Trump's Housing Plan Indicates Shift in Real Estate Market

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Trump's Housing Plan Indicates Shift in Real Estate Market

President Donald Trump's recent housing plan has sent ripples through the real estate market, signaling potential shifts that investors should closely monitor. The plan, which aims to make homeownership more accessible by advocating for lower interest rates and restricting investor home purchases, has sparked significant market interest. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.4. This level is below the 7.0 warning threshold, indicating moderate risk but suggesting that investors remain cautious.

Learn more about how CW Index works at 1marketvibe.com

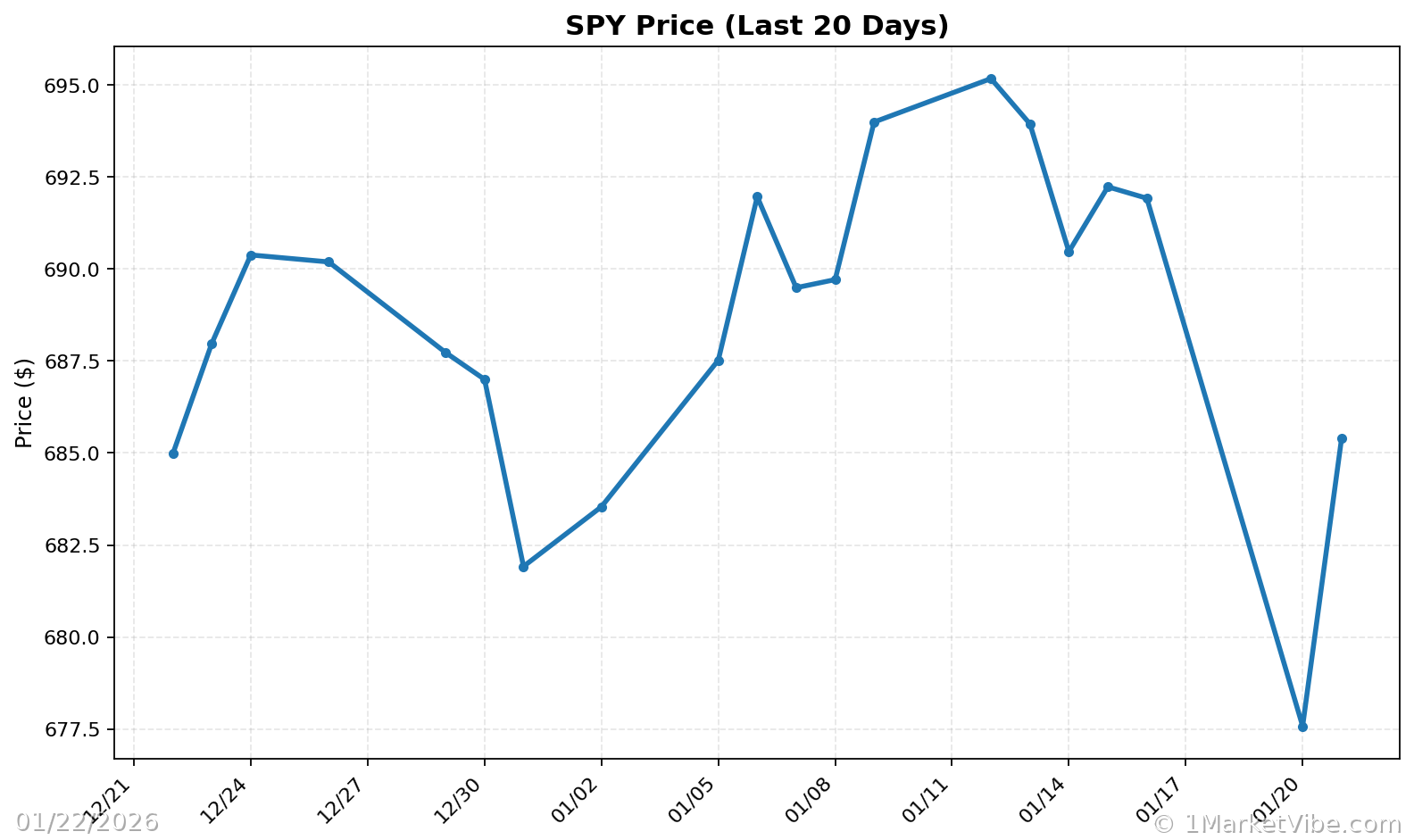

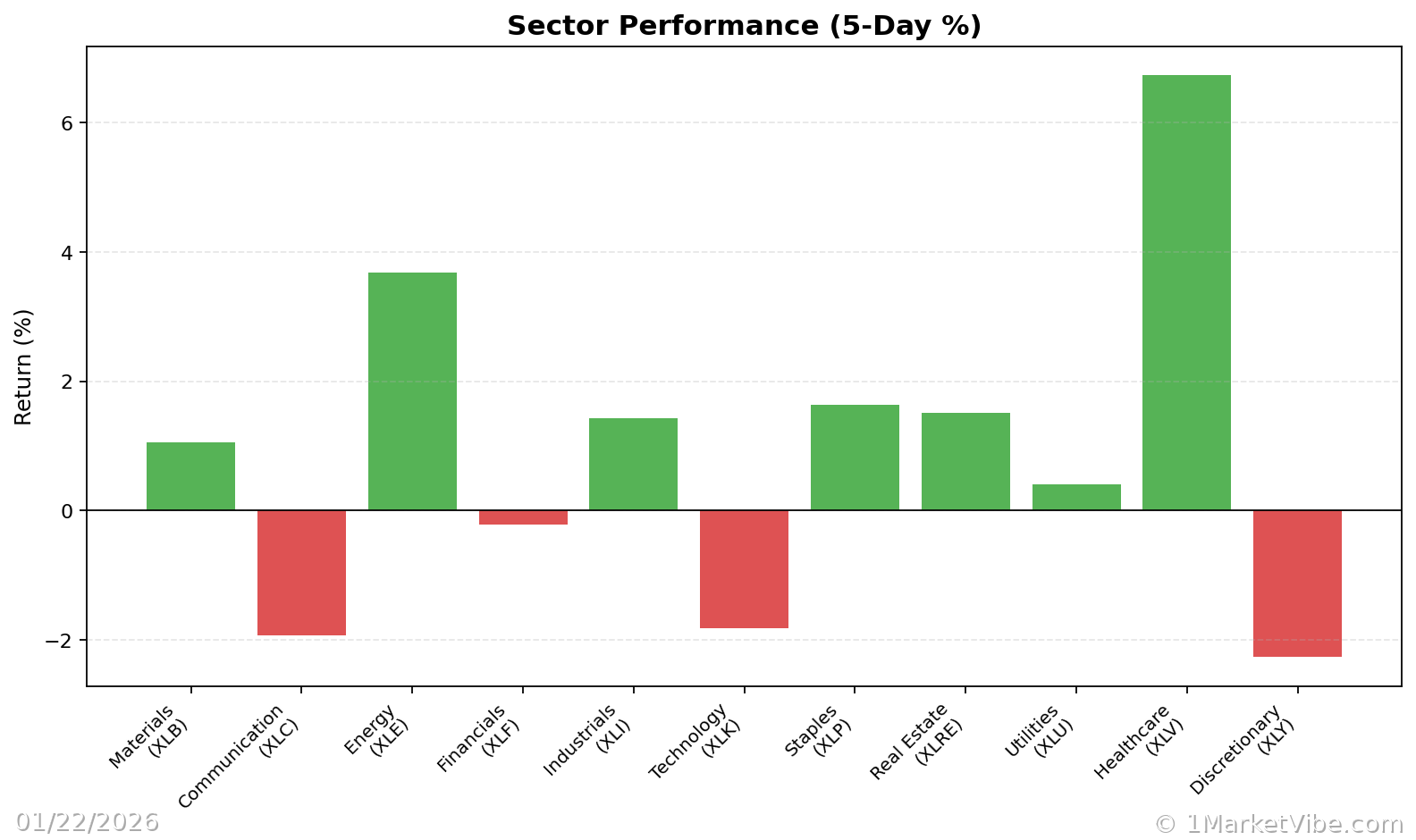

Market Response

Following Trump's announcement, the stock market experienced notable movements. The Dow Jones Industrial Average gained 200 points, reflecting investor optimism about the potential economic boost from increased homeownership. However, the real estate sector's reaction was mixed, with some stocks rising on the prospect of increased demand, while others fell due to concerns over investor restrictions. MarketVibe's CW Index suggests that while the current sentiment is positive, investors should remain vigilant for any shifts in the index that could indicate changing market conditions.

Interest Rate Implications

Trump's proposal to lower interest rates on home loans is designed to make mortgages more affordable, potentially increasing homeownership rates. If implemented, this could lead to a surge in home buying, benefiting the housing market. However, MarketVibe tracks the potential risks of such a policy, including inflationary pressures and the impact on existing mortgage-backed securities. The CW Index at 5.4 provides a moderate risk signal, but investors should watch for any upward movement towards the 6.5 level, which could indicate increased volatility.

Investor Restrictions

A key component of Trump's plan is the proposed ban on investor home purchases, aimed at reducing competition for first-time buyers. This policy could significantly alter real estate investment strategies, particularly for those relying on rental income. MarketVibe's proprietary system highlights the importance of monitoring the CW Index for any signs of market stress that could arise from such regulatory changes. Historical patterns show that similar restrictions in other markets have led to temporary price declines, as seen when the CW hit 7.1 in March 2023, resulting in an 8.3% market drop.

Historical Context

Comparing Trump's housing plan to past policies reveals potential outcomes. For instance, previous initiatives to lower interest rates have often led to short-term boosts in housing demand, followed by market corrections as prices adjust. MarketVibe's 4-6 week early warning capability allows investors to anticipate these shifts, providing a strategic advantage. By understanding historical parallels, investors can better position themselves to navigate the current landscape.

Current Market Signals

The CW Index reading of 5.4 is a crucial indicator of current market sentiment. While below the critical 7.0 threshold, it suggests that investors should remain cautious. According to MarketVibe data, the gold component of the CW Index offers early warning of potential market corrections, emphasizing the need for vigilance. Investors should monitor the index closely, especially if it approaches the 6.5 level, which could signal increased risk.

Potential Risks

While Trump's housing plan offers potential benefits, it also introduces risks. Market volatility could increase as investors react to policy changes, and economic conditions may affect the plan's implementation. MarketVibe's Enhanced CW Index provides a valuable tool for assessing these risks, offering insights into market dynamics that could impact investment strategies. By staying informed and proactive, investors can mitigate potential downsides.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.4, indicating moderate risk

- Overall market status: Yellow flag

- Key metric to watch: CW Index movement towards 6.5

📚 Learn (2-Minute Deep Dive)

Trump's housing plan could significantly impact the real estate market, with potential shifts in investment strategies. The proposal to lower interest rates may boost homeownership but could also lead to inflationary pressures. The ban on investor purchases could reduce competition, affecting rental markets. Historical parallels suggest that similar policies have led to temporary market corrections, underscoring the importance of monitoring the CW Index. As the index provides a 4-6 week early warning, investors can anticipate changes and adjust their strategies accordingly.

⚡ Act (Specific Steps)

- Reassess Portfolio Allocation: Consider reducing exposure to real estate investments that may be affected by investor restrictions.

- Monitor CW Index Closely: If the index approaches 6.5, consider hedging strategies to protect against potential volatility.

- Adjust Interest Rate Sensitivity: Evaluate the impact of potential interest rate changes on your portfolio, particularly in fixed-income investments.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Trump's housing plan indicates potential shifts in the real estate market, with implications for investment strategies. MarketVibe's Enhanced CW Index provides critical insights into market dynamics, offering a strategic advantage for investors. By leveraging MarketVibe's tools and staying informed, investors can navigate the evolving landscape with confidence.

Built by investors, for investors, MarketVibe offers unique value through its early warning systems and actionable insights. Stay ahead of market trends with MarketVibe's comprehensive analysis and decision-making frameworks.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts