Rate-Cut Speculation and Three Strategic Portfolio Moves as US Stocks Rise

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Rate-Cut Speculation and Three Strategic Portfolio Moves as US Stocks Rise

As November 2025 draws to a close, US stocks are experiencing a notable upswing, driven by increasing speculation of a potential rate cut by the Federal Reserve. This optimism is reflected in the market's buoyancy, with investors recalibrating their strategies in anticipation of a more favorable interest rate environment. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale providing a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.7. This reading remains below the critical 7.0 threshold, indicating moderate risk and suggesting that the market's current trajectory is cautiously optimistic.

Market Overview

The current market environment is characterized by a blend of optimism and caution. The Enhanced CW Index at 5.7 suggests that while there is some risk, it is not yet at a level that typically precedes significant market corrections. Historically, when the CW Index hit 7.1 in March 2023, markets fell by 8.3% over the following month. Investors are advised to monitor this index closely, as any movement towards the 6.5 mark could indicate rising volatility.

Learn more about how CW Index works at 1marketvibe.com.

Rate-Cut Expectations

The speculation around a potential rate cut is gaining momentum as economic indicators suggest a slowdown in inflationary pressures. This has led to increased investor confidence, as lower interest rates typically boost equity markets by reducing borrowing costs and encouraging spending. According to MarketVibe data, the anticipation of a rate cut is a significant factor in the current market rally, with sectors such as technology and consumer discretionary seeing notable gains.

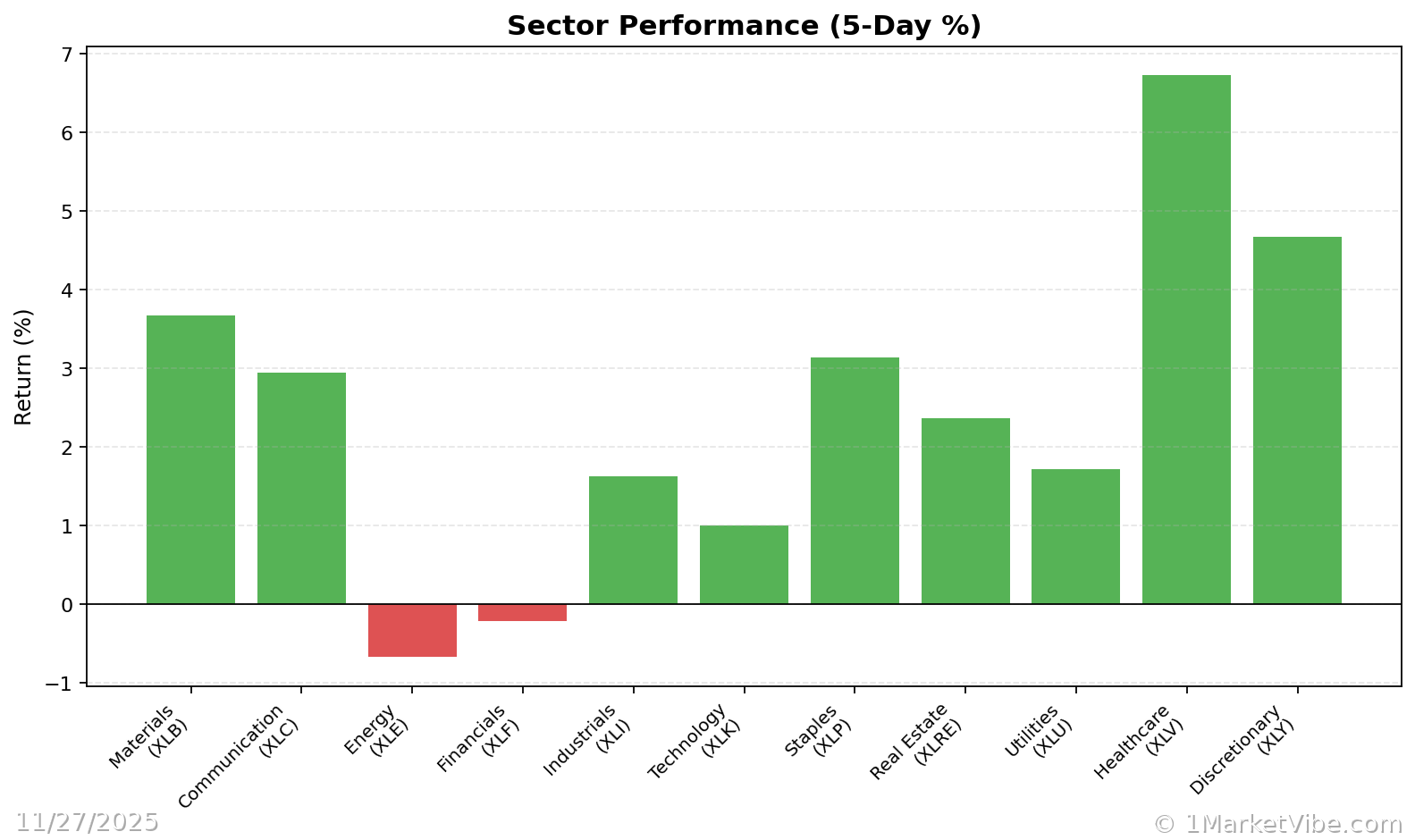

Sector Performance

Several sectors are poised to benefit from the potential rate cut:

- Technology: With a historically positive correlation to lower interest rates, the tech sector is experiencing renewed investor interest. Companies in this space are likely to benefit from reduced capital costs.

- Consumer Discretionary: As consumer spending is expected to rise with lower borrowing costs, this sector is seeing increased activity.

- Financials: While typically sensitive to rate cuts, financials are experiencing mixed performance as investors weigh the benefits of increased loan demand against the potential squeeze on interest margins.

Investment Strategies

Given the current market dynamics, investors should consider the following strategic moves:

- Diversification: Ensure portfolios are well-diversified across sectors that are likely to benefit from a rate cut.

- Risk Management: Utilize the CW Index as a guide to adjust risk exposure. If the index approaches 6.5, consider hedging strategies.

- Sector Rotation: Focus on sectors with strong growth potential in a low-rate environment, such as technology and consumer discretionary.

Economic Indicators

Recent economic data supports the case for a rate cut. Inflation has shown signs of easing, and consumer confidence is on the rise. However, the Enhanced CW Index's gold component, which provides a 4-6 week early warning, suggests that investors should remain vigilant for any shifts in market sentiment.

Global Market Reactions

Globally, markets are reacting positively to the prospect of a US rate cut. European and Asian markets have seen similar upticks, with investors worldwide recalibrating their portfolios in anticipation of more accommodative monetary policies.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index Reading: 5.7, indicating moderate risk

- Overall Market Status: Yellow flag

- Key Metric to Watch: CW Index movement towards 6.5

📚 Learn (2-Minute Deep Dive)

The current market optimism is largely driven by the expectation of a rate cut, which historically leads to increased market activity and higher valuations. However, the Enhanced CW Index at 5.7 suggests that while the market is not at immediate risk of correction, investors should remain cautious. Historical patterns show that when the CW Index approaches 7.0, the likelihood of a market downturn increases significantly. The gold component of the CW Index provides a crucial early warning, allowing investors to anticipate market shifts 4-6 weeks in advance.

⚡ Act (Specific Steps)

- For Conservative Investors: Maintain a balanced portfolio with a focus on defensive sectors. Consider increasing exposure to bonds if the CW Index trends upwards.

- For Aggressive Investors: Capitalize on growth sectors such as technology and consumer discretionary. Monitor the CW Index closely for any signs of increased risk.

- For All Investors: Regularly review portfolio allocations and adjust based on CW Index signals. Implement stop-loss orders to manage downside risk.

Get real-time CW Index alerts at 1marketvibe.com →

Conclusion

In conclusion, while the market is currently buoyed by rate-cut speculation, investors should remain vigilant. MarketVibe's Enhanced CW Index provides a critical tool for navigating these uncertain waters, offering a unique advantage with its early warning capabilities. By leveraging the Decision Edge™ Method, investors can make informed, strategic decisions that align with their risk tolerance and investment goals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.