AI Advances Lead to Job Cuts in EU Banking Sector

The European banking sector is undergoing a significant transformation as artificial intelligence (AI) continues to reshape traditional roles. According to recent reports, more than 200,000 jobs could be cut by 2030, primarily affecting back-office operations, risk management, and compliance. This shift is driven by the pursuit of efficiency gains, with AI expected to streamline processes by up to 30%. As these changes unfold, MarketVibe's proprietary Enhanced CW Index, currently at 5.53, offers a crucial early warning system for investors, providing a 4-6 week advance notice of potential market corrections by tracking institutional gold flows and market breadth. This reading is below the 7.0 warning threshold, indicating moderate risk. Learn more about how CW Index works at 1marketvibe.com.

Scope of Job Cuts

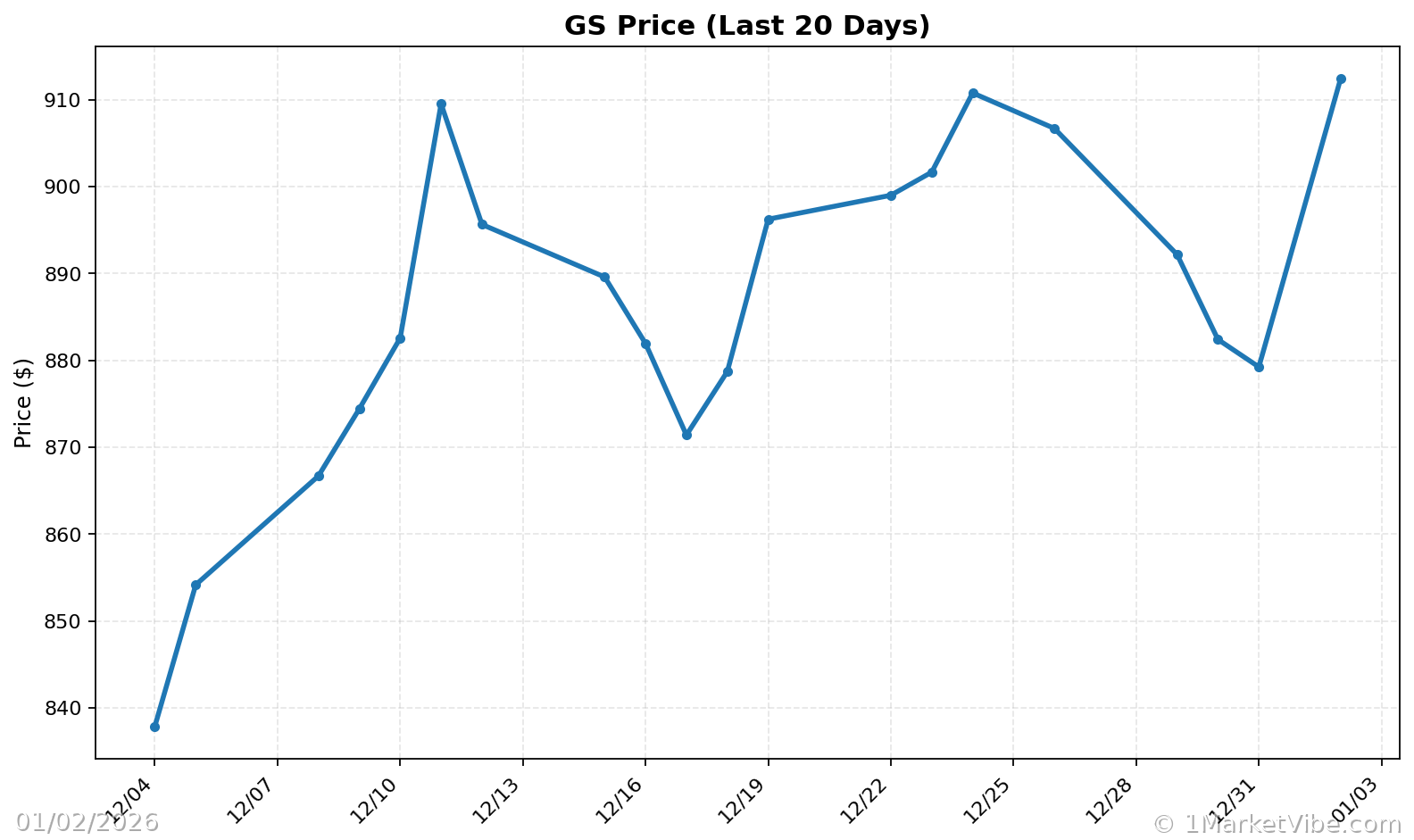

The anticipated job cuts in the EU banking sector are not limited to a single area. They are expected to hit hardest in the less visible yet critical areas of back-office operations, risk management, and compliance. These functions, often seen as the backbone of banking operations, are increasingly being automated as AI technologies prove more efficient than human counterparts in processing large volumes of data. This trend is not isolated to Europe; similar moves are being observed globally, with major institutions like Goldman Sachs also implementing AI-driven strategies.

AI's Influence on Employment

AI's growing role in traditional sectors is undeniable. As algorithms become more sophisticated, they are capable of performing tasks that were once the domain of human employees. This shift is supported by statistics showing that AI could potentially replace up to 10% of the workforce in major banks by 2030. The implications for employment are profound, as sectors that have traditionally relied on human expertise are now seeing a transition towards automation. MarketVibe's CW Index suggests that these developments could signal broader economic shifts, as AI continues to redefine industry landscapes.

Market Signals

The current reading of MarketVibe's CW Index at 5.53 reflects a moderate risk environment, suggesting that while immediate concerns are not at a crisis level, investors should remain vigilant. Historical patterns, such as when the CW Index hit 7.1 in March 2023 and markets subsequently fell 8.3%, underscore the importance of monitoring these signals. The gold component of the CW Index provides a unique early warning, alerting investors to potential market corrections well in advance. If the CW Index were to rise above 6.5, it would indicate an increased likelihood of market volatility.

Broader Economic Implications

The ripple effects of AI-driven job cuts extend beyond the banking sector. As AI technologies become more prevalent, other industries may also face similar transformations, potentially leading to systemic risks within the economy. The integration of AI could disrupt traditional business models, necessitating a reevaluation of workforce strategies across various sectors. MarketVibe's CW Index continues to track these developments, offering investors a comprehensive view of potential economic shifts.

Investor Considerations

For investors, the ongoing changes present both challenges and opportunities. Staying informed about AI developments and their impact on traditional sectors is crucial. MarketVibe's Enhanced CW Index provides valuable insights, helping investors navigate potential market shifts. By monitoring CW Index movements and understanding the implications of AI advancements, investors can make informed decisions to adjust their portfolios accordingly.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.53, indicating moderate risk

- Overall market status: Yellow flag

- Key metric to watch: CW Index crossing 6.5

📚 Learn (2-Minute Deep Dive)

The current landscape, marked by AI-driven job cuts in the banking sector, highlights a significant shift in traditional employment structures. Historical parallels, such as previous instances where technological advancements led to workforce reductions, provide context for the current situation. As AI continues to evolve, its impact on various sectors could lead to broader economic implications. Monitoring the CW Index is crucial, as it offers a predictive view of potential market corrections. The gold component of the CW Index, providing a 4-6 week early warning, is particularly valuable in anticipating these shifts. Understanding these dynamics is essential for investors looking to navigate the changing economic landscape.

⚡ Act (Specific Steps)

- Monitor position sizing: Adjust allocations based on CW Index levels, reducing exposure if the index approaches 6.5.

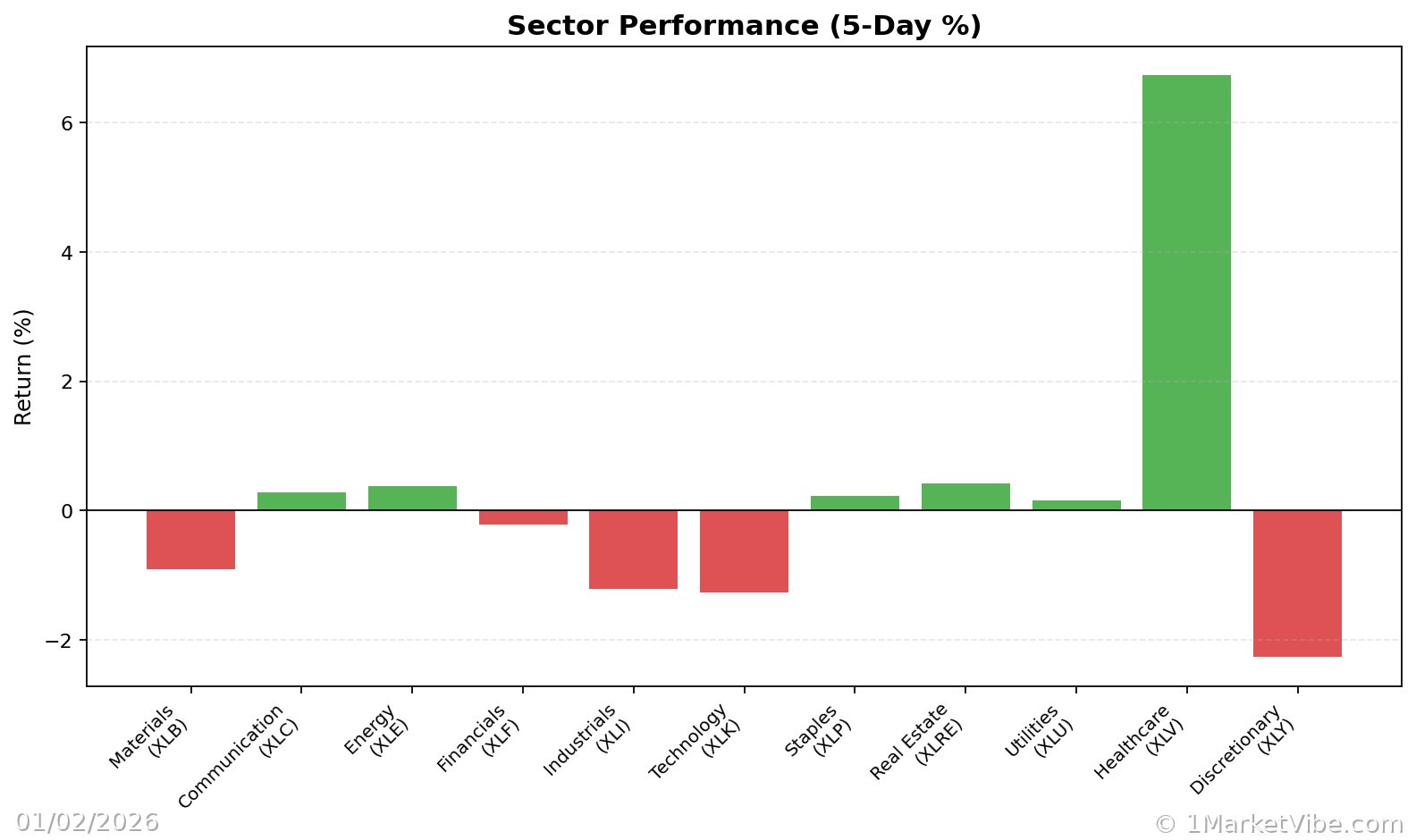

- Diversify investments: Consider sectors less impacted by AI, such as technology and healthcare.

- Implement risk management: Use hedging strategies to protect against potential market downturns.

- Stay informed: Regularly review MarketVibe updates and CW Index movements.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The integration of AI in the banking sector is a clear indicator of the broader changes underway in traditional employment structures. As job cuts loom, the importance of tools like MarketVibe's Enhanced CW Index becomes evident, providing investors with the foresight needed to navigate these shifts. By leveraging MarketVibe's insights and the Decision Edge™ Method, investors can make informed decisions to mitigate risks and capitalize on emerging opportunities. Built by investors, for investors, MarketVibe offers a unique advantage in understanding and responding to market dynamics.

Disclaimer: The information provided is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult with a financial advisor.

Charts