The Rise of AI Recipes: Implications for Thanksgiving and Investors

- Authors

- Name

- MarketVibe Team

- @1marketvibe

The Rise of AI Recipes: Implications for Thanksgiving and Investors

As artificial intelligence continues to permeate various sectors, its influence on culinary arts is becoming increasingly apparent. The rise of AI-generated recipes is not only reshaping traditional cooking practices but also impacting market dynamics. With Thanksgiving around the corner, the implications of AI recipes on holiday preparations and investor opportunities are worth exploring.

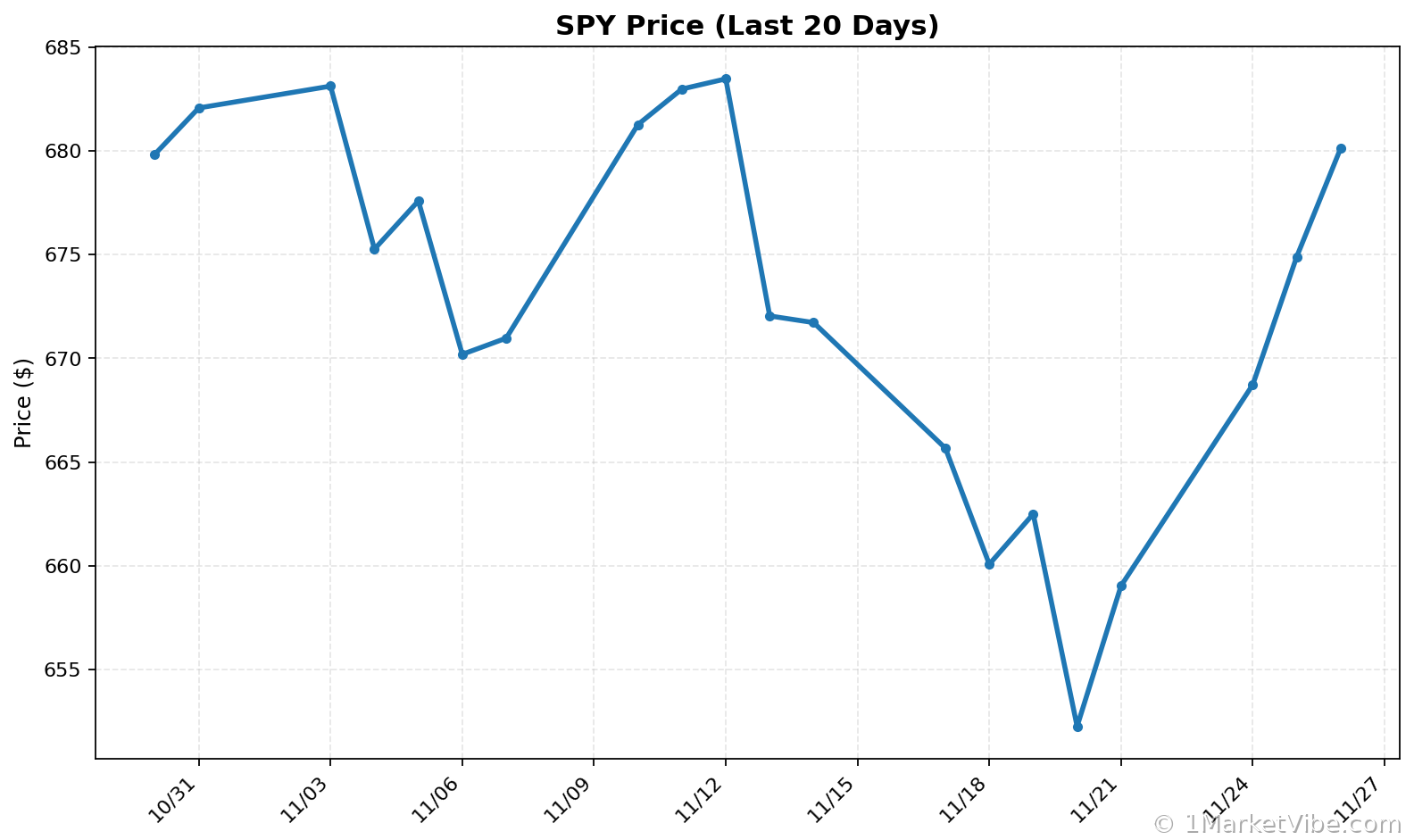

MarketVibe's Enhanced CW Index: Current Market Conditions

MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.7. This level is below the 7.0 warning threshold, indicating a moderate risk environment. Historically, when the CW Index hit 7.1 in March 2023, markets experienced an 8.3% decline over the following month. Investors should monitor the CW Index closely, particularly if it approaches the 6.5 mark, which could signal increased volatility. Learn more about how CW Index works at 1marketvibe.com.

AI Recipe Trends

AI-generated recipes are gaining traction, offering innovative culinary creations that challenge traditional norms. These recipes often leverage data from vast culinary databases, creating unique combinations that appeal to adventurous cooks. Compared to traditional recipes, AI-generated ones are engaging more users, particularly on social media platforms where visual appeal drives consumer interest. MarketVibe's CW Index suggests that this trend could influence consumer spending patterns, particularly in sectors related to food and technology.

Impact on Food Bloggers

The rise of AI recipes presents challenges for traditional food bloggers, who are experiencing a decline in web traffic as home cooks turn to AI for inspiration. Bloggers must adapt by integrating AI tools into their content creation processes or risk losing relevance. According to MarketVibe data, the shift towards AI-driven content is a trend that investors in the digital content space should monitor closely.

Consumer Behavior Shift

The shift towards AI-generated recipes is driven by several factors, including the convenience and novelty they offer. Social media platforms amplify this trend by showcasing visually appealing dishes that capture consumer attention. MarketVibe's CW Index at 5.7 indicates that while the market is stable, investors should remain vigilant as consumer preferences evolve, potentially impacting related sectors.

Thanksgiving Dinner Dynamics

AI recipes are poised to transform traditional Thanksgiving preparations. Families may opt for AI-generated dishes that offer new flavors and presentations, altering long-standing culinary traditions. MarketVibe's CW Index historical patterns show that such shifts in consumer behavior can have ripple effects on related markets, including food retail and hospitality.

Market Implications

The long-term effects of AI recipes on the food blogging industry and related sectors could be significant. Brands have the opportunity to leverage AI in their marketing strategies, creating personalized culinary experiences for consumers. MarketVibe tracks these developments, providing investors with actionable insights into emerging opportunities.

Risks and Considerations

While AI recipes offer exciting possibilities, concerns about their quality and safety remain. Consumers must critically evaluate AI-generated content to ensure it meets their standards. The MarketVibe advantage lies in its ability to provide early warnings of potential market shifts, helping investors navigate these uncertainties.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk.

- Overall market status: Yellow flag.

- Key metric to watch: CW Index movement towards 6.5.

📚 Learn (2-Minute Deep Dive)

The current CW Index reading of 5.7 suggests a stable yet cautious market environment. Historically, similar readings have preceded periods of moderate market activity. For example, when the CW Index was at 6.0 in June 2022, the market saw a 4.5% fluctuation over the next month. Investors should monitor the index closely, particularly the gold component, which provides a 4-6 week advance notice of potential corrections. Understanding these signals is crucial as AI-driven consumer trends could impact market dynamics, especially in sectors like food technology and digital content.

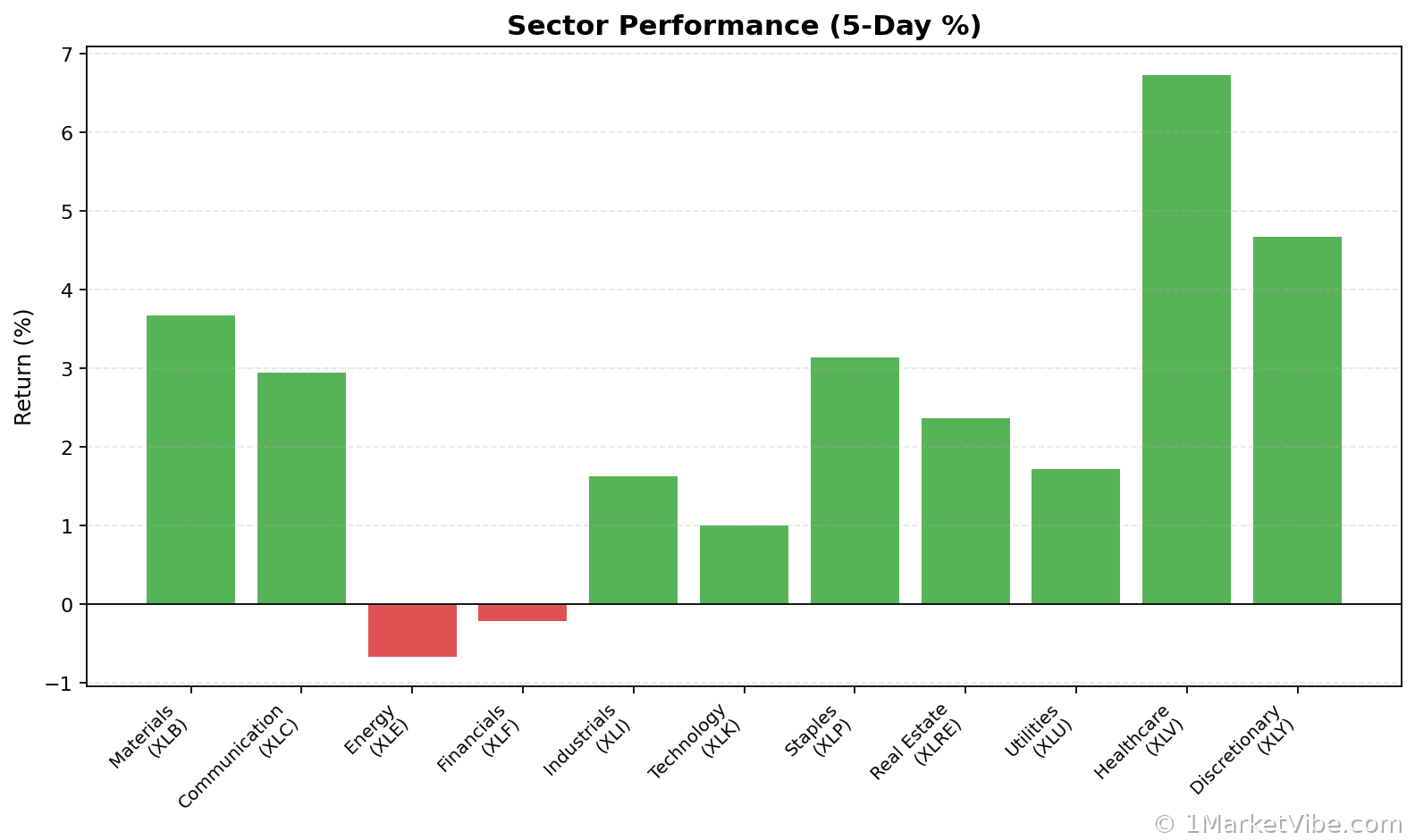

⚡ Act (Specific Steps)

- For conservative investors: Maintain current portfolio allocations but prepare to adjust if the CW Index approaches 6.5.

- For aggressive investors: Consider increasing exposure to technology and consumer discretionary sectors, leveraging AI trends.

- Risk management: Implement stop-loss orders to protect against sudden market shifts.

- Entry/exit criteria: Use the CW Index as a guide; consider exiting positions if the index exceeds 7.0.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The rise of AI recipes is reshaping culinary traditions and influencing market dynamics. As Thanksgiving approaches, the implications for family gatherings and investor opportunities are significant. MarketVibe's Enhanced CW Index and Decision Edge™ Method provide valuable insights and actionable strategies for navigating these changes. Built by investors, for investors, MarketVibe offers a unique advantage in understanding and anticipating market trends.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts