Market Risks Increase Amid Oracle's Data Center Challenges and CW Index Alert

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Market Risks Increase Amid Oracle's Data Center Challenges and CW Index Alert

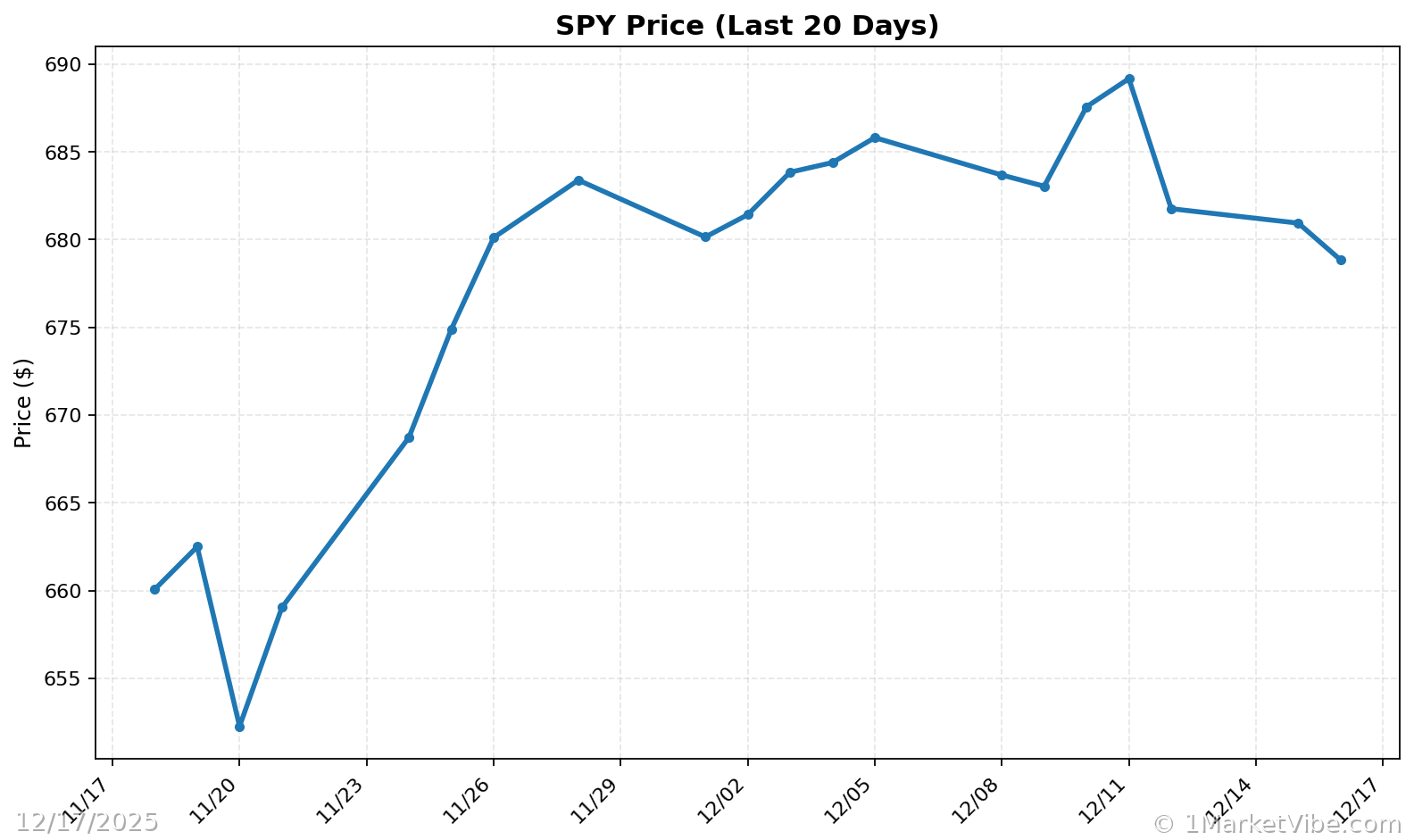

The market landscape is currently fraught with heightened risks, driven by Oracle's recent data center challenges and a notable alert from MarketVibe's proprietary Enhanced CW Index. This index, which operates on a 0-10 scale, offers a 4-6 week early warning of potential market corrections by meticulously tracking institutional gold flows and market breadth. As of today, the CW Index stands at 5.7, signaling a moderate risk level that remains below the critical 7.0 threshold. This reading suggests that while caution is warranted, the market is not yet in immediate danger of a severe downturn.

Learn more about how CW Index works at 1marketvibe.com.

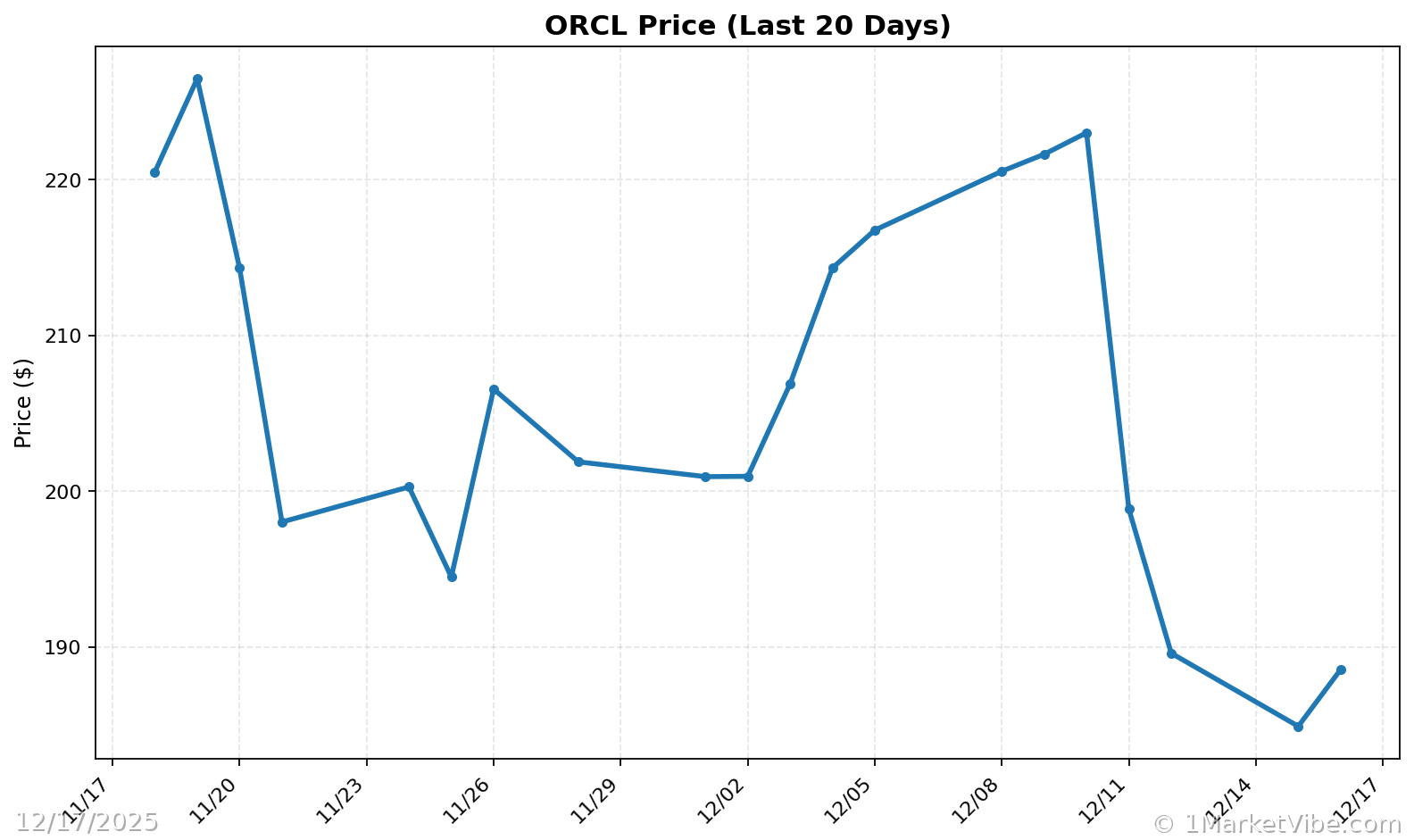

Oracle's Data Center Issues

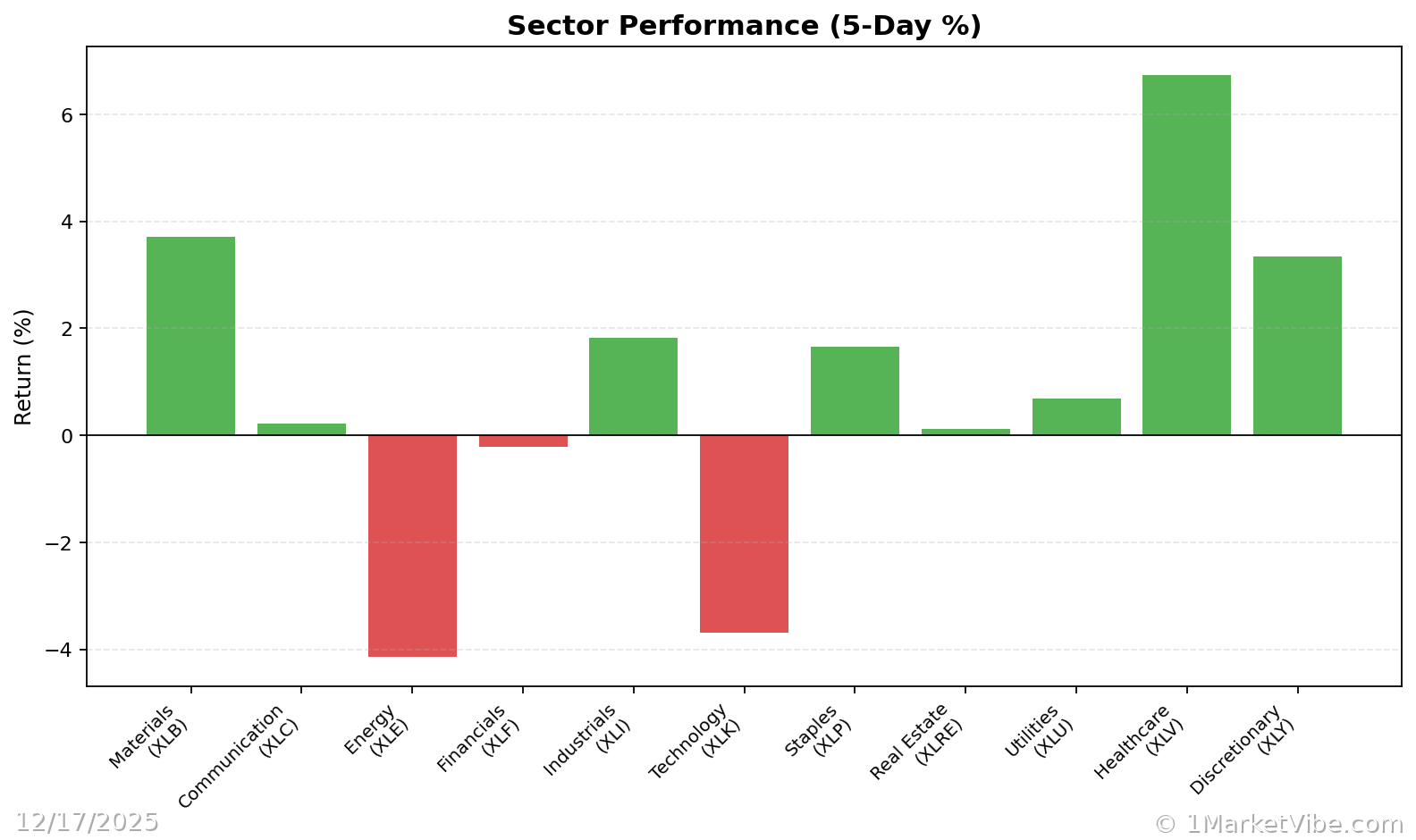

Oracle's recent data center setbacks have sent ripples through the tech sector, particularly impacting AI stocks. The disruptions have raised concerns about the reliability of cloud services, which are crucial for AI operations. This has led to increased volatility in the tech market, underscoring the importance of robust infrastructure in supporting AI advancements. The CW Index's current reading reflects these uncertainties, as institutional investors adjust their positions in response to potential risks.

Impact on AI Stocks

The tech sector, especially AI stocks, has been significantly affected by Oracle's data center issues. Companies reliant on Oracle's infrastructure for AI applications are facing operational challenges, leading to a reevaluation of their stock valuations. This situation highlights the interconnectedness of tech infrastructure and market stability. MarketVibe's CW Index suggests that investors should closely monitor these developments, as further disruptions could push the index closer to the warning threshold.

Market Volatility Analysis

Market volatility has been on the rise, with the CW Index providing a crucial early warning of potential corrections. Historical patterns show that when the CW Index reached 7.1 in March 2023, markets experienced an 8.3% decline over the following month. The current reading of 5.7 indicates moderate risk, but investors should remain vigilant. If the index trends towards 6.5, it may signal a shift towards higher volatility, warranting strategic adjustments in portfolios.

Investor Sentiment

Investor sentiment is currently cautious, influenced by Oracle's challenges and the broader tech sector's volatility. MarketVibe's data indicates a shift in institutional gold flows, a key component of the CW Index, suggesting that investors are seeking safe havens amid uncertainty. This behavior aligns with the index's role as an early warning system, providing insights into market sentiment shifts before they fully materialize.

Comparative Tech Trends

Comparing current tech trends with historical data, the CW Index reveals that market conditions are reminiscent of past periods of tech volatility. For instance, during the 2021 tech correction, the index's early warning capabilities highlighted similar patterns of risk. Investors should consider these historical parallels when evaluating current market conditions, as they provide valuable context for potential future movements.

Risk Awareness in Investments

Given the current market dynamics, risk awareness is paramount. MarketVibe's Enhanced CW Index serves as a critical tool for identifying potential risks before they escalate. Investors are advised to monitor the index closely, particularly if it approaches the 6.5 level, which could indicate a shift towards higher risk. The index's unique gold component provides a 4-6 week advance notice, allowing investors to make informed decisions.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk.

- Overall market status: Yellow flag.

- Key metric to watch: CW Index movement towards 6.5.

📚 Learn (2-Minute Deep Dive)

The current market environment, influenced by Oracle's data center issues, underscores the rising risk in tech trends. Historical parallels, such as the 2021 tech correction, provide context for understanding potential future movements. The CW Index's early warning capabilities highlight the importance of monitoring institutional gold flows, which suggest a cautious investor sentiment. As the index remains below the critical threshold, investors should remain vigilant, particularly in the tech sector, where volatility is most pronounced.

⚡ Act (Specific Steps)

- Diversify Portfolios: Consider reducing exposure to high-volatility tech stocks and increasing allocations in more stable sectors.

- Monitor CW Index: If the index approaches 6.5, prepare to adjust positions accordingly.

- Implement Hedging Strategies: Use options or other financial instruments to hedge against potential downturns.

- Stay Informed: Regularly check MarketVibe's updates for real-time alerts and insights.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

In conclusion, the current market risks, highlighted by Oracle's data center challenges and the CW Index alert, demand careful attention from investors. MarketVibe's Enhanced CW Index and Decision Edge™ Method provide invaluable tools for navigating these uncertain times. By leveraging these resources, investors can gain a strategic advantage, making informed decisions that align with their risk tolerance and investment goals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts