Gold's Rise Indicates Inflation Threat as CW Index Reaches 6.32

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Gold's Rise Indicates Inflation Threat as CW Index Reaches 6.32

Gold prices have surged recently, signaling potential inflationary pressures that investors should not overlook. As the market navigates these uncertain waters, MarketVibe's proprietary Enhanced CW Index—a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth—has reached 6.32. This level, while below the critical 7.0 threshold, suggests a moderate risk environment that warrants investor attention.

Learn more about how CW Index works at 1marketvibe.com

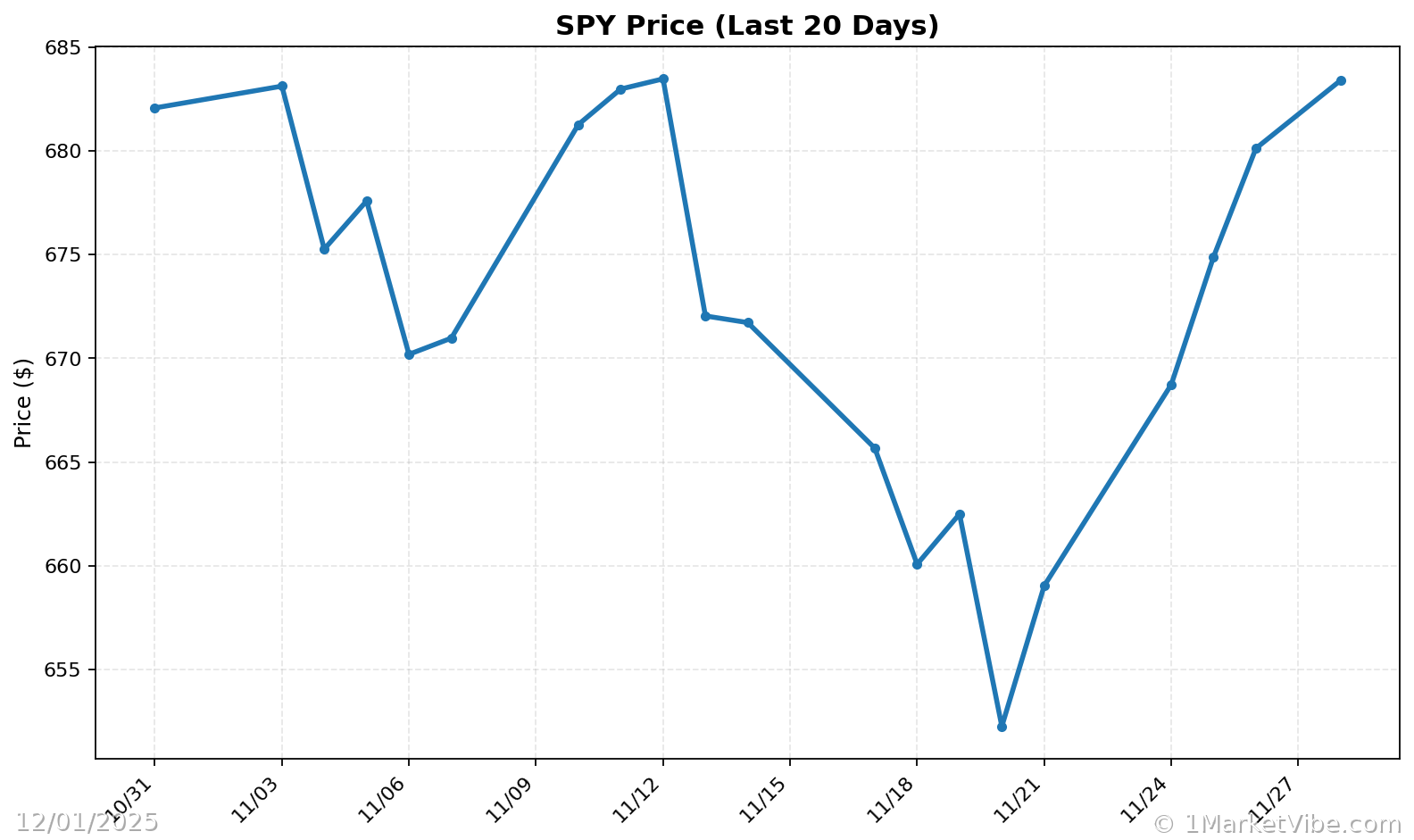

Current Market Context

Economic indicators from the White House paint a picture of robust growth, with consumer spending showing strength as the holiday season approaches. According to Politico, economic adviser Kevin Hassett has expressed optimism about the economy's trajectory, dismissing concerns from skeptics. This backdrop of economic growth, however, is juxtaposed with the rising gold prices, which often serve as a hedge against inflation.

Gold as an Inflation Indicator

Historically, gold has been a reliable barometer for inflation expectations. When inflation fears mount, investors flock to gold, driving its price upward. Recent data underscores this trend, with gold's ascent aligning with concerns over potential inflationary pressures. This relationship is a critical component of MarketVibe's Enhanced CW Index, which uses gold flows as an early warning signal for market corrections.

CW Index Analysis

The current CW Index reading of 6.32 indicates a moderate risk level. While not yet at the 7.0 threshold that historically signals heightened market correction risks, it is a level that investors should monitor closely. For instance, when the CW Index hit 7.1 in March 2023, markets subsequently fell by 8.3%. The gold component of the CW Index provides a 4-6 week advance notice, making it a valuable tool for anticipating market shifts.

Potential Market Implications

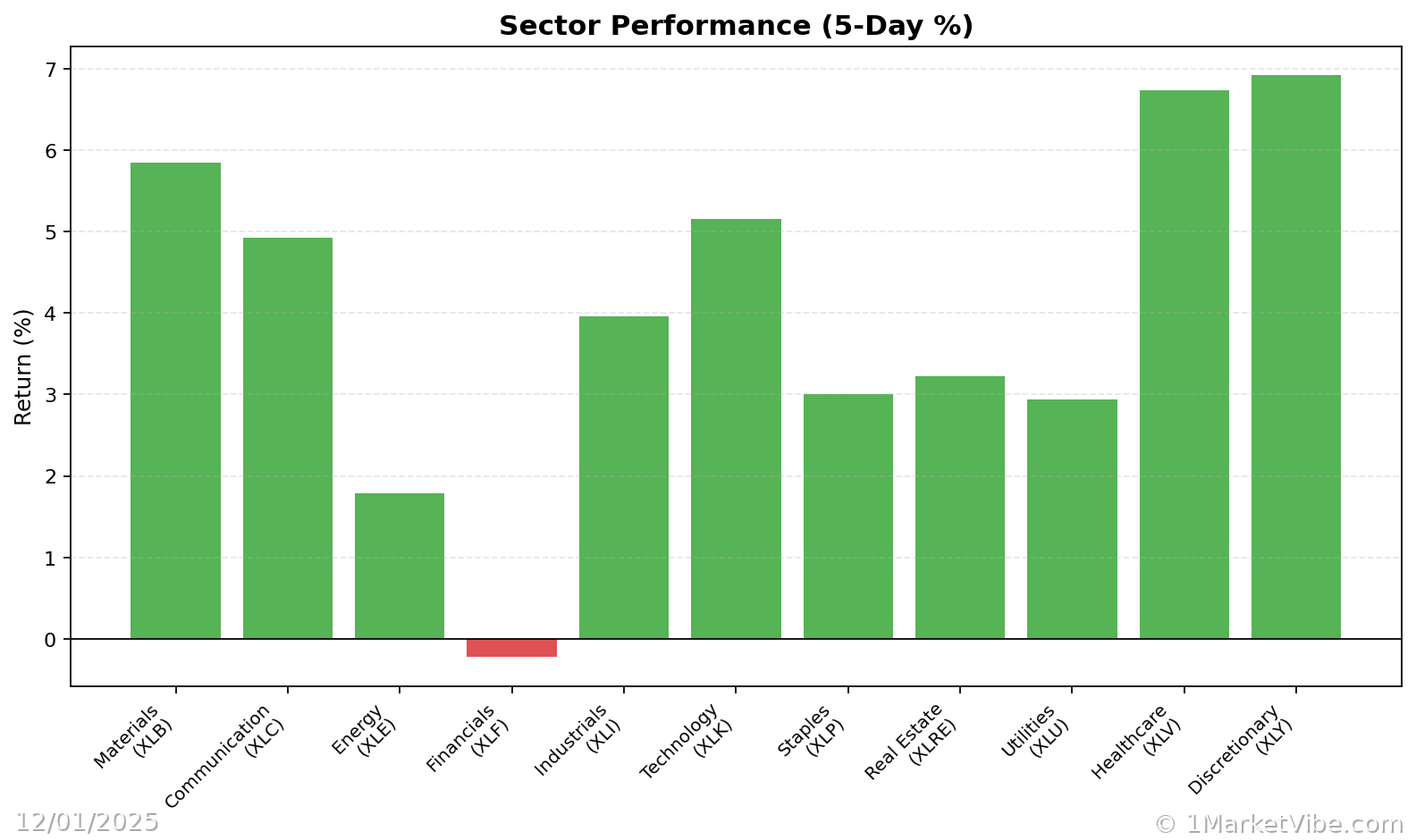

The rise in gold prices may influence investor sentiment, potentially leading to increased caution in the equity markets. Additionally, this trend could prompt the Federal Reserve to reconsider its stance on interest rates. If inflationary pressures persist, the Fed might opt for a more hawkish approach, impacting various asset classes.

Historical Context

Looking back, there have been several instances where rising gold prices foreshadowed significant market shifts. For example, in 2011, gold prices soared amid inflation fears, preceding a period of market volatility. These historical parallels highlight the importance of monitoring gold as an inflation indicator and underscore the value of MarketVibe's Enhanced CW Index in providing early warnings.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 6.32, indicating moderate risk.

- Market status: Yellow flag—caution advised.

- Key metric to watch: Gold price movements.

📚 Learn (2-Minute Deep Dive)

The current market environment is characterized by robust consumer spending and economic growth, yet rising gold prices suggest underlying inflation concerns. Historically, gold has been a precursor to inflationary periods, and its recent ascent aligns with this pattern. Investors should be vigilant, as the CW Index's 4-6 week early warning capability suggests that these trends were predictable. Monitoring the CW Index for any movement towards the 7.0 threshold will be crucial in the coming weeks.

⚡ Act (Specific Steps)

- Reassess Portfolio Allocations: Consider reducing exposure to sectors sensitive to interest rate hikes.

- Increase Gold Holdings: As a hedge against inflation, allocate a small percentage (e.g., 5-10%) of your portfolio to gold.

- Monitor CW Index Movements: If the index approaches 6.5, prepare for potential market adjustments.

- Implement Risk Management: Utilize stop-loss orders to protect against downside risk.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Gold's recent rise serves as a critical indicator of potential inflation threats, with the CW Index at 6.32 highlighting moderate market risks. As investors navigate these conditions, leveraging tools like MarketVibe's Enhanced CW Index and the Decision Edge™ Method can provide valuable insights and actionable strategies. By staying informed and proactive, investors can better manage risk and capitalize on market opportunities.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts