Tesla's Austin Robotaxi Launch and Its Implications for Investors

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Tesla's Austin Robotaxi Launch and Its Implications for Investors

Tesla's recent launch of its Robotaxi service in Austin marks a significant milestone in the autonomous vehicle industry. This development not only positions Tesla as a leader in autonomous transport but also signals potential shifts in market dynamics. As investors assess the implications, MarketVibe's proprietary Enhanced CW Index offers a critical tool for navigating these changes. The CW Index, currently at 5.7, operates on a 0-10 scale, providing a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth. This level, below the 7.0 warning threshold, indicates moderate risk, suggesting a stable yet cautious market environment. Learn more about how CW Index works at 1marketvibe.com.

Market Context

The autonomous vehicle sector is rapidly evolving, with key players like Waymo and GM making significant strides. Waymo recently halted its service in certain areas, highlighting the challenges and opportunities within this space. Tesla's move into the Robotaxi market could disrupt existing dynamics, offering a unique value proposition through its integrated technology and brand strength. According to MarketVibe data, the current CW Index reading of 5.7 suggests a stable market, yet investors should remain vigilant for shifts that could arise from increased competition and regulatory changes.

Tesla's Strategy

Tesla's approach to autonomous ridesharing focuses on leveraging its extensive data collection and AI capabilities. By integrating its Robotaxi service with existing infrastructure, Tesla aims to enhance user experience and operational efficiency. This strategy could bolster Tesla's market position, potentially increasing its market share in the autonomous transport sector. MarketVibe's Enhanced CW Index indicates that while the current market risk is moderate, historical patterns show that significant strategic moves, like Tesla's, can lead to market shifts. For instance, when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month.

Investor Implications

Tesla's Robotaxi launch could influence investor sentiment by highlighting the company's innovation and growth potential. However, the shift to Robotaxi services also presents risks, such as regulatory hurdles and technological challenges. MarketVibe's CW Index suggests monitoring the index closely; if it approaches the 6.5 level, it may signal increased market volatility. Investors should consider diversifying their portfolios and adjusting risk exposure in response to these developments.

Regulatory Considerations

The regulatory landscape for autonomous vehicles remains complex, with varying requirements across jurisdictions. Tesla may face challenges in scaling its Robotaxi services due to stringent safety and operational regulations. MarketVibe tracks these regulatory shifts, offering investors insights into potential impacts on Tesla's operations. The CW Index's gold component provides a 4-6 week early warning, allowing investors to anticipate regulatory changes that could affect market conditions.

Consumer Sentiment

Public perception of autonomous transport is crucial for adoption rates. While Tesla's brand strength may mitigate some consumer concerns, safety and reliability remain paramount. MarketVibe's proprietary system suggests that shifts in consumer sentiment could impact Tesla's market performance. Investors should monitor consumer feedback and adoption rates as indicators of potential market shifts.

Future Outlook

The autonomous transport market is poised for growth, with Tesla's Robotaxi service potentially leading the charge. Factors such as technological advancements, regulatory changes, and consumer acceptance will influence Tesla's success. MarketVibe's Enhanced CW Index, with its early warning capabilities, provides investors with a strategic advantage in navigating these uncertainties. As the CW Index currently reads 5.7, investors should remain alert to any upward movements that could signal increased market risk.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework transforms market intelligence into actionable decisions, providing investors with a strategic edge.

🔍 Glance (10-Second Takeaway)

- Current CW Index: 5.7, indicating moderate market risk.

- Overall Market Status: Yellow flag, suggesting cautious optimism.

- Key Metric to Watch: CW Index movements, particularly if approaching 6.5.

📚 Learn (2-Minute Deep Dive)

Tesla's Robotaxi launch represents a pivotal moment in the autonomous vehicle market. By leveraging its technological capabilities, Tesla aims to redefine urban transport. Historical parallels, such as Waymo's service adjustments, highlight the sector's volatility. MarketVibe's CW Index, with its gold component, offers a 4-6 week early warning of potential market corrections, providing investors with critical foresight. Monitoring regulatory developments and consumer sentiment will be essential as Tesla navigates this complex landscape.

⚡ Act (Specific Steps)

- Diversify Portfolio: Allocate 10-15% to technology and autonomous transport sectors.

- Monitor CW Index: Adjust risk exposure if the index approaches 6.5.

- Hedge Strategies: Consider options or futures to mitigate potential volatility.

- Regulatory Watch: Stay informed on regulatory changes that could impact Tesla.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Tesla's Robotaxi launch in Austin is a significant development with broad implications for the autonomous vehicle market. As investors assess the potential risks and opportunities, MarketVibe's Enhanced CW Index and Decision Edge™ Method offer valuable insights and actionable strategies. By staying informed and proactive, investors can navigate this evolving landscape with confidence. Built by investors, for investors, MarketVibe provides the tools needed to make informed decisions in a dynamic market environment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

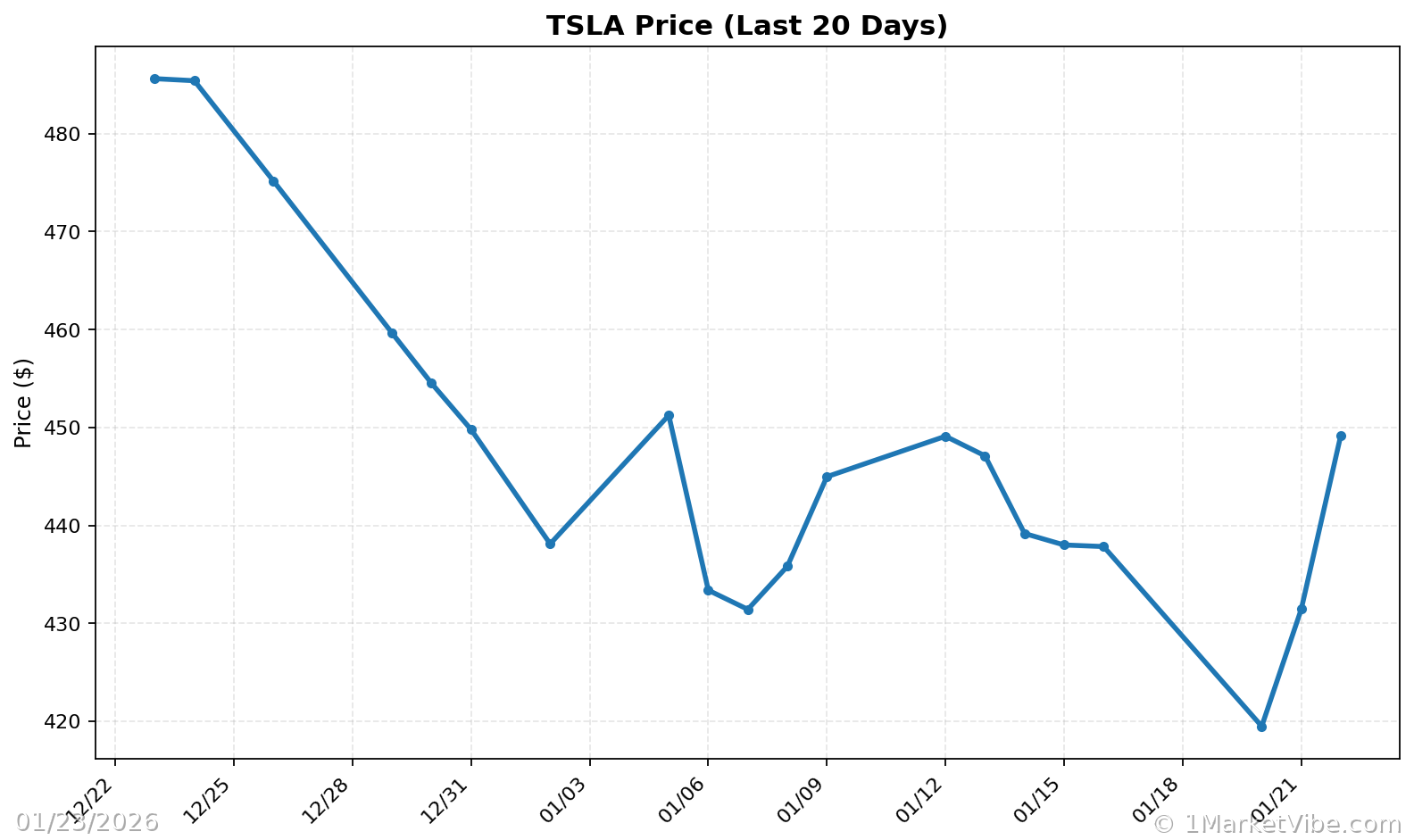

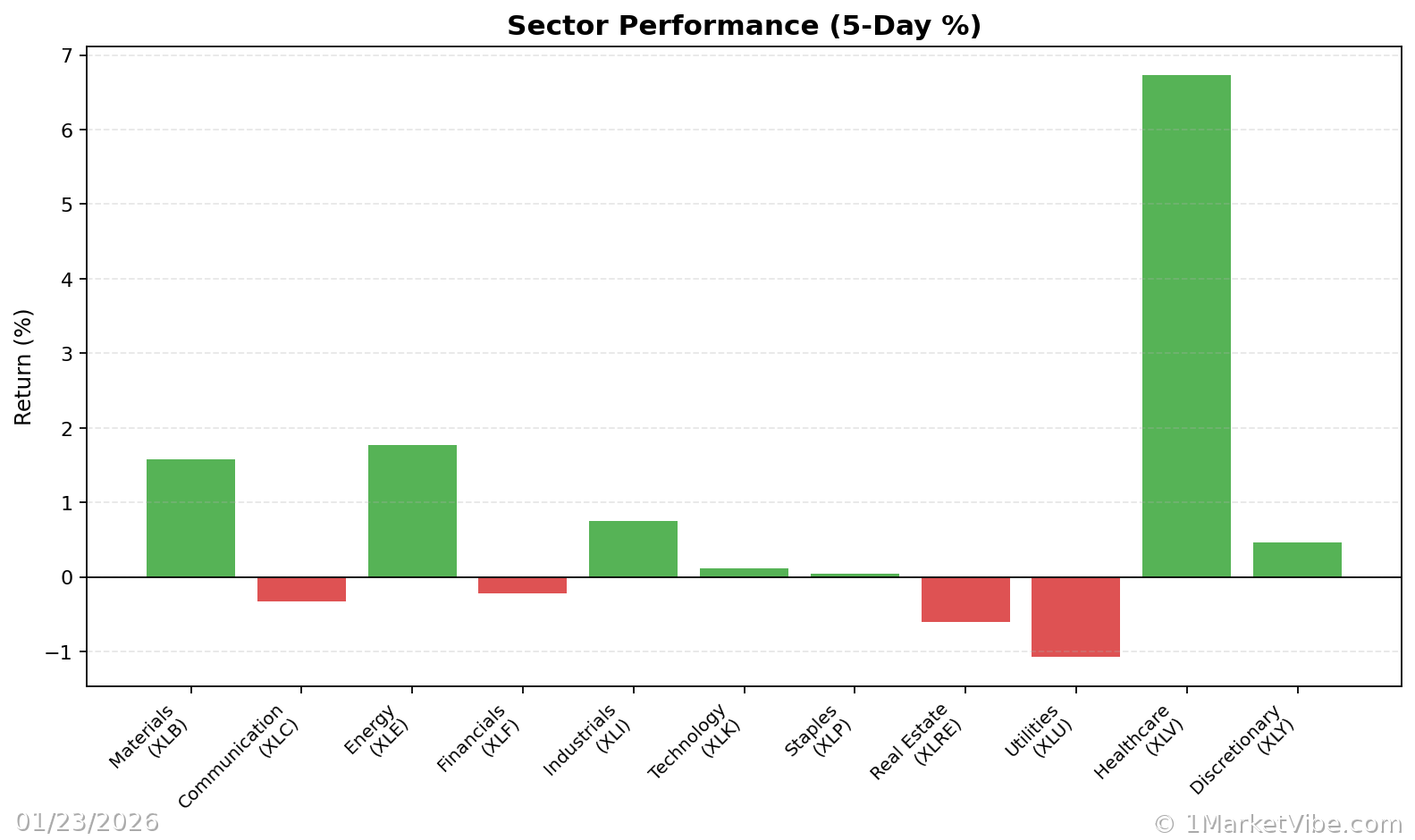

Charts