Nvidia's Record Earnings and Their Impact on AI Market Stability

Nvidia's recent earnings report has sent ripples through the financial markets, underscoring the growing influence of the AI sector. The company reported record revenue, a testament to its leadership in AI technology. This development is crucial for investors as it highlights the potential for AI to drive market stability. According to MarketVibe's proprietary Enhanced CW Index, which operates on a 0-10 scale to provide a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, the current reading stands at 7.19. This level is above the 7.0 warning threshold, indicating heightened market risk.

Learn more about how CW Index works at 1marketvibe.com.

Nvidia's Earnings Surge

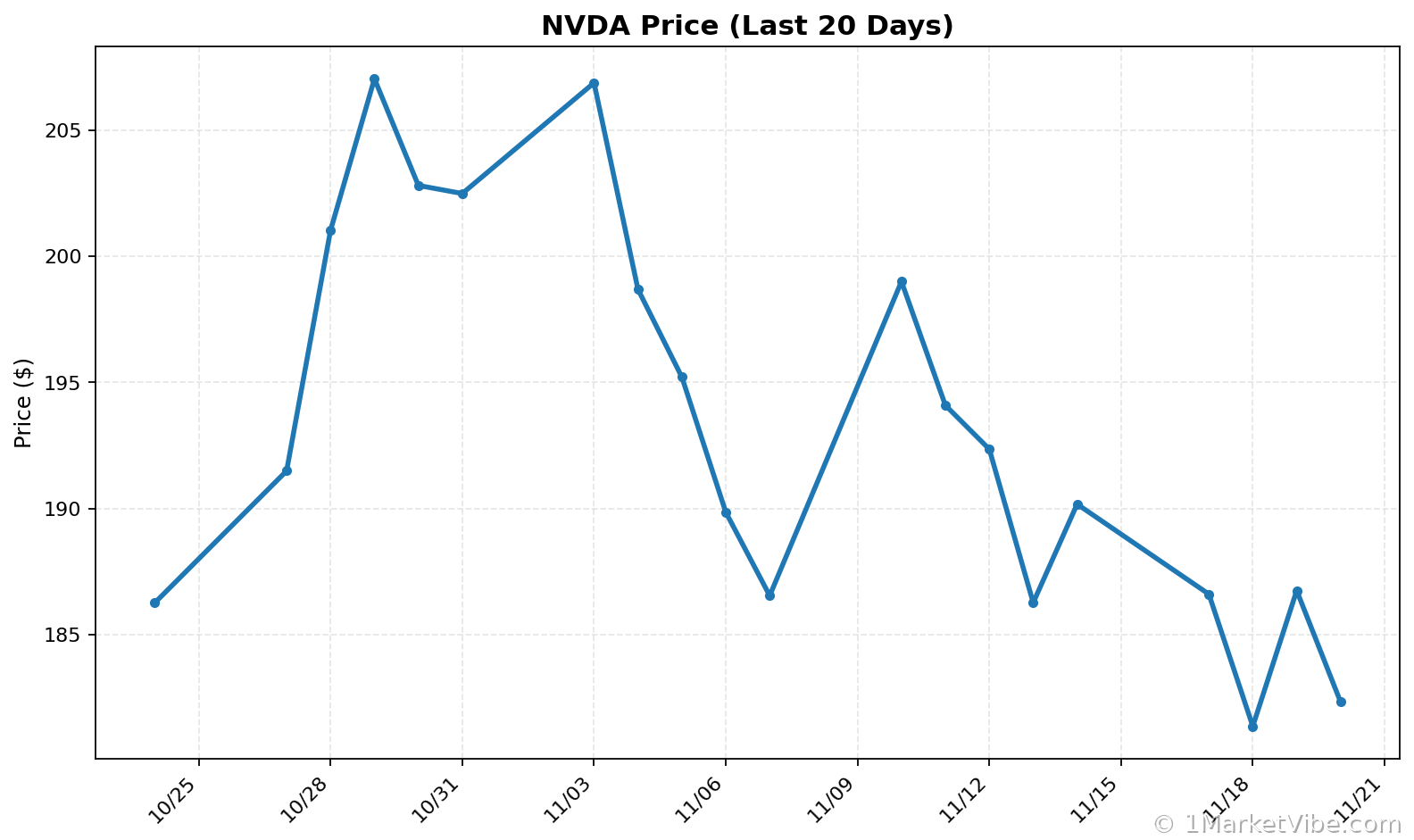

Nvidia's earnings report revealed a significant surge in revenue, driven by robust demand for its AI chips. The company reported a record $13.5 billion in revenue for the quarter, a 101% increase year-over-year. This impressive performance has propelled NVDA stock to new heights, reflecting investor confidence in Nvidia's strategic positioning within the AI sector. The Enhanced CW Index suggests that such strong earnings can stabilize market conditions, yet the elevated reading of 7.19 warns of potential volatility.

AI Sector Growth

The broader AI market continues to expand, with Nvidia at the forefront. The company's advancements in AI technology have set a benchmark for the industry, driving growth and innovation. As AI becomes more integrated into various sectors, Nvidia's role as a leader is pivotal. MarketVibe's data indicates that the AI sector's growth is a key factor in current market dynamics, with the CW Index providing an early warning of shifts in investor sentiment.

Market Stability Insights

Nvidia's performance is closely linked to market stability. The company's success in AI not only boosts its stock but also influences investor sentiment towards AI-driven companies. However, the CW Index at 7.19 suggests that while Nvidia's earnings provide a stabilizing force, the market is still susceptible to fluctuations. Historical patterns show that when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month, highlighting the need for cautious optimism.

CW Index Connection

The current CW Index reading of 7.19 is a critical indicator for investors. It suggests that while Nvidia's earnings are a positive development, the market is on alert for potential corrections. The gold component of the CW Index provides a 4-6 week early warning, allowing investors to anticipate shifts in market conditions. If the CW Index crosses 6.5, it could signal increased volatility, making it essential for investors to monitor this metric closely.

Potential Risks

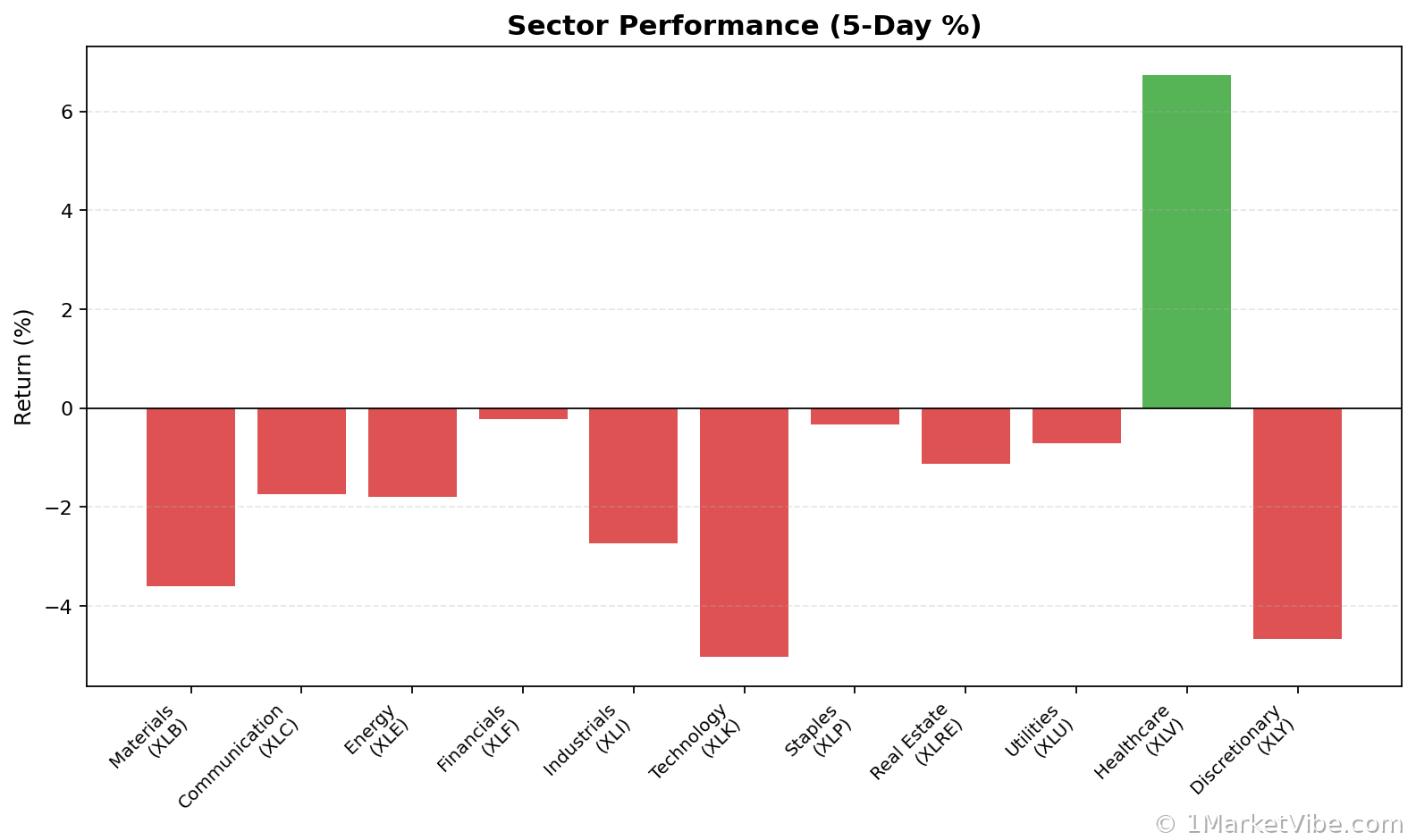

Despite Nvidia's strong performance, potential risks remain. The tech sector is inherently volatile, and over-reliance on AI growth could expose investors to significant risks. The CW Index's elevated reading underscores the importance of diversification and risk management. Investors should be wary of market corrections, particularly if the CW Index continues to trend upwards.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- CW Index reading: 7.19, indicating heightened market risk.

- Market status: Yellow flag, caution advised.

- Key metric to watch: CW Index movement, particularly if it crosses 6.5.

📚 Learn (2-Minute Deep Dive)

Nvidia's record earnings highlight the AI sector's potential to drive market stability. However, the current CW Index reading of 7.19 warns of possible corrections. Historical parallels, such as the March 2023 scenario, emphasize the need for vigilance. The gold component of the CW Index provides a crucial early warning, allowing investors to prepare for potential market shifts. As AI continues to grow, Nvidia's role remains central, but investors must remain cautious of over-reliance on this sector.

⚡ Act (Specific Steps)

- Diversify Portfolios: Reduce exposure to tech-heavy investments by reallocating 10-15% to other sectors.

- Monitor CW Index: Set alerts for CW Index movements, particularly if it approaches 6.5.

- Implement Hedging Strategies: Consider options or inverse ETFs to protect against potential downturns.

- Review Position Sizing: Adjust holdings in AI-related stocks based on CW Index signals.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Nvidia's record earnings underscore the growing influence of the AI sector on market stability. While the company's performance is a positive indicator, the elevated CW Index reading of 7.19 suggests caution. Investors should leverage MarketVibe's tools to navigate these complex market dynamics effectively. As AI continues to expand, strategic investment decisions will be crucial for long-term success.

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably.