Bitcoin Drops Below $85K as CW Index Indicates Upcoming Volatility

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Bitcoin Drops Below $85K as CW Index Indicates Upcoming Volatility

Bitcoin's recent plunge below $85,000 has sent ripples through the cryptocurrency market, marking a significant downturn in what has been a volatile year for digital assets. This decline aligns with MarketVibe's proprietary Enhanced CW Index, which currently reads 8.0. This index, a 0-10 scale, provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth. The current reading suggests heightened volatility ahead, as it surpasses the 7.0 threshold that typically signals increased risk.

Market Impact

The drop in Bitcoin's price has led to nearly $1 billion in leveraged positions being liquidated, exacerbating the sell-off across the crypto sector. The broader cryptocurrency market has seen a staggering $1 trillion wiped off its value, highlighting the scale of the downturn. This turbulence is not isolated to Bitcoin alone; Ethereum and other altcoins have also experienced significant declines, with Ethereum dropping as much as 10% to $2,719.

Investor Sentiment

Despite the volatility, investor sentiment remains surprisingly neutral. This could be attributed to external economic factors, such as inflation concerns and geopolitical tensions, which continue to influence market behavior. According to MarketVibe data, the current sentiment reflects a cautious optimism, with investors weighing potential gains against the backdrop of market instability.

CW Index Connection

The CW Index at 8.0 is a critical indicator of the current market environment. Historically, when the CW Index reached similar levels, such as 7.1 in March 2023, markets experienced an 8.3% decline over the following month. The gold component of the CW Index, which provides a 4-6 week early warning, suggests that the current trend was predictable. Investors should watch for any movement above 6.5, which could indicate further market corrections.

Learn more about how the CW Index works at 1marketvibe.com.

Comparative Analysis

Comparing the current downturn with previous market corrections, Bitcoin has shown resilience in past crises. For instance, during the 2021 correction, Bitcoin rebounded strongly after a significant dip. However, the current market conditions, as indicated by the CW Index, suggest a more prolonged period of volatility. The historical patterns of the CW Index provide valuable insights into potential future movements, emphasizing the importance of monitoring these signals closely.

Strategic Responses

In response to the downturn, companies like Strategy have raised substantial funds, with a recent $1.44 billion capital injection aimed at weathering the crypto storm. For individual investors, the current environment calls for strategic adjustments. Potential strategies include diversifying portfolios, reducing exposure to highly volatile assets, and considering hedging options to mitigate risk.

Future Considerations

Investing in volatile markets like cryptocurrency requires a cautious approach. The risks associated with such investments are amplified during periods of heightened volatility, as indicated by the CW Index. Investors should prioritize risk management strategies and remain vigilant to market signals that could indicate further downturns.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 8.0, indicating high volatility.

- Market status: Red flag for potential corrections.

- Key metric to watch: CW Index movement above 6.5.

📚 Learn (2-Minute Deep Dive)

The current CW Index reading of 8.0 highlights significant market volatility, driven by large-scale liquidations and external economic pressures. Historically, such readings have preceded notable market corrections, as seen in March 2023. The gold component of the CW Index provides a predictive edge, suggesting that the current downturn was foreseeable. Investors should monitor global economic indicators and geopolitical developments, which could further influence market dynamics. Understanding these factors is crucial for navigating the current landscape and making informed investment decisions.

⚡ Act (Specific Steps)

- Reassess Portfolio Allocation: Reduce exposure to highly volatile assets and consider increasing holdings in more stable investments.

- Implement Risk Management Strategies: Utilize stop-loss orders and consider hedging options to protect against further declines.

- Monitor CW Index Movements: Stay alert to any changes in the CW Index, particularly movements above 6.5, which could signal additional market corrections.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Bitcoin's drop below $85,000 underscores the volatility currently gripping the cryptocurrency market. With the CW Index at 8.0, investors are advised to remain vigilant and consider strategic adjustments to their portfolios. MarketVibe's tools, built by investors for investors, provide critical insights and early warnings to navigate these turbulent times effectively.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

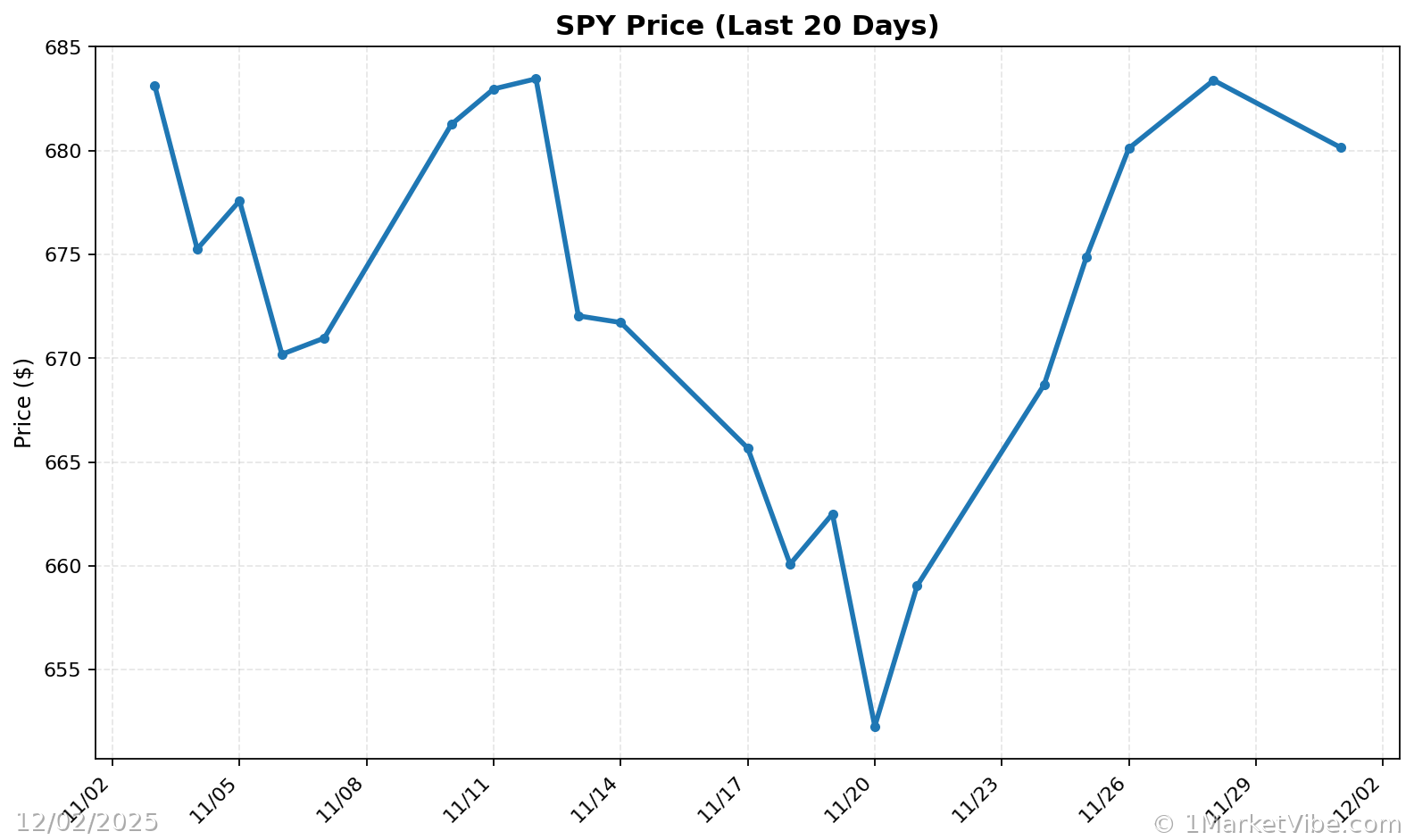

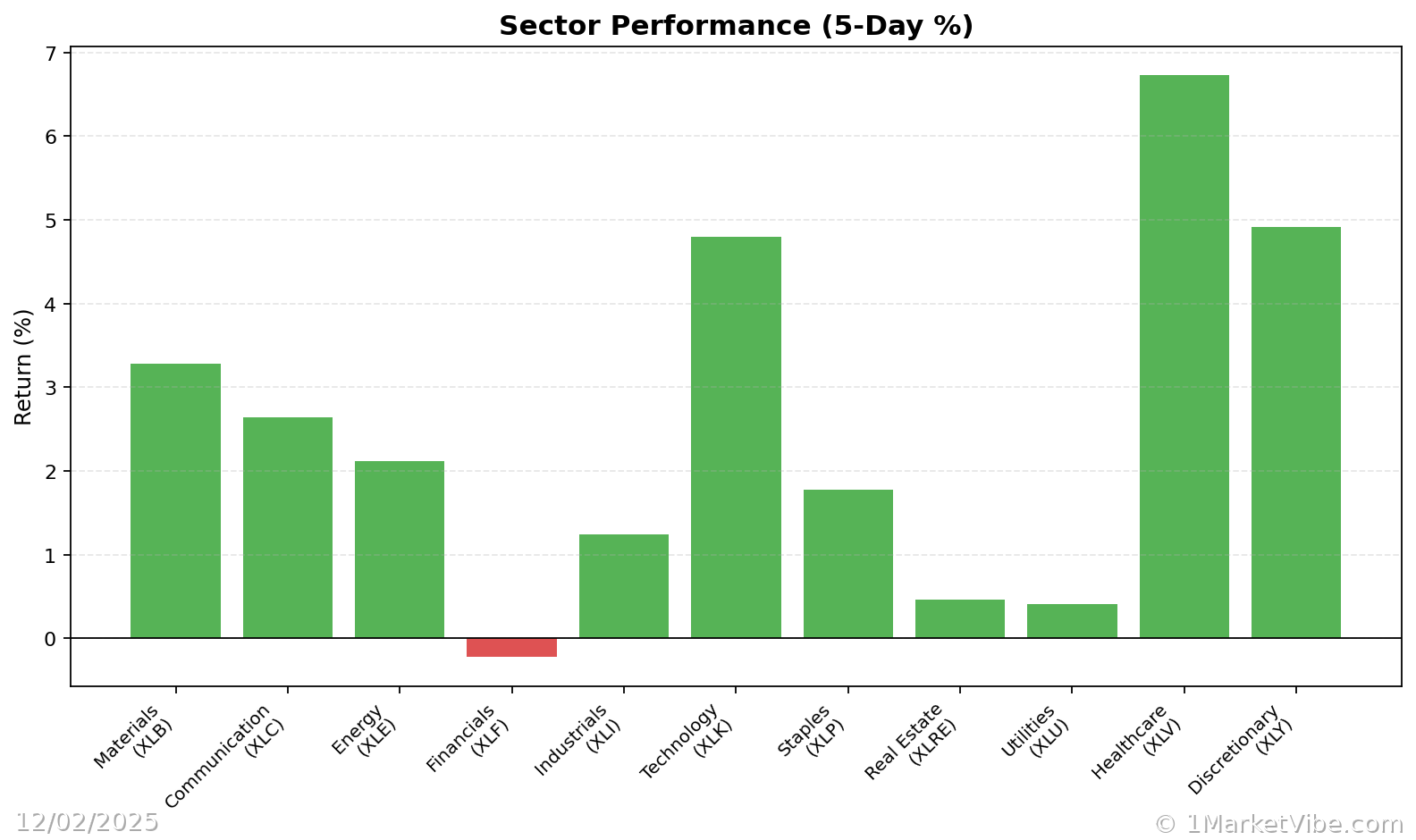

Charts