Dow Drops 900 Points as CW Index Signals Market Vulnerability

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Dow Drops 900 Points as CW Index Signals Market Vulnerability

On January 21, 2026, the Dow Jones Industrial Average experienced a significant decline, dropping 900 points amid renewed tariff threats. This dramatic fall underscores the current market volatility and aligns with MarketVibe's proprietary Enhanced CW Index, a critical tool for investors seeking early warnings of market corrections. The CW Index, which operates on a 0-10 scale, is currently at 5.7, indicating a moderate risk level below the 7.0 warning threshold. This reading suggests that while the market is under pressure, it hasn't yet reached a critical point of concern.

Learn more about how CW Index works at 1marketvibe.com

Market Context and Impact

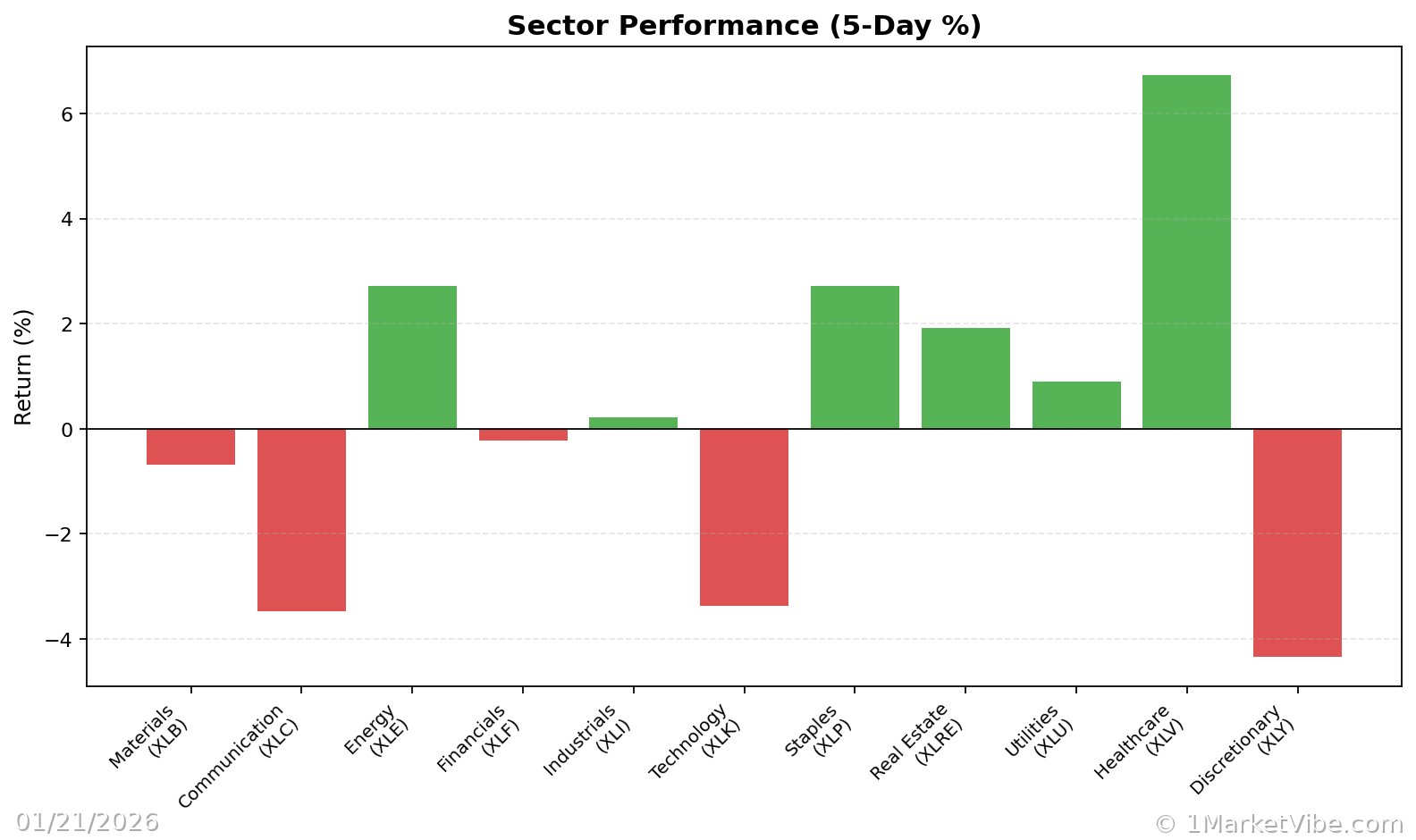

The Dow's 900-point drop reflects broader market anxieties, particularly in response to escalating tariff threats that have rattled investor confidence. This decline was mirrored by other major indices, with the S&P 500 and Nasdaq also experiencing significant losses. The tariff threats, primarily targeting key sectors such as technology and manufacturing, have heightened fears of a potential trade war, which could further destabilize global markets.

MarketVibe's CW Index suggests that these developments were predictable. Historical patterns show that when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month. The current reading of 5.7 indicates a need for cautious optimism, as the market remains vulnerable but not yet at a critical tipping point.

Tariff Threats and Market Sentiment

The specific tariff threats impacting the market today are part of a broader geopolitical strategy that has historically led to increased volatility. Tariffs can lead to higher costs for businesses, reduced consumer spending, and ultimately, slower economic growth. These factors contribute to a bearish market sentiment, as investors brace for potential negative impacts on corporate earnings and economic stability.

MarketVibe's 4-6 week early warning capability, driven by institutional gold flows and market breadth, provides a strategic advantage in anticipating such shifts. As the CW Index continues to monitor these dynamics, investors are advised to stay informed and prepared for potential market corrections.

Historical Parallels and Lessons Learned

Past market reactions to tariff announcements offer valuable insights. For instance, during the tariff disputes of 2018, markets experienced heightened volatility, with significant fluctuations in stock prices and investor sentiment. These historical parallels highlight the importance of monitoring key indicators, such as the CW Index, to navigate uncertain market conditions effectively.

MarketVibe tracks these patterns, providing investors with actionable intelligence to make informed decisions. The current situation underscores the need for vigilance and strategic planning, as the market remains susceptible to external shocks.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This framework is designed to turn market intelligence into actionable decisions, empowering investors to navigate volatility with confidence.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk.

- Overall market status: Yellow flag, suggesting caution.

- Key metric to watch: Institutional gold flows.

📚 Learn (2-Minute Deep Dive)

The current market environment is characterized by heightened volatility due to geopolitical tensions and tariff threats. The CW Index at 5.7 reflects a market that is under pressure but not yet at a critical juncture. Historical parallels, such as the market downturn in March 2023 when the CW Index reached 7.1, emphasize the importance of monitoring these signals closely.

Moving forward, investors should pay attention to developments in trade negotiations and their potential impact on market stability. The gold component of the CW Index provides a 4-6 week early warning, allowing for proactive risk management. Understanding these dynamics is crucial for navigating the current market landscape.

⚡ Act (Specific Steps)

- Reassess Portfolio Allocations: Consider reducing exposure to sectors most affected by tariffs, such as technology and manufacturing.

- Implement Hedging Strategies: Utilize options or inverse ETFs to protect against potential downside risk.

- Monitor CW Index Movements: If the CW Index approaches 6.5, prepare for increased volatility and potential market corrections.

- Stay Informed: Regularly review MarketVibe's updates and insights to adjust strategies as needed.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The Dow's 900-point decline serves as a stark reminder of the market's vulnerability to external shocks, such as tariff threats. MarketVibe's Enhanced CW Index provides a critical early warning system, helping investors navigate these turbulent times with greater confidence. By leveraging the insights and strategies offered by MarketVibe, investors can better prepare for potential market corrections and protect their portfolios from undue risk.

Built by investors, for investors, MarketVibe offers a unique advantage in understanding and anticipating market movements. Stay informed and proactive with MarketVibe's tools and insights.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts