Fed's Daly Signals December Rate Cut and CW Index Predictions

San Francisco Fed President Mary Daly has indicated support for a December interest rate cut, citing vulnerabilities in the labor market. This development comes at a crucial time as investors seek clarity on the Federal Reserve's next moves. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 6.9. This reading is below the critical 7.0 warning threshold, suggesting moderate risk but aligning with potential policy shifts.

Learn more about how CW Index works at 1marketvibe.com.

Daly's Advocacy and Market Implications

Mary Daly's support for a rate cut is significant due to her alignment with Fed Chair Jerome Powell. Her stance suggests a shift in the Fed's focus from inflation concerns to labor market stability. Historically, such shifts have led to notable market reactions. For instance, when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month. Daly's advocacy could lead to similar market adjustments, as investors recalibrate their expectations.

Labor Market Concerns

Daly's emphasis on the labor market highlights its current fragility. She noted that the risk of a nonlinear change in employment conditions is more pressing than potential inflation spikes. This perspective is crucial as the Fed navigates its dual mandate of promoting maximum employment and stable prices. Historically, labor market vulnerabilities have prompted the Fed to adjust rates, as seen in previous cycles where rate cuts were used to preempt economic slowdowns.

CWI Signals Alignment

MarketVibe's Enhanced CW Index, currently at 6.9, aligns with Daly's concerns, indicating a shift in policy focus. The CW Index's gold component provides a 4-6 week early warning, suggesting that the potential rate cut was foreseeable. Investors should note that if the CW Index crosses the 6.5 mark, it may signal increased volatility, warranting closer monitoring.

Market Reactions

The prospect of a December rate cut has already stirred investor sentiment. Historically, rate cuts have led to short-term market rallies, but the underlying economic conditions often dictate the long-term trajectory. MarketVibe's CW Index suggests that while the immediate reaction may be positive, investors should remain cautious of potential corrections, especially if the index trends upward.

Risks and Considerations

While a rate cut could support the labor market, it also carries risks. Lower rates might not address structural employment issues and could lead to asset bubbles. Investors should consider these risks and adjust their portfolios accordingly. MarketVibe's proprietary system emphasizes the importance of early warning signals, such as those provided by the CW Index, to navigate such uncertainties.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This is MarketVibe's proprietary framework for turning market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 6.9, indicating moderate risk.

- Overall market status: Yellow flag, suggesting caution.

- Key metric to watch: CW Index movement towards 7.0.

📚 Learn (2-Minute Deep Dive)

The current CW Index reading of 6.9 reflects a market in transition, with potential policy shifts on the horizon. Historical parallels, such as the March 2023 scenario, underscore the importance of monitoring these signals. The labor market's vulnerability, as highlighted by Daly, adds another layer of complexity. Investors should watch for any upward movement in the CW Index, as it may signal increased market volatility. Understanding these dynamics is crucial for making informed investment decisions.

⚡ Act (Specific Steps)

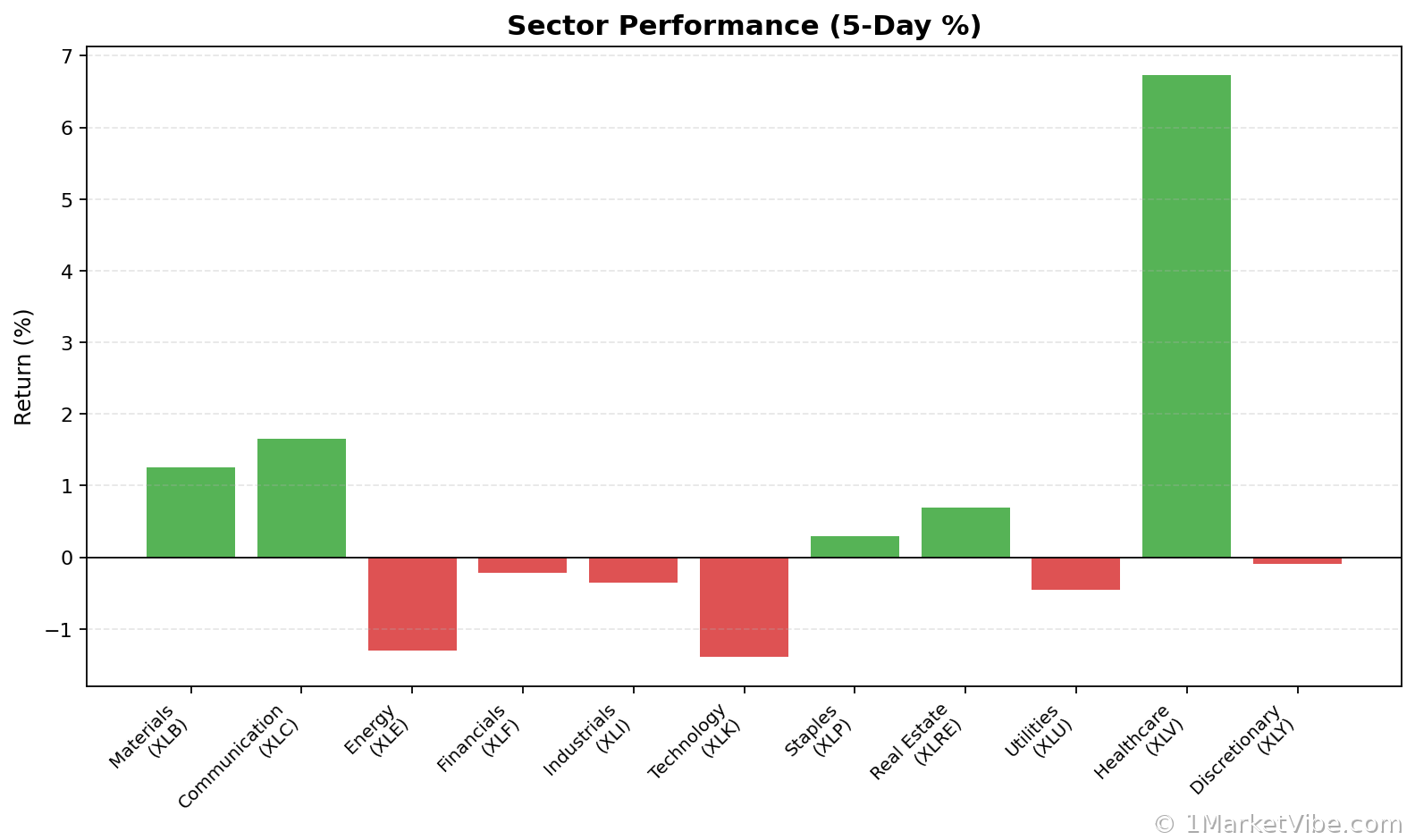

- Diversify Portfolio: Consider reallocating assets to sectors less sensitive to interest rate changes.

- Monitor CW Index: Regularly check the CW Index for any movements towards the 7.0 threshold.

- Hedge Positions: Use options or other derivatives to hedge against potential market corrections.

- Adjust Risk Exposure: Reduce exposure to high-risk assets if the CW Index trends upward.

Get real-time CW Index alerts at 1marketvibe.com →

Conclusion

Mary Daly's support for a December rate cut highlights the Fed's focus on labor market vulnerabilities. MarketVibe's Enhanced CW Index, with its current reading of 6.9, suggests moderate risk but aligns with potential policy shifts. Investors should remain vigilant, leveraging MarketVibe's tools to navigate these uncertain times. Built by investors, for investors, MarketVibe provides the insights needed to make informed decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts