Dow Declines as Powell Investigation Raises Concerns Over Market Stability

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Dow Declines as Powell Investigation Raises Concerns Over Market Stability

The Dow Jones Industrial Average experienced a notable decline recently, driven by heightened concerns over market stability following the announcement of a Department of Justice investigation into Federal Reserve Chair Jerome Powell. This development has sent ripples through the financial markets, raising questions about the potential implications for investor confidence and economic stability.

Market Reaction

The Dow's drop reflects a broader sentiment of uncertainty among investors. The investigation into Powell's actions has sparked fears of potential disruptions in monetary policy, which could have far-reaching effects on the economy. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.8. This level is below the critical 7.0 warning threshold, indicating moderate risk but suggesting vigilance is warranted. Learn more about how the CW Index works at 1marketvibe.com.

Impact of the Investigation

The investigation into Powell could undermine market confidence, as similar probes in the past have led to increased volatility. For instance, when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month. The current CW Index reading suggests that while immediate panic may not be necessary, investors should remain cautious. The gold component of the CW Index provides an early warning, allowing investors to anticipate potential market shifts.

CW Index Signals

MarketVibe's CW Index at 5.8 suggests that while the market is not yet at a critical risk level, the situation warrants close monitoring. Historical patterns show that when the CW Index approaches or exceeds 6.5, investors should prepare for potential market corrections. The unique gold component of the CW Index offers a 4-6 week advance notice, making it an invaluable tool for proactive risk management.

Broader Economic Context

Current economic conditions, including geopolitical tensions and fluctuating interest rates, contribute to the market's volatility. Comparisons with past political investigations reveal that such events often lead to temporary market instability. However, the CW Index's historical accuracy in predicting market corrections provides investors with a strategic advantage in navigating these turbulent times.

Expert Opinions

Market analysts offer diverse perspectives on the potential fallout from the Powell investigation. Some experts suggest that the market's reaction may be overblown, while others warn of prolonged instability. According to MarketVibe data, the CW Index's current reading should be a focal point for investors, as it provides an actionable early warning system to guide investment decisions.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.8

- Overall market status: Yellow flag (moderate risk)

- Key metric to watch: CW Index movement towards 6.5

📚 Learn (2-Minute Deep Dive)

The DOJ investigation into Fed Chair Powell has introduced a layer of uncertainty that could impact market stability. Historically, similar investigations have led to increased volatility, as seen when the CW Index reached 7.1 in March 2023, resulting in an 8.3% market decline. The current economic environment, characterized by geopolitical tensions and interest rate fluctuations, exacerbates these concerns. Monitoring the CW Index is crucial, as its gold component offers a 4-6 week early warning, allowing investors to adjust their strategies proactively.

⚡ Act (Specific Steps)

- Monitor Position Sizing: Adjust your portfolio allocations based on CW Index levels. Consider reducing exposure if the index trends towards 6.5.

- Risk Management: Implement hedging strategies to protect against potential downturns. Options and inverse ETFs can be effective tools.

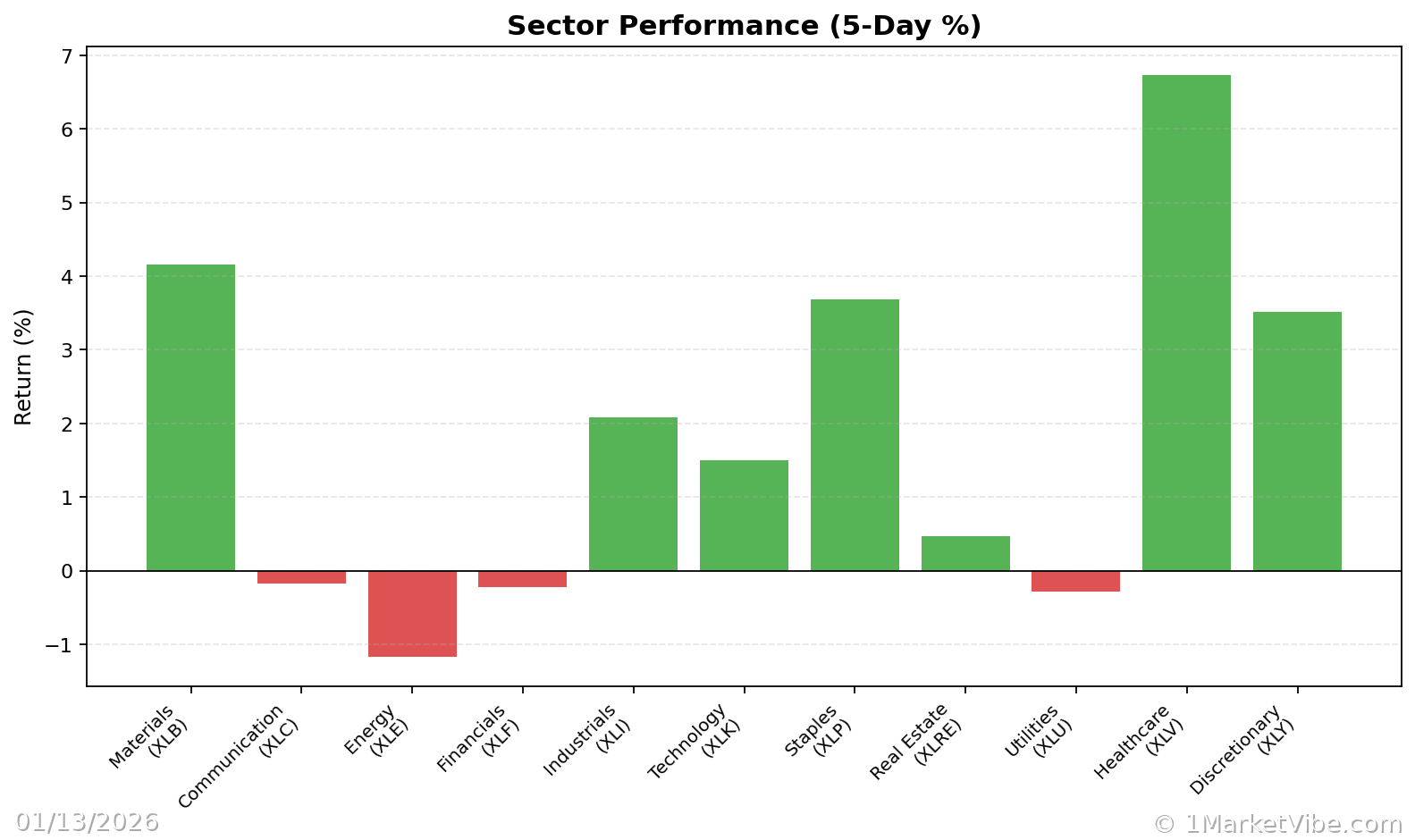

- Sector Adjustments: Re-evaluate investments in sectors most affected by monetary policy changes, such as financials and real estate.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

In conclusion, the investigation into Fed Chair Powell has introduced a new layer of complexity to the market landscape. While the current CW Index reading of 5.8 suggests moderate risk, the situation requires careful monitoring. MarketVibe's Enhanced CW Index and Decision Edge™ Method provide investors with the tools needed to navigate these uncertain times. Built by investors, for investors, MarketVibe offers a strategic advantage through its early warning capabilities and actionable insights.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts