Dow Declines 466 Points as CW Index Indicates Upcoming Volatility

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Dow Declines 466 Points as CW Index Indicates Upcoming Volatility

The Dow Jones Industrial Average closed down 466 points on January 8, 2026, marking a 0.94% decline to settle at 48,996.08. This drop follows a session where both the Dow and the S&P 500 reached new intraday highs, only to retreat as investor anxiety grew. The S&P 500 also fell by 0.34% to close at 6,920.93, while the Nasdaq Composite managed a slight gain of 0.16%, ending at 23,584.27.

MarketVibe's Enhanced CW Index: A Key Indicator

MarketVibe's proprietary Enhanced CW Index, currently at 6.1, serves as a crucial tool for investors, providing a 4-6 week early warning of potential market corrections. This index operates on a 0-10 scale, tracking institutional gold flows and market breadth to signal upcoming volatility. With the current reading below the critical 7.0 threshold, it indicates a moderate risk environment. Historical patterns, such as when the CW Index hit 7.1 in March 2023, resulting in an 8.3% market decline, underscore its predictive power. Learn more about how CW Index works at 1marketvibe.com.

Economic Data and Geopolitical Tensions

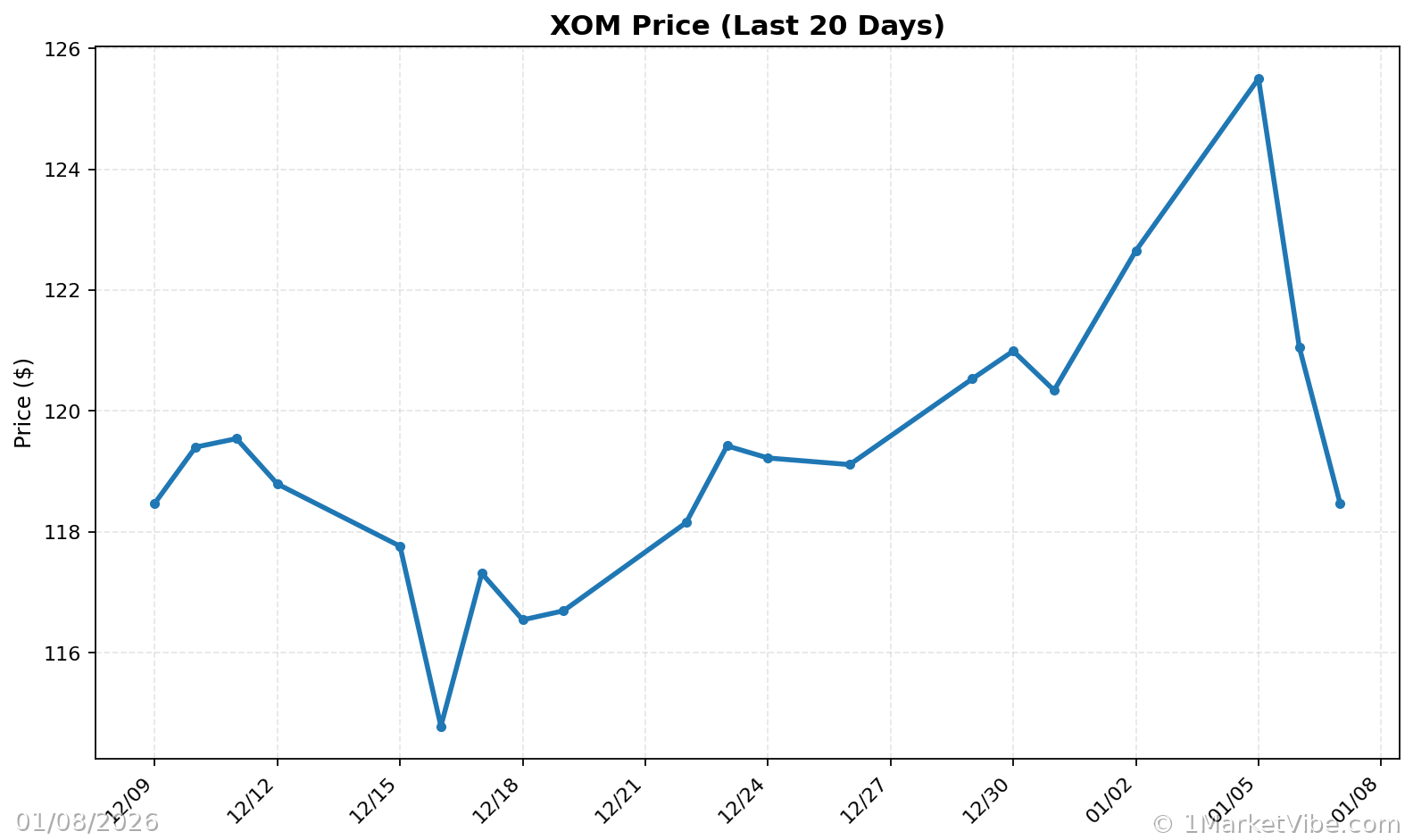

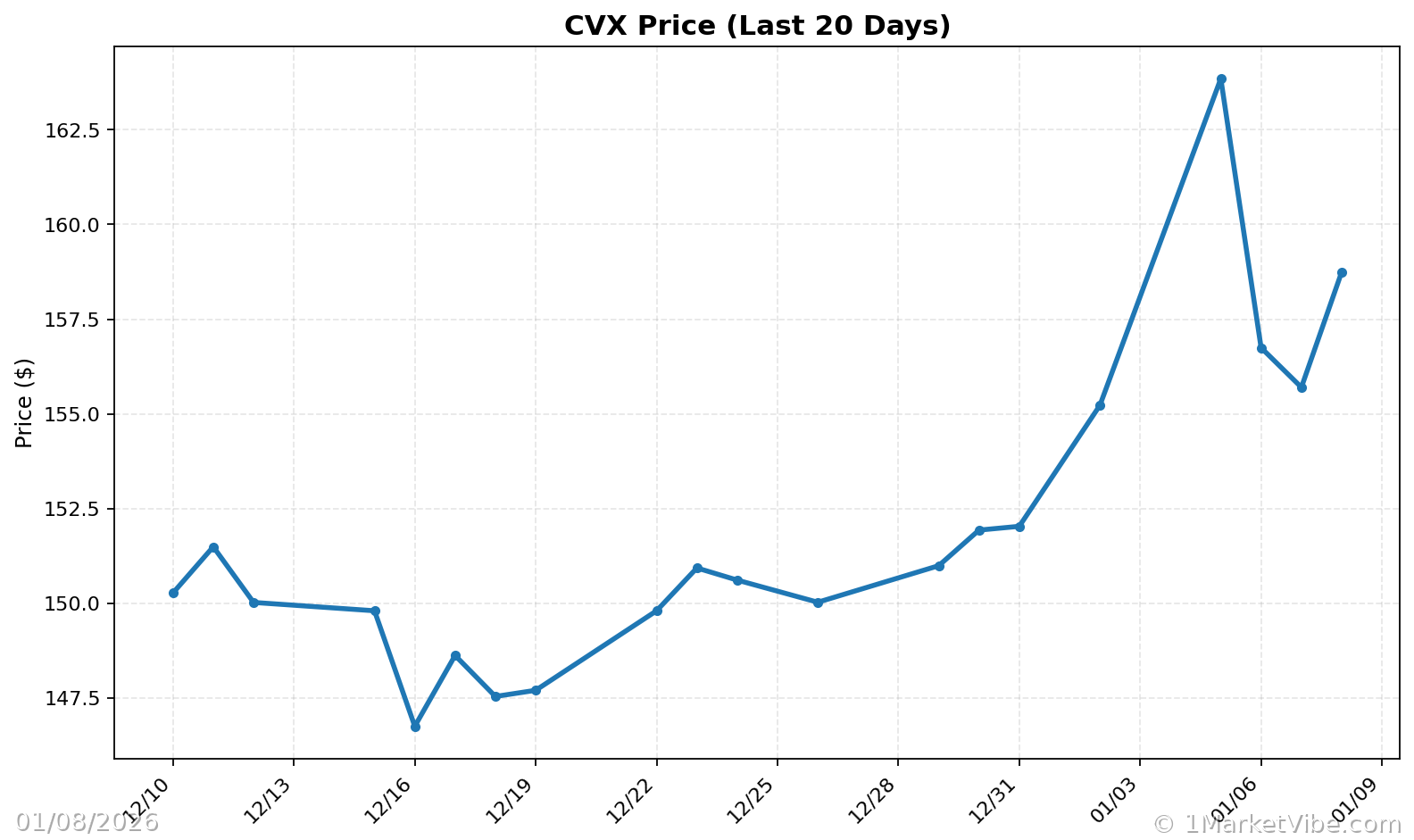

The market's downturn was exacerbated by unexpected jobs data and geopolitical developments. A surprise increase in job numbers added to concerns about potential interest rate hikes. Additionally, news from Venezuela about the transfer of 50 million barrels of oil to the U.S. has stirred fears of oversupply, impacting energy stocks like Exxon Mobil and Chevron, which saw declines of over 1%.

Historical Context and Current Sentiment

Sharp market declines following recent highs are not unprecedented. Such volatility often aligns with significant economic data releases. The current sentiment remains neutral, with investors advised to exercise caution amid these economic uncertainties. MarketVibe's CW Index suggests that while the current reading is below the warning level, vigilance is warranted, especially if the index trends towards 6.5 or higher.

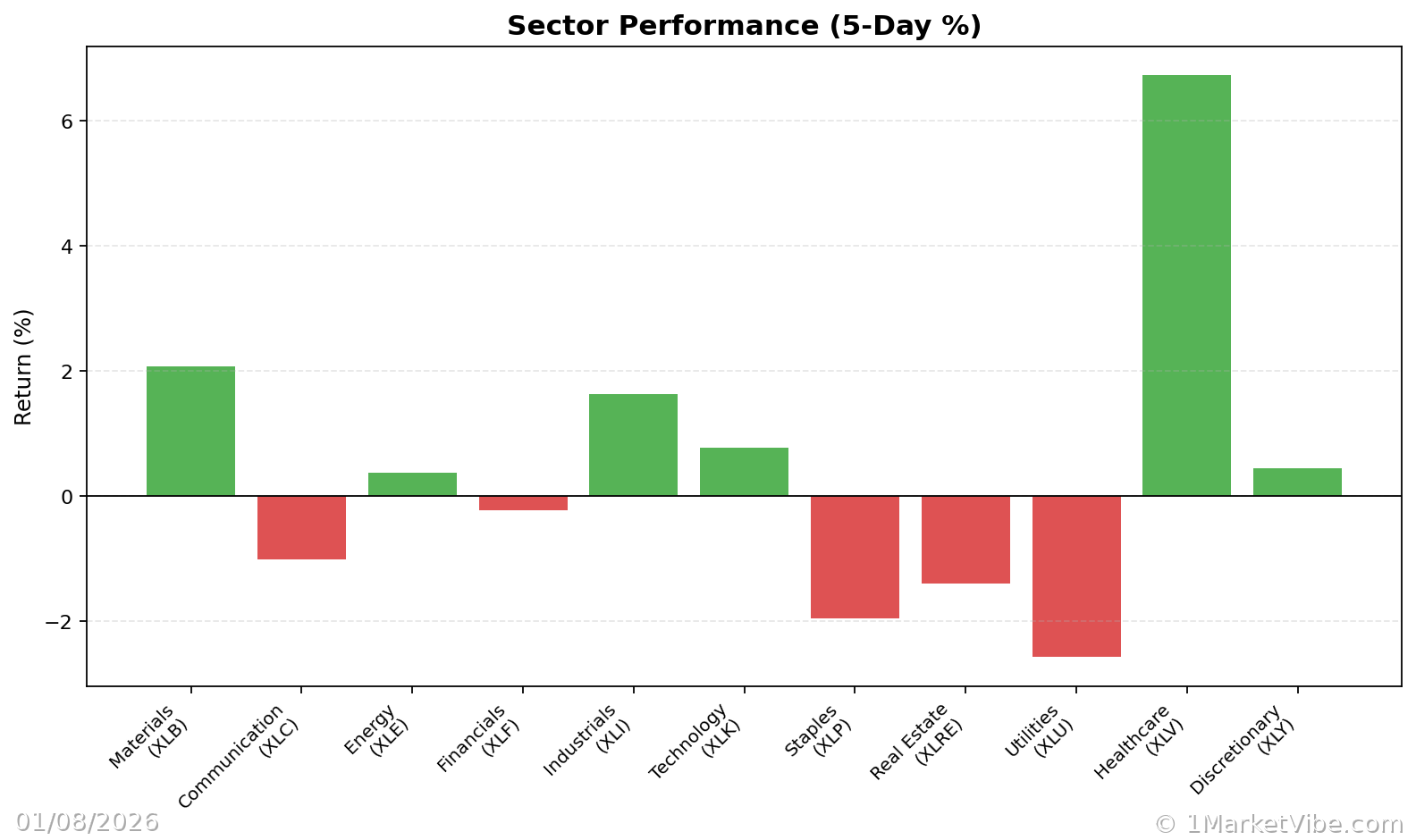

Sector Performance and Resilience

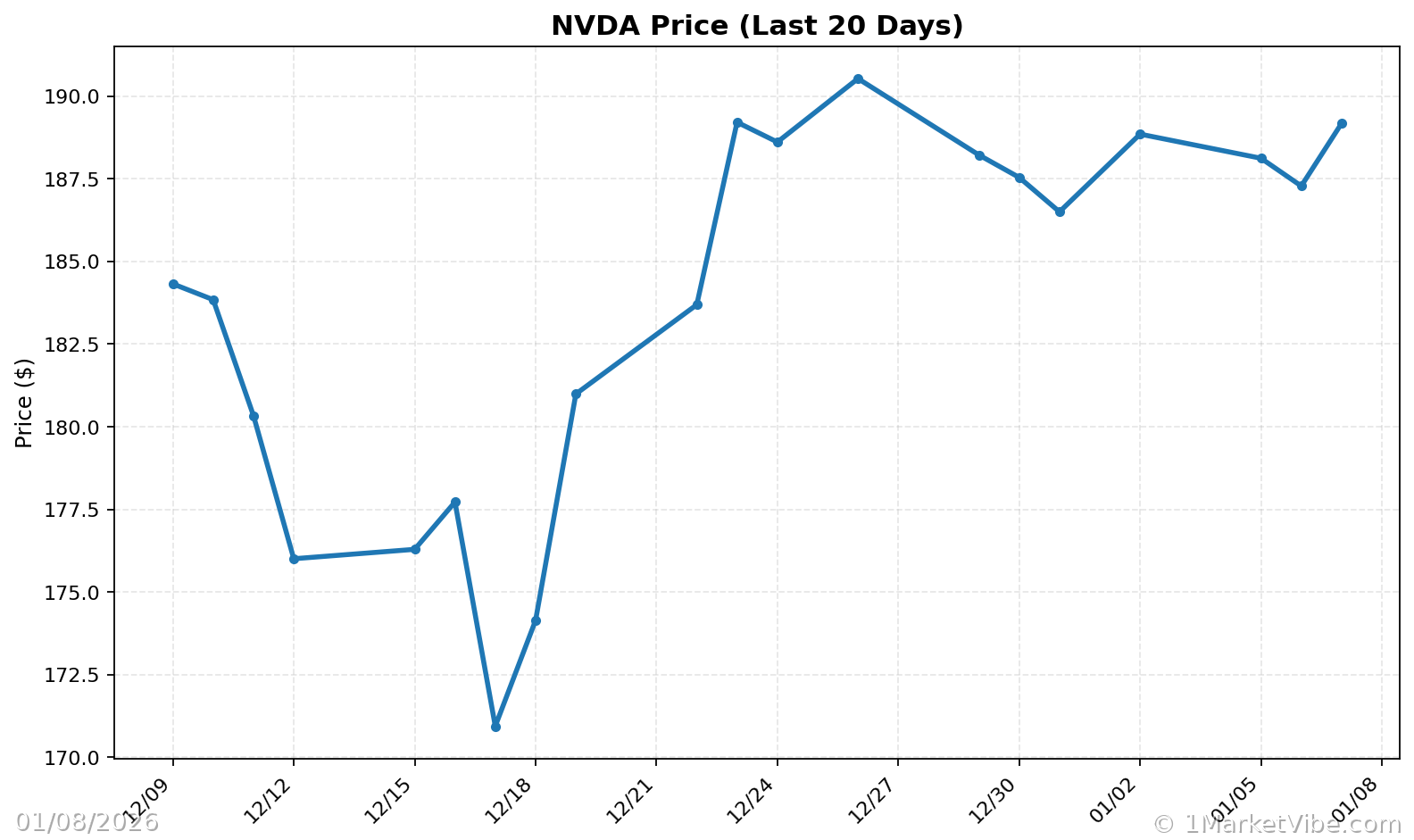

Despite the broader market decline, some sectors, particularly technology, demonstrated resilience. Nvidia, for instance, bucked the trend, reflecting sector-specific news and performance. This highlights the importance of monitoring individual stock movements within the context of broader market trends.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 6.1, indicating potential volatility.

- Market status: Yellow flag, suggesting moderate risk.

- Key metric to watch: CW Index movement towards 6.5.

📚 Learn (2-Minute Deep Dive)

The current market environment is shaped by a mix of economic data surprises and geopolitical tensions. The unexpected jobs data has reignited fears of interest rate hikes, while the geopolitical developments in Venezuela have added to the uncertainty. Historically, similar conditions have led to increased market volatility, as seen in March 2023 when the CW Index reached 7.1, leading to a significant market correction.

Investors should monitor upcoming economic reports closely, as these will provide further insights into potential market movements. The CW Index's gold component offers a 4-6 week early warning, making it a valuable tool for anticipating shifts in market sentiment.

⚡ Act (Specific Steps)

- For Conservative Investors: Maintain current positions but prepare to reduce exposure if the CW Index approaches 6.5.

- For Aggressive Investors: Consider hedging strategies, such as options or inverse ETFs, to protect against potential downturns.

- For All Investors: Reassess portfolio allocations, focusing on sectors with strong fundamentals like technology, which have shown resilience.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Monitoring and Risk Management

The current market conditions underscore the importance of effective risk management. Investors are encouraged to reassess their portfolios, considering the potential for continued volatility as the market digests recent data. Monitoring the CW Index and adjusting strategies accordingly can provide a strategic advantage.

Conclusion

The Dow's recent decline and the insights from MarketVibe's Enhanced CW Index highlight the importance of staying informed and prepared. By leveraging MarketVibe's tools, investors can navigate these uncertain times with greater confidence. Built by investors, for investors, MarketVibe provides the early warnings and actionable insights needed to make informed decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts