NASDAQ Pause Highlights Systemic Risks with CW Index at 6.49

The recent halt in NASDAQ trading has cast a spotlight on potential systemic risks within the financial markets. This unexpected pause has left investors grappling with uncertainty, highlighting the importance of vigilant market analysis. In this context, MarketVibe's proprietary Enhanced CW Index, a 0-10 scale providing a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, becomes an invaluable tool. The CW Index is currently at 6.49, just below the critical 7.0 threshold, indicating moderate risk but warranting close attention.

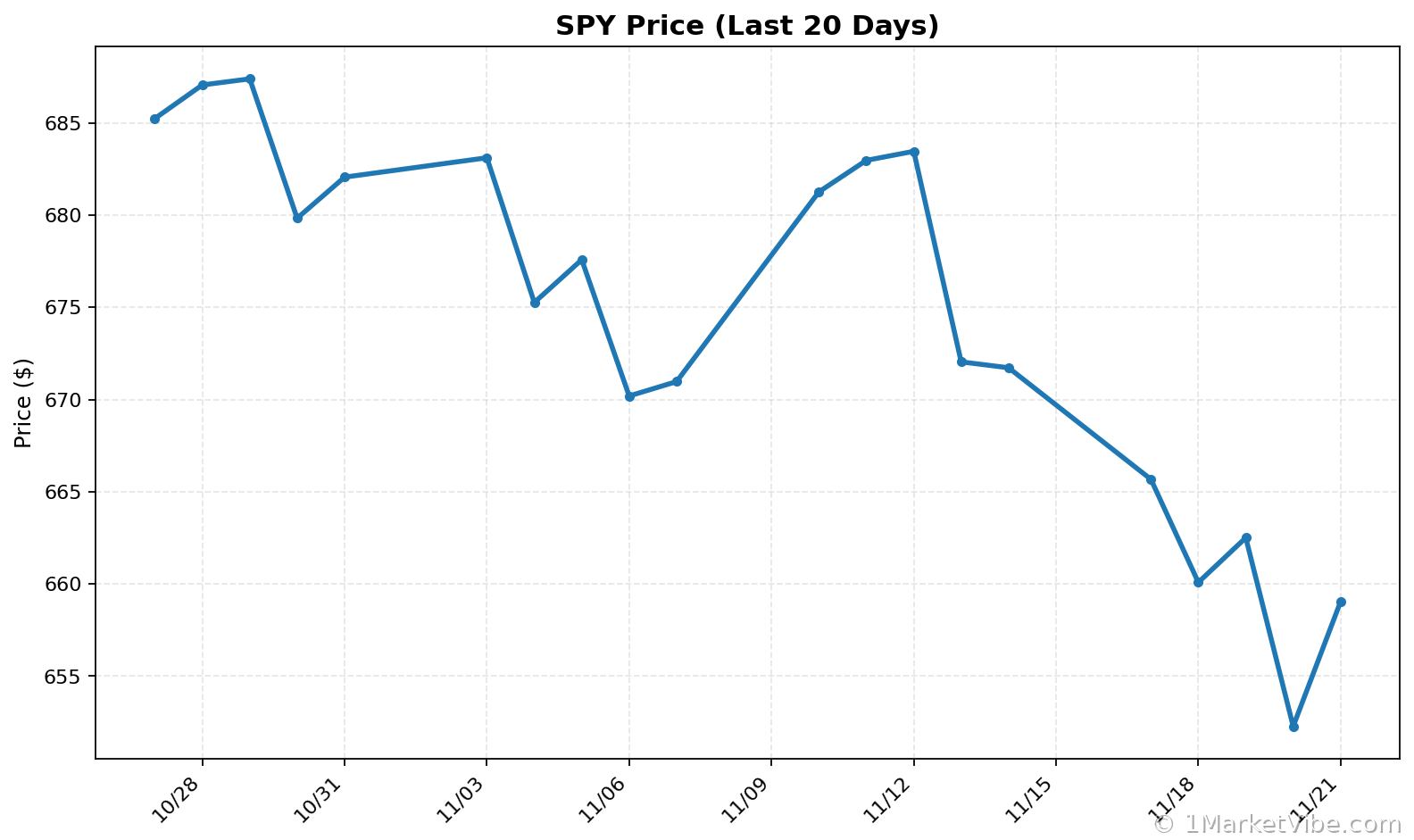

Market Reaction

Investor sentiment has been notably cautious following the NASDAQ trading halt. The abrupt pause has triggered a reassessment of market positions, with many investors opting for a wait-and-see approach. Historically, such halts have led to increased volatility as markets digest the implications. The current CW Index reading of 6.49 suggests a heightened awareness of potential corrections, as seen when the index hit 7.1 in March 2023, leading to an 8.3% market decline.

Learn more about how CW Index works at 1marketvibe.com.

Historical Context

Trading halts are not unprecedented, but their causes and effects vary. Past instances, such as the 2015 NYSE halt, resulted in temporary market disruptions but were quickly resolved. However, the current situation is compounded by broader systemic risks, as indicated by the CW Index's proximity to the warning threshold. Historical patterns show that when the CW Index approaches or exceeds 7.0, markets often experience significant corrections.

Systemic Risk Indicators

Several indicators suggest systemic risks are present. The CW Index's current reading of 6.49 is a critical signal, reflecting increased gold flows as institutions seek safe-haven assets. Additionally, market breadth has narrowed, with fewer stocks participating in upward movements. These factors, combined with recent cybersecurity threats to financial institutions, underscore the need for heightened vigilance.

CW Index Analysis

The CW Index at 6.49 is a pivotal indicator in the current market climate. It reflects a moderate risk level, with the potential for escalation if systemic issues persist. The gold component of the CW Index provides a 4-6 week advance notice, allowing investors to anticipate potential market corrections. As the index approaches the 7.0 threshold, investors should prepare for possible volatility.

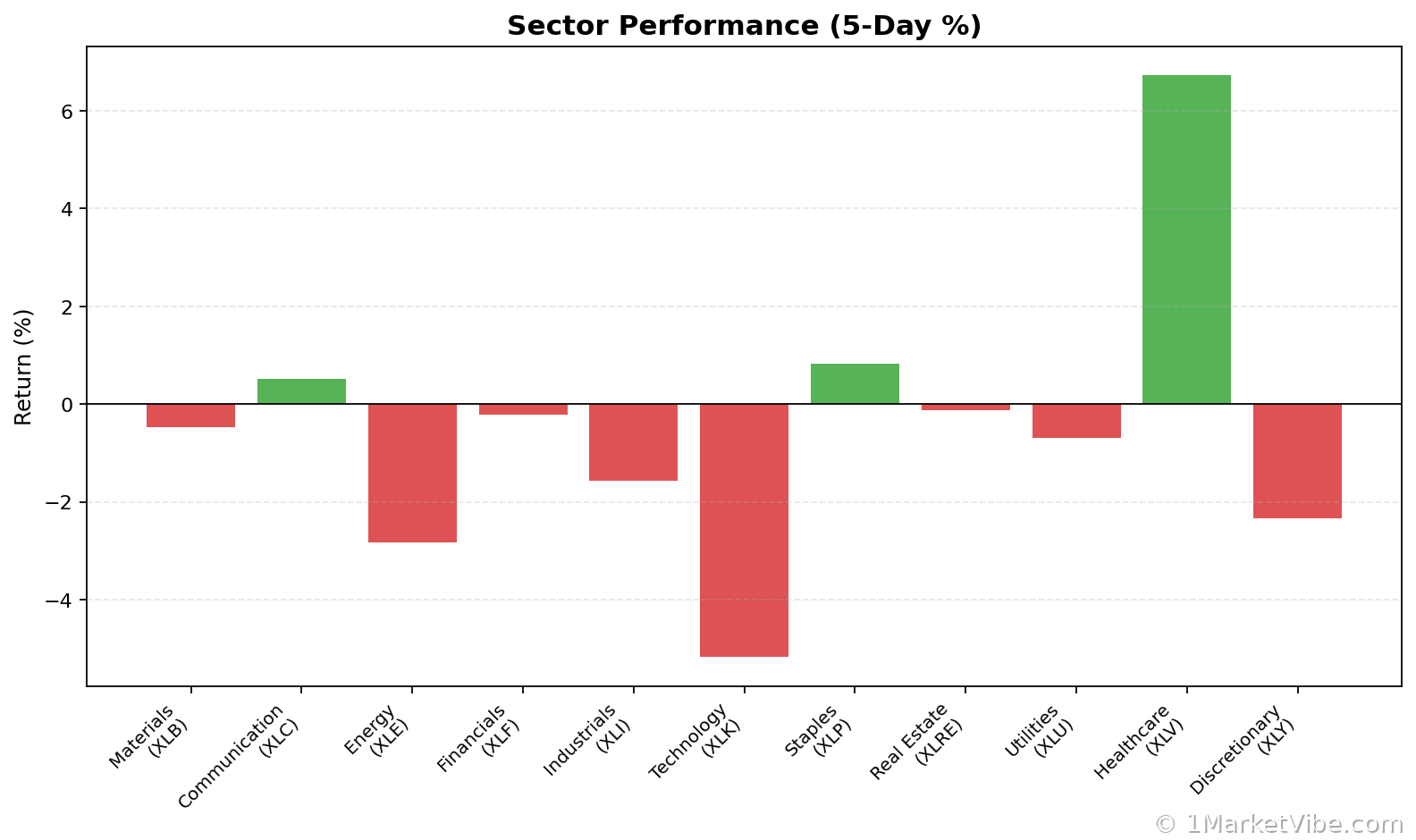

Sector Impacts

The trading halt's ripple effects are likely to be felt across various sectors. Technology stocks, heavily weighted in the NASDAQ, may experience increased volatility. Additionally, sectors reliant on stable financial conditions, such as real estate and consumer discretionary, could face challenges. The CW Index suggests that investors should monitor these sectors closely for signs of stress.

Investor Strategies

In light of the current uncertainty, investors should adopt cautious strategies. The CW Index's reading of 6.49 suggests a need for prudent risk management. Diversification and hedging strategies can mitigate potential losses. Monitoring the CW Index for any movement towards the 7.0 threshold will be crucial in adjusting investment strategies.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework helps investors turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index: 6.49, indicating moderate risk.

- Market Status: Yellow flag, caution advised.

- Key Metric: Watch for CW Index crossing 6.5.

📚 Learn (2-Minute Deep Dive)

The NASDAQ trading halt serves as a stark reminder of potential systemic risks. Historical parallels, such as the 2015 NYSE halt, show that while markets can recover quickly, underlying issues may persist. The CW Index's current reading of 6.49 reflects increased institutional gold flows, signaling a shift towards risk aversion. This trend aligns with broader market concerns, including cybersecurity threats and economic uncertainty. Monitoring the CW Index for any upward movement is essential, as it provides a 4-6 week early warning of potential market corrections.

⚡ Act (Specific Steps)

- Diversify Holdings: Reduce exposure to high-volatility sectors like technology.

- Hedge Positions: Consider options or inverse ETFs to protect against downturns.

- Monitor CW Index: If the index crosses 6.5, reassess risk exposure and adjust portfolios accordingly.

- Stay Informed: Regularly check for updates on systemic risks and market conditions.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The NASDAQ trading halt underscores the importance of being prepared for systemic risks. With the CW Index at 6.49, investors are advised to remain vigilant and proactive in managing their portfolios. MarketVibe's tools, built by investors for investors, provide the early warning and actionable insights needed to navigate these uncertain times.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly and unpredictably.

Charts