AI Chip Tariffs and Their Impact on Nvidia Amid US-China Trade Tensions

- Authors

- Name

- MarketVibe Team

- @1marketvibe

AI Chip Tariffs and Their Impact on Nvidia Amid US-China Trade Tensions

As geopolitical tensions between the United States and China escalate, the tech industry finds itself at the forefront of a complex trade battle. Nvidia, a leader in the AI chip market, is particularly vulnerable to these developments. The introduction of AI chip tariffs has significant implications for Nvidia's operations and the broader tech sector. In this context, MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, becomes an invaluable tool. The CW Index is currently at 5.7, below the 7.0 warning threshold, indicating moderate risk. This level suggests that while the market is not in immediate danger, investors should remain vigilant.

Learn more about how CW Index works at 1marketvibe.com.

Current Geopolitical Landscape

The ongoing trade tensions between the US and China have led to a series of tariffs affecting technology imports and exports. These tariffs are a strategic move by the US to curb China's technological advancements, particularly in AI. For Nvidia, which relies heavily on the Chinese market, these tariffs pose a direct threat to its revenue and supply chain stability. The CW Index at 5.7 suggests that while the market has not reached a critical point, the situation warrants close monitoring. Historically, when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month, underscoring the importance of staying informed.

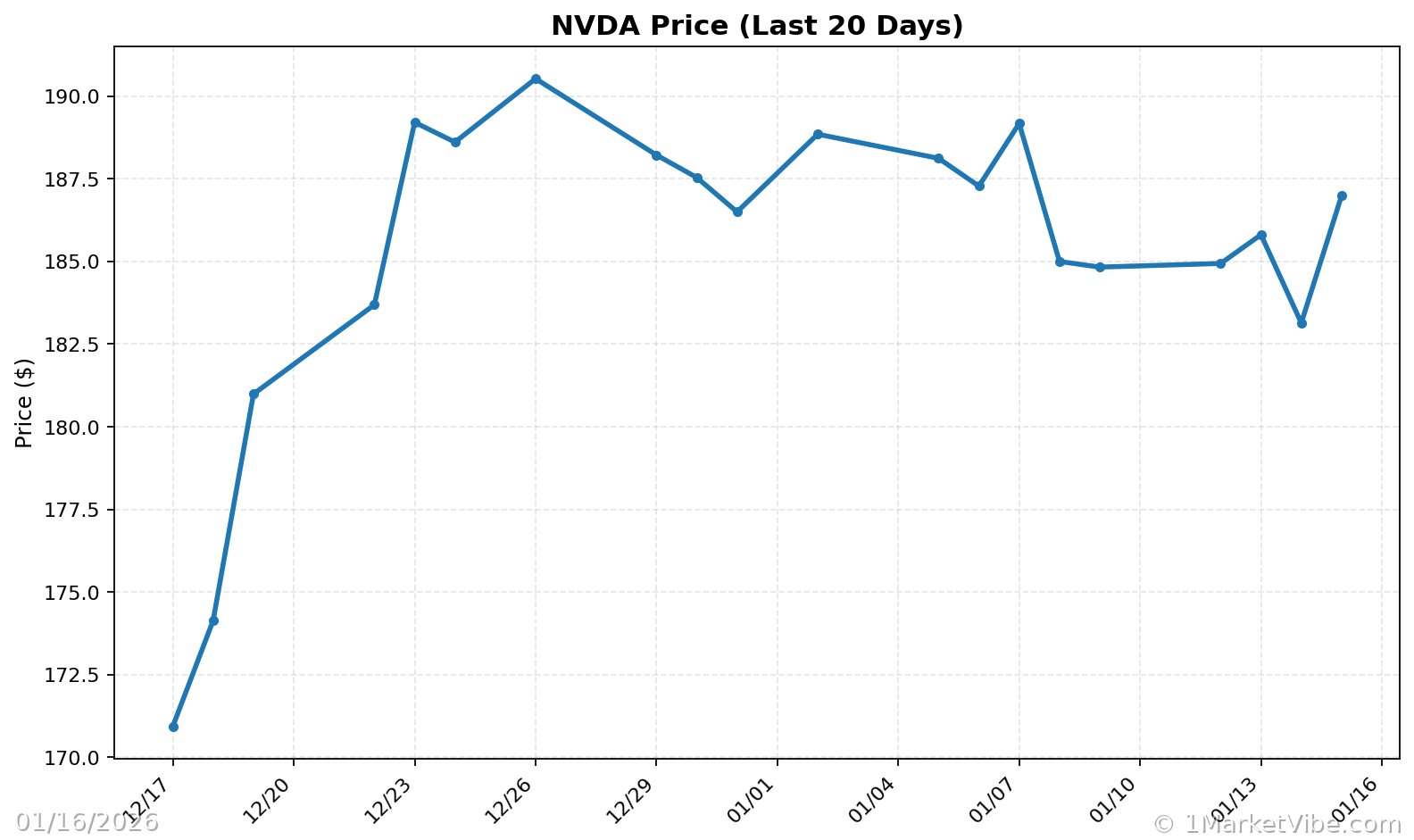

Nvidia's Strategic Response

In response to these challenges, Nvidia is re-evaluating its supply chain and exploring alternative markets to mitigate the impact of tariffs. This strategic pivot includes increasing investments in regions less affected by US-China tensions. The MarketVibe advantage lies in its ability to track these shifts through the CW Index, providing investors with early warnings of potential market corrections. Nvidia's proactive measures are crucial as the CW Index suggests that any significant increase in tariffs could push the index closer to the 7.0 threshold, signaling heightened risk.

Market Reactions

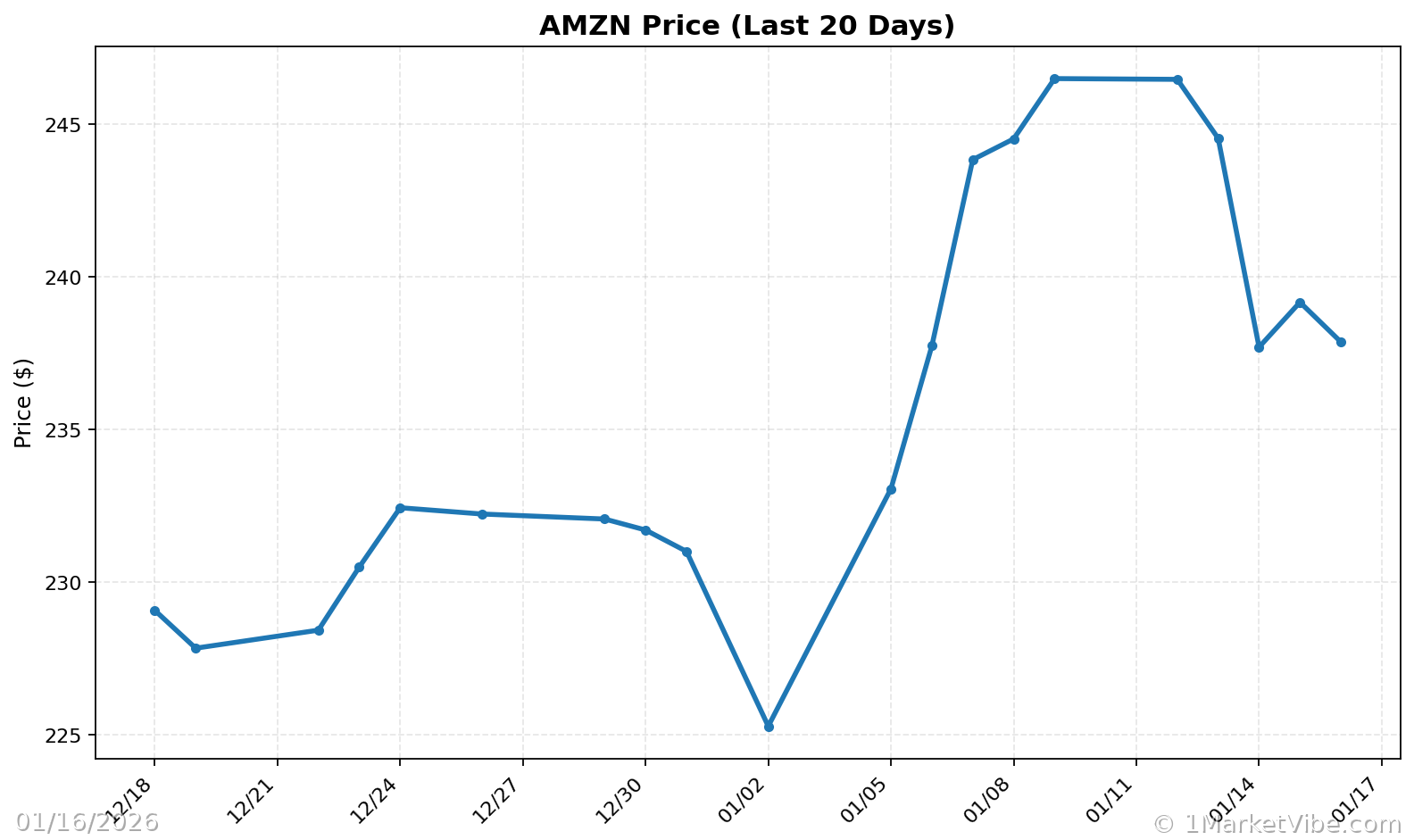

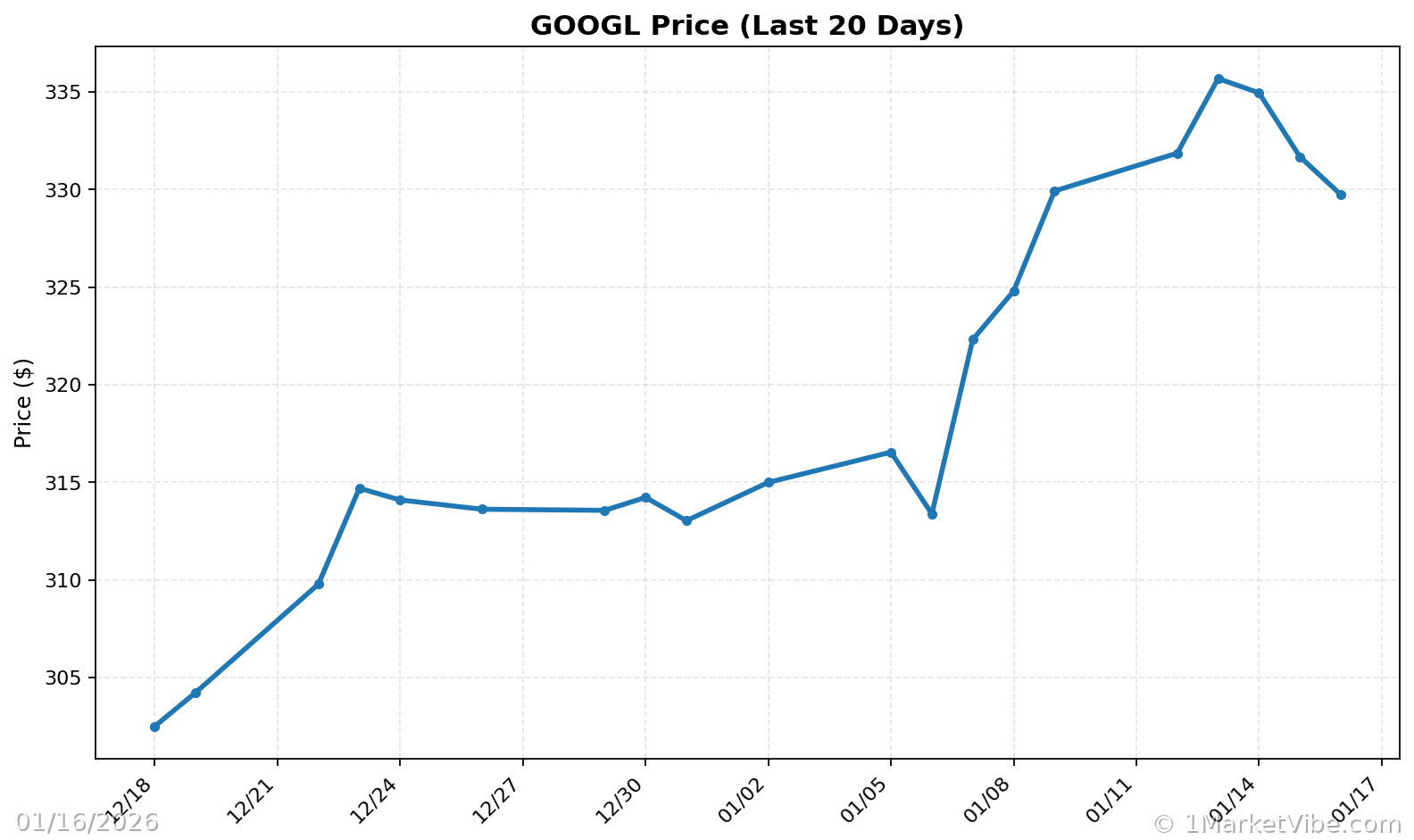

The stock market's response to Nvidia's challenges has been mixed. While Nvidia's stock has experienced volatility, competitors like Amazon and Google have also felt the ripple effects. According to MarketVibe data, the CW Index's current reading reflects a market that is cautious but not yet in panic mode. Investors should watch for any movement in the CW Index towards 6.5, which could indicate a shift in market sentiment. The gold component of the CW Index provides a 4-6 week advance notice, allowing investors to adjust their strategies accordingly.

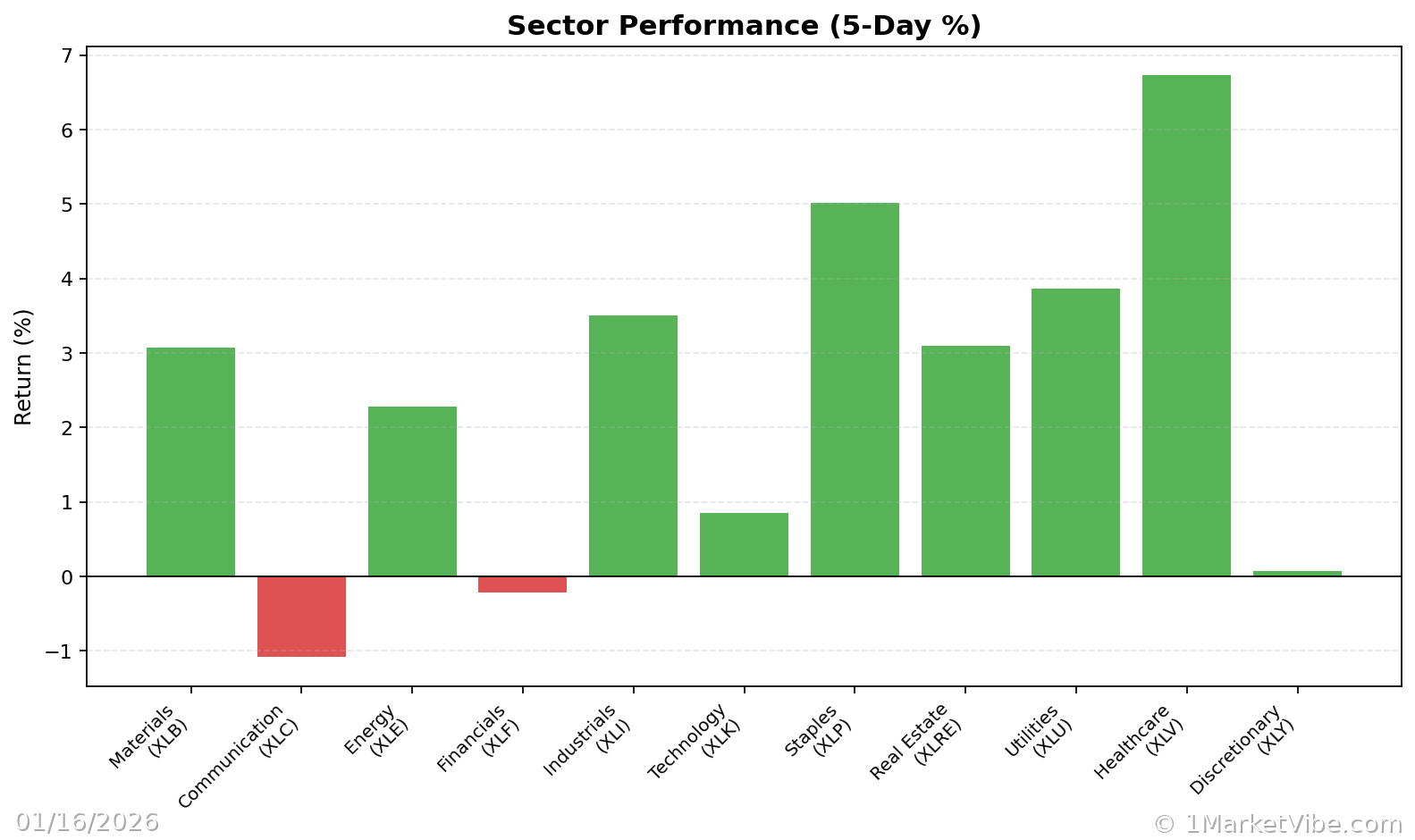

Broader Tech Sector Implications

The implications of AI chip tariffs extend beyond Nvidia, affecting the entire tech sector. Companies reliant on AI technology are reassessing their strategies to navigate the uncertain geopolitical landscape. The CW Index's historical patterns show that similar geopolitical tensions have led to significant market corrections, emphasizing the need for a proactive approach. The MarketVibe proprietary system is built by investors, for investors, offering insights that help navigate these complex scenarios.

Investor Sentiment

Investor sentiment towards Nvidia remains cautious amidst these geopolitical risks. Analysts and market experts highlight the importance of monitoring the CW Index as a barometer for potential market shifts. The current reading of 5.7 indicates that while there is no immediate cause for alarm, investors should remain prepared for any changes. MarketVibe tracks these developments closely, providing actionable insights for investors.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7 - Moderate risk

- Overall market status: Yellow flag

- Key metric to watch: CW Index movement towards 6.5

📚 Learn (2-Minute Deep Dive)

The current geopolitical tensions between the US and China have placed Nvidia in a challenging position. The introduction of AI chip tariffs directly impacts Nvidia's revenue and supply chain, prompting the company to explore alternative markets. Historically, similar geopolitical tensions have led to significant market corrections, as evidenced by the CW Index's past readings. The current situation underscores the importance of monitoring the CW Index for any signs of escalation. Investors should pay attention to the gold component of the CW Index, which provides a 4-6 week early warning of potential market shifts.

⚡ Act (Specific Steps)

- Monitor Position Sizing: Adjust your portfolio based on CW Index levels. If the index approaches 6.5, consider reducing exposure to high-risk sectors.

- Risk Management: Implement hedging strategies to protect against potential market downturns.

- Diversification: Explore opportunities in regions less affected by US-China tensions to mitigate risk.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Nvidia's challenges amid US-China trade tensions highlight the importance of strategic adaptability and market awareness. The CW Index provides a critical early warning system, allowing investors to navigate these uncertain times with confidence. As the geopolitical landscape continues to evolve, staying informed and proactive is essential for safeguarding investments in the tech sector.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts