Trump's Threats Trigger Stock Selloff and Indicate Market Instability

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Trump's Threats Trigger Stock Selloff and Indicate Market Instability

The stock market has recently experienced heightened volatility, largely attributed to former President Donald Trump's latest geopolitical threats. These developments have prompted a significant selloff, raising concerns about market stability. In this context, MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, becomes an essential tool for investors. The CW Index is currently at 5.7, which is below the 7.0 warning threshold, indicating a moderate risk environment.

Learn more about how CW Index works at 1marketvibe.com.

Market Reaction

Following Trump's statements, the stock market saw a notable decline. This reaction is not unprecedented; markets have historically been sensitive to geopolitical tensions. For instance, when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month. Currently, the CW Index at 5.7 suggests that while the risk is moderate, investors should remain vigilant. The gold component of the CW Index provides a crucial early warning, allowing investors to anticipate potential market corrections 4-6 weeks in advance.

Geopolitical Tensions

Trump's threats have the potential to escalate geopolitical risks, which could further destabilize the market. Historically, political tensions have led to increased market volatility, as seen during the trade wars of 2018. The CW Index has been a reliable indicator during such times, as it tracks shifts in institutional gold flows, a common safe-haven asset during periods of uncertainty.

Federal Reserve's Role

The involvement of Federal Reserve Chairman Jerome Powell in political matters adds another layer of complexity. Powell's recent attendance at Supreme Court arguments concerning Trump's bid to fire a key official highlights the intersection of politics and monetary policy. The CW Index reflects these dynamics, as changes in Fed policies can significantly impact market reactions.

Current Market Indicators

The CW Index's current reading of 5.7 is a critical signal for investors. This level, while below the warning threshold, suggests that market conditions are worth monitoring closely. The 4-6 week early warning capability of the CW Index is particularly valuable, as it allows investors to prepare for potential shifts in market sentiment.

Investor Sentiment

Investor sentiment remains cautious amid the current uncertainty. While the CW Index indicates moderate risk, factors such as geopolitical tensions and Federal Reserve policies continue to influence confidence. Historically, when the CW Index has approached higher levels, investor sentiment has shifted towards risk aversion.

Historical Context

Past instances where political threats affected markets provide valuable lessons. For example, during the 2018 trade tensions, the CW Index effectively signaled increased market risk, allowing investors to adjust their strategies accordingly. Understanding these historical patterns can help investors navigate current conditions.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk.

- Overall market status: Yellow flag.

- Key metric to watch: Institutional gold flows.

📚 Learn (2-Minute Deep Dive)

The current geopolitical tensions, coupled with Trump's threats, have introduced a layer of unpredictability to the market. Historically, such tensions have led to increased volatility. The CW Index at 5.7 suggests that while the market is not at immediate risk, investors should remain cautious. Monitoring institutional gold flows is crucial, as they often provide early signals of market sentiment shifts. The current situation underscores the importance of being prepared for potential market corrections, as indicated by the CW Index's historical patterns.

⚡ Act (Specific Steps)

- Diversify Portfolios: Consider reallocating assets to include more stable investments, such as bonds or gold, in response to the CW Index signals.

- Monitor Market Indicators: Keep a close eye on the CW Index and institutional gold flows for any significant changes.

- Adjust Risk Exposure: If the CW Index approaches the 6.5 level, consider reducing exposure to high-risk sectors.

- Implement Hedging Strategies: Use options or other derivatives to hedge against potential market downturns.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

In summary, Trump's threats have triggered a stock selloff, highlighting potential market instability. The CW Index at 5.7 indicates moderate risk, but investors should remain vigilant. By leveraging MarketVibe's tools, such as the Enhanced CW Index and Decision Edge™ Method, investors can navigate these uncertain times with greater confidence. Built by investors, for investors, MarketVibe provides the insights needed to make informed decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

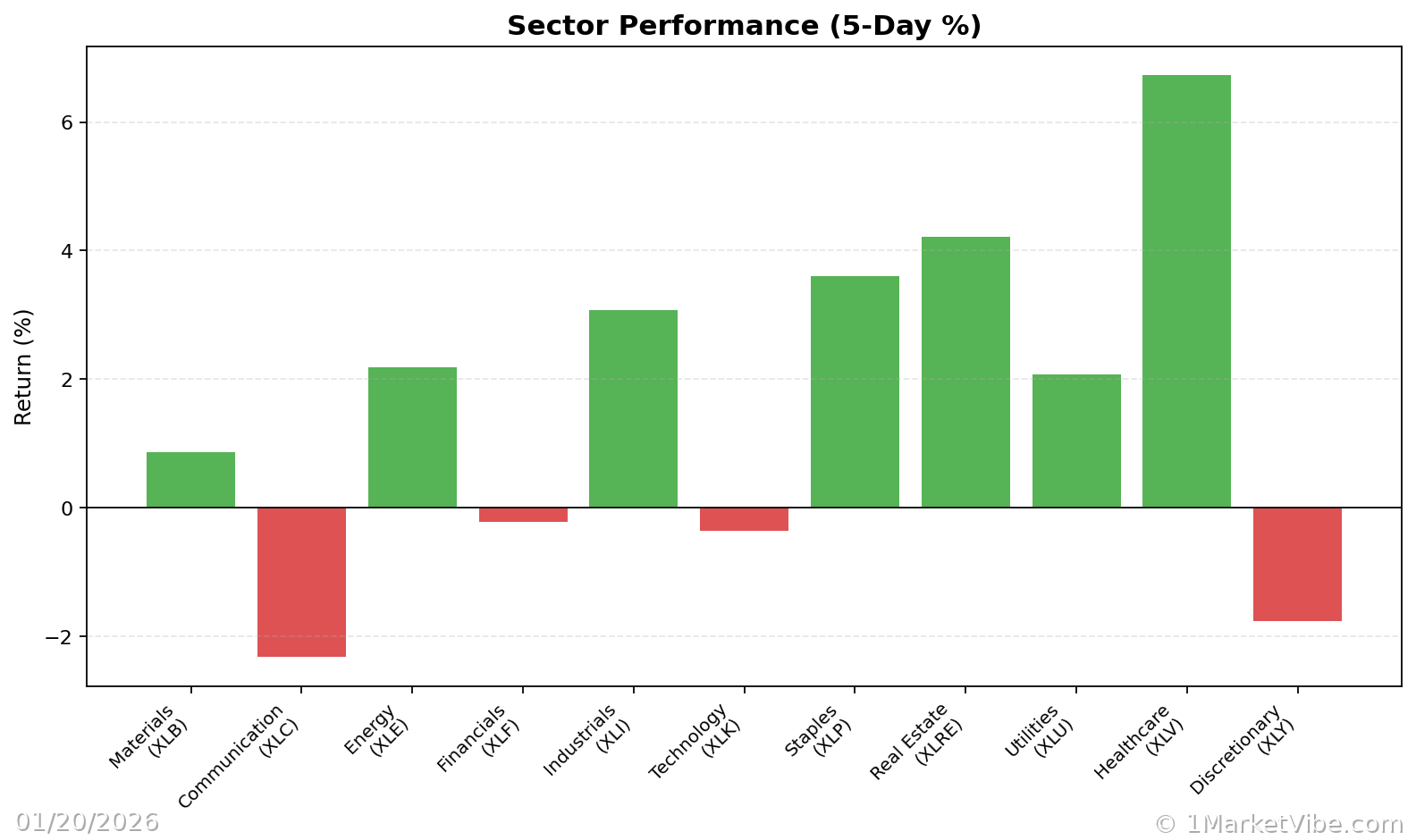

Charts