AI Resilience: Nvidia's Forecast Eases Market Concerns Amid S&P Decline

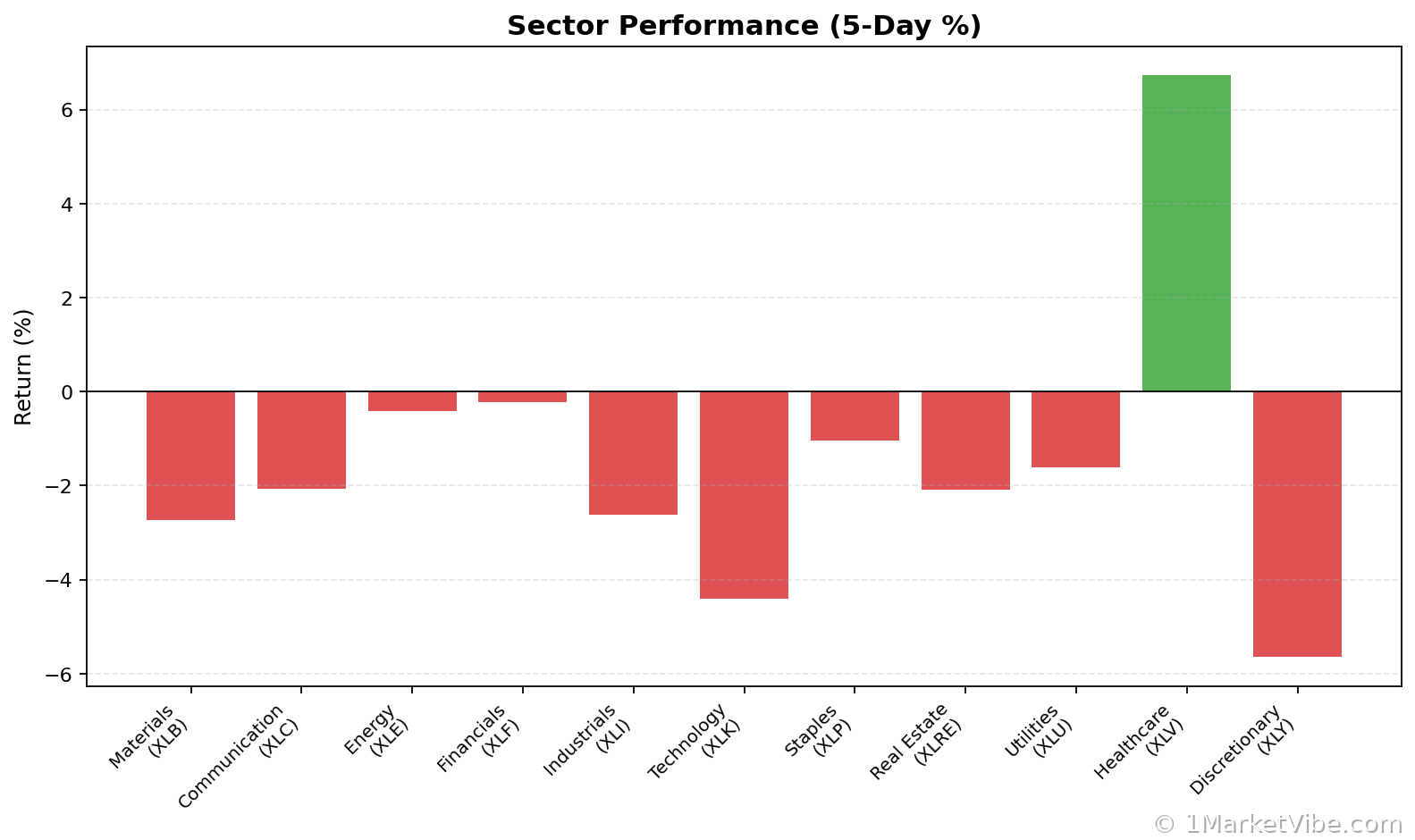

In the midst of market volatility, Nvidia's robust forecast has emerged as a beacon of resilience, particularly in the AI sector. This development comes at a critical time as the S&P 500 experiences its fourth consecutive decline, raising concerns among investors. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale providing a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 6.42. This level is below the 7.0 warning threshold, indicating moderate risk but suggesting a predictable trend in AI investments.

Learn more about how CW Index works at 1marketvibe.com

Nvidia's AI Surge Amid Market Volatility

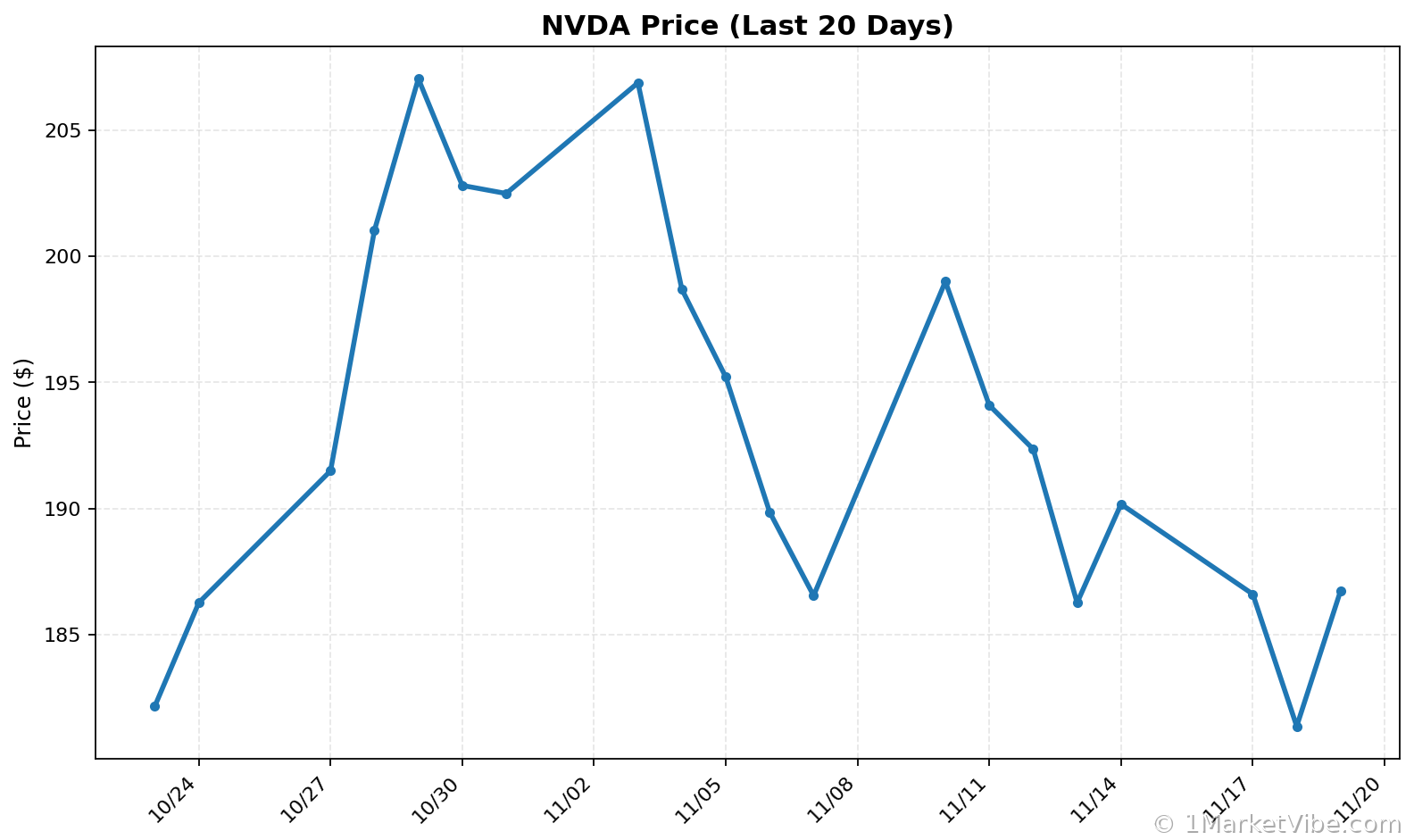

Nvidia's recent performance has been a stabilizing factor in an otherwise turbulent market. The company's strong earnings report and optimistic forecast have provided much-needed reassurance to investors. As the S&P 500 notches its fourth straight loss, Nvidia's resilience in the AI market offers a counterbalance to broader market concerns. This highlights the significance of AI in current market dynamics, where technological advancements continue to drive investor confidence.

MarketVibe's CW Index suggests that Nvidia's performance aligns with historical patterns where robust tech forecasts have previously mitigated broader market declines. For instance, when the CW Index hit 7.1 in March 2023, markets fell 8.3%, underscoring the importance of monitoring these signals.

S&P 500 Decline and Nvidia's Stabilizing Role

The S&P 500's recent performance reflects broader market concerns, with the index marking its longest slide since December 2022. Investors are keenly watching Nvidia's earnings as a potential stabilizing factor. The company's strong position in the AI sector, coupled with its strategic investments, positions it well to weather market volatility.

According to MarketVibe data, the CW Index at 6.42 indicates a moderate risk environment, suggesting that while caution is warranted, the AI sector's growth potential remains robust. This is further supported by the US's plans to approve sales of AI chips to Saudi firm Humain, indicating a global trend of increasing AI investments.

Nvidia's Forecast and AI Market Resilience

Nvidia's robust forecast suggests resilience in the AI markets, setting it apart from other tech stocks during market downturns. The company's strategic investments and partnerships, such as those with Microsoft and Anthropic, underscore its confidence in the sector's growth. This positions Nvidia as a leader in the AI space, capable of navigating market challenges effectively.

MarketVibe tracks these developments closely, with the CW Index providing a 4-6 week early warning of potential market corrections. This proactive approach allows investors to adjust their strategies accordingly, leveraging the insights provided by MarketVibe's proprietary system.

Global AI Investment Trends

The US's decision to approve AI chip sales to Saudi firm Humain highlights the global trend of increasing investments in AI. This move reflects the confidence of tech giants in the sector's growth potential. Companies like Nvidia are at the forefront of this trend, investing heavily in AI to drive innovation and maintain competitive advantages.

The MarketVibe advantage lies in its ability to provide actionable insights through its Enhanced CW Index, helping investors navigate these complex market dynamics. Historical patterns show that when the CW Index trends upwards, as it did in early 2023, investors can anticipate shifts in market sentiment and adjust their portfolios accordingly.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions, empowering investors to make informed choices.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 6.42, indicating moderate risk

- Overall market status: Yellow flag, suggesting caution

- Key metric to watch: Nvidia's AI market performance

📚 Learn (2-Minute Deep Dive)

Nvidia's robust forecast amidst the S&P 500's decline highlights the resilience of the AI market. Historical parallels show that tech stocks with strong forecasts often stabilize broader market concerns. The current situation underscores the importance of monitoring AI investments, as they continue to drive market dynamics.

MarketVibe's 4-6 week early warning capability suggests that the current trend in AI investments was predictable. As tech giants pour billions into AI, investors should remain vigilant, watching for shifts in the CW Index that could signal changes in market sentiment.

⚡ Act (Specific Steps)

- Monitor position sizing: Adjust allocations based on CW Index levels; consider increasing exposure to AI stocks like Nvidia if the index remains below 7.0.

- Adjust risk exposure: Diversify portfolios to mitigate potential market corrections; focus on sectors with strong growth forecasts.

- Consider hedging strategies: If the CW Index trends towards 7.0, implement hedging strategies to protect against potential downturns.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Summary and Implications for Investors

Nvidia's role in calming market jitters underscores the importance of AI in current market dynamics. As the S&P 500 faces ongoing challenges, Nvidia's robust forecast offers a counterbalance, providing investors with confidence in the tech sector's growth potential. Built by investors, for investors, MarketVibe's tools offer a strategic advantage, enabling proactive decision-making in a volatile market environment.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably.

Charts