Five Essential Buffett Insights for Navigating Investment Fluctuations

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Five Essential Buffett Insights for Navigating Investment Fluctuations

As we step into 2026, the investment landscape is marked by significant shifts and challenges. Warren Buffett, the Oracle of Omaha, has long been a guiding light for investors navigating market fluctuations. His wisdom remains invaluable, especially as we face uncertain times. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.7. This level is below the 7.0 warning threshold, indicating moderate risk. Understanding how to apply Buffett's insights in conjunction with MarketVibe's tools can provide a strategic edge.

Current Market Dynamics

The current market conditions are shaped by a series of retail closures and economic uncertainties. In 2025, over 8,100 stores closed across the U.S., a 12% increase from the previous year. This wave of bankruptcies has contributed to a cautious market sentiment. MarketVibe's CW Index suggests that while the risk is moderate, vigilance is essential as the index remains sensitive to shifts in gold flows and market breadth.

Buffett's Key Insights

Warren Buffett's investment philosophies offer timeless guidance. Here are five essential insights:

Long-Term Perspective: Buffett emphasizes the importance of a long-term investment horizon. This aligns with MarketVibe's CW Index, which provides early warnings, allowing investors to prepare for potential downturns.

Value Investing: Identifying undervalued stocks is crucial. MarketVibe's data can help pinpoint sectors where value opportunities may arise.

Diversification: Buffett advises against putting all eggs in one basket. Monitoring the CW Index can guide diversification strategies by highlighting sectors with rising risk.

Patience and Discipline: Market fluctuations require a steady hand. The CW Index at 5.7 indicates that while immediate panic isn't warranted, strategic patience is key.

Understanding Market Cycles: Recognizing the cyclical nature of markets helps in timing investments. Historical patterns in the CW Index, such as the 7.1 reading in March 2023 that preceded an 8.3% market drop, illustrate these cycles.

CW Index Analysis

MarketVibe's Enhanced CW Index is a critical tool for investors. With a current reading of 5.7, it signals moderate risk but not immediate danger. The index's ability to track institutional gold flows provides a unique early warning system, offering a 4-6 week advance notice of potential market corrections. When the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month, underscoring its predictive power.

Learn more about how CW Index works at 1marketvibe.com.

Risk Assessment

The moderate risk indicated by the CW Index suggests that investors should remain cautious. The index's gold component is particularly noteworthy, as it often signals shifts in market sentiment before they become apparent in broader indices. If the CW Index approaches or exceeds 6.5, it may be time to reassess risk exposure.

Strategic Implications

In light of Buffett's insights and the current CW Index reading, here are strategic considerations:

- Focus on Fundamentals: Prioritize investments in companies with strong fundamentals and resilient business models.

- Sector Rotation: Consider rotating into sectors less affected by recent retail closures and economic challenges.

- Risk Management: Use the CW Index as a guide to adjust position sizes and hedge against potential downturns.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This is MarketVibe's proprietary framework for turning market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index: 5.7, indicating moderate risk.

- Market Status: Yellow flag; maintain caution.

- Key Metric: Watch for CW Index crossing 6.5.

📚 Learn (2-Minute Deep Dive)

The current market environment is shaped by significant retail closures and economic uncertainties. Historical parallels, such as the March 2023 market drop following a CW Index spike, highlight the importance of monitoring this index. As the CW Index provides a 4-6 week early warning, it allows investors to anticipate and prepare for potential market corrections. Understanding these dynamics is crucial for informed decision-making.

⚡ Act (Specific Steps)

- Diversify Holdings: Ensure a balanced portfolio across sectors.

- Monitor CW Index: Adjust allocations if the index trends towards 6.5 or higher.

- Hedge Positions: Consider protective puts or inverse ETFs if risk levels increase.

- Reassess Regularly: Use MarketVibe's tools to stay updated on market shifts.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Warren Buffett's insights remain a cornerstone for navigating investment fluctuations. Coupled with MarketVibe's Enhanced CW Index and Decision Edge™ Method, investors are equipped to make informed, strategic decisions. As we move through 2026, staying informed and adaptable will be key to capitalizing on opportunities and managing risks.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly and unpredictably.

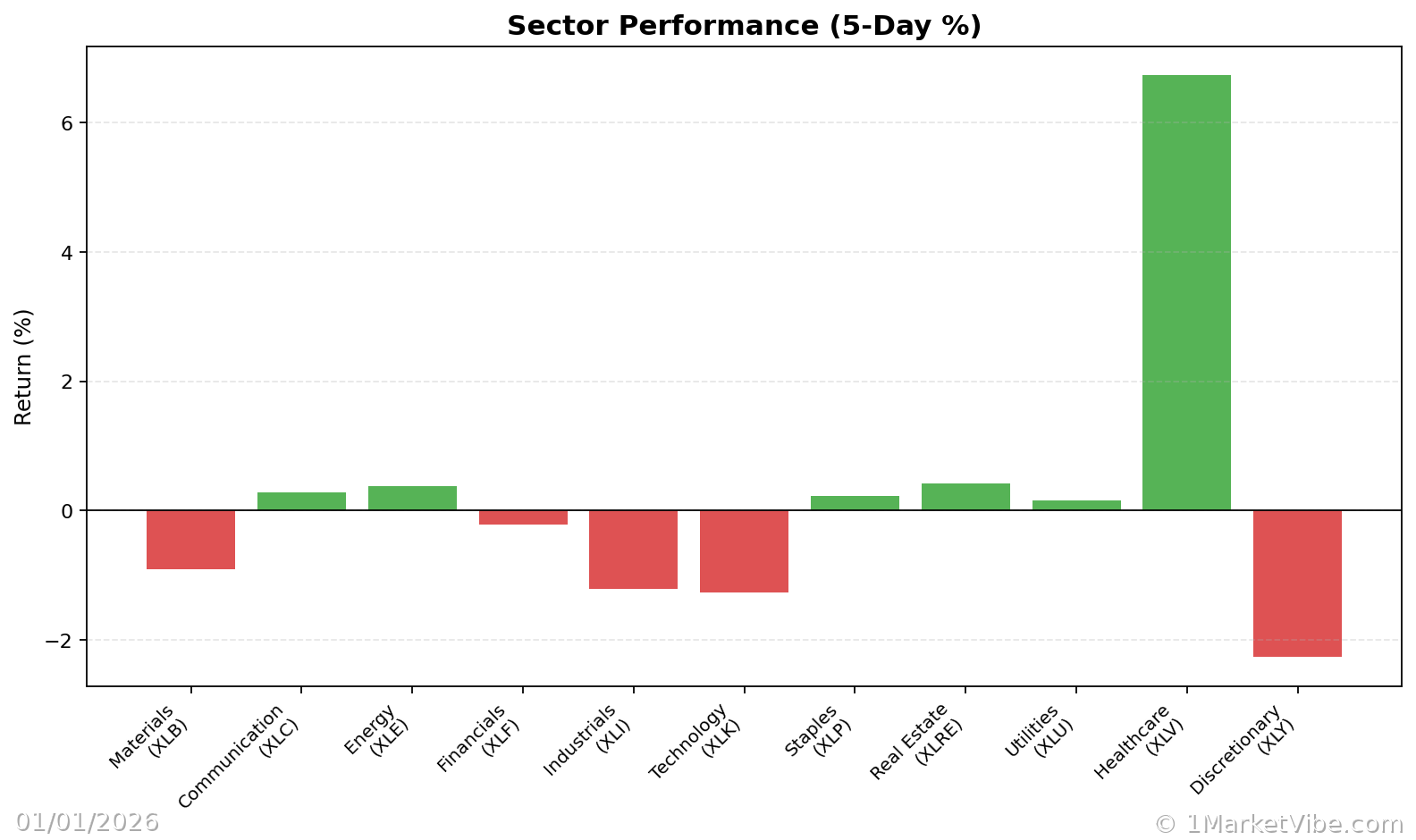

Charts