Five-Year Low in Job Openings: Implications of the CW Index for Investors

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Five-Year Low in Job Openings: Implications of the CW Index for Investors

As the U.S. job market hits a five-year low in job openings, investors are left pondering the broader economic implications. This decline, reported as the second lowest level in five years, signals potential cooling in economic activity. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.5. This reading, below the critical 7.0 warning threshold, suggests a moderate risk environment, aligning with the observed job market trends.

Learn more about how CW Index works at 1marketvibe.com

Current Job Market Status

Recent data indicates a significant drop in job openings, with U.S. employers posting fewer positions in November compared to previous months. This decline reflects a cautious approach to hiring, even as economic growth shows signs of slowing. The hiring rate remains sluggish, contributing to concerns about future consumer spending and economic momentum. When compared to historical data, this trend mirrors periods of economic uncertainty, where businesses hold back on expansion plans.

Economic Implications

The reduction in job openings may be an early indicator of economic cooling. A decrease in hiring can lead to reduced consumer confidence, as individuals become wary of job security and future income prospects. This, in turn, can dampen consumer spending, a critical driver of economic growth. MarketVibe's CW Index suggests that the current job market conditions are consistent with a moderate risk environment, as indicated by its current reading of 5.5. Historically, when the CW Index reached similar levels, such as 7.1 in March 2023, markets experienced an 8.3% decline over the following month.

CW Index Connection

MarketVibe's Enhanced CW Index provides valuable insights into the current market landscape. The index's current reading of 5.5 reflects moderate risk, with its gold component offering a 4-6 week early warning of potential market corrections. This aligns with the current job market trends, suggesting that investors should remain vigilant. The CW Index's historical patterns show that significant movements, particularly crossing the 6.5 threshold, warrant close attention as they may signal increased market volatility.

Sector-Specific Insights

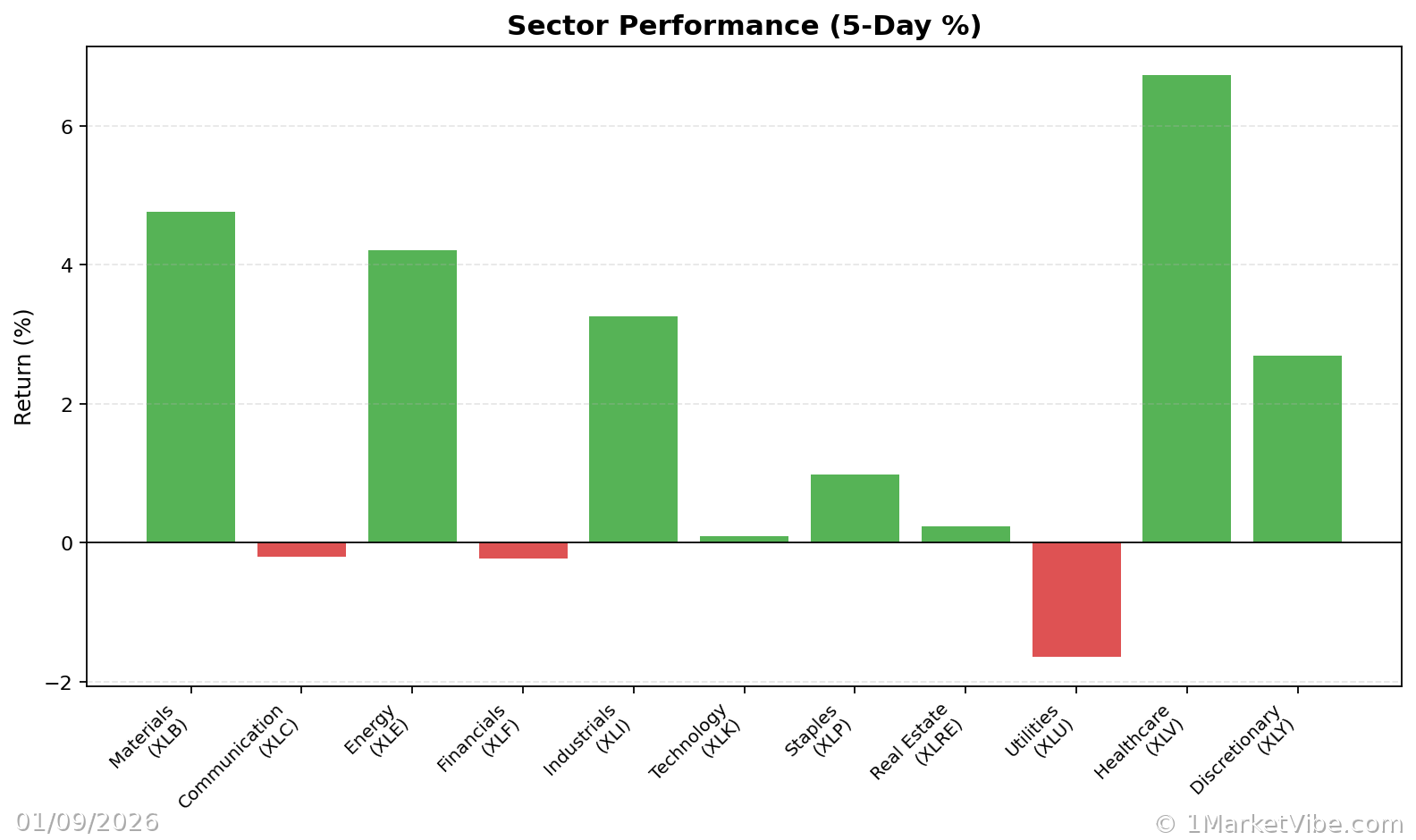

Certain sectors are more vulnerable to the hiring slowdown. Industries such as retail and hospitality, which rely heavily on consumer spending, may face challenges if the job market continues to weaken. Conversely, sectors like technology and healthcare, which have shown resilience in past downturns, may offer more stability. MarketVibe tracks these sectoral shifts, providing investors with actionable insights to navigate these changes effectively.

Investor Considerations

For investors, the current job market trends underscore the importance of strategic positioning. While the CW Index indicates moderate risk, it is crucial not to overreact to short-term fluctuations. Instead, investors should focus on long-term strategies, adjusting their portfolios to mitigate potential risks. MarketVibe's proprietary system offers a comprehensive view of market dynamics, enabling investors to make informed decisions.

Historical Context

Looking back at previous economic downturns, similar patterns in job market trends have often preceded broader economic challenges. During the 2008 financial crisis, for example, a sharp decline in job openings was an early warning sign of the impending recession. By understanding these historical parallels, investors can better prepare for potential future scenarios.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.5, indicating moderate risk.

- Overall market status: Yellow flag, suggesting caution.

- Key metric to watch: Job openings and hiring rates.

📚 Learn (2-Minute Deep Dive)

The decline in job openings is a critical indicator of potential economic cooling. Historically, similar trends have led to reduced consumer spending and slower economic growth. MarketVibe's CW Index, with its current reading of 5.5, aligns with these signals, providing a 4-6 week early warning of potential market corrections. Investors should monitor this index closely, as movements beyond the 6.5 threshold could indicate heightened market volatility. Understanding these dynamics is essential for navigating the current economic landscape.

⚡ Act (Specific Steps)

- Diversify Portfolio: Allocate a portion of investments to sectors less affected by the hiring slowdown, such as technology and healthcare.

- Adjust Risk Exposure: Consider reducing exposure to high-risk sectors like retail and hospitality.

- Monitor CW Index Movements: Stay alert for any changes in the CW Index, particularly if it approaches the 6.5 level.

- Implement Hedging Strategies: Use options or other hedging tools to protect against potential market downturns.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The current decline in job openings highlights potential economic challenges ahead. MarketVibe's Enhanced CW Index, with its moderate risk reading, provides a valuable early warning system for investors. By leveraging MarketVibe's proprietary tools and insights, investors can navigate these uncertain times with confidence. As always, it's crucial to remain informed and prepared for any market shifts.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.