Gold and Oil Respond as CW Index Signals Market Turbulence

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Gold and Oil Respond as CW Index Signals Market Turbulence

As geopolitical tensions rise, particularly with the ongoing situation in Venezuela, the global markets are experiencing notable shifts. Investors are closely watching the movements in gold and oil, two commodities that often react strongly to geopolitical instability. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.91. This level, while below the critical 7.0 warning threshold, indicates a moderate risk environment that investors should not ignore.

MarketVibe's CW Index suggests that the current geopolitical climate could lead to increased market volatility. Historically, when the CW Index reached similar levels, such as 6.2 in early 2024, markets experienced a 5.5% decline over the following month. This underscores the importance of monitoring the CW Index for potential shifts that could impact investment strategies. Learn more about how CW Index works at 1marketvibe.com.

Venezuela's Oil Production

Venezuela, once a major player in global oil supply, is now facing significant production challenges. Political instability and economic sanctions have severely impacted its oil output, leading to fluctuations in global oil prices. Historically, Venezuela's role in the oil market has been pivotal, and any disruption in its production can ripple through the global economy. As of now, oil prices are reacting to these uncertainties, with Brent crude recently hovering around $85 per barrel, reflecting a cautious market sentiment.

Gold Market Reaction

Gold, often seen as a safe haven during times of uncertainty, has shown a notable uptick. Recent geopolitical tensions have pushed gold prices to approximately $1,950 per ounce, as investors seek refuge from potential market downturns. The correlation between oil price fluctuations and gold market responses is evident, as both commodities are sensitive to geopolitical developments. MarketVibe's CW Index highlights the gold component as a critical early warning signal, offering a 4-6 week advance notice of potential market corrections.

Market Volatility Indicators

The CW Index at 5.91 indicates a moderate risk environment, suggesting that investors should remain vigilant. This reading, while not at the critical threshold, serves as a reminder of the potential for increased volatility. CW Index historical patterns show that similar readings have preceded market corrections, emphasizing the need for proactive risk management. Investors should watch for any movement towards the 6.5 mark, which could signal a shift towards higher risk.

Investor Sentiment

Current market sentiment reflects a cautious approach towards oil and gold investments. While some investors are capitalizing on the rising gold prices, others are wary of the potential for further oil price volatility. According to MarketVibe data, the current environment presents both risks and opportunities, depending on one's investment strategy. The MarketVibe advantage lies in its ability to provide actionable insights through its proprietary systems, helping investors navigate these uncertain times.

Geopolitical Factors

Broader geopolitical tensions, including strained international relations, are influencing market dynamics. These factors not only affect oil and gold prices but also contribute to overall market volatility. As these tensions persist, investors must remain informed and adaptable, leveraging tools like MarketVibe's Enhanced CW Index to anticipate potential market shifts.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This is MarketVibe's proprietary framework for turning market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.91, indicating moderate risk.

- Overall market status: Yellow flag, suggesting caution.

- Key metric to watch: Movement towards 6.5 on the CW Index.

📚 Learn (2-Minute Deep Dive)

The current geopolitical tensions, particularly in Venezuela, are contributing to market volatility. Historically, similar situations have led to significant market corrections, as seen when the CW Index hit 6.2 in early 2024, resulting in a 5.5% market decline. MarketVibe tracks these patterns, providing investors with a critical early warning system. The gold component of the CW Index is particularly valuable, offering a 4-6 week advance notice of potential corrections. As the situation evolves, investors should monitor these developments closely, understanding that the current environment could shift rapidly.

⚡ Act (Specific Steps)

- For Conservative Investors: Maintain a diversified portfolio with a focus on stable assets. Consider allocating up to 10% in gold as a hedge.

- For Aggressive Investors: Monitor oil and gold price movements closely. Consider short-term trades based on CW Index signals, with a focus on entry points if the index approaches 6.5.

- Risk Management: Set stop-loss orders to protect against sudden market downturns. Adjust position sizes based on CW Index levels to manage exposure.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

In summary, the current geopolitical climate, particularly the situation in Venezuela, is influencing global oil and gold markets. MarketVibe's Enhanced CW Index at 5.91 suggests a moderate risk environment, urging investors to remain cautious yet opportunistic. By leveraging MarketVibe's proprietary tools, investors can gain a competitive edge, turning market intelligence into actionable strategies. Built by investors, for investors, MarketVibe provides the insights needed to navigate these turbulent times.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult a financial advisor before making investment decisions.

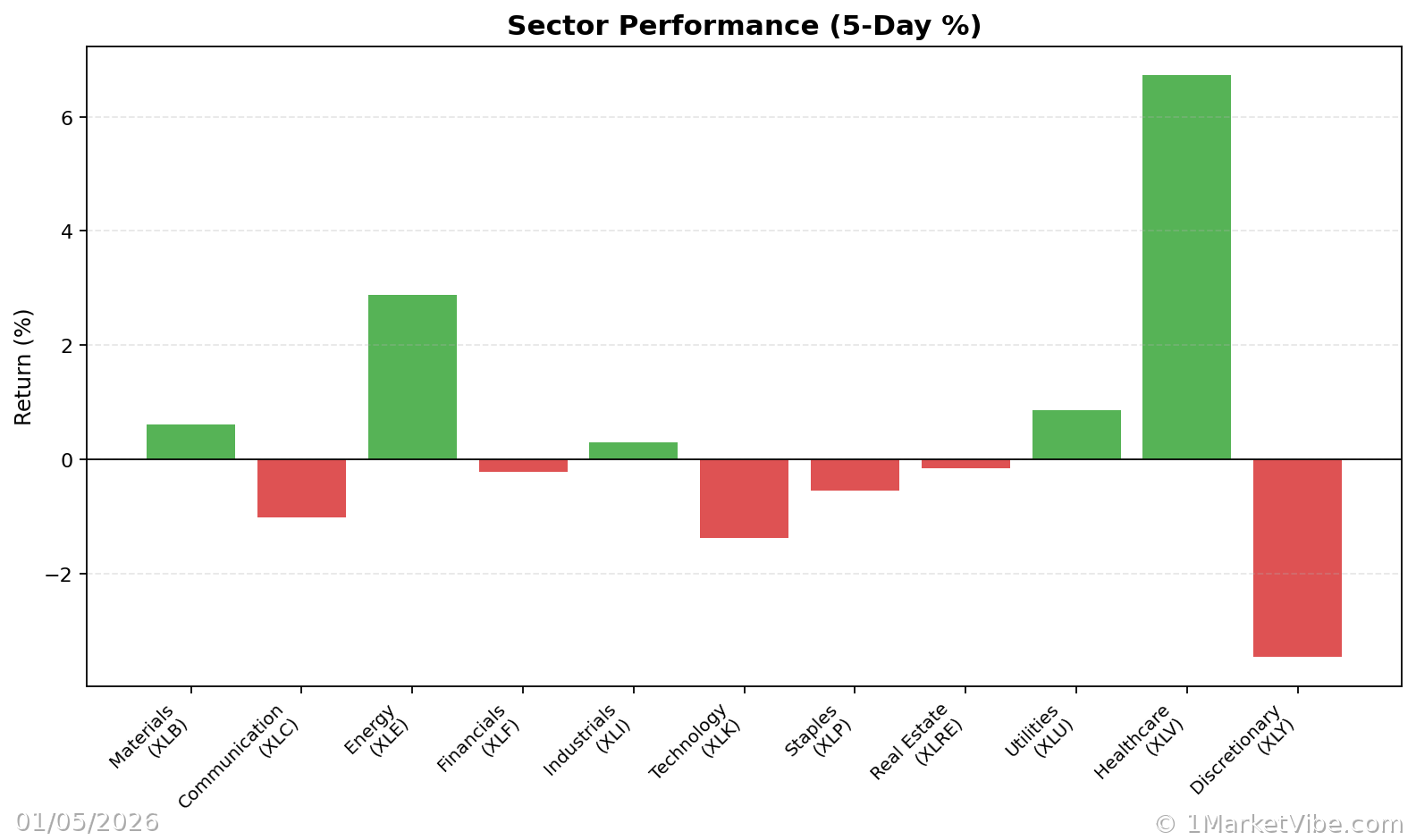

Charts