CW Index at 4.7 and the Impact of the Federal Reserve's Rate Decision

- Authors

- Name

- MarketVibe Team

- @1marketvibe

CW Index at 4.7 and the Impact of the Federal Reserve's Rate Decision

The Federal Reserve's recent decision to cut interest rates by 25 basis points has sent ripples through the financial markets. As investors digest this move, MarketVibe's proprietary Enhanced CW Index, a critical tool for anticipating market corrections, currently stands at 4.7. This index, which operates on a 0-10 scale, provides a 4-6 week early warning of potential market downturns by analyzing institutional gold flows and market breadth. At 4.7, the CW Index remains below the 7.0 warning threshold, indicating a moderate risk environment.

Learn more about how the CW Index works at 1marketvibe.com.

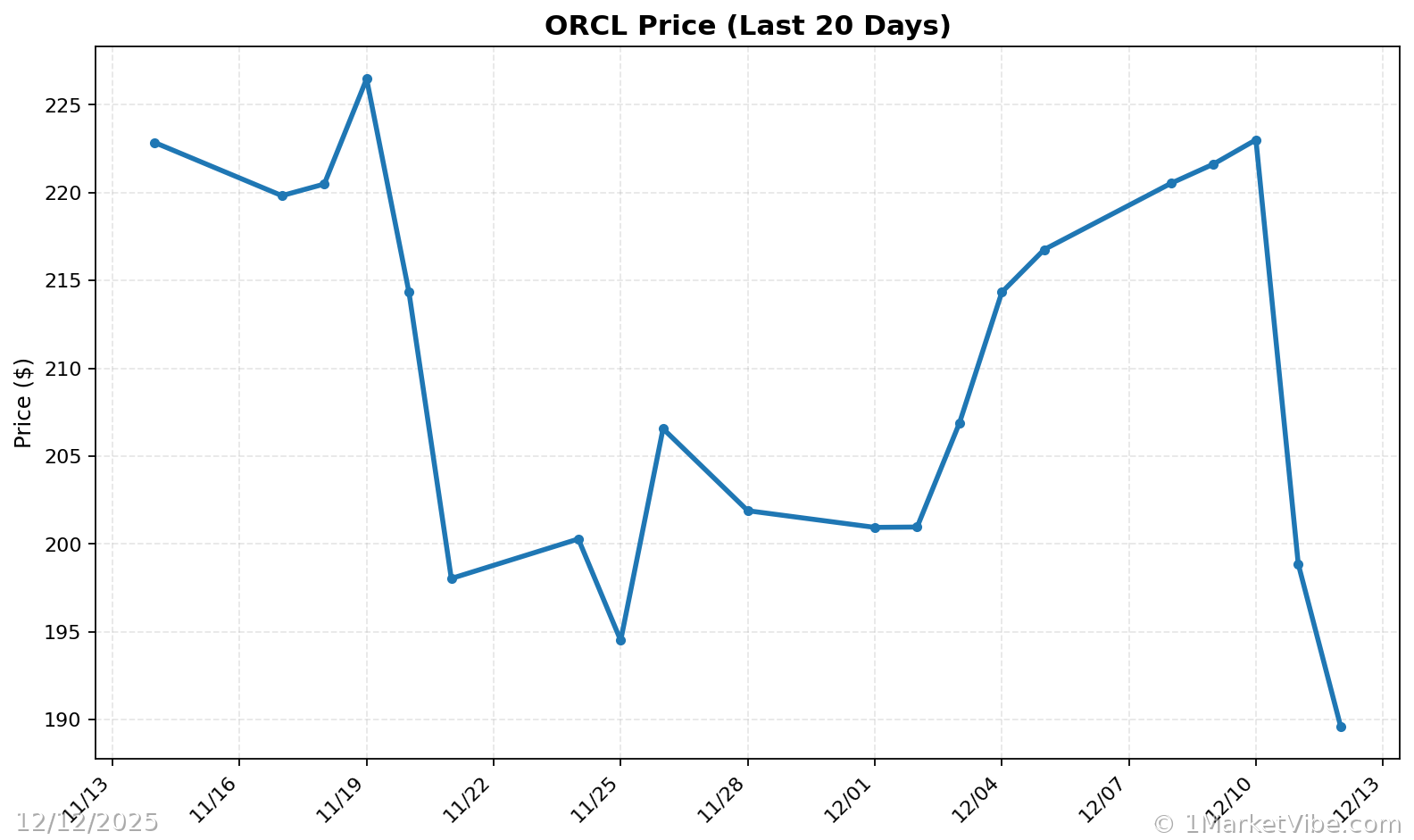

Market Reaction to the Fed's Rate Cut

The immediate market response to the Federal Reserve's rate cut was mixed. The Dow Jones Industrial Average surged by 646.26 points, or 1.34%, reaching a new high of 48,704.01. Meanwhile, the S&P 500 edged up 0.21% to 6,901.00, also marking a record close. However, the Nasdaq Composite fell by 0.26% to 23,593.86, reflecting the pressure on tech stocks following disappointing results from Oracle. This divergence underscores the market's complex reaction to the Fed's decision, as investors weigh the benefits of lower rates against sector-specific challenges.

Fed's Rationale and Risks

Federal Reserve Chair Jerome Powell highlighted that the rate cut aims to support economic growth amid ongoing uncertainties. However, he cautioned that there is "no risk-free path," acknowledging potential challenges ahead. The decision to lower rates reflects concerns about slowing growth and geopolitical tensions, which could impact market stability. MarketVibe's CW Index suggests that while the immediate risk is moderate, investors should remain vigilant for any shifts in market sentiment.

CW Index Analysis

The current CW Index reading of 4.7 indicates a moderate risk environment, with no immediate signs of a market correction. Historically, when the CW Index has approached the 7.0 threshold, such as in March 2023 when it hit 7.1, markets experienced an 8.3% decline over the following month. The gold component of the CW Index provides a critical early warning, allowing investors to anticipate potential downturns 4-6 weeks in advance. As the CW Index remains below the warning level, it suggests that the market is not yet in a high-risk zone, but investors should monitor for any upward movement towards 6.5, which could signal increasing risk.

Sector Impacts

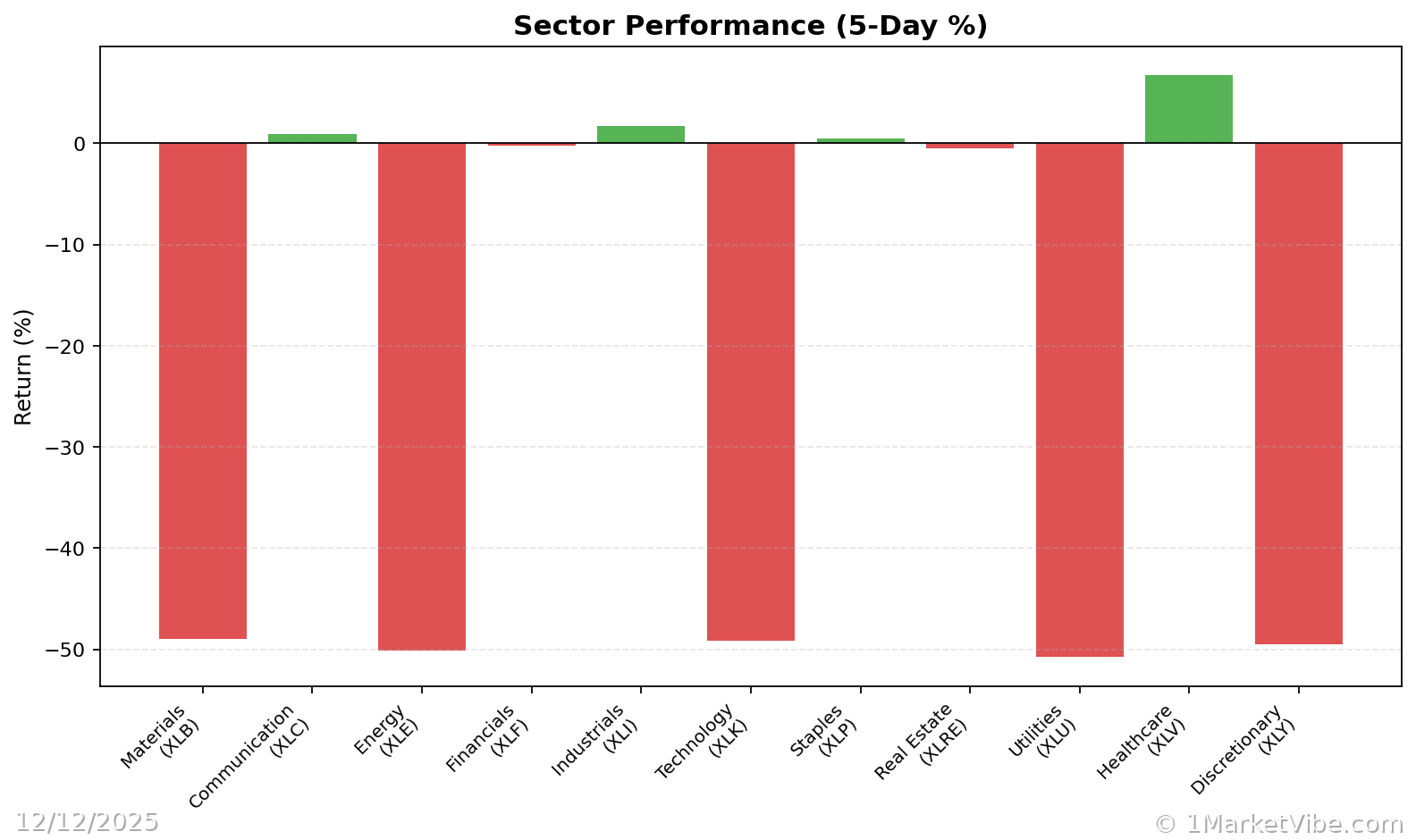

The Fed's rate cut has had varied effects across different sectors. Tech stocks, particularly those involved in AI, have faced pressure, with Oracle's 11% drop highlighting concerns about the sustainability of tech investments. Conversely, sectors like gold mining have benefited, as lower rates typically boost gold prices. MarketVibe tracks these sectoral shifts closely, providing investors with actionable insights based on the CW Index's early warning signals.

Investor Sentiment and Strategies

Investor sentiment remains cautiously optimistic, with many viewing the rate cut as a supportive measure for economic growth. However, the mixed performance across sectors suggests that investors are selectively reallocating capital. According to MarketVibe data, maintaining a diversified portfolio and adjusting exposure based on CW Index signals can help manage risk. Investors should consider reducing exposure to high-risk tech stocks while increasing allocations to sectors poised to benefit from lower rates.

Long-Term Considerations

Looking ahead, the implications of the Fed's rate cut extend beyond immediate market reactions. While the current CW Index reading suggests moderate risk, the potential for future rate adjustments and geopolitical developments could alter market dynamics. Investors should remain attentive to changes in the CW Index, particularly if it approaches the 6.5 level, which could indicate heightened risk. MarketVibe's proprietary system, built by investors for investors, offers a strategic advantage in navigating these uncertainties.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 4.7, indicating moderate risk.

- Overall market status: Yellow flag.

- Key metric to watch: CW Index movement towards 6.5.

📚 Learn (2-Minute Deep Dive)

The Federal Reserve's rate cut reflects ongoing economic uncertainties and aims to stimulate growth. Historically, similar rate cuts have led to mixed market reactions, with some sectors benefiting more than others. The current CW Index reading of 4.7 suggests that while immediate risk is moderate, investors should remain vigilant. The gold component of the CW Index provides a crucial early warning, allowing for strategic adjustments in anticipation of potential market shifts. Monitoring the CW Index for any upward movement is essential, as it could signal increasing risk levels.

⚡ Act (Specific Steps)

- Diversify Portfolio: Reduce exposure to high-risk tech stocks and increase allocations to sectors like gold mining.

- Monitor CW Index: Pay close attention to any movement towards the 6.5 level, which could indicate rising risk.

- Adjust Risk Exposure: Consider hedging strategies if the CW Index continues trending upwards.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

The Federal Reserve's rate cut has introduced new dynamics into the market, with the CW Index at 4.7 indicating moderate risk. While the immediate impact has been sector-specific, long-term implications could alter market stability. MarketVibe's Enhanced CW Index and Decision Edge™ Method provide investors with the tools needed to navigate these complexities effectively. By leveraging these insights, investors can make informed decisions and manage risk proactively.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts