Amazon's AI Chip Launch Challenges Nvidia's Dominance

Amazon's recent announcement of its new AI chip has sent ripples through the tech industry, challenging the established dominance of Nvidia and Google in the AI hardware market. This strategic move by Amazon is poised to reshape the competitive landscape, potentially altering market dynamics significantly. As investors assess the implications, MarketVibe's proprietary Enhanced CW Index, a 0-10 scale that provides a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 5.7. This level is below the 7.0 warning threshold, indicating moderate risk in the current market environment.

Learn more about how CW Index works at 1marketvibe.com

Amazon's AI Chip Details

Amazon's new AI chip is designed to enhance the capabilities of its cloud services, targeting a broad range of applications from machine learning to data analytics. The chip boasts advanced specifications that promise increased efficiency and performance, positioning Amazon to compete directly with Nvidia's offerings. This development is particularly significant as Amazon aims to capture a larger share of the AI hardware market, which has been predominantly led by Nvidia and Google.

Competitive Landscape

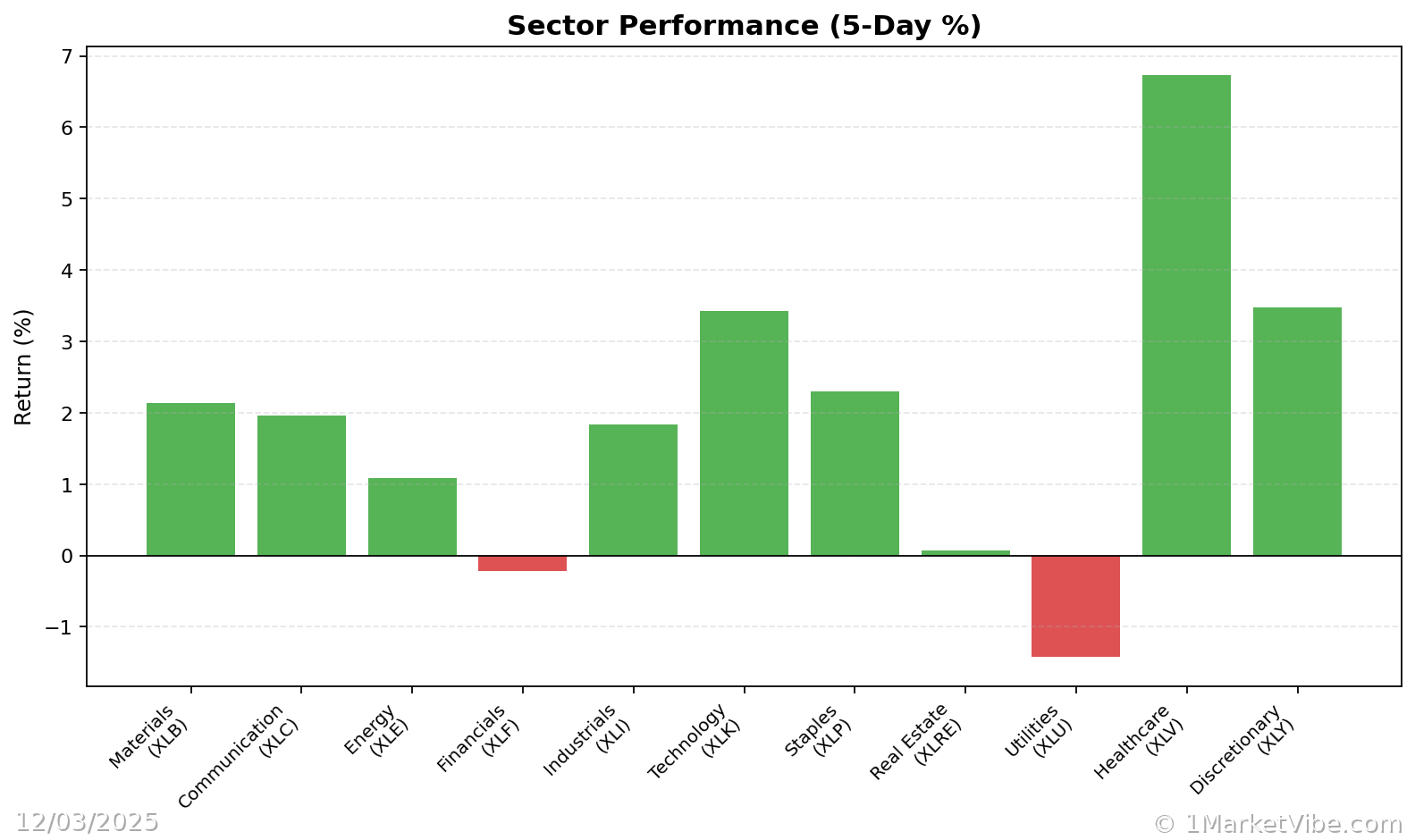

Nvidia and Google have long been leaders in the AI chip market, with Nvidia's GPUs being a staple for AI applications. However, Amazon's entry introduces a formidable competitor. The potential impact on Nvidia and Google's market share could be substantial, as Amazon leverages its vast cloud infrastructure to integrate and promote its new chip. MarketVibe's CW Index suggests that investors should monitor these developments closely, as shifts in market leadership could influence broader tech sector performance.

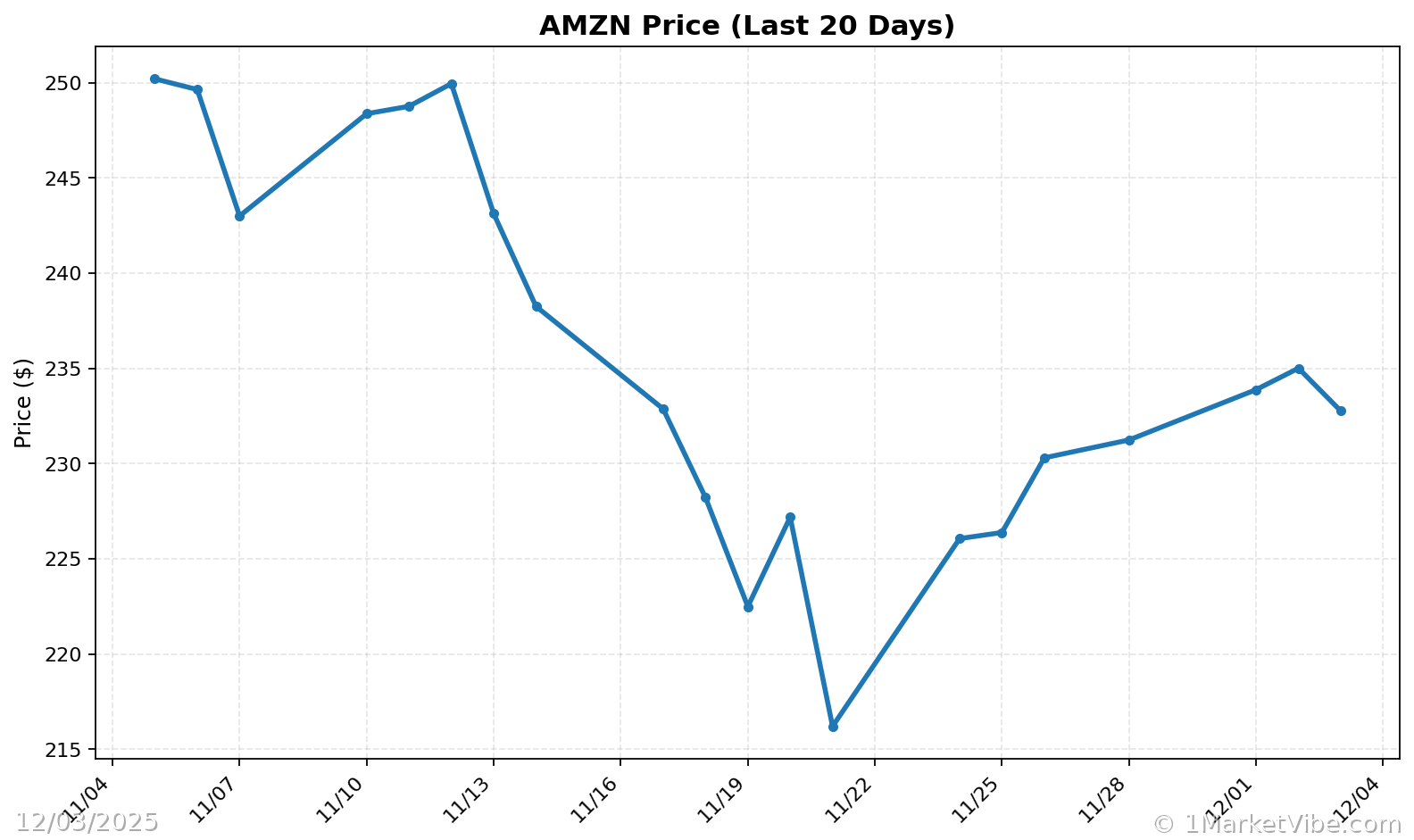

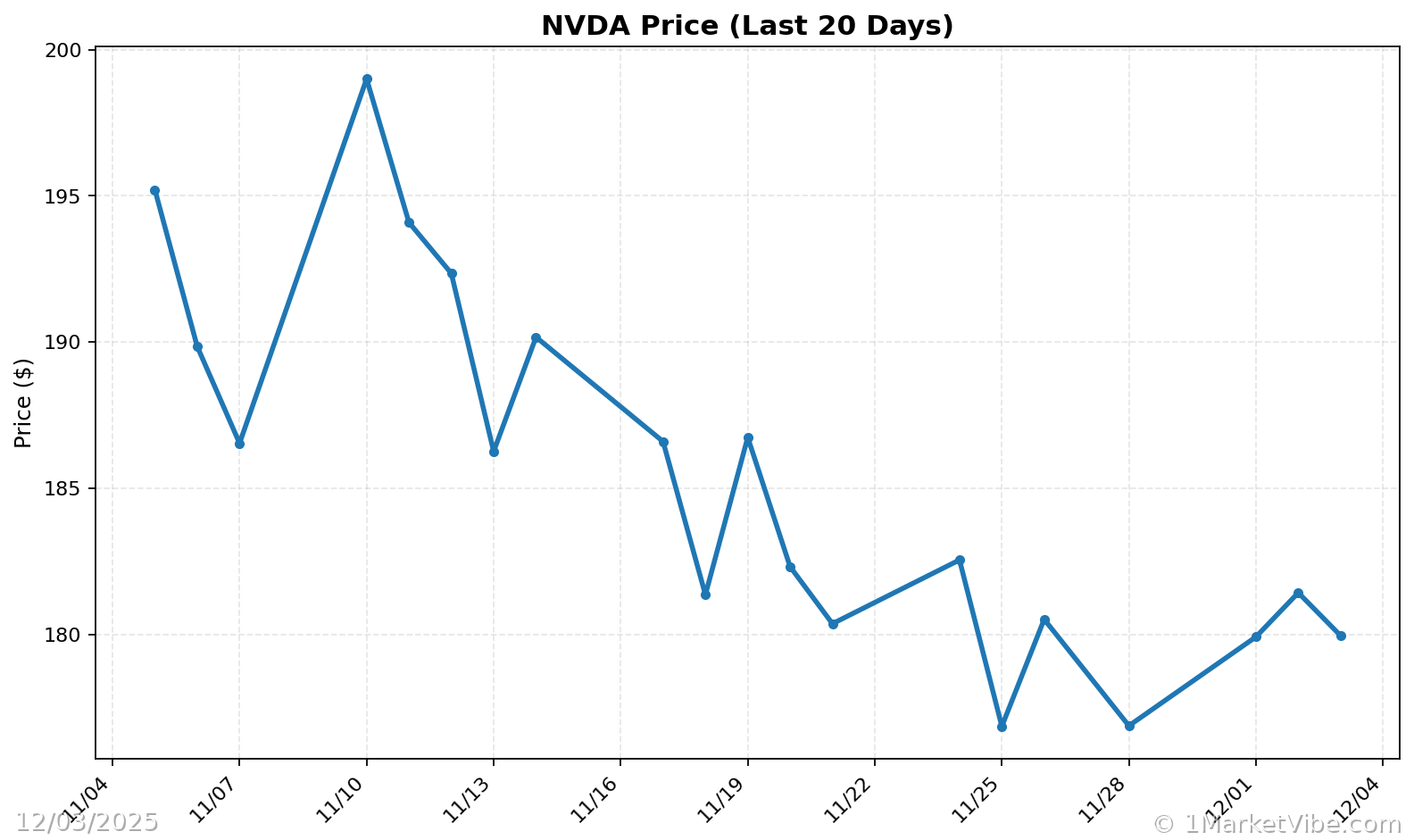

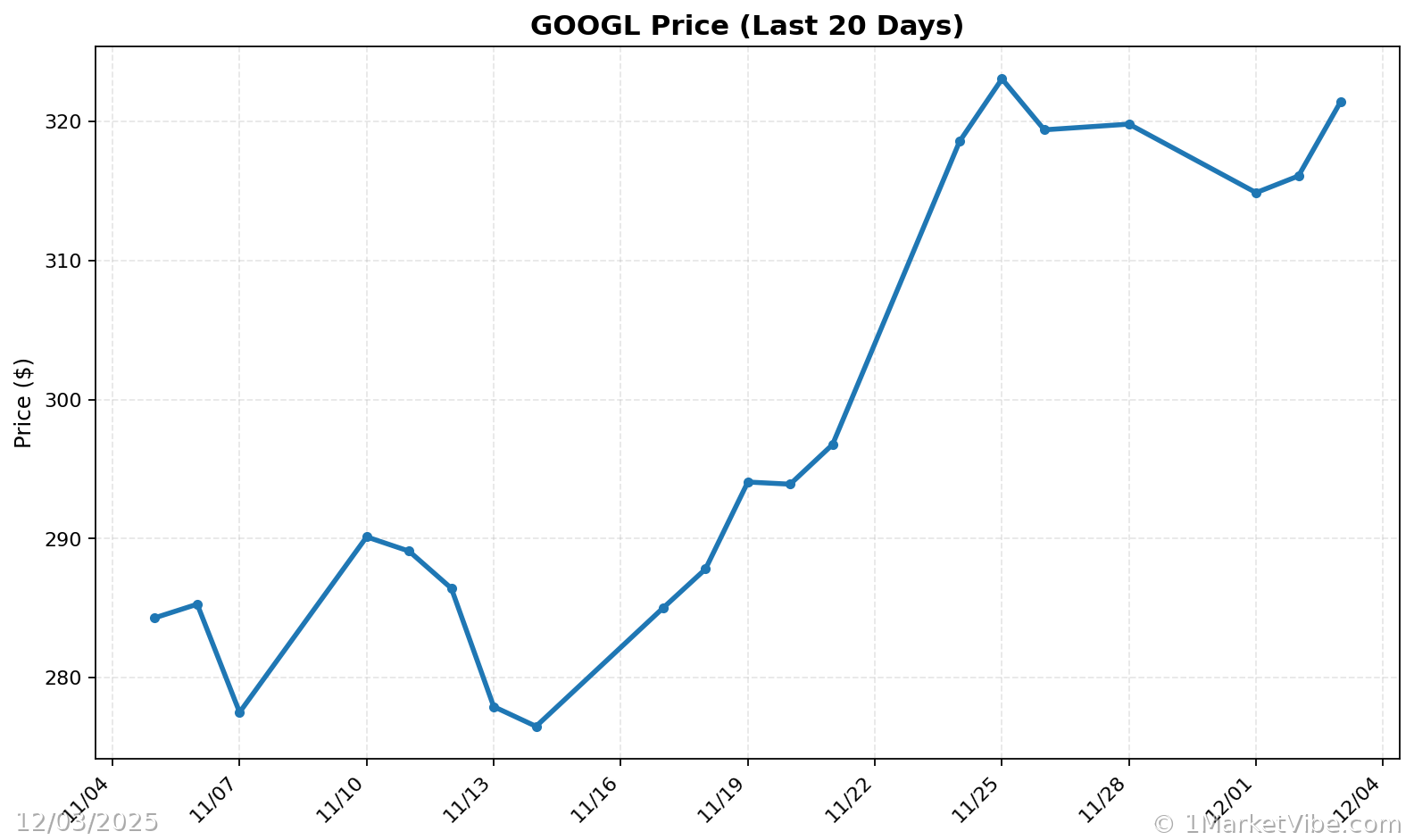

Market Reactions

The initial stock market response to Amazon's announcement was mixed. While Amazon's shares saw a modest uptick, Nvidia experienced a slight decline, reflecting investor concerns about increased competition. Google's reaction was more muted, as the company continues to focus on its own AI advancements. According to MarketVibe data, these movements align with historical patterns where new entrants have disrupted existing market leaders.

Potential Disruptions

Amazon's AI chip could significantly alter the dynamics of AI hardware, affecting companies that rely heavily on Nvidia's technology. This disruption may lead to increased innovation and competition, ultimately benefiting consumers with more choices and potentially lower costs. MarketVibe's Enhanced CW Index provides a crucial early warning system, allowing investors to anticipate potential market corrections as these changes unfold.

Challenges Ahead

Despite the promising outlook, Amazon faces several challenges in its AI chip strategy. Technical hurdles, such as ensuring compatibility and performance parity with existing solutions, are significant. Additionally, gaining market acceptance and building a robust ecosystem around its chip will be critical for long-term success. MarketVibe's CW Index at 5.7 indicates that while the current risk is moderate, investors should remain vigilant for any shifts that could signal increased volatility.

Expert Opinions

Industry analysts have offered varied insights on Amazon's move. Some view it as a bold step that could redefine the AI landscape, while others caution that the road to dominance is fraught with obstacles. Historical parallels, such as when CW Index hit 7.1 in March 2023 and markets fell 8.3%, suggest that significant market shifts can occur when new technologies disrupt established players.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework helps investors turn market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- Current CW Index reading: 5.7, indicating moderate risk.

- Overall market status: Yellow flag.

- Key metric to watch: Institutional gold flows.

📚 Learn (2-Minute Deep Dive)

Amazon's entry into the AI chip market is a strategic maneuver that could disrupt existing hierarchies. Historically, new entrants have reshaped markets, as seen when CW Index levels indicated impending corrections. Investors should monitor Amazon's integration of its chip into its cloud services and its impact on Nvidia's market share. The current situation matters because it could lead to increased competition and innovation, potentially altering investment strategies in the tech sector.

⚡ Act (Specific Steps)

- Diversify Holdings: Consider diversifying tech investments to mitigate potential risks associated with market shifts.

- Monitor CW Index: Watch for any movement towards the 6.5 level, which could signal increased volatility.

- Adjust Allocations: If CW Index trends upwards, consider reducing exposure to high-risk tech stocks.

- Hedge Positions: Use options or other hedging strategies to protect against potential downturns.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

Amazon's strategic positioning in the AI market presents both opportunities and challenges. As the tech landscape evolves, MarketVibe's Enhanced CW Index and Decision Edge™ Method provide invaluable tools for navigating these changes. By leveraging these insights, investors can make informed decisions, balancing risk and opportunity in a dynamic environment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Charts