Market Overview

The Nasdaq Composite experienced a notable decline today, driven by heightened competition in the AI chip sector. Google's recent advancements in AI technology pose a significant challenge to Nvidia, a leader in the field. This development has led to increased volatility in the tech sector, impacting investor sentiment. According to MarketVibe's proprietary Enhanced CW Index, the current reading stands at 5.7, which is below the critical 7.0 threshold, indicating a moderate risk environment. This index, which provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, suggests that while the market is under pressure, it hasn't reached a critical tipping point.

MarketVibe's CW Index suggests that investors should remain vigilant, especially given the historical context where a reading above 7.0 has often preceded significant market downturns. For instance, when the CW Index hit 7.1 in March 2023, markets fell by 8.3% over the following month. Learn more about how CW Index works at 1marketvibe.com.

AI Chip Rivalry

The tech sector is currently witnessing a pivotal shift as Google intensifies its efforts in AI chip development, directly challenging Nvidia's dominance. Google's AI advancements have sparked investor interest, leading to a rally in Alphabet's stock, while Nvidia's shares have faced downward pressure. This rivalry is reshaping investment trends within the tech industry, as investors reassess their positions in light of these developments. MarketVibe tracks these shifts closely, providing early warning signals through its gold flow analysis.

Investor Sentiment

Investor sentiment has been mixed, with some seeing Google's advancements as a positive disruption, while others are concerned about the implications for Nvidia's market share. The CW Index at 5.7 indicates that while there is caution in the market, the risk of a major correction remains moderate. Investors are advised to monitor the situation closely, especially if the CW Index approaches the 6.5 level, which could signal increased volatility.

Historical Context

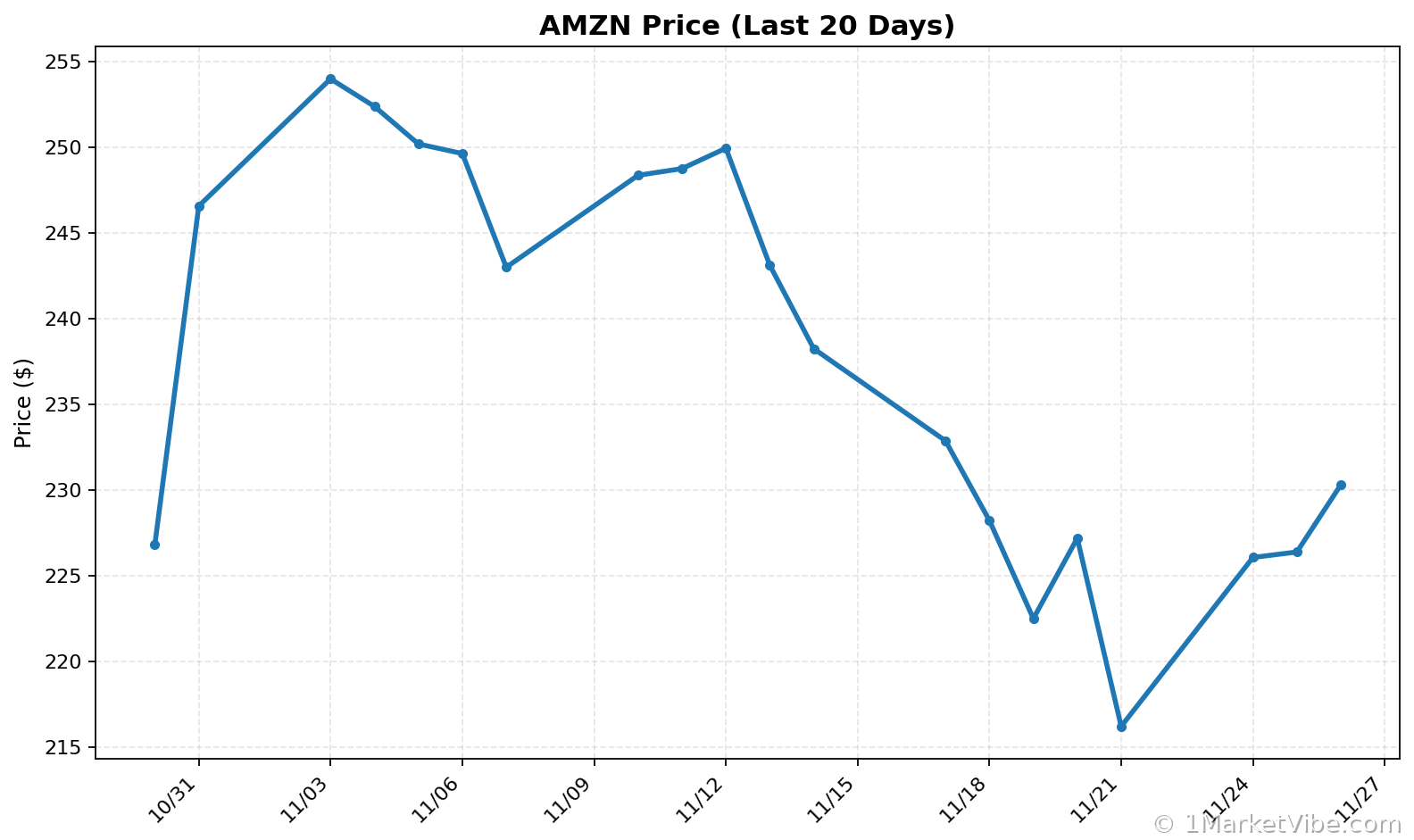

Historically, shifts in tech leadership have had significant impacts on market dynamics. For example, the rise of cloud computing in the early 2010s saw substantial shifts in market leadership, with companies like Amazon and Microsoft gaining prominence. CW Index historical patterns show that such transitions can lead to both opportunities and risks for investors. What makes the Enhanced CW Index unique is the gold component, which provides a 4-6 week advance notice of potential market shifts.

Market Signals

Current market signals suggest a cautious approach. MarketVibe's CW Index suggests that while the current reading is below the warning threshold, investors should remain alert to any changes in the index. A move towards 6.5 or higher could indicate a need for more defensive positioning. According to MarketVibe data, the tech sector's volatility is a key area to watch, particularly as AI developments continue to unfold.

Implications for Investors

The implications for investors are significant. As Google challenges Nvidia, there may be opportunities to capitalize on shifts in market leadership. However, MarketVibe's proprietary system advises caution, given the current CW Index reading. Investors should consider adjusting their portfolios to manage risk, particularly in tech-heavy allocations.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This is MarketVibe's proprietary framework for turning market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk.

- Overall market status: Yellow flag, suggesting caution.

- Key metric to watch: CW Index movement towards 6.5.

📚 Learn (2-Minute Deep Dive)

The current rivalry between Google and Nvidia in the AI chip market is reshaping tech investment trends. Historically, such competitive shifts have led to significant market realignments. For instance, the rise of mobile technology in the late 2000s saw Apple and Google emerge as dominant players, reshaping the tech landscape. MarketVibe's 4-6 week early warning capability suggests that investors should monitor these developments closely. The current situation matters because it could signal a broader shift in tech leadership, impacting valuations and investor strategies.

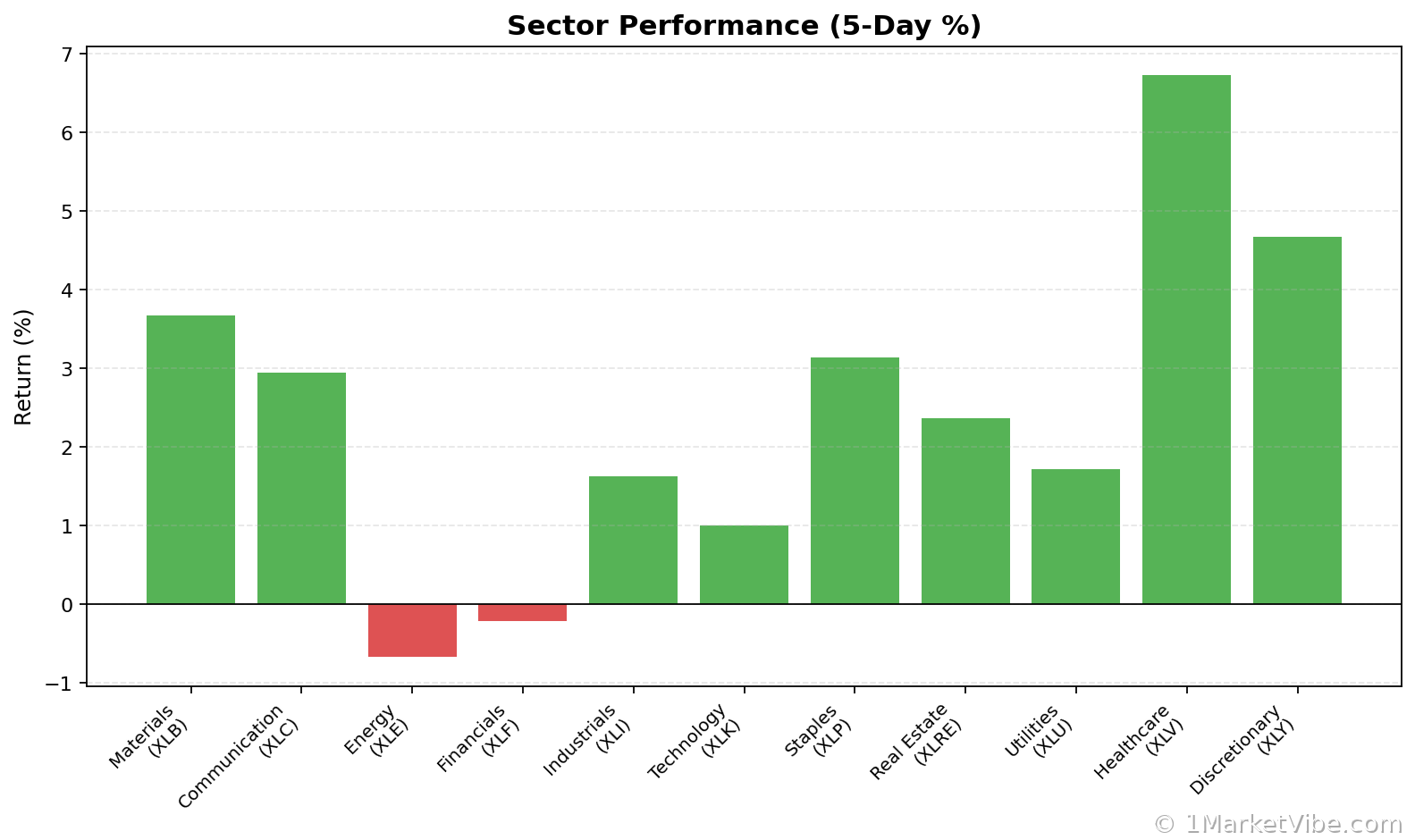

⚡ Act (Specific Steps)

- Monitor CW Index: If the index approaches 6.5, consider reducing exposure to high-volatility tech stocks.

- Adjust Portfolio: Rebalance towards sectors with stable growth prospects, such as healthcare or consumer staples.

- Risk Management: Implement stop-loss orders to protect against sudden market downturns.

- Hedge Positions: Consider using options or other derivatives to hedge against potential losses in tech-heavy portfolios.

Get real-time CW Index alerts at 1marketvibe.com →

Conclusion

In conclusion, the Nasdaq's decline amid Google's AI challenge to Nvidia highlights the dynamic nature of the tech sector. MarketVibe's Enhanced CW Index provides valuable insights, helping investors navigate these changes with a 4-6 week early warning system. By leveraging MarketVibe's proprietary system, investors can make informed decisions, balancing risk and opportunity in a rapidly evolving market landscape. Built by investors, for investors, MarketVibe offers tools that are both actionable and insightful.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a professional advisor before making investment decisions.

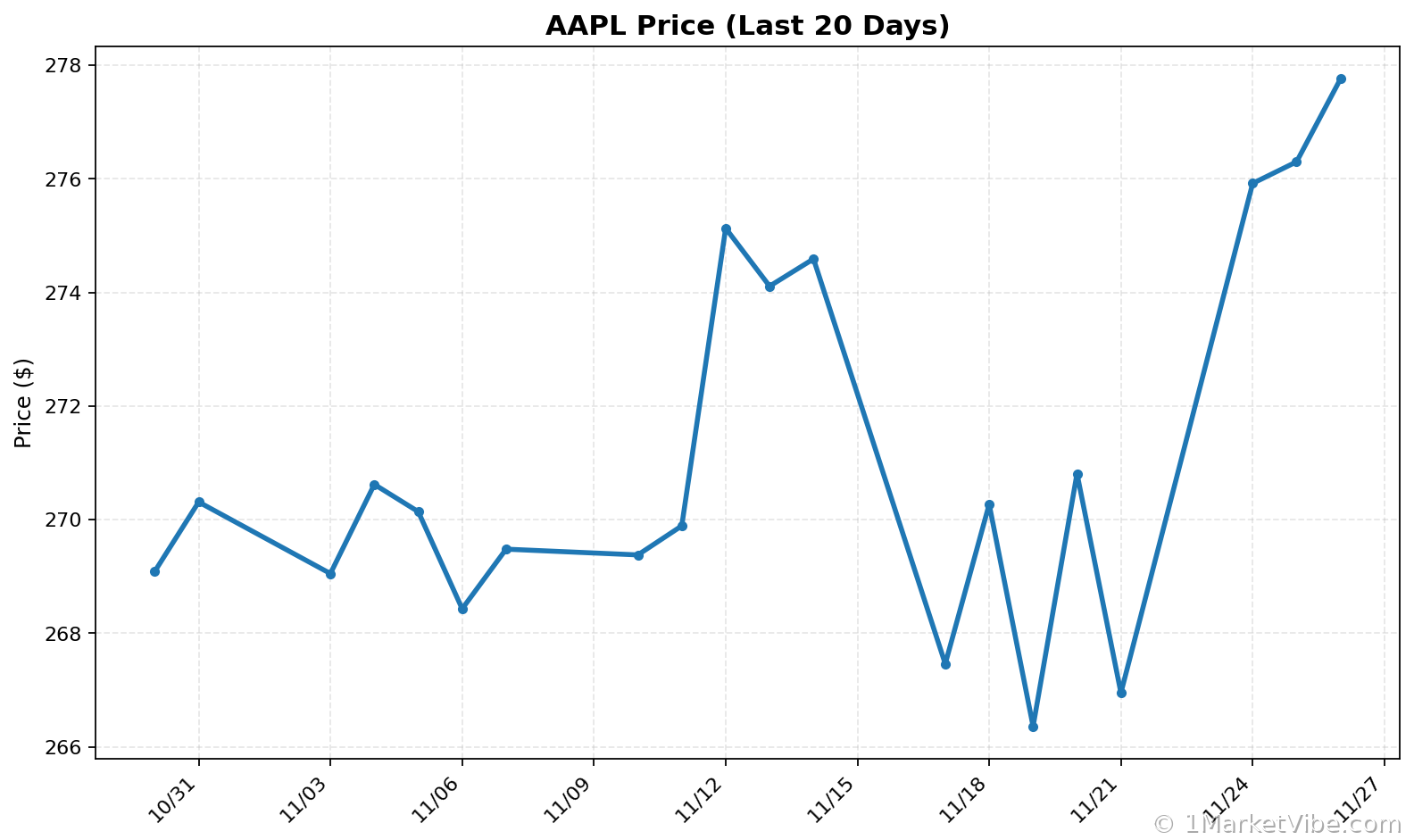

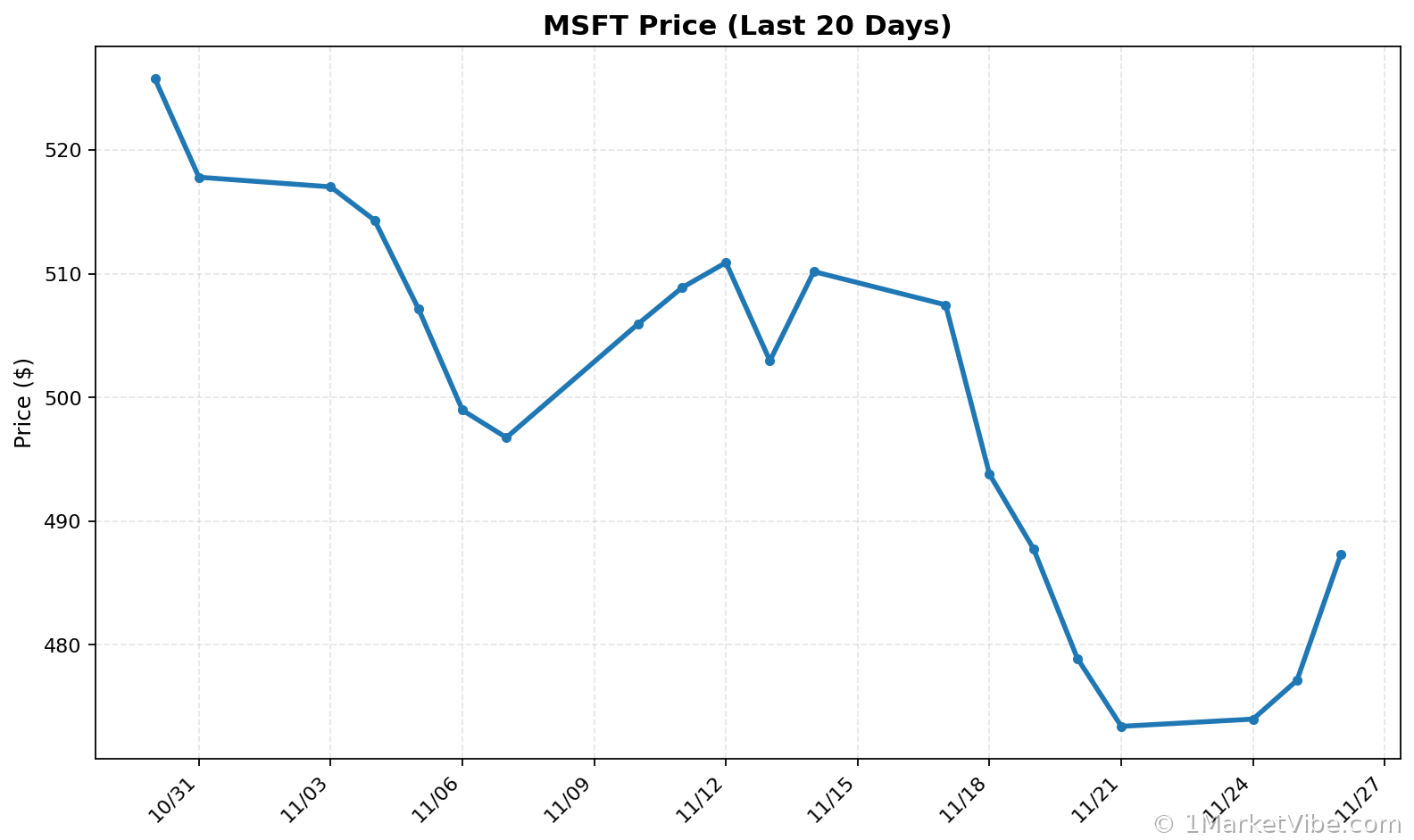

Charts