Nvidia's Decline in the AI Chip Market: Key Insights for Investors

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Market Overview

The stock market landscape is currently marked by significant fluctuations, with major indices such as the Dow, S&P 500, and Nasdaq experiencing varied movements. As of today, the Nasdaq has notably declined, driven by shifts in the AI chip market. This volatility is underscored by MarketVibe's proprietary Enhanced CW Index, which is currently at 5.7. This reading, below the critical 7.0 warning threshold, suggests a moderate risk environment, providing a 4-6 week early warning of potential market corrections by tracking institutional gold flows and market breadth. Investors should remain vigilant as these indicators suggest a cautious approach is warranted.

Learn more about how CW Index works at 1marketvibe.com

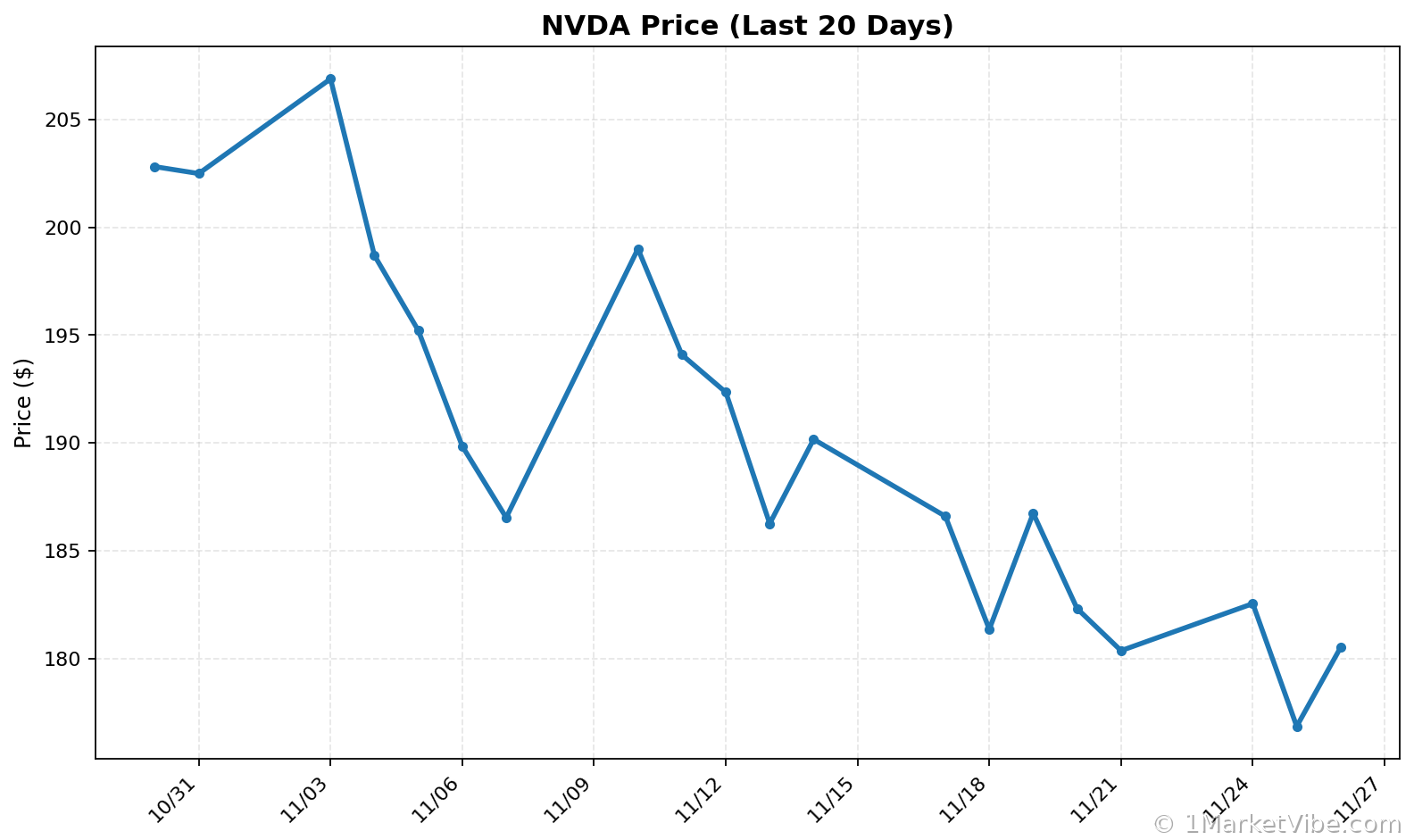

Nvidia's Decline

Nvidia, once a dominant force in the AI chip market, is experiencing a notable decline in its stock value. Several factors contribute to this downturn, including intensified competition from industry giants like Alphabet. The rivalry in AI chip development has pressured Nvidia's market share, impacting its stock performance. According to MarketVibe data, the CW Index's current reading of 5.7 reflects these competitive pressures and the broader market's moderate risk level. Historical patterns, such as the CW Index reaching 7.1 in March 2023, led to an 8.3% market drop, highlighting the importance of monitoring these signals.

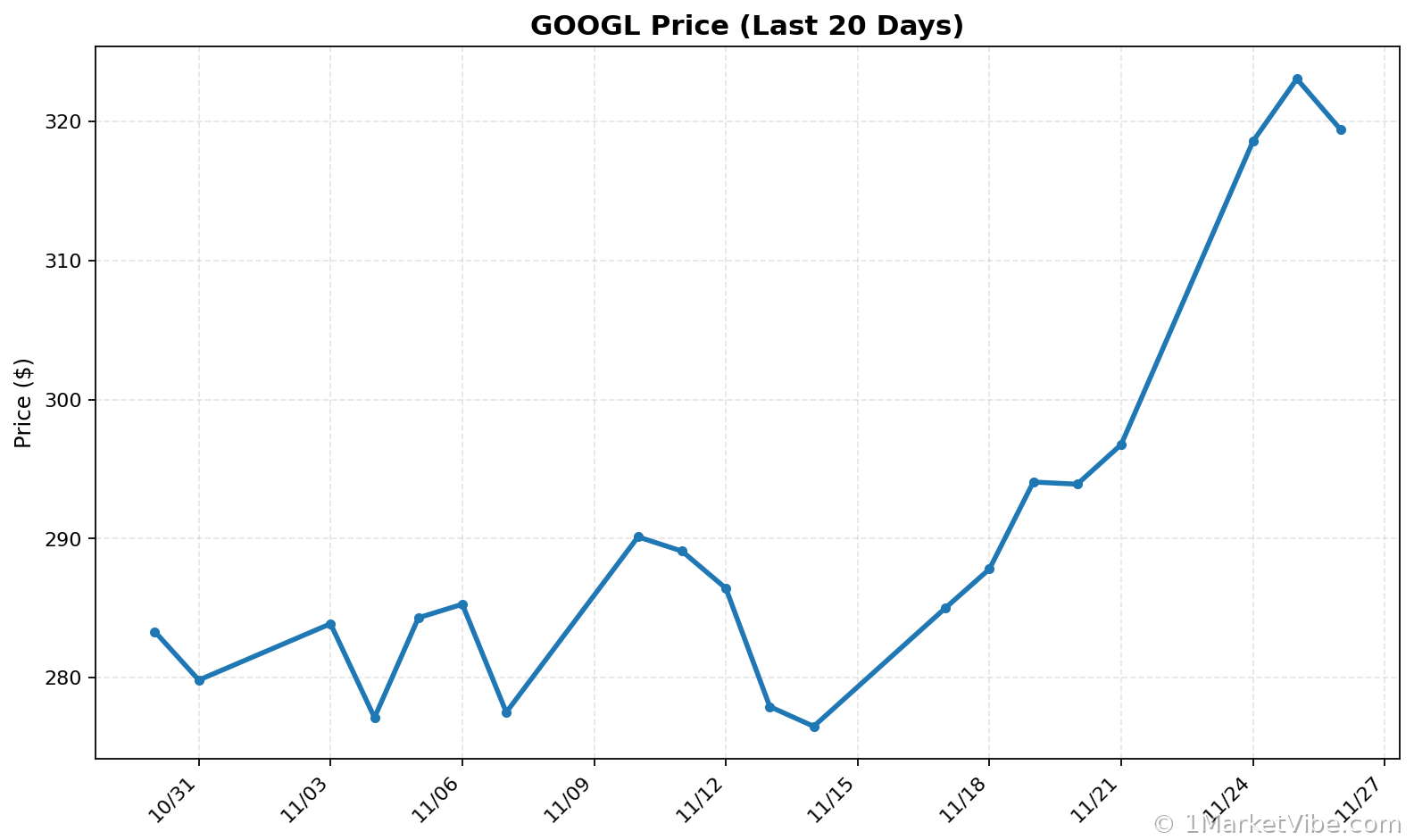

Alphabet's Rally

Conversely, Alphabet has seen a rally in its stock, buoyed by advancements in its AI chip technology. This surge is a testament to Alphabet's strategic positioning in the AI sector, which has allowed it to capitalize on Nvidia's challenges. The CW Index suggests that while Alphabet's rise is promising, the overall market sentiment remains cautious. Investors should note that the CW Index's gold component provides an early warning, offering insights into potential shifts in market dynamics over the coming weeks.

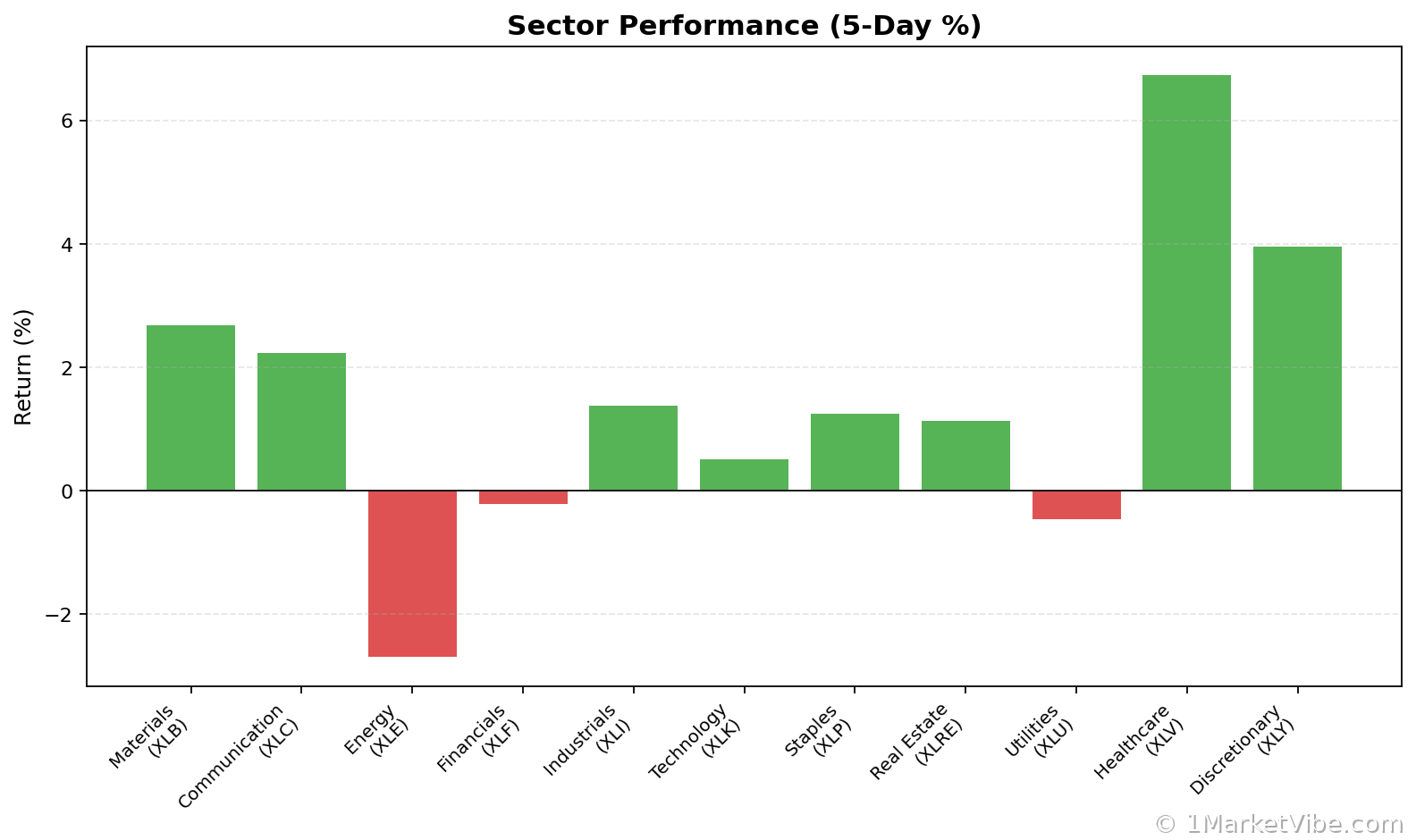

Sector Analysis

The tech sector is at the forefront of these developments, with AI advancements driving significant changes. Key players, including Nvidia and Alphabet, are navigating a landscape marked by rapid innovation and fierce competition. MarketVibe's Enhanced CW Index continues to track these shifts, providing investors with a crucial tool to anticipate market movements. As the CW Index remains below the warning threshold, it indicates that while the sector is dynamic, the risk level is currently moderate.

Investor Sentiment

Investor sentiment towards tech stocks is currently mixed, reflecting the uncertainties and potential risks within the market. The CW Index at 5.7 suggests that while there is no immediate cause for alarm, investors should remain cautious. Historical parallels, such as the market's reaction to previous CW Index spikes, underscore the importance of staying informed and prepared for potential volatility.

Global Market Influence

The influence of U.S. market trends extends beyond domestic borders, impacting Asian stocks and global economic factors. The correlation between these markets highlights the interconnected nature of today's financial landscape. MarketVibe's CW Index, with its early warning capabilities, provides valuable insights into how these global dynamics may unfold, offering investors a strategic advantage in navigating potential risks.

Future Considerations

Looking ahead, investors should closely monitor the CW Index for any movements towards the 6.5 level, which could signal increased risk. Key indicators to watch include further developments in the AI chip market and broader economic factors that may influence market recovery or further decline. MarketVibe's proprietary system, built by investors for investors, remains an essential resource for tracking these trends.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk.

- Overall market status: Yellow flag.

- Key metric to watch: CW Index movement towards 6.5.

📚 Learn (2-Minute Deep Dive)

The current market scenario is shaped by competitive dynamics in the AI chip sector, with Nvidia facing challenges from Alphabet's advancements. Historical parallels, such as the CW Index reaching 7.1 in March 2023, remind us of the market's sensitivity to these developments. As the CW Index remains below the warning threshold, it suggests that while risks are present, they are not yet at critical levels. Monitoring the CW Index's gold component will be crucial in anticipating potential market corrections over the next 4-6 weeks.

⚡ Act (Specific Steps)

- For conservative investors: Maintain current positions but prepare to adjust if the CW Index approaches 6.5.

- For aggressive investors: Consider reducing exposure to high-risk tech stocks, reallocating to more stable sectors.

- Risk management: Implement stop-loss orders to protect against sudden downturns.

- Entry/exit criteria: Re-evaluate positions if the CW Index crosses the 6.5 mark.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

In summary, Nvidia's decline in the AI chip market and Alphabet's rise highlight the dynamic nature of the tech sector. MarketVibe's Enhanced CW Index at 5.7 provides a moderate risk assessment, emphasizing the importance of vigilance and strategic planning. By leveraging MarketVibe's proprietary tools, investors can navigate these complexities with confidence, equipped with early warnings and actionable insights.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly and unpredictably.

Charts