Fed Divided on Rate Cuts: Strategies for Portfolio Adjustment

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Fed Divided on Rate Cuts: Strategies for Portfolio Adjustment

As 2025 draws to a close, the Federal Reserve's recent minutes reveal a significant division among officials regarding potential rate cuts. This split has left investors questioning the future direction of monetary policy and its implications for market dynamics. Understanding these dynamics is crucial for investors aiming to anticipate market shifts and adjust their portfolios accordingly.

MarketVibe's Enhanced CW Index: Your Early Warning System

In this uncertain environment, MarketVibe's proprietary Enhanced CW Index serves as a critical tool for investors. This index operates on a 0-10 scale, providing a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth. Currently, the CW Index is at 5.7, which is below the 7.0 warning threshold, indicating a moderate risk level. This reading suggests that while caution is warranted, the market is not yet at a high-risk tipping point.

Learn more about how CW Index works at 1marketvibe.com.

Fed Officials' Split

The minutes from the Fed's December meeting highlight a tight split among officials regarding the necessity of rate cuts. Some members advocate for a reduction to stimulate economic growth, while others caution against potential inflationary pressures. This division underscores the complexity of the current economic landscape and the challenges in predicting the Fed's next moves.

Market Reactions

Market participants are closely monitoring the Fed's cautious stance, which has led to mixed reactions. Some sectors have experienced increased volatility as investors weigh the potential impacts of differing monetary policies. The CW Index at 5.7 suggests that while the market is not in immediate danger, investors should remain vigilant. Historical patterns show that when the CW Index reached 7.1 in March 2023, markets fell 8.3% over the following month, highlighting the importance of staying informed.

Historical Context

Comparing the current situation with past Fed decisions provides valuable insights. During previous rate cut cycles, markets often experienced initial volatility followed by stabilization as policies took effect. For instance, in 2019, when the Fed cut rates three times, the CW Index provided early warnings, allowing investors to adjust their strategies proactively. These historical parallels emphasize the importance of monitoring the CW Index for early signals of market shifts.

Current CW Index Insights

The Enhanced CW Index is a vital tool for understanding current market trends. With a reading of 5.7, it indicates a moderate risk level, suggesting that while the market is stable, investors should be prepared for potential changes. The gold component of the CW Index provides a 4-6 week advance notice, allowing investors to anticipate shifts and adjust their portfolios accordingly. If the CW Index crosses 6.5, it would signal an increased risk, prompting a reevaluation of investment strategies.

Risks and Considerations

Investors should be aware of the potential risks associated with rate cuts and market stability. While rate reductions can stimulate economic growth, they may also lead to inflationary pressures and increased market volatility. According to MarketVibe data, maintaining a balanced portfolio and monitoring the CW Index for early warnings can help mitigate these risks.

MarketVibe Decision Edge™: Your Action Plan

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk

- Overall market status: Yellow flag

- Key metric to watch: CW Index movement towards 6.5

📚 Learn (2-Minute Deep Dive)

The division among Fed officials highlights the complexity of the current economic environment. Historical parallels, such as the 2019 rate cuts, demonstrate that markets can experience initial volatility before stabilizing. The CW Index serves as a critical tool, offering a 4-6 week early warning of potential market corrections. Monitoring this index allows investors to anticipate shifts and adjust strategies proactively. Understanding the implications of the Fed's cautious stance is essential for navigating these uncertain times.

⚡ Act (Specific Steps)

- Diversify Portfolio: Maintain a balanced allocation across sectors to mitigate risk.

- Monitor CW Index: Keep a close eye on the CW Index, especially if it approaches 6.5, which would signal increased risk.

- Adjust Risk Exposure: Consider reducing exposure in sectors that may be more sensitive to rate changes.

- Hedging Strategies: Implement hedging strategies to protect against potential market downturns.

- Stay Informed: Regularly review MarketVibe's insights and updates for the latest market intelligence.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The Fed's cautious approach and internal divisions underscore the importance of staying informed and prepared. By leveraging tools like MarketVibe's Enhanced CW Index and the Decision Edge™ Method, investors can navigate these uncertain times with confidence. As the market landscape evolves, maintaining a proactive approach will be key to achieving investment success.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

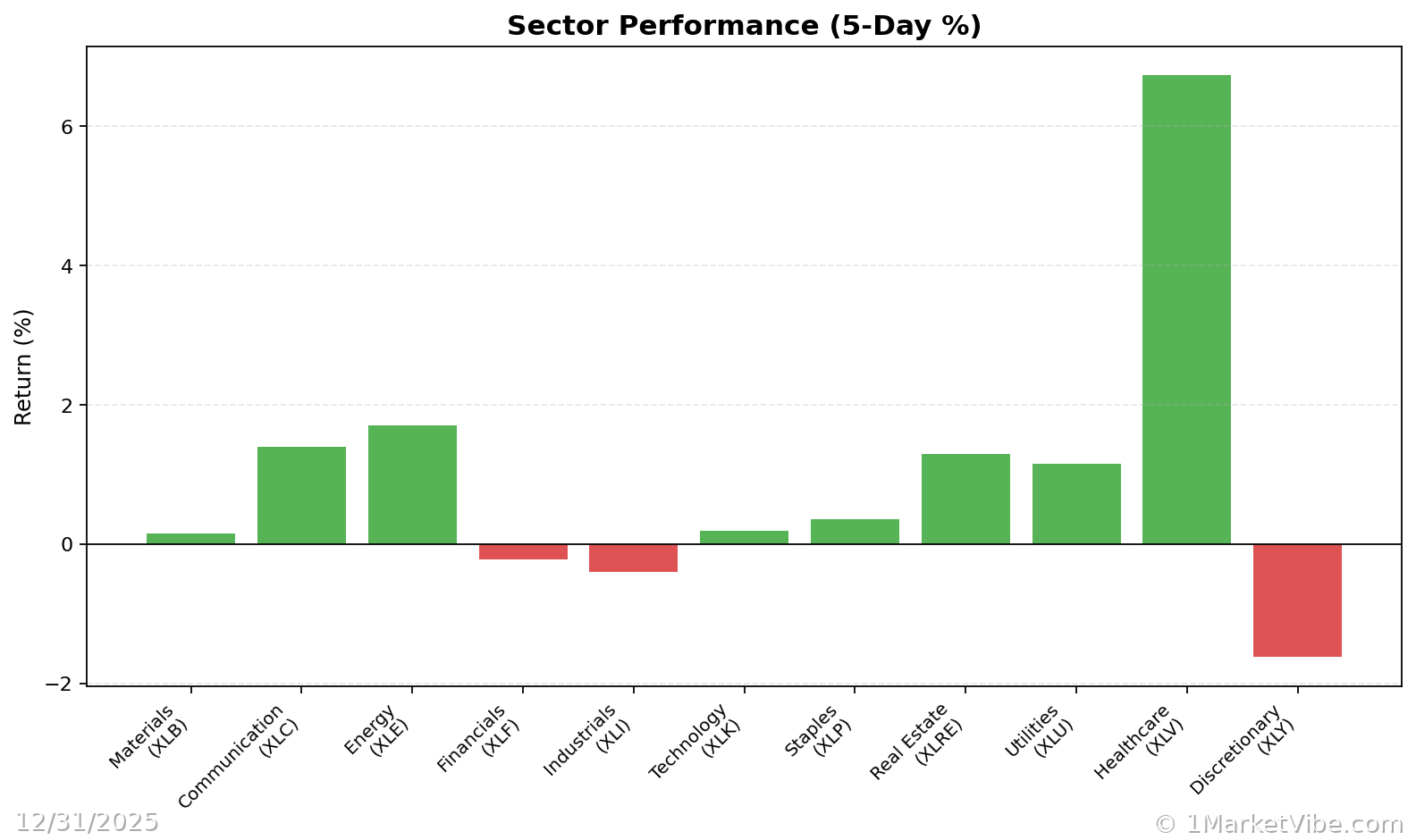

Charts