Burry and Nvidia: Three Impacts on AI Market Dynamics

As the holiday season unfolds, the financial markets are abuzz with discussions surrounding Michael Burry's recent critiques of Nvidia, a key player in the AI sector. Known for his prescient bets against the housing market prior to the 2008 financial crisis, Burry's insights are closely watched by investors. His current stance against Nvidia has sparked significant interest, particularly as it coincides with a pivotal moment in AI market dynamics.

Market Context and CW Index Insight

MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.7. This level is below the critical 7.0 warning threshold, indicating moderate risk in the market. Historically, when the CW Index hit 7.1 in March 2023, markets experienced an 8.3% decline. Investors should remain vigilant, especially if the CW Index trends upward, as it could signal increased volatility.

Learn more about how CW Index works at 1marketvibe.com.

Michael Burry's Position on Nvidia

Michael Burry has a reputation for identifying market bubbles and his recent comments on Nvidia have not gone unnoticed. Burry has criticized Nvidia's financial practices, suggesting that its stock-based compensation has significantly impacted shareholder value. He argues that Nvidia's financial strategies resemble those of companies that have historically faced severe market corrections. Burry's bearish stance, including his substantial put options on Nvidia, reflects his belief that the AI sector may be overvalued.

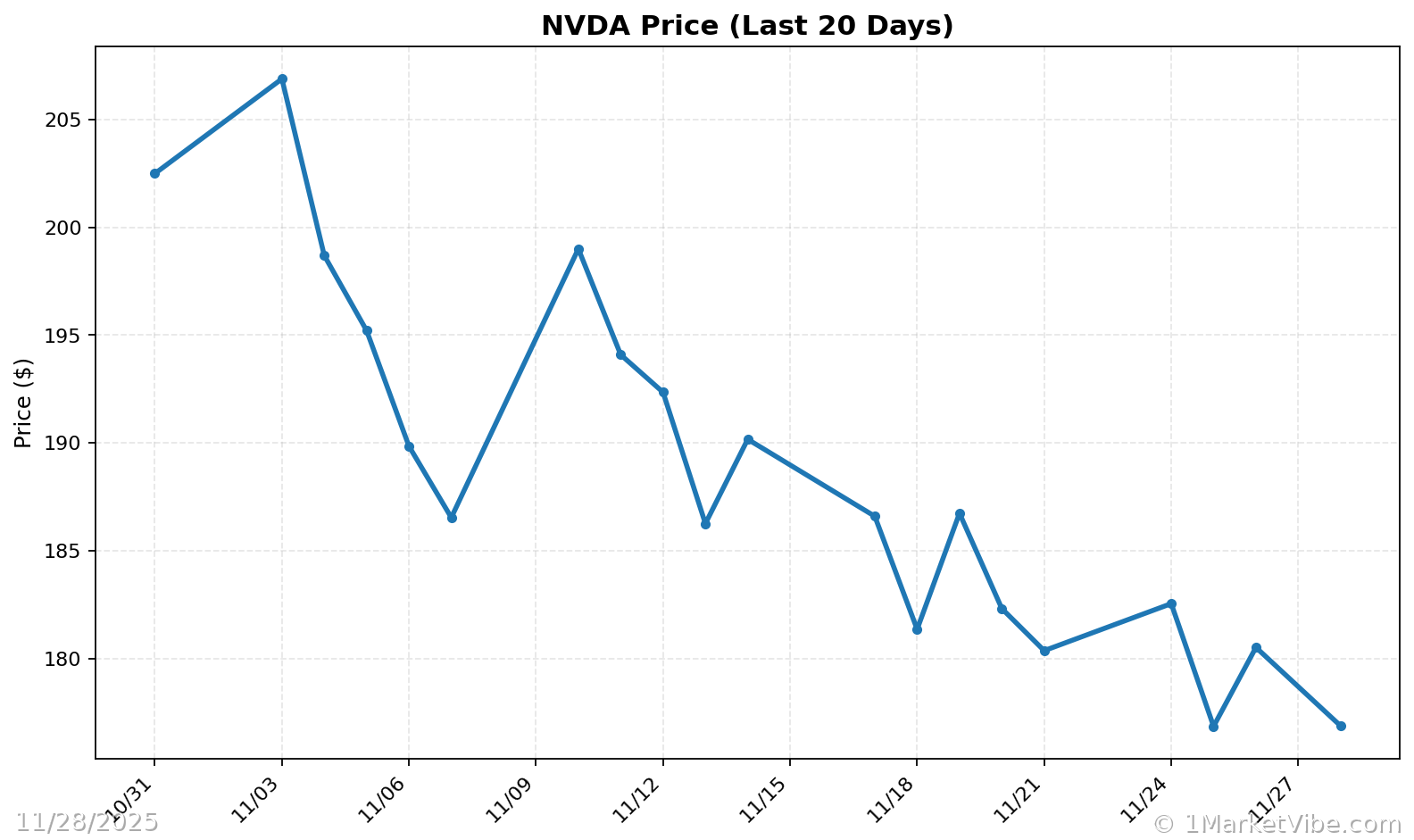

Nvidia's Market Landscape

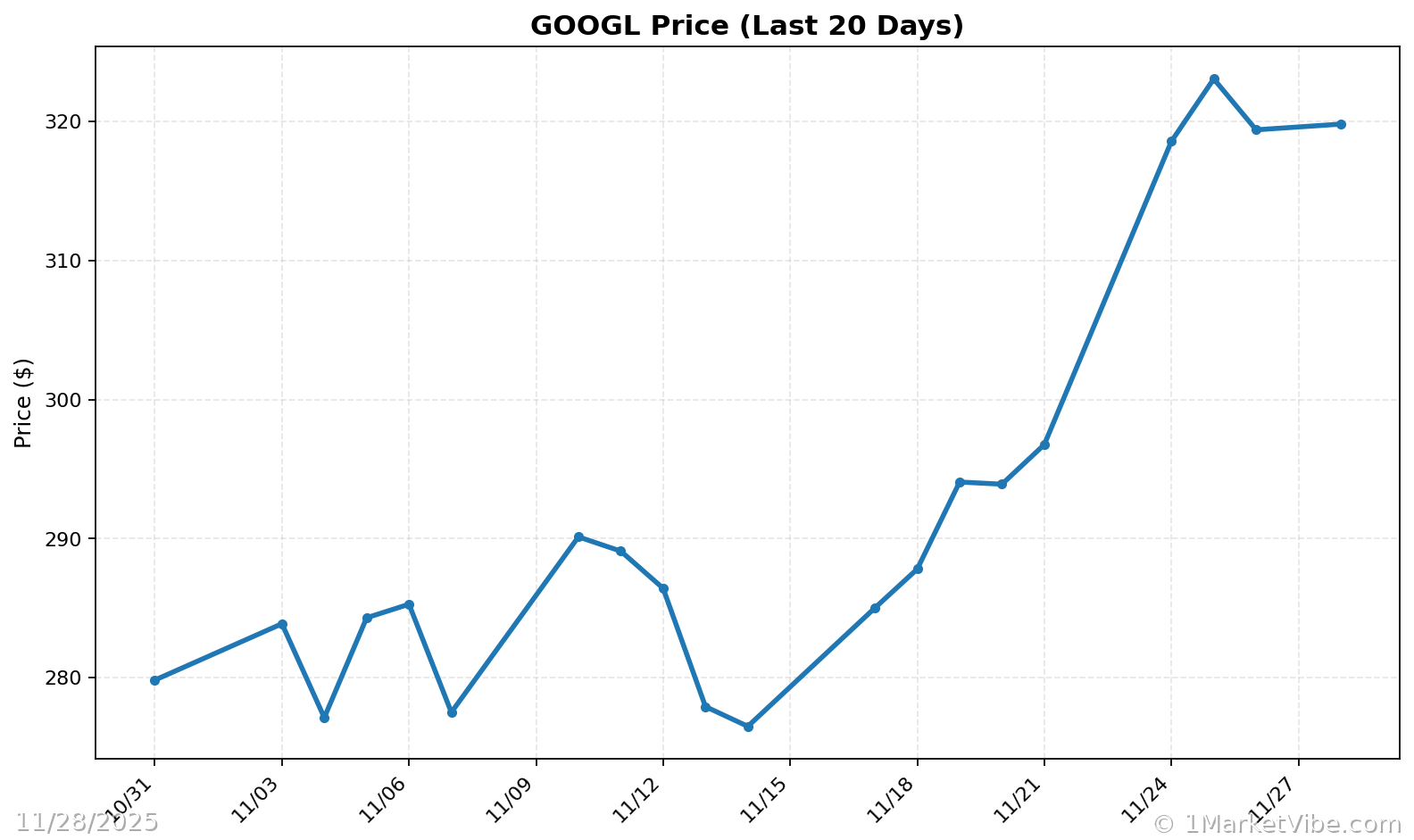

Nvidia remains a dominant force in the AI chip market, boasting robust earnings and a strong market position. However, the competitive landscape is shifting, with companies like Alphabet entering the fray. Nvidia's recent earnings report was impressive, yet Burry's criticisms have cast a shadow over its long-term prospects. The company's response to Burry's allegations highlights the tension between maintaining investor confidence and addressing potential vulnerabilities.

AI Chip Competition Intensifies

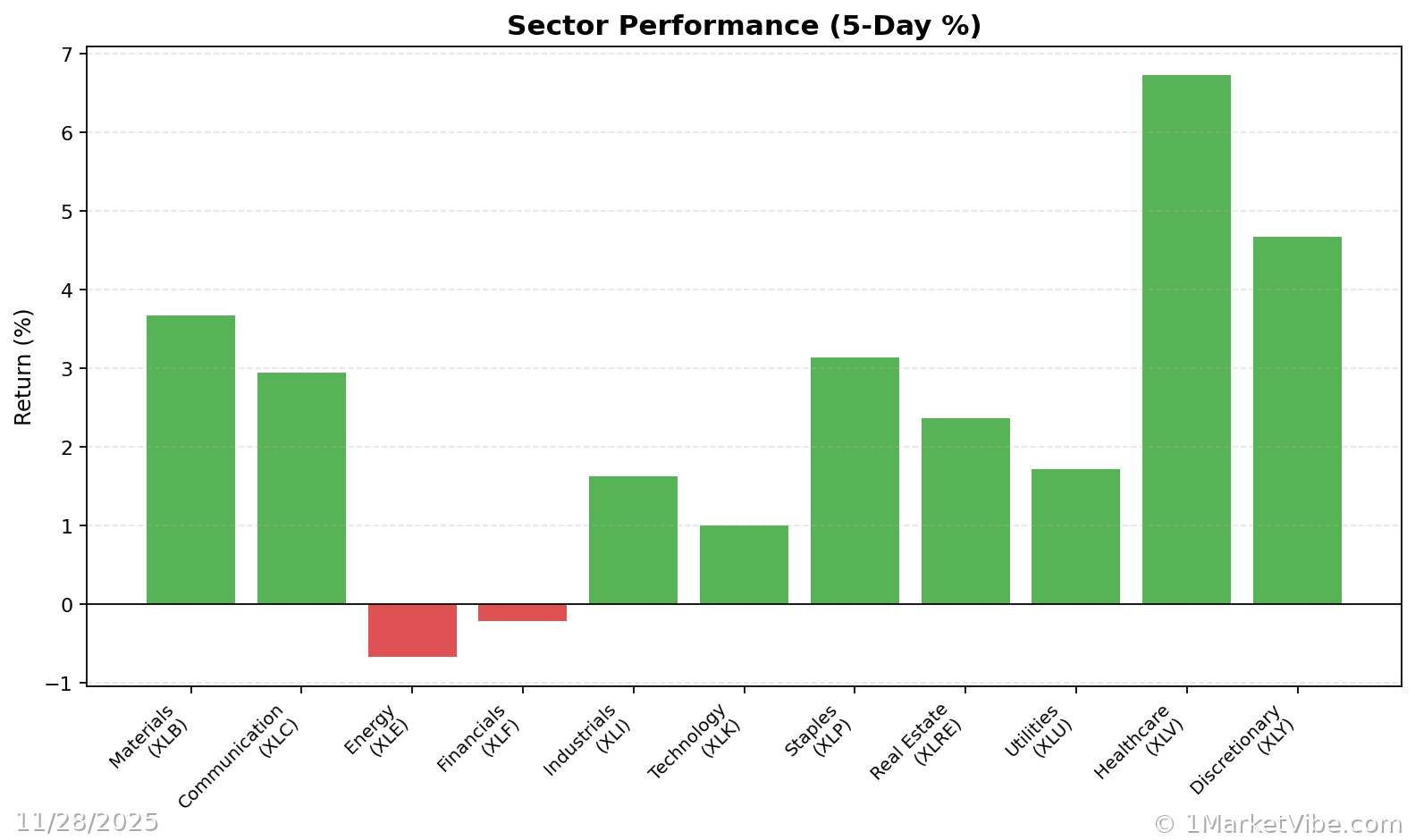

The AI chip sector is witnessing heightened competition as tech giants vie for dominance. Nvidia's leadership is being challenged by new entrants, which could impact its market share and profitability. This rivalry is crucial for investors to monitor, as shifts in market leadership could influence stock performance and sector dynamics. MarketVibe's CW Index suggests that investors should watch for changes in institutional gold flows, which could provide early warnings of market shifts.

Investor Sentiment and Potential Risks

Burry's views have the potential to sway investor sentiment, particularly among those wary of overvaluation in the tech sector. His comparisons of Nvidia to past market bubbles underscore the risks of unchecked growth. Investors should consider the broader implications of Burry's warnings, especially in light of the CW Index's moderate risk indication. A shift towards a higher CW Index reading could signal the need for increased caution.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework helps investors turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index: 5.7, indicating moderate risk.

- Market Status: Yellow flag, caution advised.

- Key Metric: Institutional gold flows.

📚 Learn (2-Minute Deep Dive)

The current market dynamics, influenced by Burry's critiques and Nvidia's competitive challenges, present a nuanced landscape. Historically, similar scenarios have led to significant market corrections, as seen with Cisco in the late 1990s. Investors should monitor the CW Index closely; a rise above 6.5 could indicate increasing risk. The gold component of the CW Index provides a 4-6 week early warning, offering a strategic advantage in anticipating market shifts.

⚡ Act (Specific Steps)

- For Conservative Investors: Maintain current positions but prepare to reduce exposure if the CW Index approaches 6.5.

- For Aggressive Investors: Consider hedging strategies, such as options, to mitigate potential downside risks.

- For All Investors: Regularly review portfolio allocations and adjust based on CW Index trends and market developments.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Michael Burry's critiques of Nvidia highlight significant considerations for investors in the AI sector. While Nvidia remains a formidable player, the competitive landscape and potential overvaluation pose risks. MarketVibe's Enhanced CW Index and Decision Edge™ Method offer valuable tools for navigating these complexities. As the market evolves, staying informed and proactive is crucial for managing risk and seizing opportunities.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts