Fed Rate Cut Drives Dow Surge Amid Market Volatility Concerns

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Fed Rate Cut Drives Dow Surge Amid Market Volatility Concerns

The Federal Reserve's recent decision to cut interest rates has sent ripples through the financial markets, with the Dow Jones Industrial Average surging nearly 500 points. This move, aimed at stimulating economic growth, comes amid ongoing concerns about market volatility. The rate cut has been a catalyst for investor optimism, yet it also raises questions about the sustainability of this market rally.

MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.7. This level is below the critical 7.0 warning threshold, indicating moderate risk. However, investors should remain vigilant as the market adjusts to this new monetary policy landscape. Learn more about how CW Index works at 1marketvibe.com.

Market Reaction

The Dow's impressive gain reflects a strong initial market reaction to the Fed's rate cut. Investor sentiment has been buoyed by the prospect of lower borrowing costs, which could spur economic activity. However, MarketVibe's CW Index suggests that while the immediate reaction is positive, the underlying market conditions warrant caution. Historical patterns show that when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month, highlighting the importance of monitoring this key indicator.

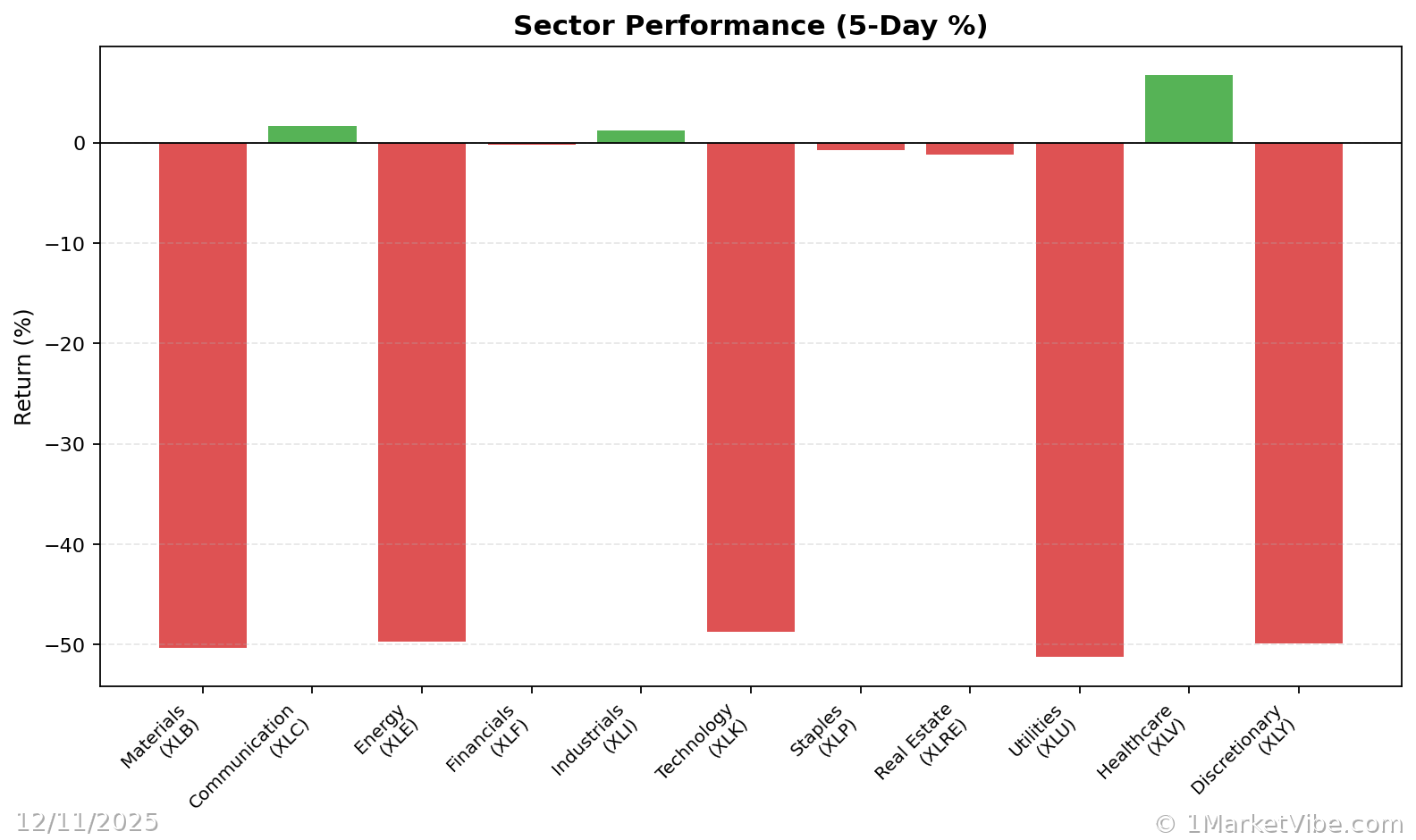

Sector Impacts

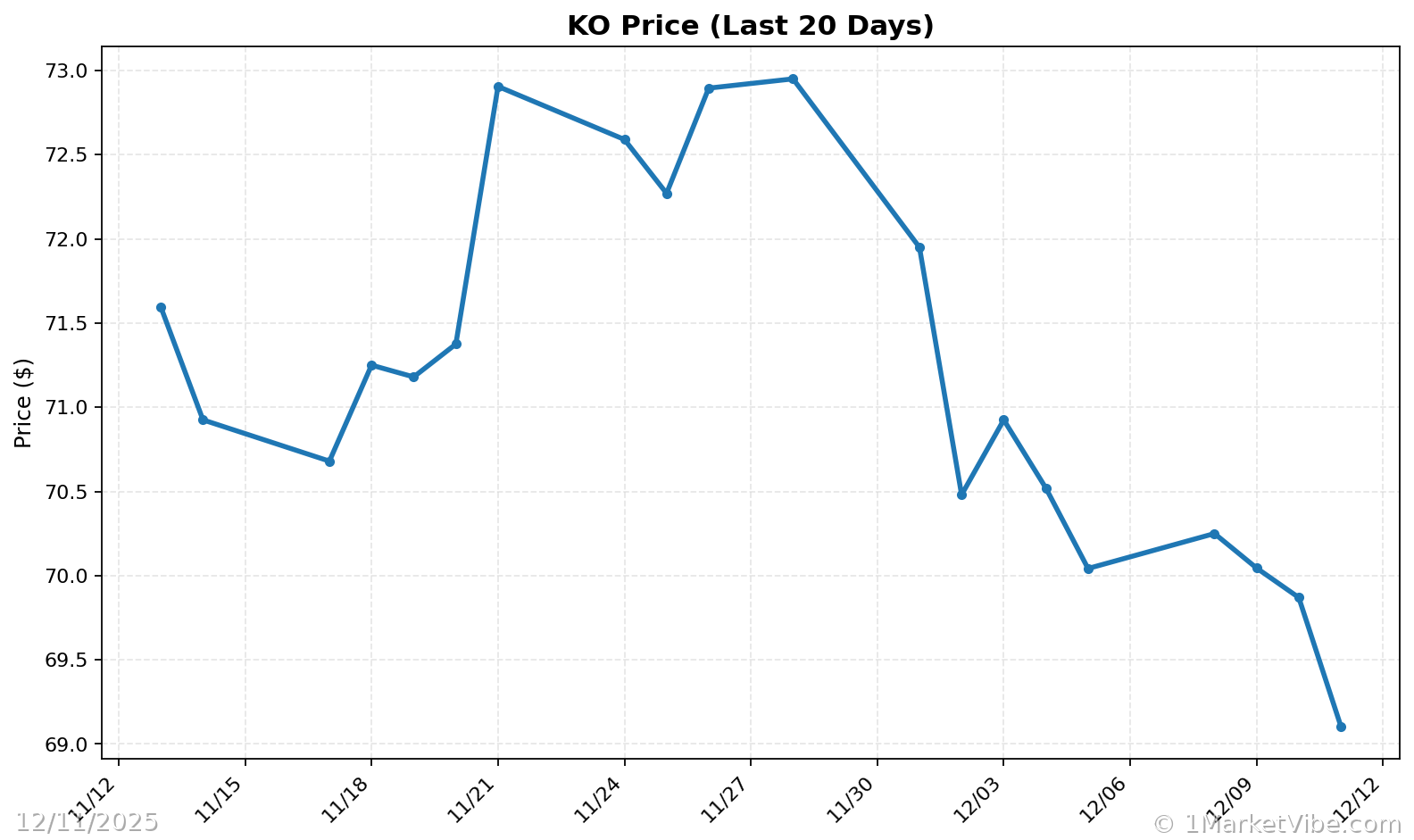

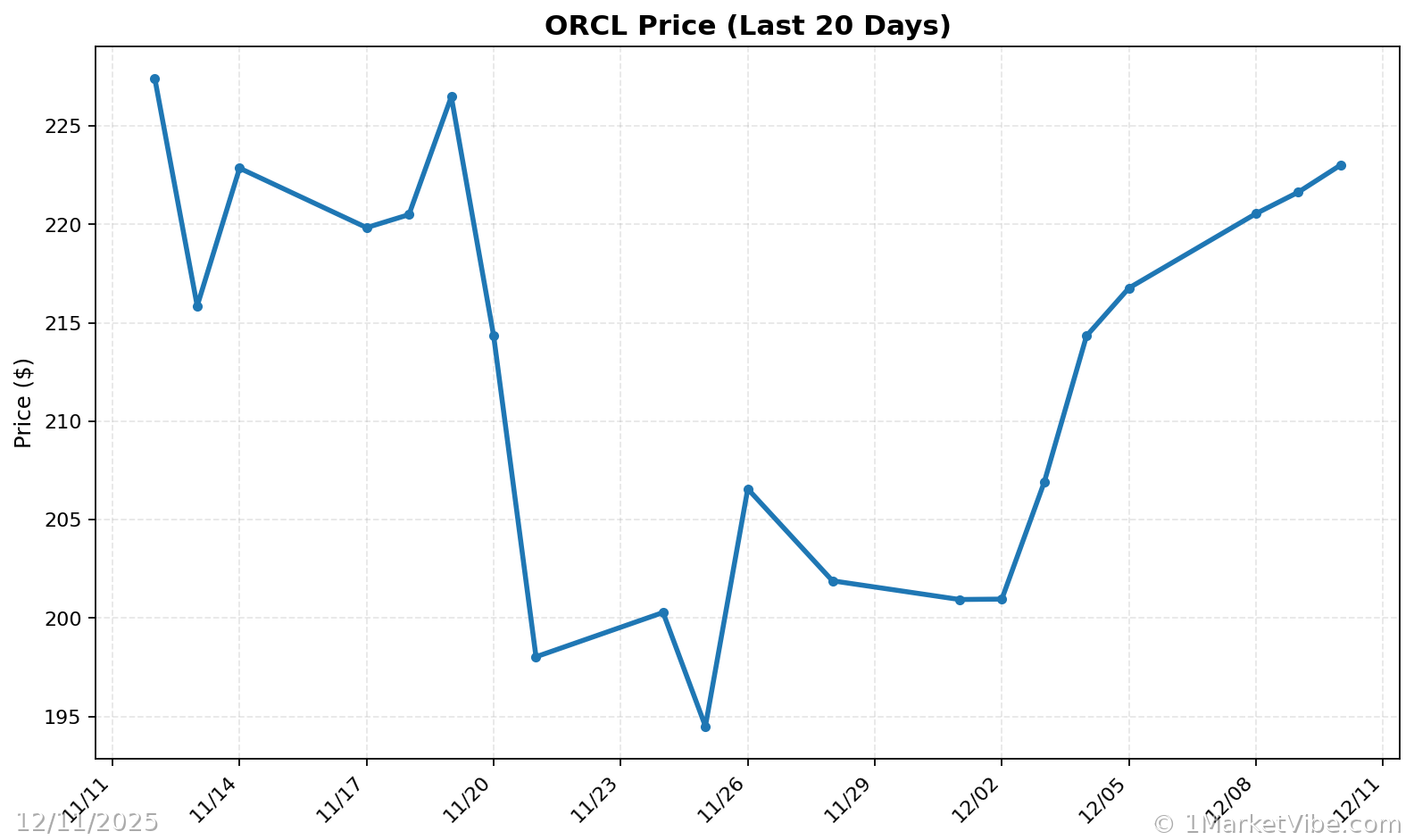

Several sectors have benefitted from the rate cut, notably consumer goods, which are poised to capitalize on increased consumer spending. Coca-Cola, for instance, remains a strong performer, with its shares climbing nearly 13% this year. Conversely, the tech sector faces challenges, as evidenced by Oracle's mixed results, which have failed to alleviate concerns over AI-related uncertainties.

Historical Context

Historically, Fed rate cuts have been a double-edged sword. While they often provide short-term boosts to the market, they can also signal underlying economic weaknesses. The current situation mirrors past instances where initial market euphoria gave way to increased volatility. For example, following a rate cut in 2019, markets experienced heightened fluctuations as investors grappled with economic uncertainties.

Risk Assessment

Despite the positive market response, potential risks loom. The current CW Index reading of 5.7 suggests moderate risk, but any upward movement towards the 6.5-7.0 range could signal increased volatility. MarketVibe's 4-6 week early warning system, with its unique gold flow component, provides critical insights into potential market corrections, allowing investors to adjust their strategies proactively.

Investment Strategies

Given the current market dynamics, investors should consider the following strategies to navigate potential volatility:

- Diversification: Spread investments across various sectors to mitigate risk.

- Risk Management: Adjust position sizes based on CW Index levels.

- Hedging: Consider hedging strategies if the CW Index trends upward.

These strategies emphasize the importance of a balanced approach, combining growth opportunities with risk mitigation.

Expert Opinions

Financial analysts offer varying perspectives on the long-term effects of the Fed's rate cut. Some view it as a necessary measure to sustain economic growth, while others caution against over-reliance on monetary policy as a market stabilizer. The consensus underscores the need for investors to remain informed and adaptable in their strategies.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index: 5.7, indicating moderate risk.

- Market Status: Yellow flag; cautious optimism.

- Key Metric: Monitor CW Index movements closely.

📚 Learn (2-Minute Deep Dive)

The current market environment, influenced by the Fed's rate cut, presents both opportunities and risks. Historical parallels suggest that while rate cuts can boost markets, they also precede periods of volatility. The CW Index's moderate reading indicates that while immediate risks are contained, investors should be prepared for potential shifts. Monitoring the CW Index and gold flow trends will be crucial in anticipating market corrections.

⚡ Act (Specific Steps)

- Review Portfolio: Ensure diversification across sectors.

- Adjust Positions: Consider reducing exposure in high-volatility sectors if CW Index trends upward.

- Implement Hedging: Use options or other hedging strategies to protect against potential downturns.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The Fed's rate cut has injected optimism into the markets, yet the potential for volatility remains. MarketVibe's Enhanced CW Index, currently at 5.7, provides a crucial early warning system, helping investors navigate these uncertain times. By leveraging MarketVibe's tools and strategies, investors can make informed decisions that align with their risk tolerance and investment goals. Built by investors, for investors, MarketVibe offers a unique advantage in today's dynamic market environment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts