JPMorgan's Profit Decline Highlights Broader Financial Sector Risks

- Authors

- Name

- MarketVibe Team

- @1marketvibe

JPMorgan's Profit Decline Highlights Broader Financial Sector Risks

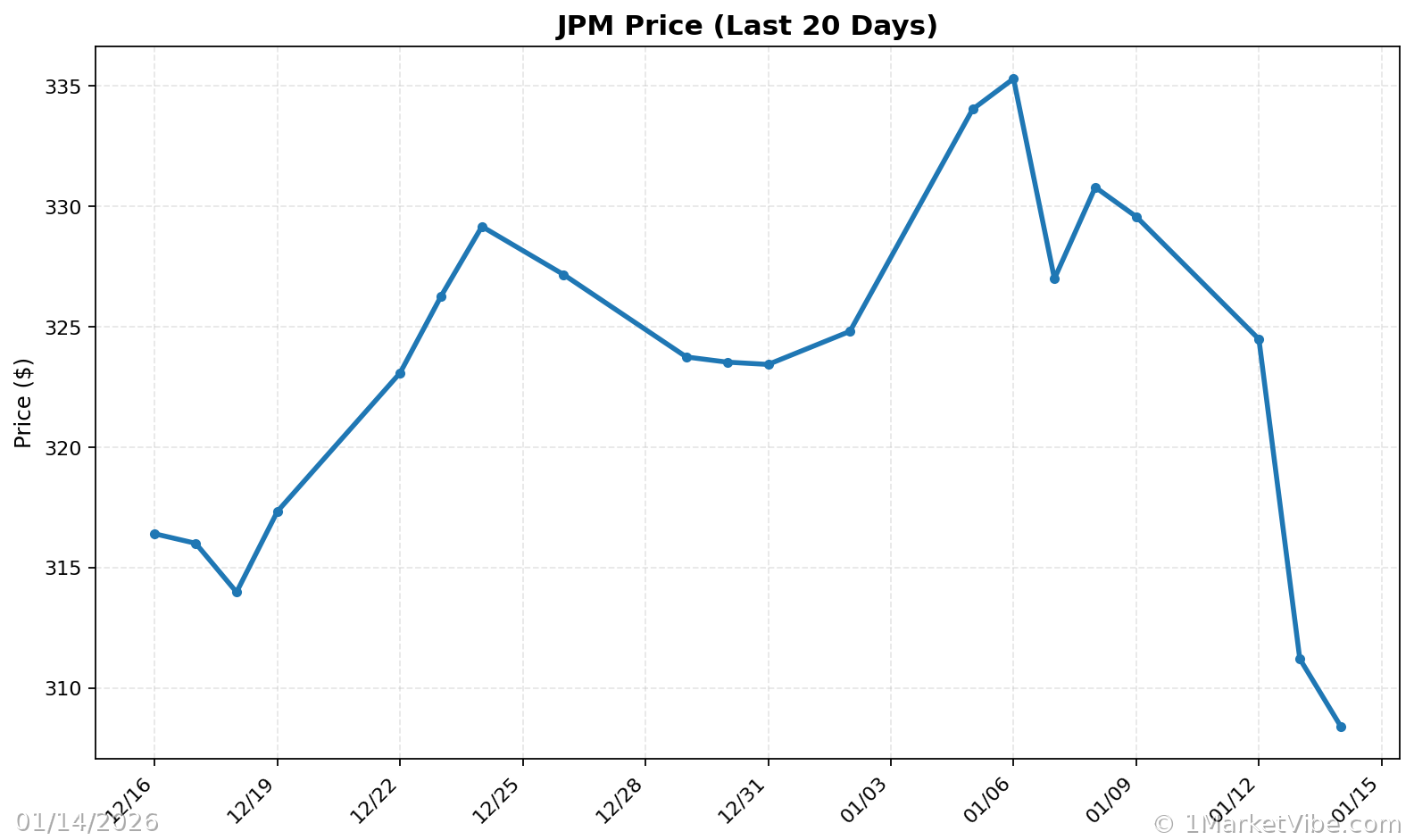

JPMorgan Chase's recent earnings report has sent ripples through the financial markets, underscoring potential vulnerabilities within the broader financial sector. Despite surpassing expectations on both the top and bottom lines, JPMorgan's shares fell by 4.2%, highlighting investor concerns over the sustainability of its earnings amid a volatile economic landscape. This development aligns with MarketVibe's proprietary Enhanced CW Index, which is currently reading 5.7 out of 10. This level, while below the critical 7.0 threshold, indicates a moderate risk environment, suggesting investors should remain vigilant.

Profit Decline Details

JPMorgan reported a decline in investment banking fees, which fell short of market expectations, despite an increase in overall trading revenue. This mixed performance has raised questions about the resilience of the financial sector, especially as the bank's CFO, Jeremy Barnum, hinted at potential challenges from proposed regulatory changes, such as a cap on credit card interest rates. This uncertainty is reflected in the broader market, with the S&P 500 and Dow Jones Industrial Average both experiencing declines of 0.19% and 0.8%, respectively.

Market Reaction

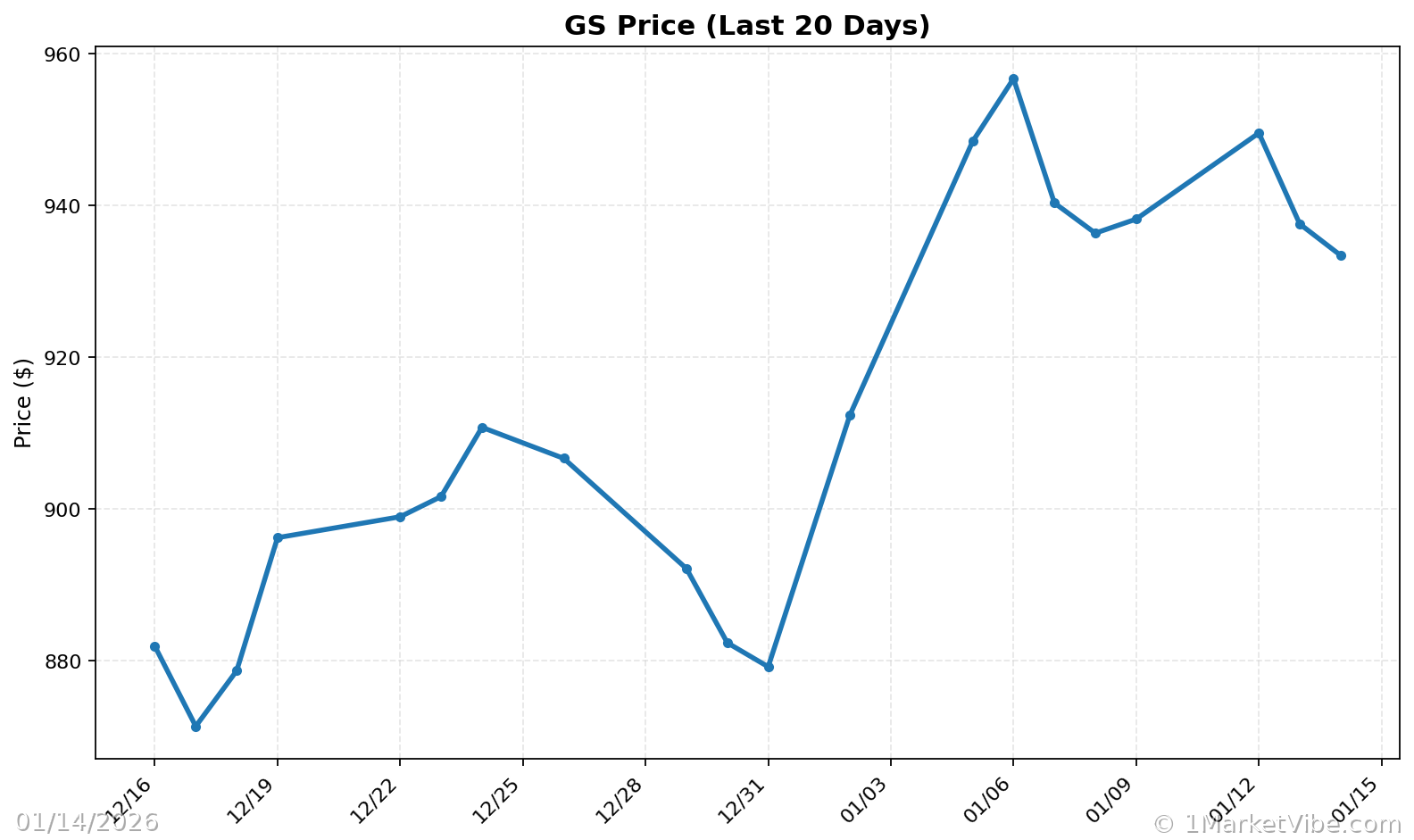

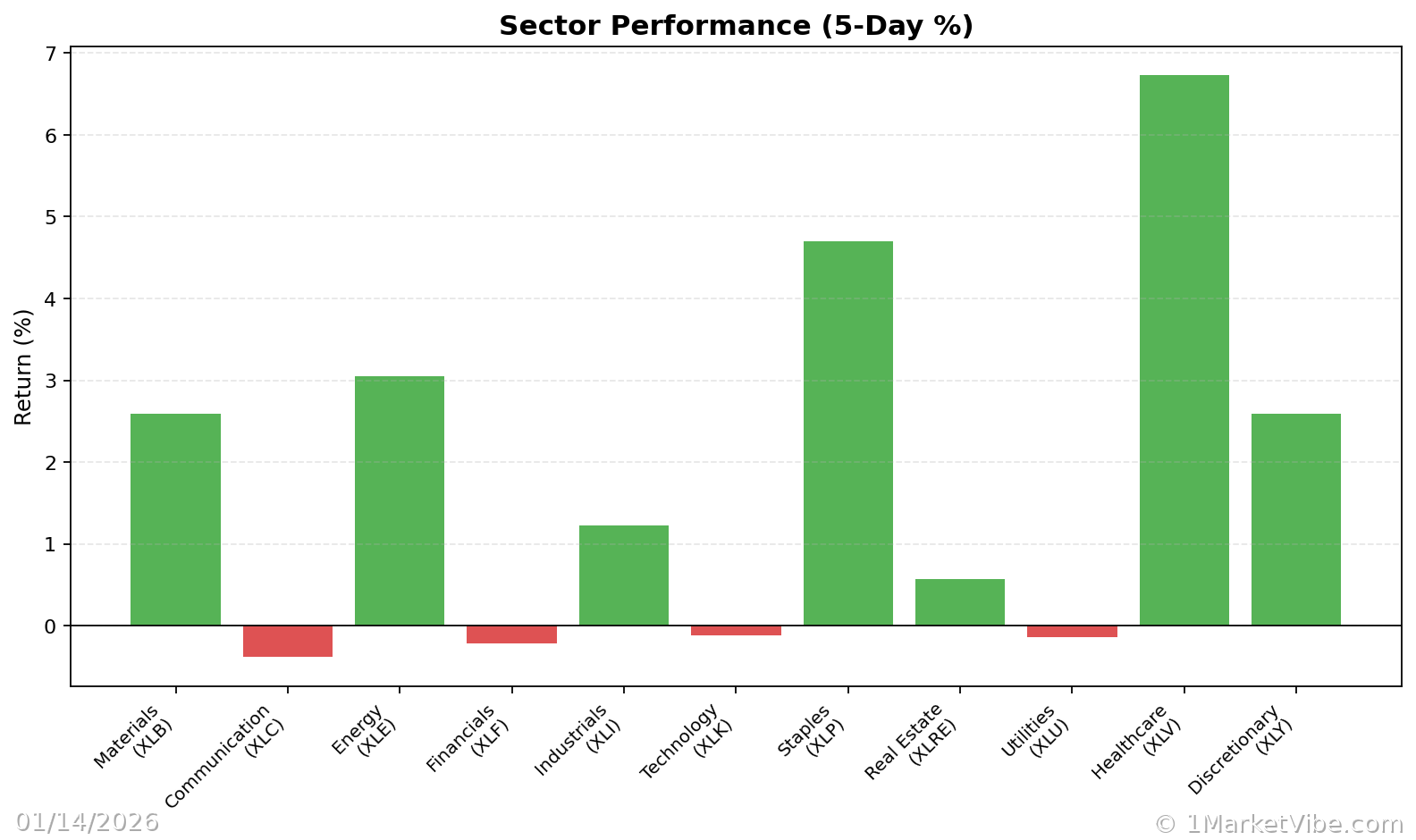

The market's reaction to JPMorgan's earnings report was swift, with the financial sector experiencing notable pressure. Other major financial stocks, including Goldman Sachs, Mastercard, and Visa, also saw declines, contributing to the sector's overall downturn. According to MarketVibe data, these movements are consistent with the current CW Index reading, which suggests that while immediate risks are moderate, investors should be cautious of potential shifts in market dynamics.

Broader Financial Sector Risks

JPMorgan's performance is not an isolated case but rather a reflection of broader challenges facing the financial sector. The proposed regulatory changes, coupled with geopolitical tensions and fluctuating economic indicators, have created an environment of uncertainty. MarketVibe's 4-6 week early warning system, which incorporates institutional gold flows, provides a critical lens through which investors can anticipate potential market corrections.

Investor Sentiment

Investor sentiment remains cautious, influenced by external factors such as political developments and economic data releases. The recent consumer price index report, which showed a slight increase in inflation, has added to the complexity of the current market environment. MarketVibe's Enhanced CW Index continues to serve as a valuable tool for investors, offering insights into potential market shifts before they occur.

Historical Context

Historically, similar earnings reports have led to significant market reactions. For instance, when the CW Index reached 7.1 in March 2023, markets experienced an 8.3% decline over the following month. This historical context underscores the importance of monitoring the CW Index for early warning signs of market corrections.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to transform market intelligence into actionable decisions for investors.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk.

- Market status: Yellow flag, suggesting caution.

- Key metric to watch: Institutional gold flows.

📚 Learn (2-Minute Deep Dive)

The current market conditions, highlighted by JPMorgan's earnings report, reflect broader systemic risks within the financial sector. The decline in investment banking fees, despite overall revenue growth, signals potential vulnerabilities. Historical parallels, such as the March 2023 market decline, emphasize the importance of being prepared for potential downturns. MarketVibe's Enhanced CW Index, with its gold flow component, provides a crucial early warning system, allowing investors to anticipate market corrections 4-6 weeks in advance.

Going forward, investors should monitor regulatory developments and geopolitical tensions, as these factors could significantly impact market stability. The current situation underscores the need for a strategic approach to risk management, leveraging tools like the CW Index to navigate uncertain times.

⚡ Act (Specific Steps)

- Diversify Portfolio: Consider reallocating investments to include a mix of asset classes, reducing exposure to high-risk sectors.

- Monitor CW Index: Regularly check the CW Index for changes. If it approaches or exceeds 6.5, consider increasing defensive positions.

- Implement Hedging Strategies: Use options or other derivatives to hedge against potential market downturns.

- Stay Informed: Keep abreast of regulatory changes and geopolitical developments that could impact the financial sector.

For more detailed insights and real-time alerts, access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

JPMorgan's profit decline serves as a cautionary tale for investors, highlighting the broader risks within the financial sector. By leveraging tools like MarketVibe's Enhanced CW Index and the Decision Edge™ Method, investors can better navigate the complexities of the current market environment. As always, maintaining a balanced and informed approach is key to managing risk effectively.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts