Will Fed Rate Cuts Trigger a Market Shift?

As the Federal Reserve contemplates potential rate cuts, investors are keenly observing how these decisions might influence market dynamics. MarketVibe's proprietary Enhanced CW Index, a critical tool for assessing market sentiment, plays a pivotal role in understanding these shifts. This index, operating on a 0-10 scale, provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth. Currently, the CW Index stands at 5.7, below the 7.0 warning threshold, indicating moderate risk. This reading suggests a cautious optimism in the market, but vigilance remains essential.

Learn more about how CW Index works at 1marketvibe.com

Current Fed Landscape

Recent statements from Federal Reserve officials have fueled speculation about upcoming rate cuts. Economic indicators, including inflation rates and employment figures, continue to influence these discussions. The Fed's potential shift towards a more accommodative policy could have significant implications for various sectors. As the central bank weighs its options, the market remains on edge, with investors closely monitoring every announcement for clues on future monetary policy.

CW Index Insights

The current CW Index reading of 5.7 reflects a market in a state of moderate risk. Historically, when the CW Index approached similar levels, such as in March 2023 when it hit 7.1, markets experienced an 8.3% decline over the following month. The gold component of the CW Index, which provides a 4-6 week early warning, suggests that investors should remain alert to potential shifts. If the CW Index were to rise above 6.5, it could signal increased volatility and a need for strategic adjustments.

Market Reactions

Speculation around rate cuts has historically led to varied market reactions. In the past, announcements of rate cuts have often resulted in short-term market rallies, followed by periods of volatility. The current environment, as indicated by the CW Index, suggests that while optimism exists, investors should brace for potential fluctuations. The market's response to any Fed announcement will likely depend on the specifics of the rate cut and accompanying economic data.

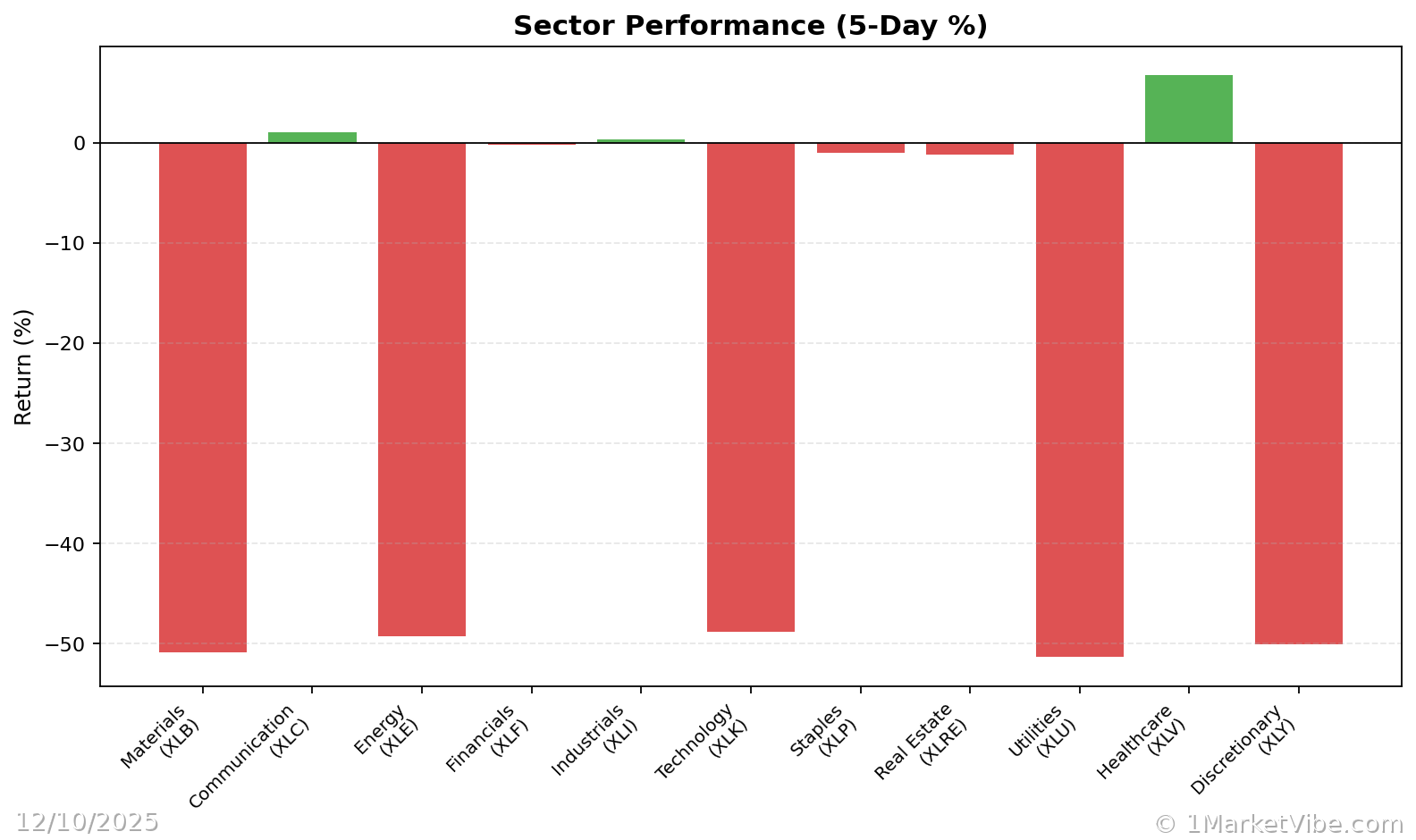

Sector Impacts

Certain industries are more sensitive to interest rate changes. For instance, the financial sector could face pressure due to narrower interest margins, while real estate might benefit from lower borrowing costs. Investors should consider adjusting their portfolios to account for these potential impacts. Diversification across sectors and careful monitoring of the CW Index can help mitigate risks associated with these shifts.

Risks and Considerations

While rate cuts can stimulate economic activity, they also carry risks. Premature cuts could lead to inflationary pressures or asset bubbles. Economic factors such as global trade tensions and geopolitical events could further complicate the Fed's decision-making process. Investors should remain aware of these risks and consider them when making investment decisions.

Expert Opinions

Economists offer diverse perspectives on the Fed's trajectory. Some argue that rate cuts are necessary to sustain economic growth, while others caution against potential overheating. As we look towards 2026, understanding these viewpoints can provide valuable insights into the broader economic landscape and inform investment strategies.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework helps investors turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk

- Overall market status: Yellow flag

- Key metric to watch: CW Index movement towards 6.5

📚 Learn (2-Minute Deep Dive)

The current CW Index reading suggests a market in a state of cautious optimism. Historically, similar readings have preceded periods of volatility, particularly when rate cuts are on the horizon. Investors should monitor economic indicators and Fed announcements closely, as these will provide further context for potential market shifts. The gold component of the CW Index offers a unique advantage, providing a 4-6 week early warning of changes, allowing investors to prepare accordingly.

⚡ Act (Specific Steps)

- For conservative investors: Maintain current positions but consider increasing exposure to defensive sectors like utilities and consumer staples.

- For aggressive investors: Look for opportunities in sectors that benefit from lower rates, such as real estate and technology, but set stop-loss orders to manage risk.

- Risk management: If the CW Index approaches 6.5, consider hedging strategies such as options or inverse ETFs to protect against potential downturns.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

As the Fed deliberates on rate cuts, the market remains in a state of watchful anticipation. MarketVibe's Enhanced CW Index provides a critical lens through which investors can gauge potential risks and opportunities. By leveraging the insights from the CW Index and the Decision Edge™ Method, investors can navigate these uncertainties with greater confidence. Remember, these tools are built by investors, for investors, offering a strategic advantage in an ever-changing market landscape.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.