliant on cross-border supply chains, such as automotive and technology, face heightened risks. For instance, European car manufacturers could see increased costs and supply chain delays. MarketVibe tracks these industry-specific risks, helping investors make informed decisions. Companies already affected by market volatility serve as case studies, illustrating the tangible impacts of geopolitical tensions on business operations.

Investor Strategies

Navigating potential market risks requires strategic foresight. Investors should closely monitor CW Index trends to make informed decisions. The index's current reading suggests a moderate risk environment, but shifts could signal the need for adjustments. MarketVibe's proprietary system, built by investors for investors, emphasizes the importance of early warning signals. By tracking CW Index movements, investors can better prepare for potential market corrections.

Historical Context

Comparing the current situation with past trade wars provides valuable insights. Historical parallels, such as the U.S.-China trade tensions, demonstrate the economic impacts of prolonged disputes. Markets often react with volatility, underscoring the importance of preparedness. Lessons learned from these events highlight the need for vigilance and strategic planning. MarketVibe's Enhanced CW Index offers a historical perspective, helping investors anticipate similar outcomes.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7 - indicates moderate risk

- Overall market status: Yellow flag

- Key metric to watch: CW Index movement towards 6.5

📚 Learn (2-Minute Deep Dive)

The current geopolitical landscape, combined with Europe's trade strategy, presents a complex scenario. Historical parallels, such as the U.S.-China trade war, show that prolonged disputes can lead to significant market volatility. Monitoring the CW Index is crucial, as its gold component provides a 4-6 week early warning of potential market corrections. Understanding these dynamics helps investors anticipate shifts and adjust their strategies accordingly.

Going forward, investors should watch for any increase in the CW Index towards the 6.5 level, which could signal heightened risk. The current situation matters because it affects global trade flows and economic stability. MarketVibe's proprietary system offers a unique advantage by providing early warnings, allowing investors to act proactively rather than reactively.

⚡ Act (Specific Steps)

- Diversify Portfolio: Reduce exposure to sectors vulnerable to trade disruptions, such as automotive and technology.

- Monitor CW Index: Set alerts for any movement towards 6.5, indicating increased risk.

- Hedge Positions: Consider hedging strategies to protect against potential market downturns.

- Adjust Allocations: Rebalance portfolios to favor sectors with stable outlooks, such as healthcare and utilities.

- Stay Informed: Regularly review MarketVibe's insights for updates on geopolitical developments and CW Index trends.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Europe's $8 trillion trade strategy, amid geopolitical tensions, presents both challenges and opportunities for investors. MarketVibe's Enhanced CW Index, currently at 5.7, provides a critical early warning system, helping investors navigate potential market risks. By leveraging MarketVibe's tools and insights, investors can make informed decisions and prepare for future market shifts. As always, staying vigilant and proactive is key to successful investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts