Understanding Fed Divisions and Strategic Portfolio Adjustments Before Rate Cuts

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Understanding Fed Divisions and Strategic Portfolio Adjustments Before Rate Cuts

As the Federal Reserve signals potential rate cuts amidst internal divisions, investors are left navigating a complex landscape. Understanding these divisions is crucial for strategic portfolio adjustments. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale providing a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.7. This level is below the 7.0 warning threshold, indicating moderate risk. This insight is vital as investors assess the implications of potential monetary policy shifts.

Learn more about how CW Index works at 1marketvibe.com

Current Fed Landscape

The Federal Reserve is experiencing notable divisions regarding the timing and magnitude of potential rate cuts. Key figures within the Fed hold differing perspectives, with some advocating for immediate cuts to stimulate economic growth, while others urge caution, citing inflationary concerns. This internal debate is pivotal as it influences market expectations and investor strategies. Understanding these dynamics helps investors anticipate potential policy shifts and adjust their portfolios accordingly.

Market Reactions

Markets have responded with volatility to the Fed's mixed signals. Historically, such divisions within the Fed have led to uncertainty, affecting market stability. For instance, when the CW Index hit 7.1 in March 2023, markets fell 8.3% over the following month. Currently, the CW Index at 5.7 suggests moderate risk, but investors should remain vigilant. If the index trends towards 6.5 or higher, it may signal increased market volatility.

CW Index Insights

The current CW Index reading of 5.7 reflects a moderate risk environment. MarketVibe's CW Index, with its unique gold component, provides a 4-6 week early warning of potential market corrections. This predictive capability is crucial for investors looking to preemptively adjust their strategies. Historical patterns show that significant movements in the CW Index often precede market shifts, making it an invaluable tool for proactive risk management.

Risk Awareness

Understanding the risks associated with potential rate cuts is essential. While rate cuts can stimulate economic activity, they may also lead to increased inflation and market volatility. The CW Index's current reading below the warning threshold suggests moderate risk, but investors should be cautious. Monitoring the index for upward trends can provide early warnings of potential market corrections.

Portfolio Strategy Guidance

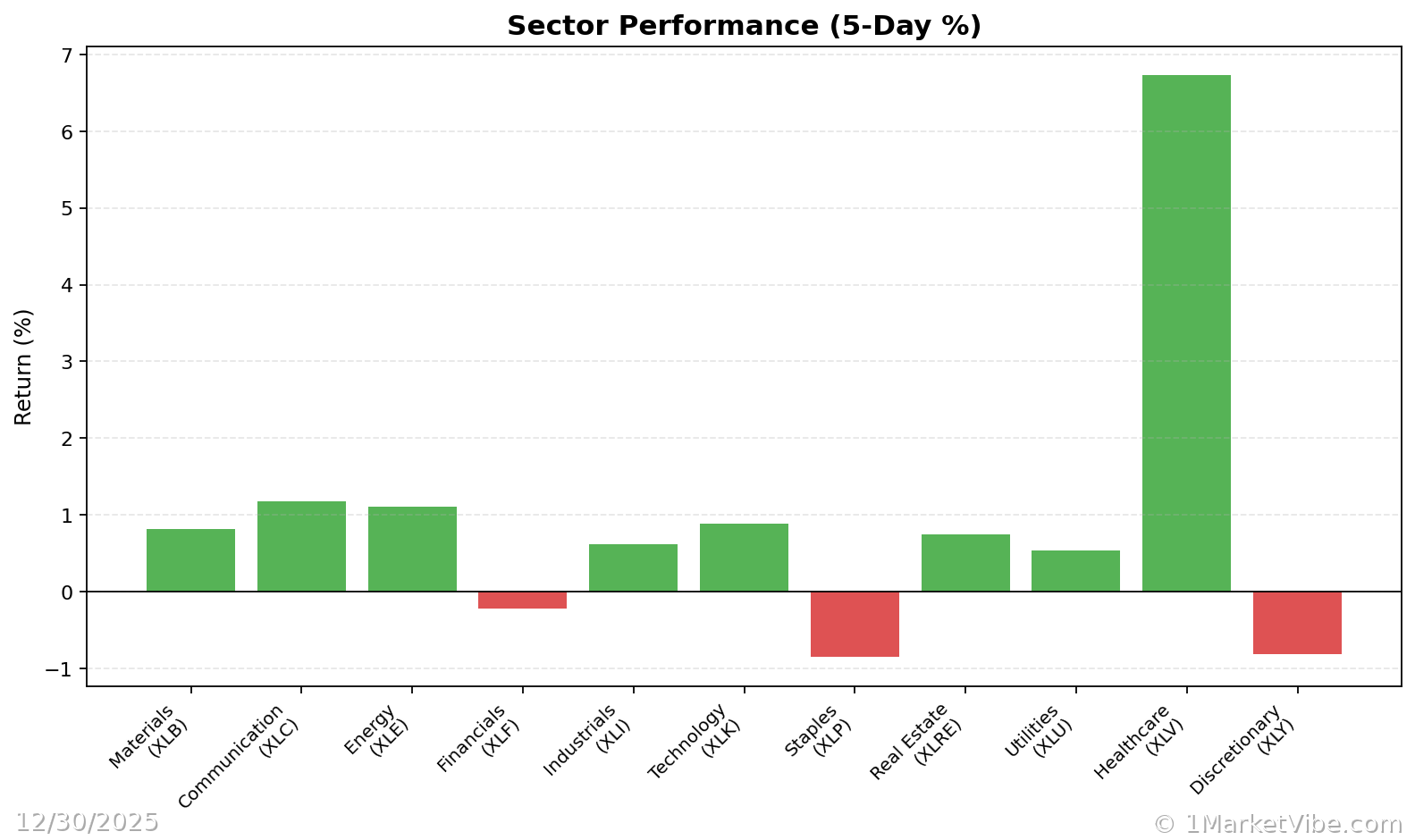

Investors should consider adjusting their portfolio strategies in light of the Fed's signals. The CW Index at 5.7 indicates moderate risk, but potential rate cuts could alter this landscape. Risk management and asset allocation are key considerations. Diversifying across sectors and maintaining a balanced portfolio can help mitigate risks associated with market volatility.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk

- Overall market status: Yellow flag

- Key metric to watch: CW Index trends towards 6.5

📚 Learn (2-Minute Deep Dive)

The current Fed divisions highlight the complexity of the economic landscape. Historical parallels, such as the March 2023 market drop, underscore the importance of monitoring the CW Index. The index's gold component offers a 4-6 week early warning, providing investors with a crucial advantage. Understanding these dynamics helps investors anticipate potential market shifts and adjust their strategies accordingly.

⚡ Act (Specific Steps)

- Diversify Holdings: Allocate 20-30% of your portfolio to sectors less affected by interest rate changes.

- Monitor CW Index: If the index approaches 6.5, consider reducing exposure to high-risk assets.

- Implement Hedging Strategies: Use options or other derivatives to protect against potential downturns.

- Adjust Risk Exposure: Rebalance your portfolio to align with current market conditions and risk tolerance.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Monitoring the divisions within the Federal Reserve is crucial for navigating market uncertainties. MarketVibe's Enhanced CW Index provides valuable insights into potential market corrections, offering a 4-6 week early warning system. By understanding these signals and adjusting portfolio strategies accordingly, investors can better manage risks and capitalize on opportunities. Built by investors, for investors, MarketVibe offers the tools needed to stay ahead in a dynamic market environment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a financial advisor for personalized investment guidance.

Charts