Google's AI Launch and the Implications of a 5.7 CW Index

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Google's AI Launch and the Implications of a 5.7 CW Index

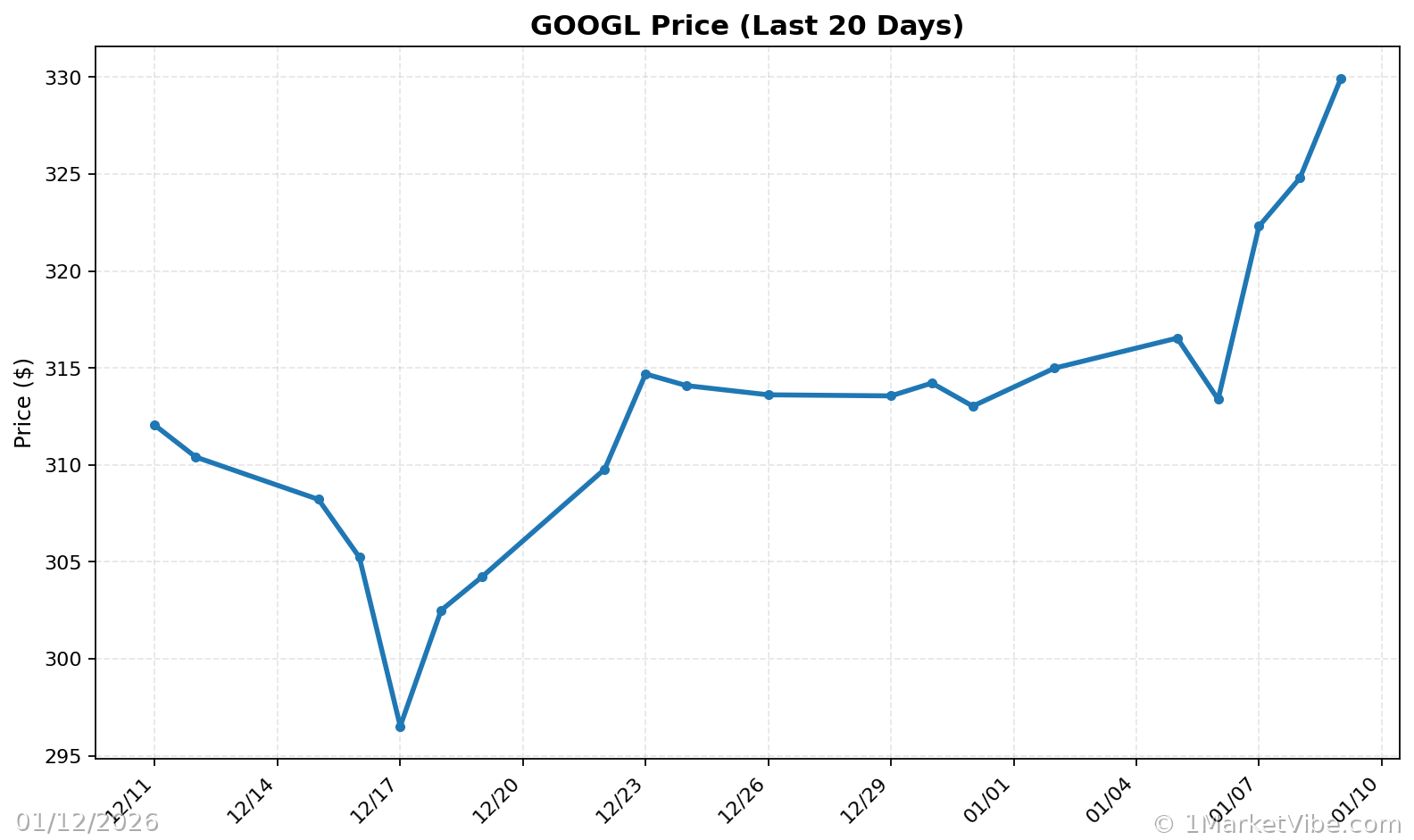

Google's recent launch of its AI commerce protocol marks a significant milestone in the retail sector, promising to reshape consumer experiences and market dynamics. As artificial intelligence continues to integrate into various industries, its impact on retail is particularly profound, offering enhanced personalization and efficiency. This development coincides with MarketVibe's proprietary Enhanced CW Index, which currently reads 5.7 on a 0-10 scale. This index provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth. A reading of 5.7 is below the 7.0 warning threshold, indicating a moderate risk environment.

Learn more about how CW Index works at 1marketvibe.com.

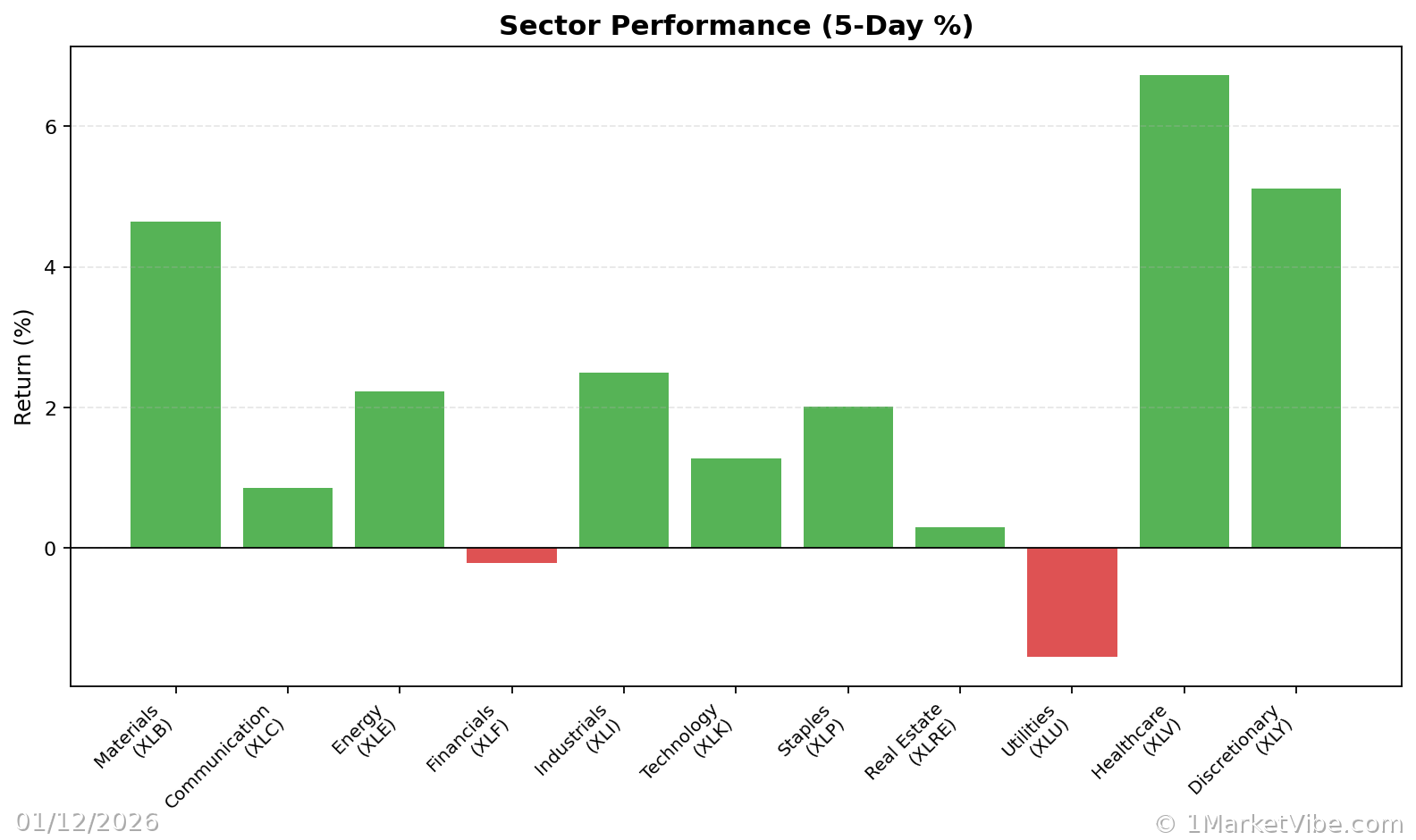

Market Context

The retail market is undergoing a transformation, driven by technological advancements and shifting consumer preferences. Traditional retail operations are increasingly adopting AI technologies to stay competitive. Google's AI commerce protocol is poised to enhance these operations by offering seamless integration with existing Google services, potentially challenging established players like Amazon and Nvidia. This shift aligns with MarketVibe's CW Index, which suggests that the market is in a state of moderate risk, with historical patterns indicating potential volatility if the index were to rise above 6.5.

Google's AI Commerce Protocol

Google's new AI commerce protocol is designed to streamline the shopping experience by leveraging AI to provide personalized recommendations and efficient transaction processes. This protocol integrates seamlessly with Google's suite of services, offering retailers a robust platform to enhance customer engagement. As the retail landscape evolves, MarketVibe's CW Index will be crucial in monitoring how these technological shifts impact market stability.

Competitive Landscape

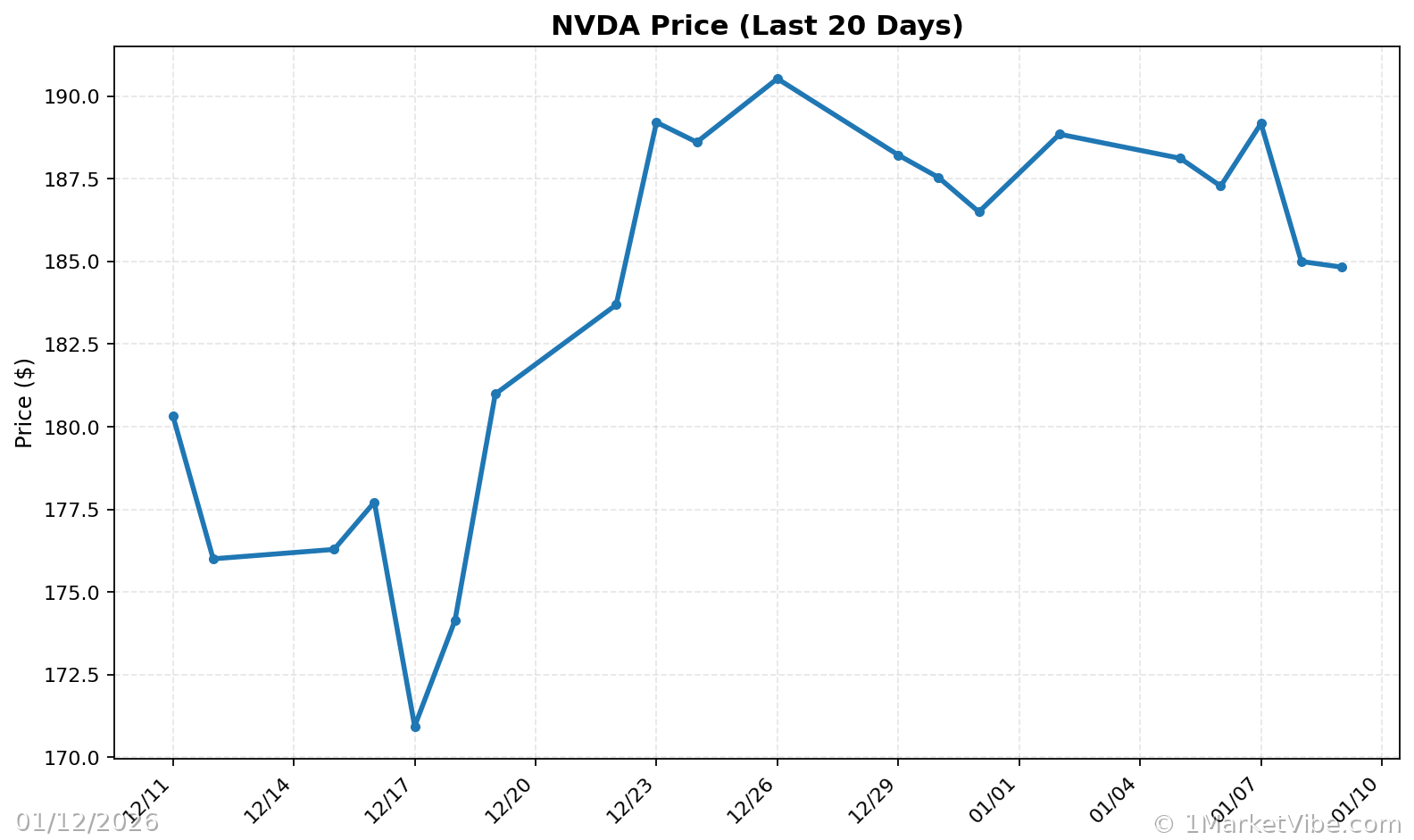

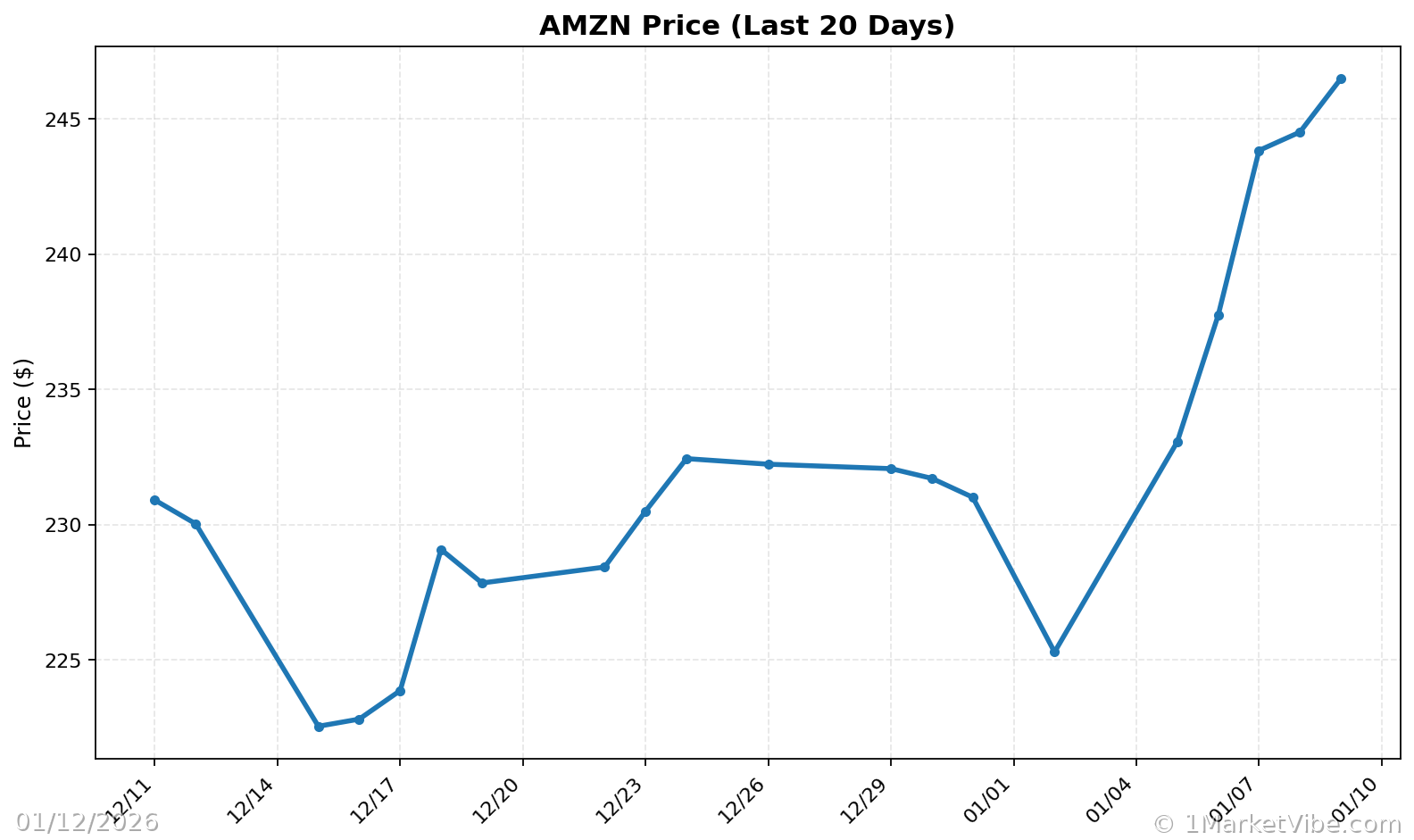

The introduction of Google's AI commerce protocol presents both challenges and opportunities. Established players like Amazon and Nvidia may face increased competition, while new entrants could find opportunities in this AI-driven market. MarketVibe's CW Index will be an essential tool for investors to gauge the competitive landscape, offering insights into potential market shifts and risks.

Consumer Implications

For consumers, Google's AI commerce protocol promises a more personalized and efficient shopping experience. This could lead to shifts in consumer behavior, as shoppers increasingly rely on AI-driven recommendations. MarketVibe's CW Index will help investors understand how these changes might affect consumer spending patterns and overall market sentiment.

Investor Considerations

Investors should closely monitor developments in AI-driven retail technologies. The current CW Index reading of 5.7 suggests moderate risk, but investors should be vigilant for any changes that could signal increased volatility. Historical data shows that when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month. As such, the index serves as a valuable early warning system for potential market corrections.

Market Sentiment

Market sentiment regarding Google's AI launch is cautiously optimistic. While the potential for innovation is significant, investors are aware of the risks associated with rapid technological change. MarketVibe's CW Index provides a historical perspective, showing how similar technological advancements have impacted markets in the past. This context is crucial for understanding current sentiment and potential future trends.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework helps investors turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk.

- Overall market status: Yellow flag.

- Key metric to watch: CW Index movement towards 6.5.

📚 Learn (2-Minute Deep Dive)

The launch of Google's AI commerce protocol is a pivotal moment for the retail sector. This development could significantly alter market dynamics, as AI technologies become more integrated into consumer experiences. Historical parallels, such as the rise of e-commerce, demonstrate how technological advancements can disrupt traditional markets. MarketVibe's CW Index provides a 4-6 week early warning of potential market corrections, making it an invaluable tool for investors navigating these changes. Monitoring the index's movement is crucial, as a rise above 6.5 could signal increased market volatility.

⚡ Act (Specific Steps)

- Monitor CW Index Levels: Adjust portfolio allocations based on the CW Index. A rise above 6.5 may warrant increased caution.

- Diversify Holdings: Consider diversifying investments across sectors less impacted by AI-driven changes.

- Implement Hedging Strategies: Use options or other financial instruments to hedge against potential market downturns if the CW Index trends upwards.

- Stay Informed: Regularly check updates on the CW Index and market news to make informed decisions.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Google's AI commerce protocol launch represents a significant shift in the retail landscape, with potential implications for market dynamics and consumer behavior. MarketVibe's Enhanced CW Index, currently at 5.7, provides a critical early warning system for investors, offering insights into potential market corrections. As AI technologies continue to evolve, staying informed and proactive is essential for navigating the complexities of today's market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts