Dow Rises 4% Following Maduro's Capture and Stabilization of Oil Markets

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Dow Rises 4% Following Maduro's Capture and Stabilization of Oil Markets

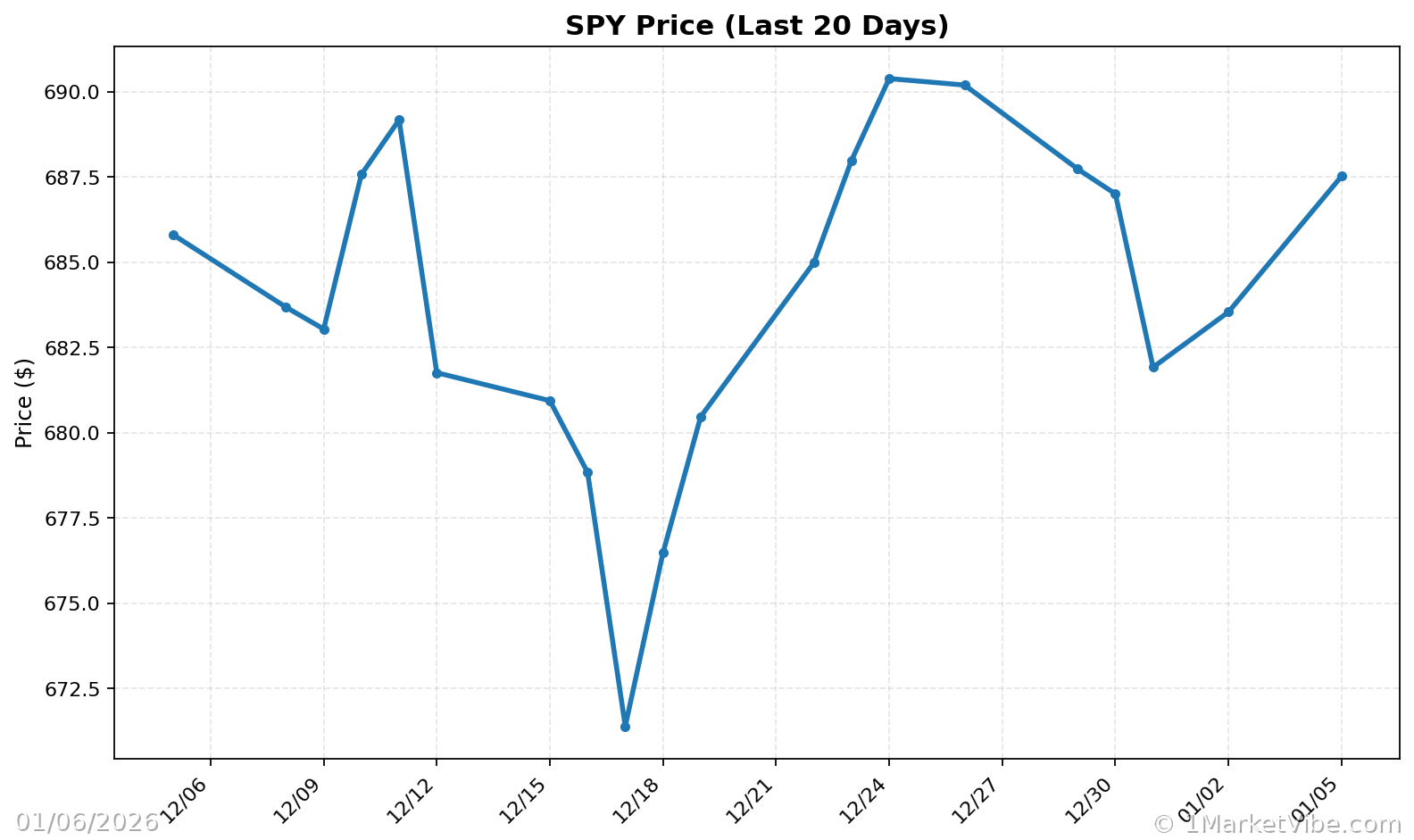

The Dow Jones Industrial Average surged by 4% today, a significant uptick driven by geopolitical developments. The capture of Venezuela's leader, Nicolás Maduro, by U.S. forces has introduced a new dynamic into the global oil markets, potentially stabilizing prices and impacting investor sentiment. This event has unfolded amidst a backdrop of fluctuating market conditions, where MarketVibe's proprietary Enhanced CW Index plays a crucial role in providing early warnings of market corrections. Currently, the CW Index stands at 5.8, below the critical 7.0 threshold, suggesting a moderate risk environment.

MarketVibe's Enhanced CW Index is a powerful tool on a 0-10 scale that tracks institutional gold flows and market breadth to offer a 4-6 week early warning of potential market corrections. This unique feature allows investors to anticipate changes rather than react to them. Learn more about how the CW Index works at 1marketvibe.com.

Impact on Oil Markets

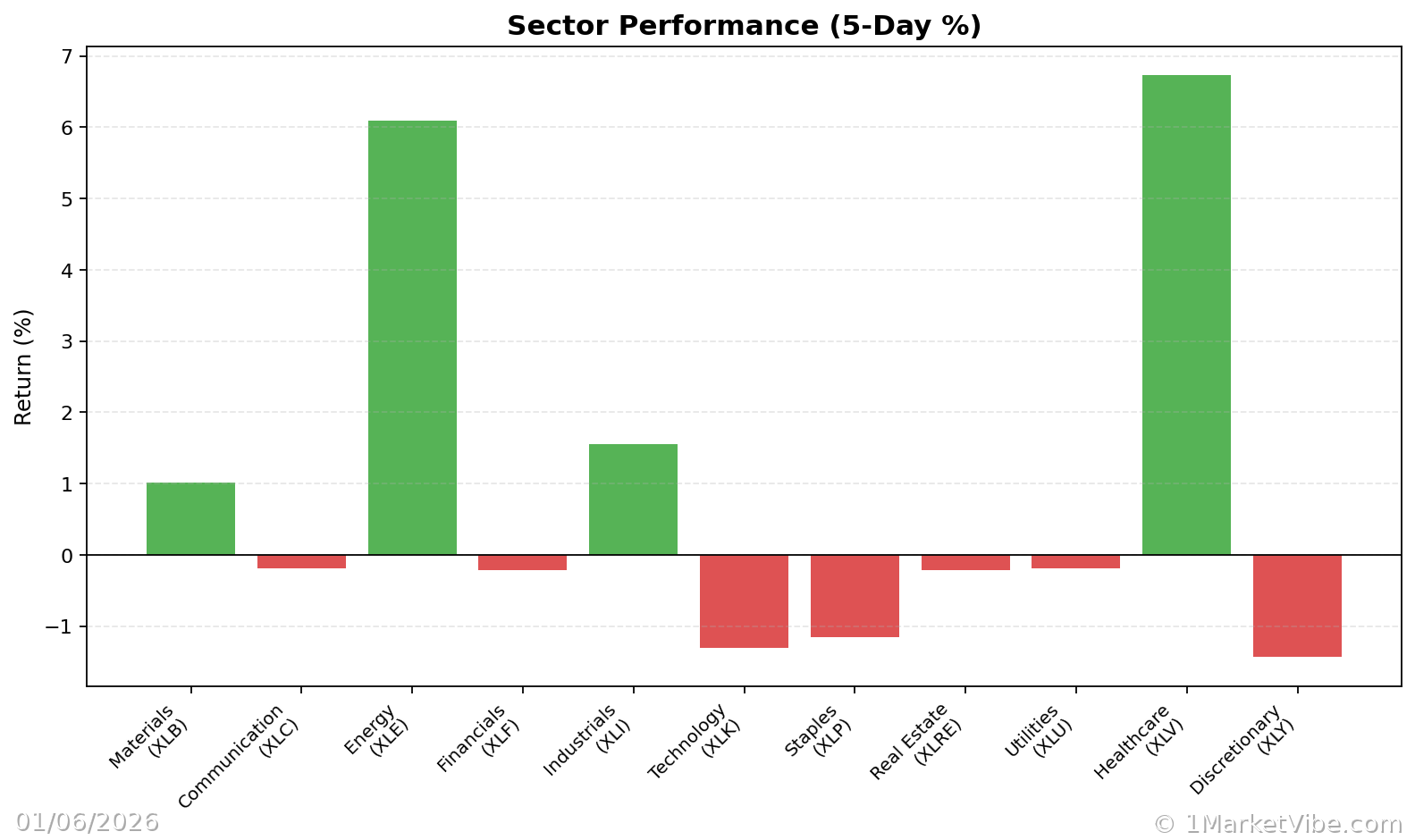

The capture of Maduro is expected to stabilize oil prices, which have been volatile due to geopolitical tensions. Venezuela, holding some of the world's largest oil reserves, plays a critical role in global supply dynamics. With Maduro's capture, there is potential for increased production and export stability, which could lead to a more balanced supply-demand equation. This stabilization is likely to affect energy stocks positively, as well as industries heavily reliant on oil, such as transportation and manufacturing.

Market Reactions

The immediate effect of this geopolitical shift has been a rally in the Dow and other major indices. Energy and finance sectors, in particular, have shown robust performance. The energy sector benefits directly from potential oil market stabilization, while financials gain from improved economic outlooks and reduced volatility. MarketVibe's CW Index suggests that while the current reading of 5.8 indicates moderate risk, investors should remain vigilant for any shifts that could push the index closer to the warning level of 7.0.

Investor Sentiment

Investor sentiment remains cautiously optimistic. While the capture of Maduro has introduced a sense of stability, the broader geopolitical landscape continues to pose risks. MarketVibe's proprietary system, built by investors for investors, emphasizes the importance of monitoring the CW Index for any upward trends that could signal increased market risk. Historical patterns show that when the CW Index hit 7.1 in March 2023, markets experienced an 8.3% decline, underscoring the importance of this early warning system.

Historical Context

The U.S.-Venezuela relationship has historically impacted global markets. Past tensions have led to fluctuations in oil prices and market volatility. For instance, during the 2019 crisis, oil prices spiked, causing ripple effects across various sectors. MarketVibe tracks these historical patterns to provide investors with actionable insights. The current situation, while unique, offers parallels that can guide investor strategies.

Future Considerations

Looking ahead, investors should consider the potential risks associated with ongoing geopolitical instability. Monitoring the CW Index is crucial, as any movement towards the 6.5 level could indicate a need for heightened caution. MarketVibe's 4-6 week early warning capability allows investors to adjust their portfolios proactively, rather than reactively. The gold component of the CW Index is particularly valuable, providing insights into institutional sentiment and potential market shifts.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.8, indicating moderate risk.

- Overall market status: Yellow flag, suggesting cautious optimism.

- Key metric to watch: CW Index movement towards 6.5.

📚 Learn (2-Minute Deep Dive)

The capture of Maduro has the potential to stabilize oil markets, impacting global equity trends positively. Historical parallels, such as the 2019 Venezuela crisis, show that geopolitical events can lead to significant market shifts. Monitoring the CW Index is essential, as it provides a 4-6 week early warning of potential corrections. The current situation matters because it could lead to increased investor confidence and reduced volatility. However, the geopolitical landscape remains complex, and investors should remain vigilant for any changes that could affect market dynamics.

⚡ Act (Specific Steps)

- For conservative investors: Maintain current allocations but monitor the CW Index closely. If it trends towards 6.5, consider reducing exposure to high-risk sectors.

- For aggressive investors: Consider increasing exposure to energy and financial sectors, which stand to benefit from oil market stabilization.

- Risk management: Implement hedging strategies if the CW Index shows signs of approaching the warning threshold.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The Dow's 4% rise following Maduro's capture highlights the interconnectedness of geopolitical events and market dynamics. While the current environment suggests cautious optimism, MarketVibe's Enhanced CW Index remains a critical tool for navigating potential risks. Investors are encouraged to leverage MarketVibe's insights and tools to make informed decisions in this evolving landscape.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult with a financial advisor before making investment decisions.

Charts