Nvidia Earnings Boost Tech Stocks and Indicate Market Resilience

Nvidia's recent earnings report has provided a significant boost to tech stocks, highlighting resilience in the sector despite ongoing concerns about an AI bubble. As the tech landscape evolves, understanding market signals becomes crucial for investors. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 6.42. This reading is below the critical 7.0 warning threshold, indicating moderate risk and suggesting that the market's current resilience was anticipated.

Learn more about how CW Index works at 1marketvibe.com.

Nvidia's Earnings Report

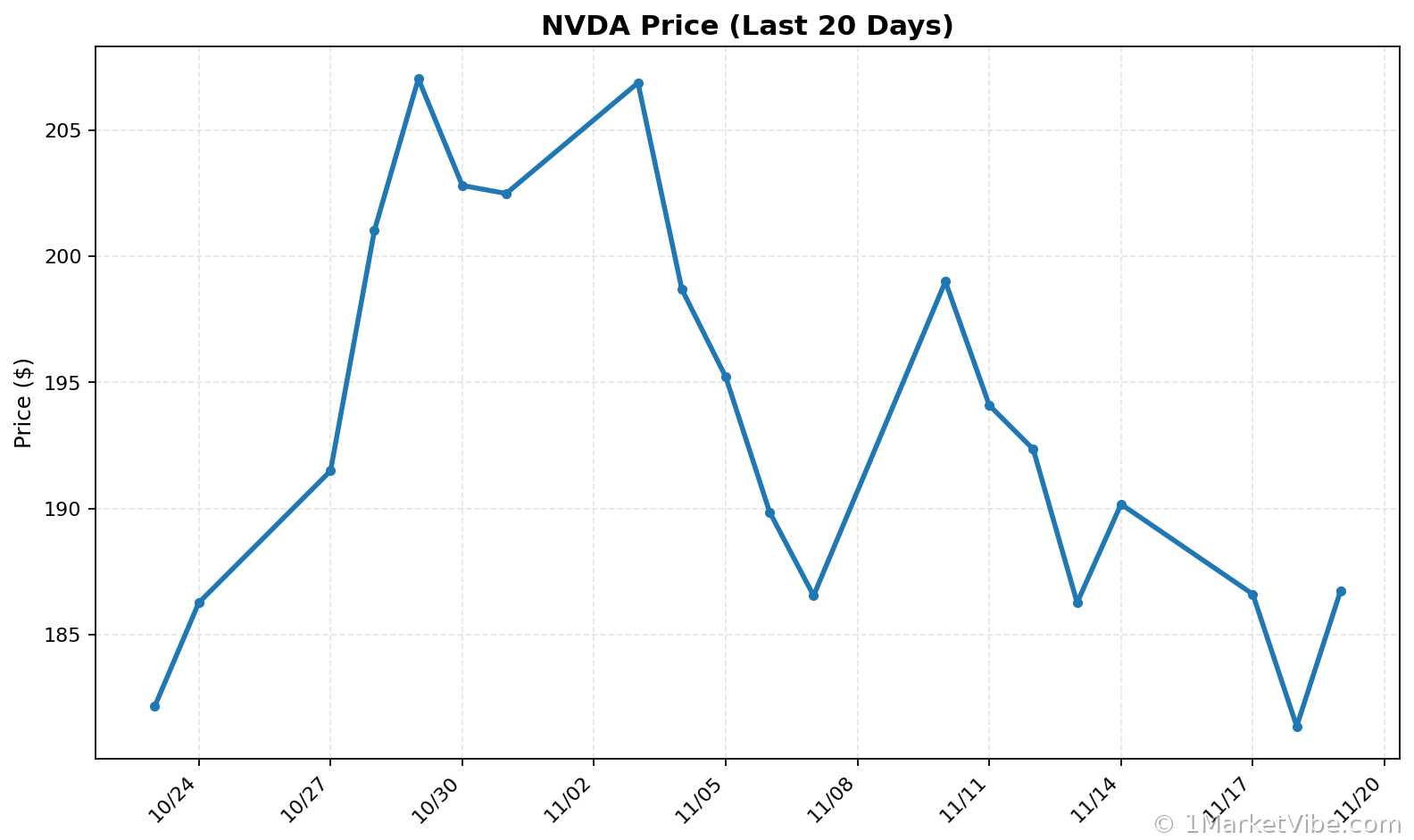

Nvidia's earnings report exceeded expectations, driven by strong demand for its AI-related products. The company's revenue surged by 24% year-over-year, reflecting robust growth in its data center and gaming segments. This performance has not only bolstered Nvidia's stock but also instilled confidence across the tech sector. The report underscores Nvidia's pivotal role in the AI revolution, which is a key driver of tech market dynamics.

Market Reaction

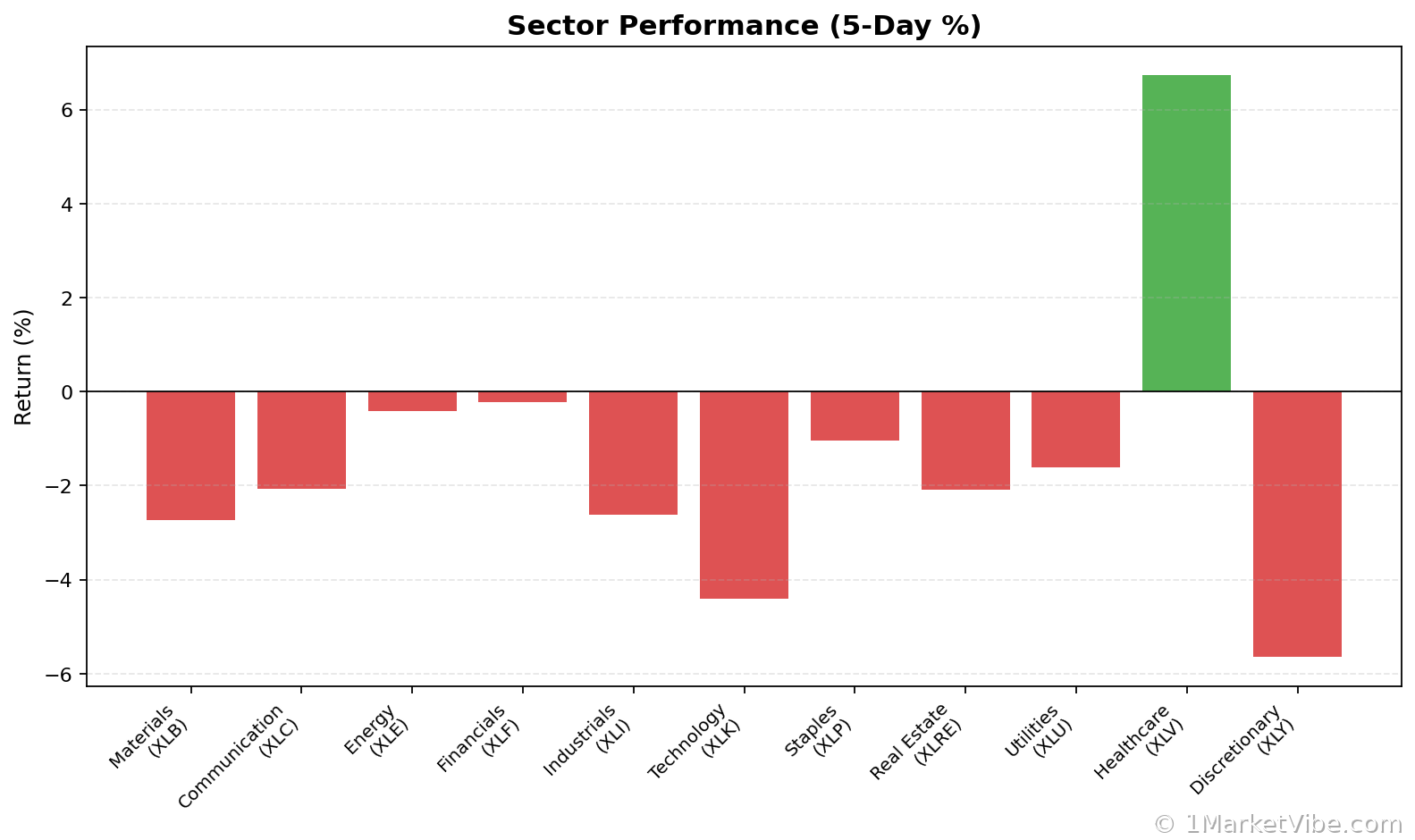

Following Nvidia's earnings announcement, tech stocks rallied, with the Nasdaq Composite rising by 2.3%. This uptick was led by gains in semiconductor and AI-focused companies, which benefited from Nvidia's positive outlook. MarketVibe's CW Index suggests that this rally aligns with historical patterns where strong earnings reports from industry leaders often catalyze broader market gains. For instance, when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month, highlighting the importance of monitoring this index for early warning signals.

AI Sector Resilience

The AI sector continues to demonstrate resilience, driven by sustained demand for AI technologies across various industries. Nvidia's earnings report has reinforced investor confidence in the sector's growth potential. MarketVibe's CW Index at 6.42 indicates that while there is moderate risk, the sector's fundamentals remain strong. The gold component of the CW Index provides a 4-6 week advance notice, allowing investors to anticipate potential shifts in market sentiment.

Broader Tech Market Trends

Beyond Nvidia, the broader tech market is witnessing a resurgence. Companies focusing on cloud computing, cybersecurity, and digital transformation are experiencing increased investor interest. MarketVibe's proprietary system tracks these trends, providing actionable insights for investors. The current CW Index reading suggests that while the market is not without risks, the underlying growth drivers remain intact.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework helps investors turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 6.42, indicating moderate risk.

- Overall market status: Yellow flag, suggesting caution.

- Key metric to watch: Institutional gold flows.

📚 Learn (2-Minute Deep Dive)

Nvidia's earnings report has highlighted the resilience of the tech sector amid concerns of an AI bubble. Historically, strong earnings from key players like Nvidia have led to broader market rallies. The current CW Index reading of 6.42 suggests that while the market is not at immediate risk of correction, investors should remain vigilant. Monitoring institutional gold flows, a critical component of the CW Index, can provide early warning of potential market shifts. As the tech sector continues to evolve, understanding these dynamics is crucial for informed investment decisions.

⚡ Act (Specific Steps)

- For conservative investors: Maintain current tech allocations but consider reducing exposure if the CW Index approaches 7.0.

- For aggressive investors: Increase exposure to AI and semiconductor stocks, leveraging Nvidia's positive outlook.

- Risk management: Implement stop-loss orders to protect against sudden market downturns.

- Hedging strategies: Consider options or futures to hedge against potential volatility.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Nvidia's earnings report has provided a much-needed boost to tech stocks, underscoring the sector's resilience. MarketVibe's Enhanced CW Index at 6.42 indicates moderate risk, allowing investors to navigate the market with confidence. By leveraging MarketVibe's proprietary system and Decision Edge™ Method, investors can make informed decisions in a rapidly changing market landscape. Built by investors, for investors, MarketVibe offers the tools needed to stay ahead.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably. Always conduct your own research before making investment decisions.

Charts