Bitcoin's Rise and Nasdaq's Fall: Implications for Your Portfolio

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Bitcoin's Rise and Nasdaq's Fall: Implications for Your Portfolio

The financial landscape is witnessing a notable shift as Bitcoin's ascent contrasts sharply with the Nasdaq's recent decline. This divergence highlights potential implications for investors seeking to navigate these volatile times. MarketVibe's proprietary Enhanced CW Index, a critical tool that offers a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently reading 6.5. This level is below the critical 7.0 threshold, suggesting moderate risk but indicating potential market instability.

Market Overview

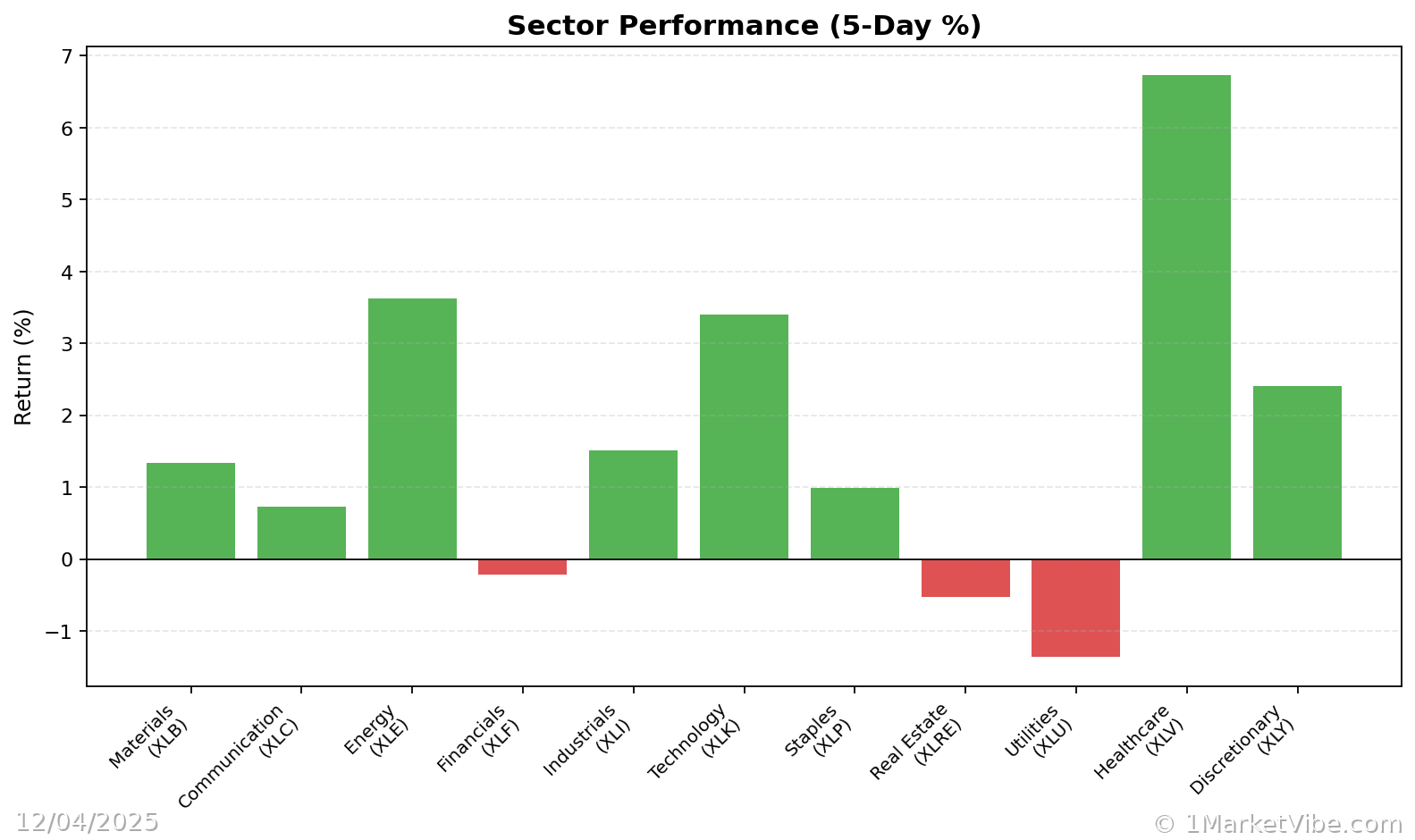

In recent weeks, the Nasdaq has faced downward pressure, influenced by economic indicators such as job losses and sector-specific challenges. Meanwhile, Bitcoin has surged, capturing investor interest as a potential hedge against traditional market volatility. The CW Index at 6.5 suggests that while the market is not at immediate risk of a severe correction, caution is warranted. Historically, when the CW Index reached 7.1 in March 2023, markets experienced an 8.3% decline, underscoring the importance of monitoring this index closely.

Learn more about how CW Index works at 1marketvibe.com.

Job Losses Impact

The latest ADP report reveals significant job losses, which have dampened market confidence. This development could have far-reaching implications for consumer spending and economic growth. As companies like Micron shift focus towards AI-related products, the tech sector faces additional challenges. These dynamics contribute to the current market sentiment, as reflected in MarketVibe's CW Index.

Tech Sector Dynamics

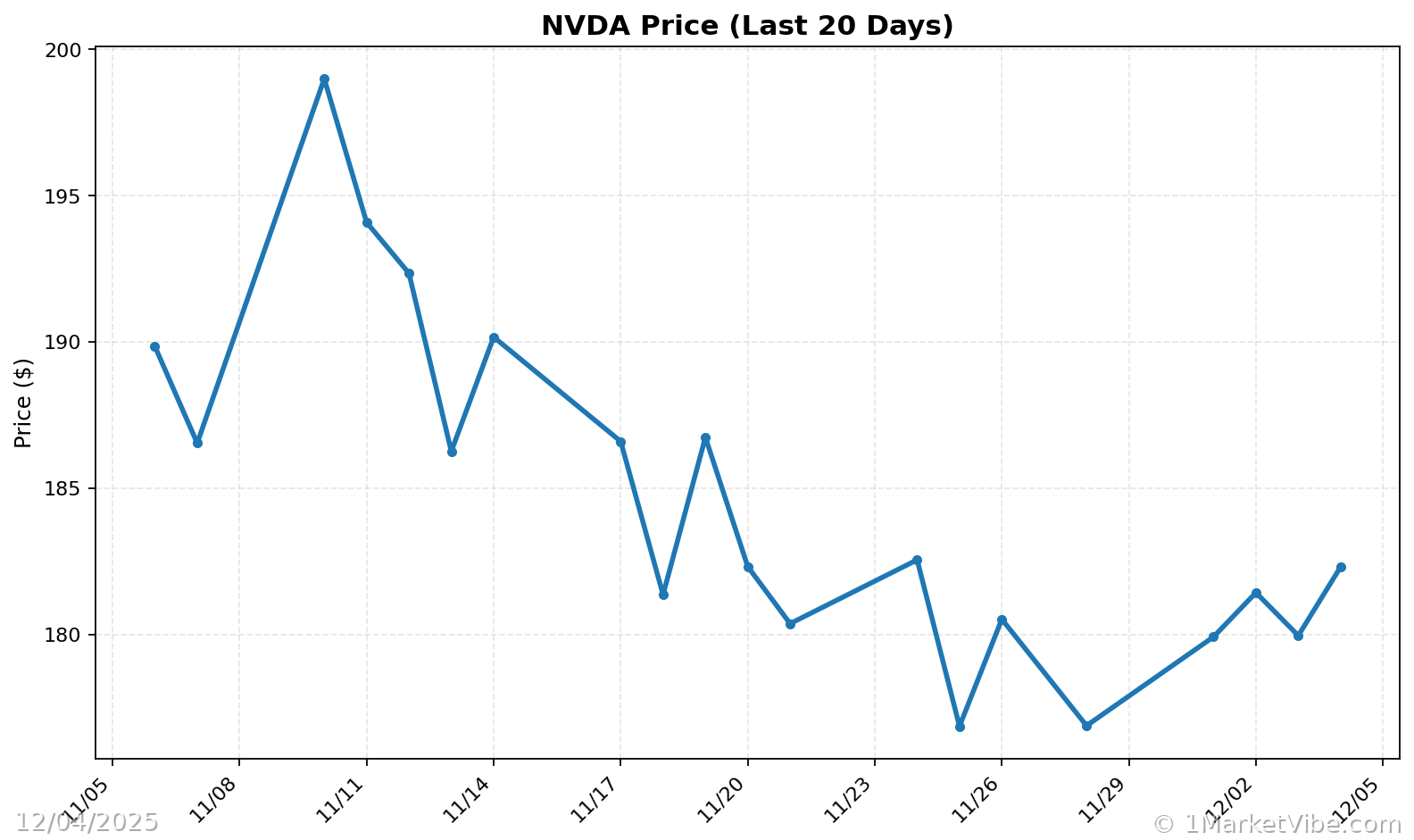

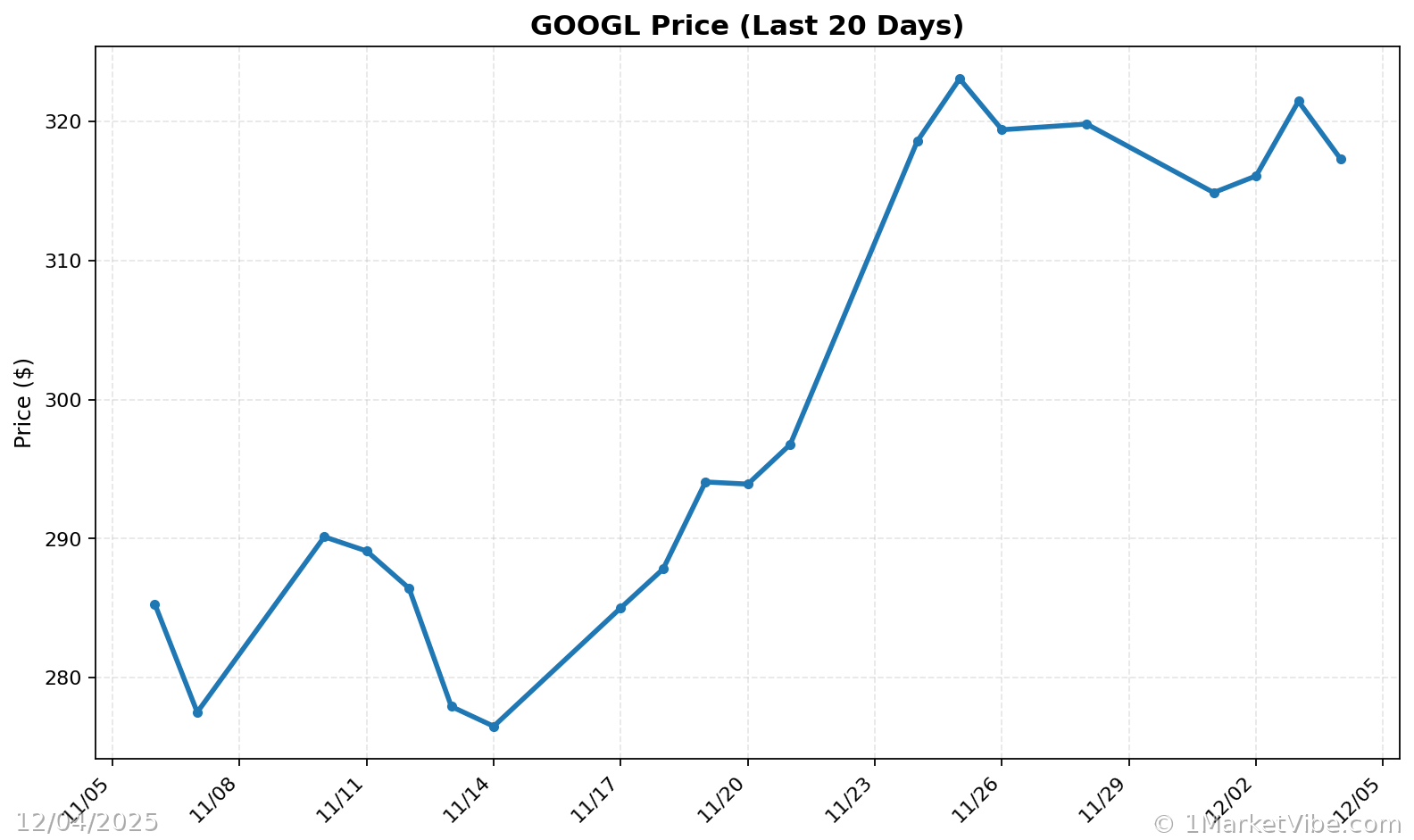

Tech giants like Nvidia are grappling with increased competition, particularly from Google's advancements in AI. This has led to a strategic pivot for companies such as Micron, which is now prioritizing AI-related products over traditional consumer offerings. These shifts are contributing to the Nasdaq's decline, as investors reassess the growth prospects of tech stocks. MarketVibe's CW Index continues to track these developments, providing early warning signals for potential market corrections.

Bitcoin's Resilience

Bitcoin's rise amidst broader market declines can be attributed to several factors, including its perceived role as a hedge against inflation and economic uncertainty. Investor sentiment is increasingly shifting towards cryptocurrencies, driven by their decentralized nature and potential for high returns. MarketVibe's Enhanced CW Index highlights this trend, as institutional gold flows suggest a growing interest in alternative assets.

Market Sentiment Analysis

The current CW Index reading of 6.5 indicates a neutral sentiment among investors, suggesting caution as they navigate these uncertain times. While the index remains below the warning threshold, its historical patterns emphasize the need for vigilance. If the CW Index crosses 6.5, it could signal increased market instability, prompting investors to reassess their portfolios.

Future Implications

The long-term effects of job losses on market recovery remain uncertain, but they could potentially slow economic growth and consumer spending. Meanwhile, Bitcoin's role in diversifying investment strategies continues to gain traction. As traditional markets face headwinds, cryptocurrencies offer an alternative avenue for investors seeking to mitigate risk.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework is designed to turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 6.5, indicating moderate risk.

- Overall market status: Yellow flag, suggesting caution.

- Key metric to watch: Institutional gold flows.

📚 Learn (2-Minute Deep Dive)

The current market environment is characterized by contrasting trends, with Bitcoin's rise countering the Nasdaq's decline. Historical parallels, such as the March 2023 correction, highlight the importance of monitoring the CW Index. As job losses impact consumer confidence, the tech sector's challenges further complicate the landscape. Investors should remain vigilant, as the CW Index provides a 4-6 week early warning of potential market corrections.

⚡ Act (Specific Steps)

- Diversify Holdings: Consider increasing exposure to cryptocurrencies like Bitcoin to hedge against traditional market volatility.

- Adjust Risk Exposure: Reduce holdings in tech stocks facing competitive pressures, such as Nvidia.

- Monitor CW Index: If the index approaches 7.0, consider reallocating assets to more stable sectors.

- Implement Hedging Strategies: Use options or other derivatives to protect against potential downturns.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →.

Conclusion

In summary, the current market dynamics underscore the need for strategic portfolio adjustments. MarketVibe's Enhanced CW Index and Decision Edge™ Method provide valuable insights and actionable steps to navigate these volatile times. As Bitcoin rises and the Nasdaq falls, investors are encouraged to remain vigilant and leverage MarketVibe's tools for early warning and informed decision-making.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts