Stocks Rally as US Inflation Eases with CW Index at 6.29

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Stocks Rally as US Inflation Eases with CW Index at 6.29

As the year draws to a close, the U.S. stock market is experiencing a notable rally, driven by easing inflationary pressures. Recent data indicates a slowdown in inflation, providing a much-needed boost to investor confidence. In this context, MarketVibe's proprietary Enhanced CW Index, a key market signal tool, is currently at 6.29. This index, which operates on a 0-10 scale, offers a 4-6 week early warning of potential market corrections by tracking institutional gold flows and market breadth. With the current reading below the critical 7.0 threshold, it suggests a moderate risk environment, allowing investors to breathe a sigh of relief.

Learn more about how CW Index works at 1marketvibe.com.

Current Inflation Data

Recent reports show a deceleration in inflation, with consumer prices rising at a slower pace than in previous months. This trend is a welcome development for markets that have been grappling with inflationary pressures for much of the year. The latest figures indicate a year-over-year inflation rate of 3.2%, down from 4.1% earlier in the year. This easing is largely attributed to stabilizing energy prices and improved supply chain conditions.

Market Reaction

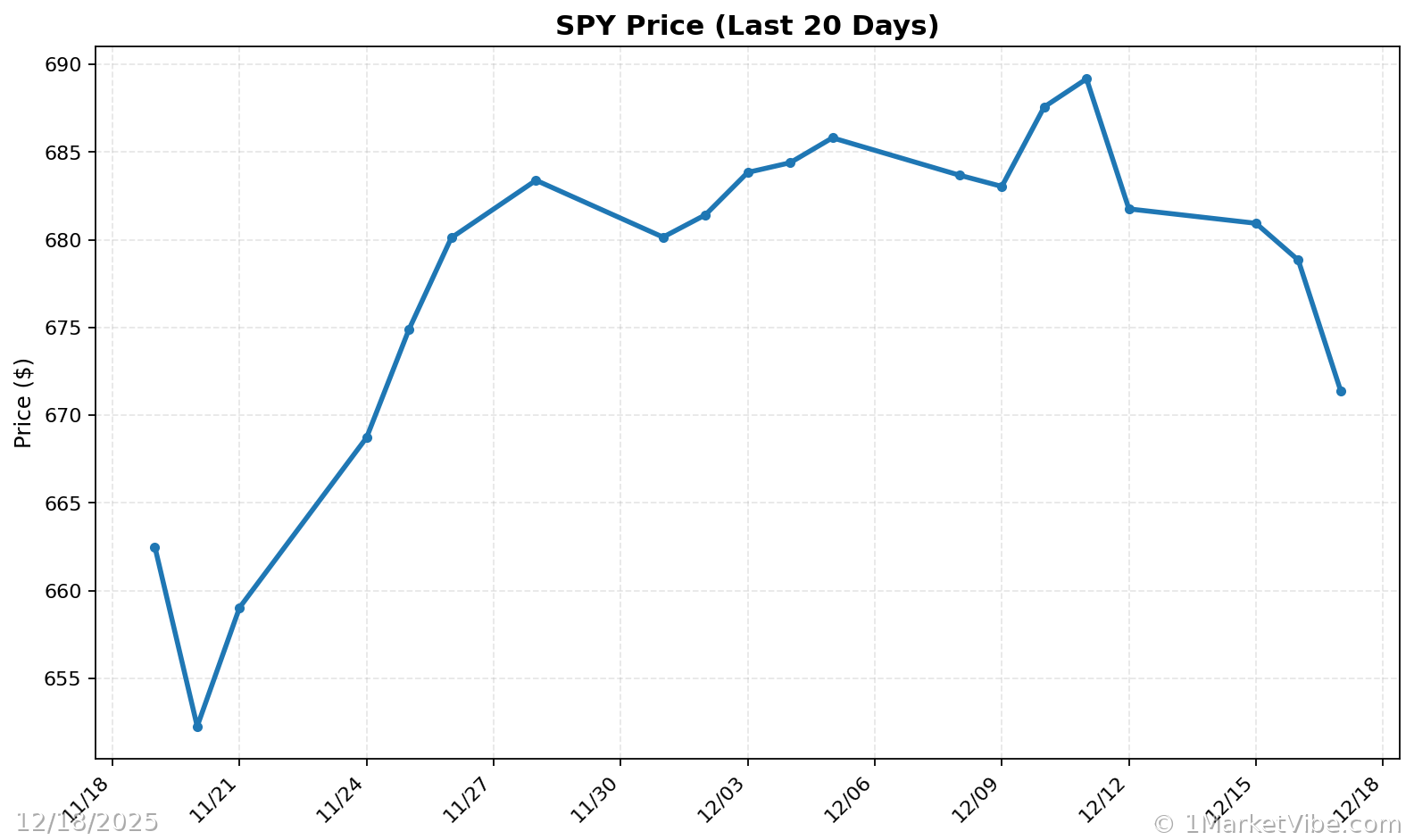

The stock market has responded positively to the easing inflation data. Major indices, including the S&P 500 and the Dow Jones Industrial Average, have seen gains as investor sentiment improves. The S&P 500 has risen by 2.5% over the past week, while the Dow has climbed 1.8%. This uptick reflects growing optimism that the Federal Reserve may adopt a more dovish stance in its upcoming meetings.

CW Index Insights

MarketVibe's Enhanced CW Index at 6.29 suggests a moderate risk environment, providing investors with a cautiously optimistic outlook. Historically, the CW Index has proven to be a reliable early warning system. For instance, when the index hit 7.1 in March 2023, markets subsequently fell by 8.3% over the following month. The current level, below the 7.0 warning threshold, indicates that while risks remain, they are not yet at a critical level. The gold component of the CW Index continues to provide valuable 4-6 week advance notice, helping investors anticipate potential market shifts.

Risk Assessment

Despite the positive market reaction, it's important to maintain a balanced perspective. The current CW Index reading of 6.29 underscores a moderate risk environment. Factors such as geopolitical tensions, potential changes in monetary policy, and unexpected economic data could influence future market stability. Investors should remain vigilant and consider these variables when making investment decisions.

Investor Sentiment

Investor sentiment has improved in light of the recent inflation data. According to MarketVibe data, there is a noticeable uptick in confidence among institutional investors, who are increasingly optimistic about the market's short-term prospects. However, the CW Index's moderate risk signal serves as a reminder to proceed with caution, balancing optimism with prudent risk management.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 6.29, indicating moderate risk.

- Overall market status: Yellow flag, suggesting cautious optimism.

- Key metric to watch: Inflation trends and Federal Reserve policy signals.

📚 Learn (2-Minute Deep Dive)

The current market environment is shaped by easing inflation, which has historically led to positive stock market performance. The CW Index at 6.29 reflects a moderate risk level, suggesting that while the market is not in immediate danger, vigilance is required. Historical patterns show that when the CW Index approaches the 7.0 threshold, market corrections often follow. Investors should monitor inflation data closely, as it will influence Federal Reserve decisions and, consequently, market dynamics. The gold component of the CW Index continues to offer a crucial early warning, providing investors with a strategic advantage in anticipating market shifts.

⚡ Act (Specific Steps)

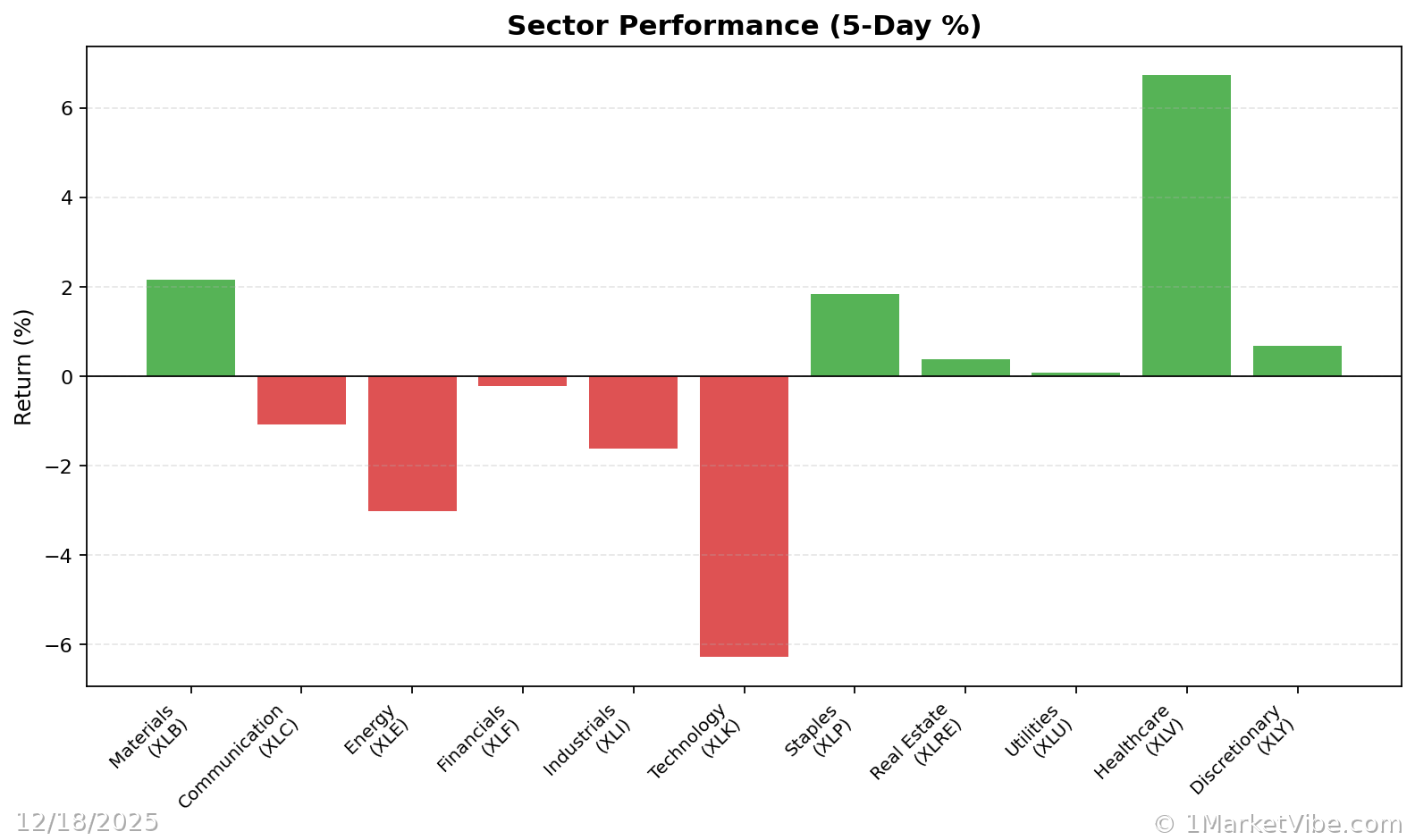

- For conservative investors: Maintain current positions but consider reducing exposure to high-volatility sectors. Monitor the CW Index for any upward movement towards 7.0.

- For aggressive investors: Explore opportunities in sectors benefiting from easing inflation, such as consumer discretionary and technology. Consider increasing allocations by 5-10%.

- Risk management: Implement stop-loss orders to protect against sudden market downturns. Reassess portfolio allocations if the CW Index rises above 6.5.

Get real-time CW Index alerts at 1marketvibe.com →

Conclusion

In summary, the easing of inflation has provided a boost to the stock market, with major indices showing positive momentum. MarketVibe's Enhanced CW Index at 6.29 indicates a moderate risk environment, offering investors a cautiously optimistic outlook. By leveraging MarketVibe's tools, investors can navigate these conditions with greater confidence. As always, it's crucial to remain informed and prepared for potential market shifts.

Built by investors, for investors, MarketVibe offers a unique advantage in understanding and responding to market signals. For more insights and tools, visit 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a financial advisor before making investment decisions.

Charts