S&P 500 Declines 1% Amid Tech Earnings Pressure on Market Stability

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Market Overview

The S&P 500 experienced a notable decline of 1% today, driven largely by pressures from the tech sector's earnings reports. This downturn underscores the market's current instability, as investors react to mixed signals from major technology firms. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.7. This level is below the 7.0 warning threshold, indicating moderate risk but suggesting vigilance is necessary as market conditions evolve.

MarketVibe's Enhanced CW Index suggests that while the current reading indicates moderate risk, the tech sector's volatility could lead to broader market impacts. Historically, when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month. Investors should watch for any upward movement in the CW Index, particularly if it approaches the 6.5 level, which could signal increased risk. Learn more about how the CW Index works at 1marketvibe.com.

Tech Sector Impact

Recent earnings reports from major tech companies have been a mixed bag, with some firms exceeding expectations while others fall short. This inconsistency has contributed to the S&P 500's decline, as tech stocks play a significant role in the index's composition. The tech sector's performance is critical, as it often sets the tone for broader market sentiment.

MarketVibe's CW Index at 5.7 reflects these uncertainties, as the tech sector's performance can heavily influence market stability. The gold component of the CW Index provides a 4-6 week early warning, allowing investors to anticipate potential shifts. As tech earnings continue to roll in, investors should remain cautious and monitor the CW Index for any changes that could indicate increased risk.

Historical Context

The current market environment bears similarities to past periods of tech-driven volatility. For instance, in 2021, a series of disappointing tech earnings reports led to a 2% drop in the S&P 500 over a single week. During that time, MarketVibe's CW Index rose sharply, providing an early warning of the downturn. This historical parallel highlights the importance of monitoring tech sector developments and their potential impact on the broader market.

MarketVibe's Enhanced CW Index has consistently proven its value as an early warning system. By tracking institutional gold flows, it offers investors a unique perspective on market risk. As the tech sector continues to influence market dynamics, the CW Index remains a crucial tool for anticipating potential corrections.

Investor Sentiment

Investor sentiment is currently cautious, as evidenced by the S&P 500's recent decline. Concerns about tech earnings and broader economic conditions are contributing to a more risk-averse mindset. According to MarketVibe data, the CW Index's current reading of 5.7 suggests that while risk is moderate, investors should remain vigilant.

The CW Index's historical patterns show that when sentiment shifts, it can lead to significant market movements. For example, in 2022, a sudden change in investor sentiment led to a 5% drop in the S&P 500 over two weeks. MarketVibe's Enhanced CW Index provided an early warning during that period, underscoring its value as a predictive tool.

Potential Risks

Several potential risks could further impact market stability. These include ongoing geopolitical tensions, changes in monetary policy, and continued volatility in the tech sector. MarketVibe's CW Index at 5.7 indicates that while these risks are currently moderate, they could escalate if conditions change.

Investors should watch for any significant movements in the CW Index, particularly if it approaches or exceeds the 6.5 level. Such a shift could signal increased risk and the potential for market corrections. The gold component of the CW Index offers a 4-6 week early warning, providing investors with valuable time to adjust their strategies.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework helps investors turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk

- Overall market status: Yellow flag, suggesting caution

- Key metric to watch: Tech sector earnings and CW Index movements

📚 Learn (2-Minute Deep Dive)

The current market environment is characterized by tech sector volatility and broader economic uncertainties. MarketVibe's CW Index at 5.7 reflects these conditions, providing a moderate risk assessment. Historical parallels, such as the 2021 tech earnings-driven downturn, highlight the potential for similar patterns to emerge.

Investors should monitor tech earnings reports closely, as they can significantly influence market sentiment. The CW Index's gold component offers a 4-6 week early warning, allowing for proactive adjustments. Understanding these dynamics is crucial for navigating the current market landscape.

⚡ Act (Specific Steps)

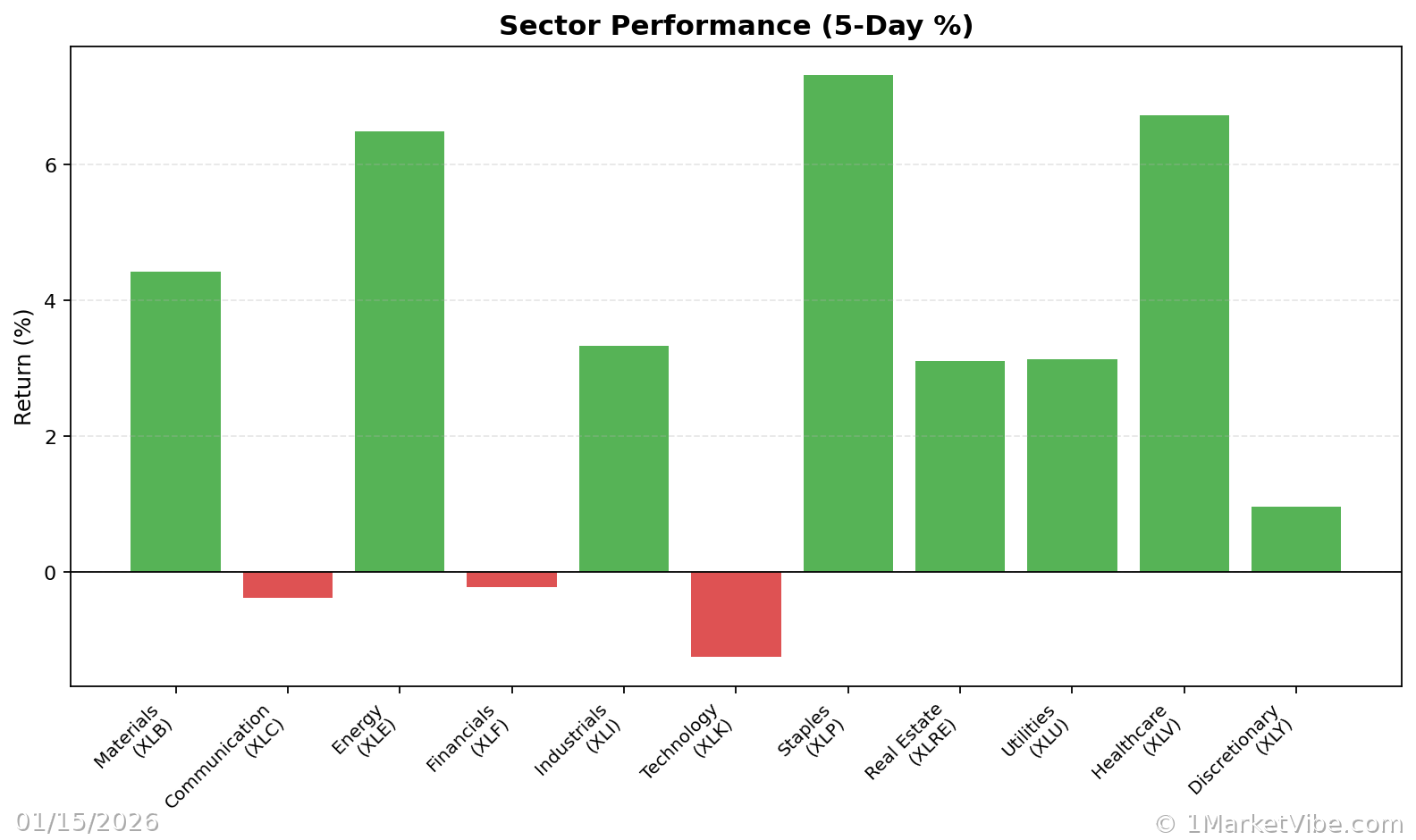

- Diversify Holdings: Consider reducing exposure to tech-heavy portfolios and increasing allocations to more stable sectors.

- Monitor CW Index: If the CW Index approaches 6.5, consider hedging strategies to mitigate potential risks.

- Adjust Risk Exposure: Based on CW Index signals, adjust position sizes and risk exposure accordingly.

- Stay Informed: Access real-time CW Index alerts at 1marketvibe.com to stay ahead of market shifts.

Conclusion

The S&P 500's recent decline highlights the impact of tech sector volatility on market stability. MarketVibe's Enhanced CW Index at 5.7 provides a crucial early warning of potential risks, allowing investors to make informed decisions. By leveraging the Decision Edge™ Method, investors can navigate the current market environment with confidence.

For more insights and to access MarketVibe's full Decision Edge framework, visit 1marketvibe.com →.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.