Tech Sector Faces Reckoning as CW Index Indicates Volatility

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Tech Sector Faces Reckoning as CW Index Indicates Volatility

The tech sector is currently under scrutiny as MarketVibe's proprietary Enhanced CW Index signals potential volatility ahead. This index, which operates on a 0-10 scale, is designed to provide a 4-6 week early warning of market corrections by analyzing institutional gold flows and market breadth. As of today, the CW Index stands at 5.7, indicating a moderate risk level, as it remains below the critical 7.0 threshold that typically signals heightened market caution.

Current Market Context

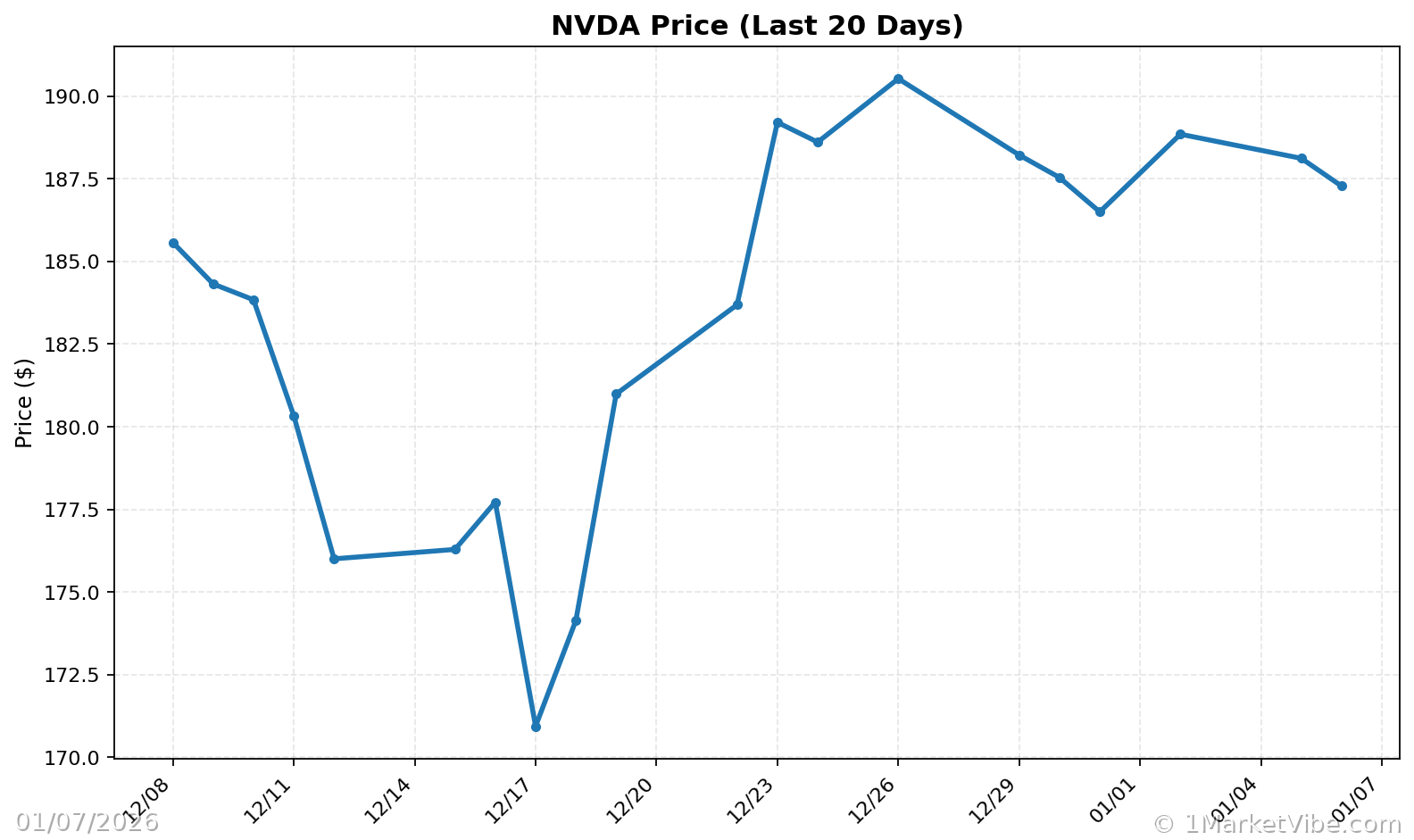

Recent trends in the tech sector have shown signs of instability. Notably, shares of data center cooling-related companies have experienced a downturn following comments from Nvidia's CEO, Jensen Huang, highlighting potential challenges in the sector. Additionally, the tech industry is navigating the complexities of acquisitions, such as Pattern Energy's agreement to acquire Cordelio Power, which could influence market dynamics. These developments align with MarketVibe's CW Index, which suggests a watchful eye on tech investments is prudent.

Learn more about how CW Index works at 1marketvibe.com

Key Developments Impacting the Tech Sector

- Nvidia's Influence: Nvidia's recent statements have led to a decline in stocks related to data center cooling, reflecting the sector's sensitivity to corporate guidance and market sentiment.

- Clean Energy Acquisitions: Pattern Energy's acquisition of Cordelio Power underscores the growing intersection between tech and clean energy, potentially offering new avenues for tech sector diversification.

CW Index Insights

The current CW Index reading of 5.7 suggests that while the risk is moderate, investors should remain vigilant. Historically, when the CW Index reached 7.1 in March 2023, markets experienced an 8.3% decline over the following month. This historical context emphasizes the importance of monitoring the index closely, especially if it approaches the 6.5 level, which could indicate a shift towards higher volatility.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework helps investors turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index: 5.7, indicating moderate risk

- Market Status: Yellow flag for tech sector

- Key Metric to Watch: CW Index movements towards 6.5

📚 Learn (2-Minute Deep Dive)

The tech sector's current volatility is a reflection of broader market uncertainties, influenced by corporate earnings, geopolitical tensions, and sector-specific challenges like those highlighted by Nvidia. Historically, the CW Index has proven to be a reliable early warning system. For instance, its gold component provided foresight during the 2023 market correction, allowing investors to adjust their strategies proactively. As the tech sector continues to evolve, understanding these signals becomes crucial for maintaining a balanced portfolio.

Investors should pay attention to upcoming earnings reports and regulatory changes that could further impact tech valuations. The current market environment underscores the importance of data-driven decision-making, particularly as the CW Index provides a 4-6 week advance notice of potential market shifts.

⚡ Act (Specific Steps)

- Reassess Tech Holdings: Consider reducing exposure to high-volatility tech stocks if the CW Index trends towards 6.5.

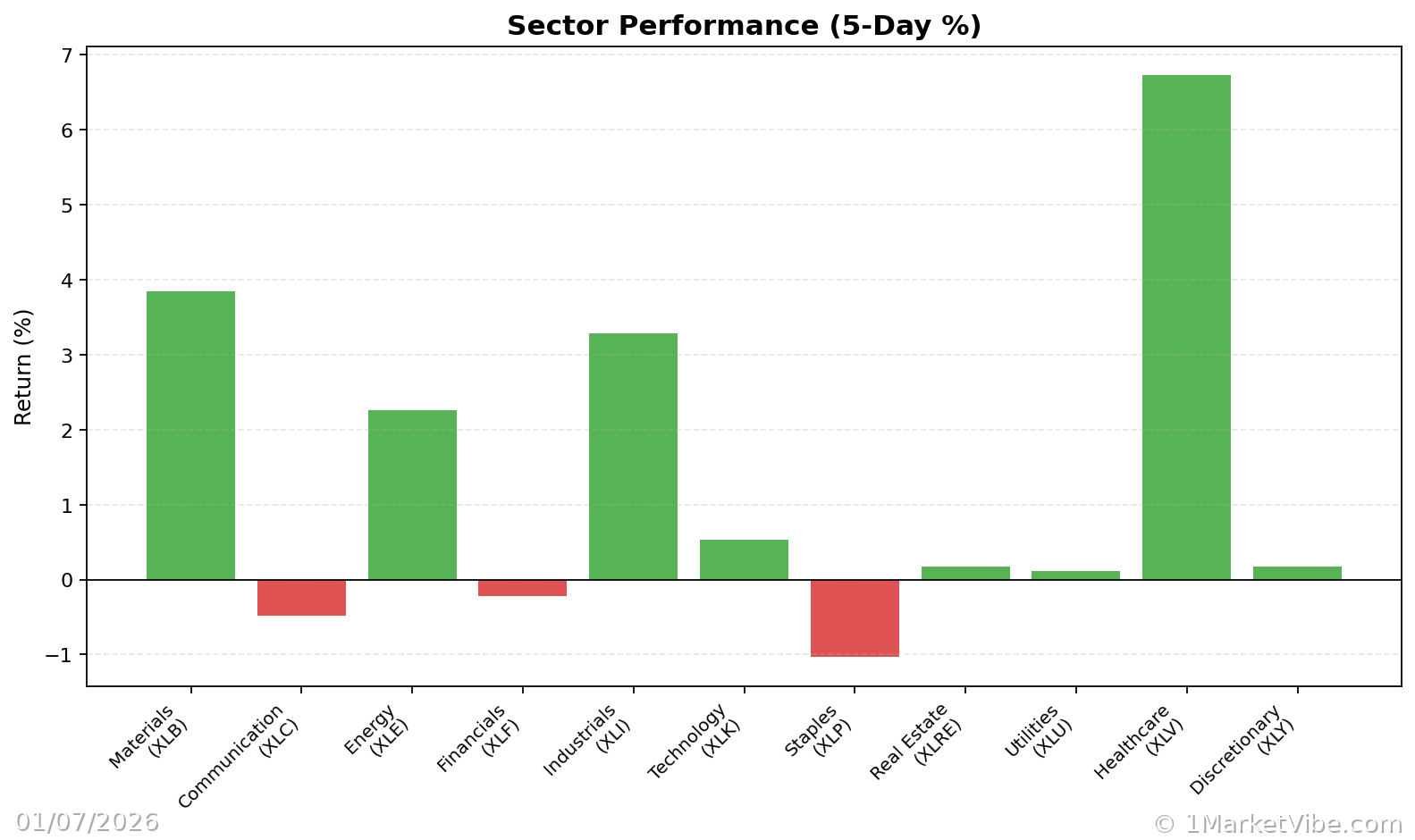

- Diversify Investments: Explore opportunities in sectors like clean energy, which are gaining traction and offer potential growth.

- Implement Risk Management: Use hedging strategies to protect against potential downturns, especially if the CW Index approaches the warning threshold.

- Monitor MarketVibe Alerts: Stay updated with real-time CW Index alerts to make informed decisions.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

In summary, the tech sector faces a period of potential volatility as indicated by MarketVibe's Enhanced CW Index. Investors should remain cautious, leveraging MarketVibe's tools to navigate these uncertain times. By staying informed and proactive, fund managers can better position their portfolios to withstand market fluctuations.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts