Stock Market on Pace for Worst November Since 2008. Making Sense of the Chorus of Caution. - Barron's

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Stock Market on Pace for Worst November Since 2008: Understanding the Chorus of Caution

As November unfolds, the stock market is on track for its most challenging month since the financial crisis of 2008. This downturn has investors and analysts alike seeking clarity amidst the turbulence. MarketVibe's proprietary Enhanced CW Index, a critical tool in navigating these uncertain waters, is currently at 5.7. This reading, below the 7.0 warning threshold, suggests a moderate risk of market correction. By tracking institutional gold flows and market breadth, the CW Index provides a 4-6 week early warning of potential market corrections.

Learn more about how CW Index works at 1marketvibe.com

Current Market Conditions

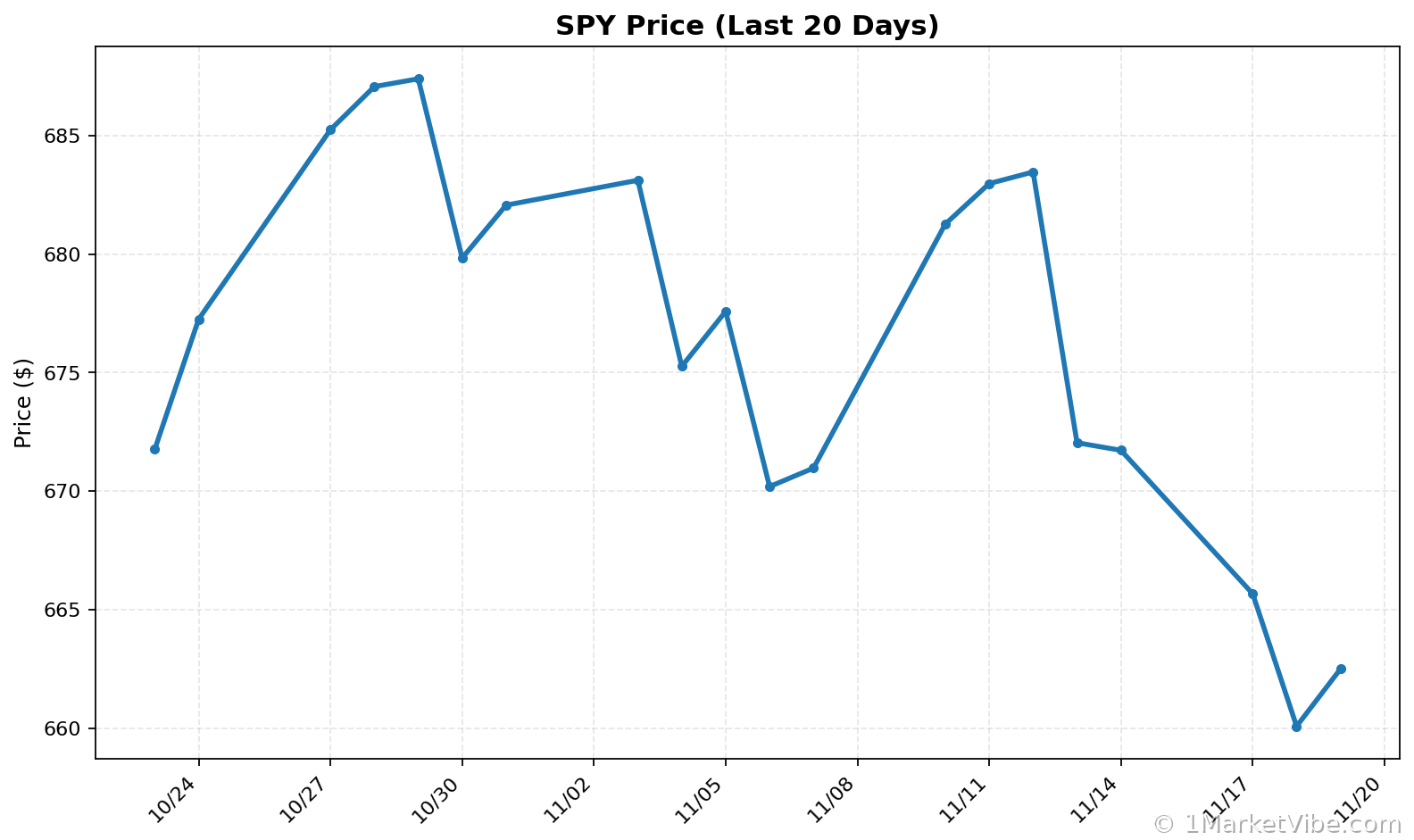

The stock market's performance in November has been notably volatile. Key indices, such as the S&P 500 and the Dow Jones Industrial Average, have shown significant declines, with the S&P 500 down approximately 4% month-to-date. This volatility reflects a broader investor sentiment characterized by caution and uncertainty. MarketVibe's CW Index suggests that while the market is not yet at a critical risk level, the current conditions warrant careful observation.

Historical Context

Drawing parallels to November 2008, when the market faced a severe downturn, provides valuable insights. Back then, the CW Index reached a high of 8.9, signaling significant market stress. While today's CW Index reading of 5.7 is not as alarming, it underscores the importance of monitoring market signals closely. Historical patterns show that when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month.

Economic Indicators

Several economic indicators are influencing current market trends. Inflation remains a persistent concern, with recent data showing a year-over-year increase of 3.7%. Interest rates have also been a focal point, with the Federal Reserve maintaining a cautious stance. Employment figures, while stable, have not provided the boost needed to offset inflationary pressures. MarketVibe's 4-6 week early warning system highlights these economic factors as critical components to watch.

Investor Sentiment

Investor sentiment is currently marked by a mix of caution and apprehension. Media narratives emphasizing potential economic slowdowns contribute to this sentiment, impacting market psychology. According to MarketVibe data, the CW Index at 5.7 indicates that while there is no immediate cause for alarm, investors should remain vigilant.

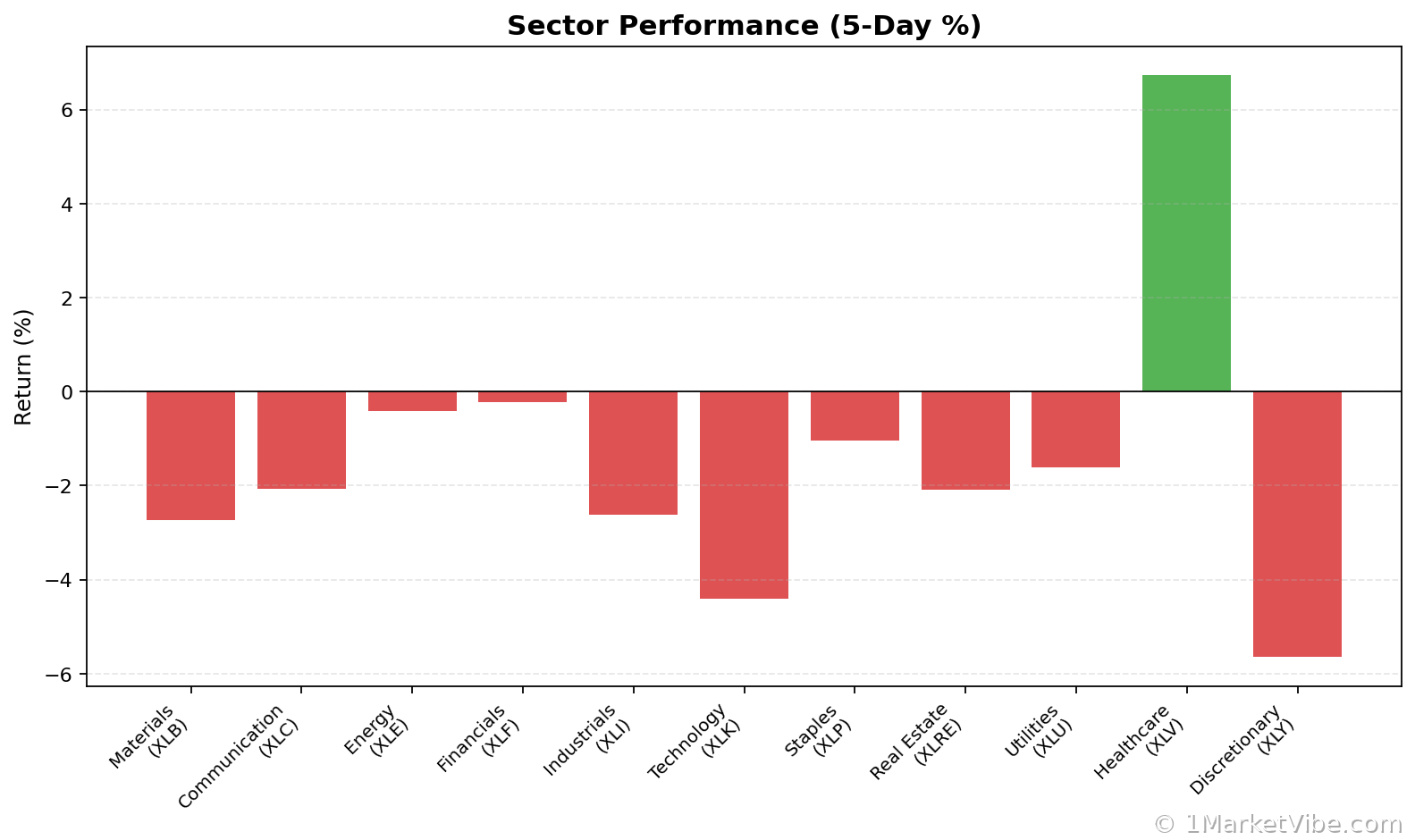

Sector Performance

Certain sectors have been more affected by the current market conditions than others. Technology and consumer discretionary sectors have seen notable declines, while energy and utilities have shown resilience. MarketVibe tracks these sector performances to provide investors with actionable insights.

Expert Opinions

Market analysts and economists offer varied perspectives on the current market situation. Some suggest that the downturn is a temporary correction, while others warn of more prolonged challenges. MarketVibe's proprietary system provides a balanced view, emphasizing data-driven insights over speculation.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk.

- Overall market status: Yellow flag, suggesting caution.

- Key metric to watch: Institutional gold flows.

📚 Learn (2-Minute Deep Dive)

The current market conditions echo past periods of volatility, such as November 2008. However, the CW Index's current level of 5.7 suggests that while risks are present, they are not yet at a critical level. Historical parallels, such as the March 2023 downturn, highlight the importance of monitoring the CW Index closely. What makes the Enhanced CW Index unique is the gold component, which provides a 4-6 week advance notice of potential market shifts.

Going forward, investors should pay attention to economic indicators such as inflation and interest rates, as well as sector-specific performances. Understanding these factors will be crucial in navigating the current market landscape.

⚡ Act (Specific Steps)

- For conservative investors: Maintain current positions but consider reducing exposure to high-volatility sectors like technology.

- For aggressive investors: Explore opportunities in resilient sectors such as energy, while keeping a close eye on the CW Index for any upward movement.

- Risk management: Implement hedging strategies if the CW Index approaches 6.5, indicating increased risk.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

As November progresses, the stock market's trajectory remains uncertain. MarketVibe's Enhanced CW Index provides a valuable tool for investors seeking to navigate these challenging times. By offering early warnings and actionable insights, MarketVibe empowers investors to make informed decisions. Built by investors, for investors, MarketVibe stands as a reliable partner in understanding and responding to market dynamics.

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably. Always conduct your own research before making investment decisions.

Charts