PepsiCo's Elliott Deal and Its Implications for Market Stability

- Authors

- Name

- MarketVibe Team

- @1marketvibe

PepsiCo's Elliott Deal and Its Implications for Market Stability

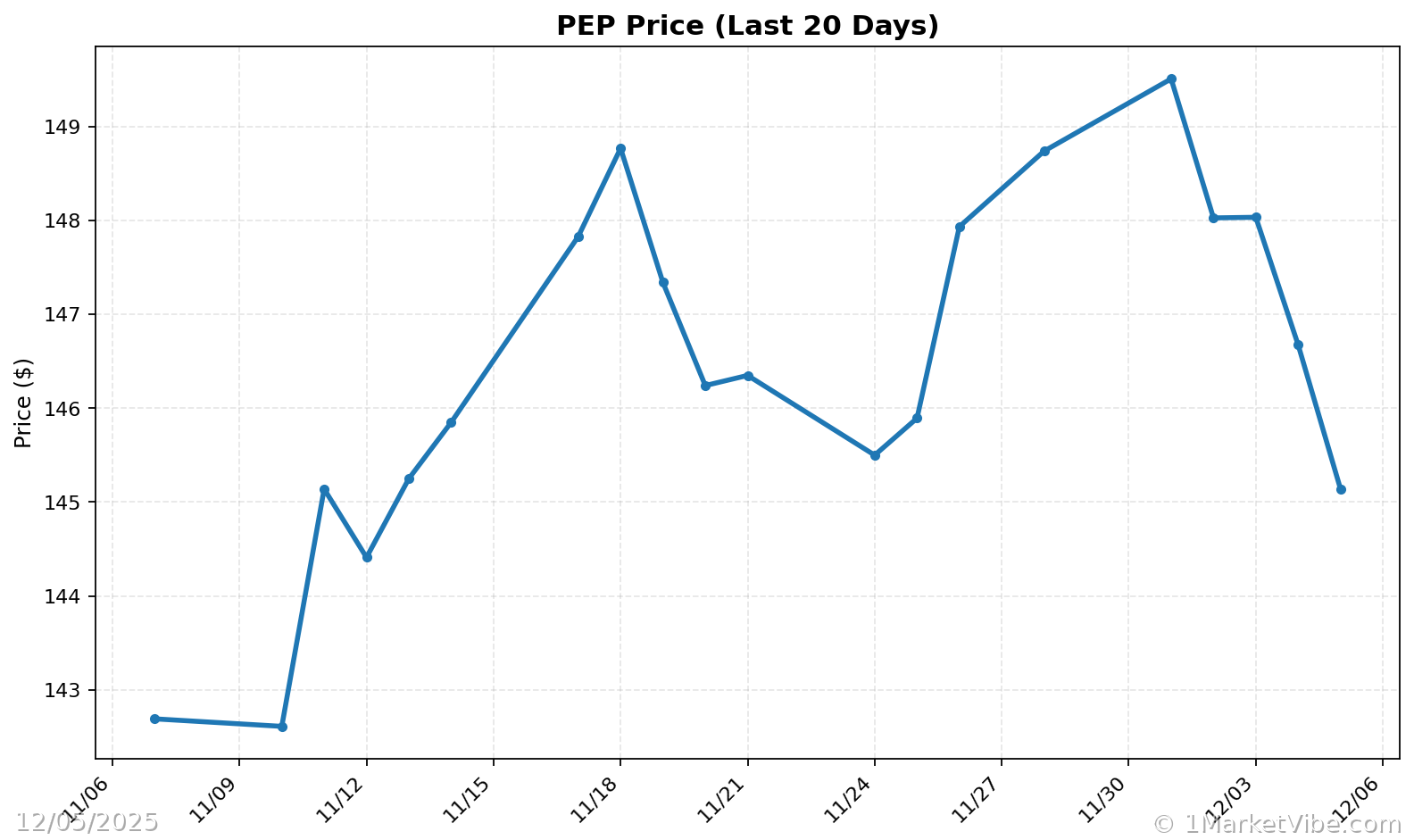

PepsiCo's recent negotiations with activist investor Elliott Management have captured the attention of market participants, highlighting the significant role activist investors play in corporate governance. As the market digests this development, it's crucial to understand how such settlements can influence market stability. MarketVibe's proprietary Enhanced CW Index, a 0-10 scale providing a 4-6 week early warning of market corrections by tracking institutional gold flows and market breadth, is currently at 6.36. This level is below the critical 7.0 threshold, indicating moderate risk but warranting close monitoring.

Current Market Context

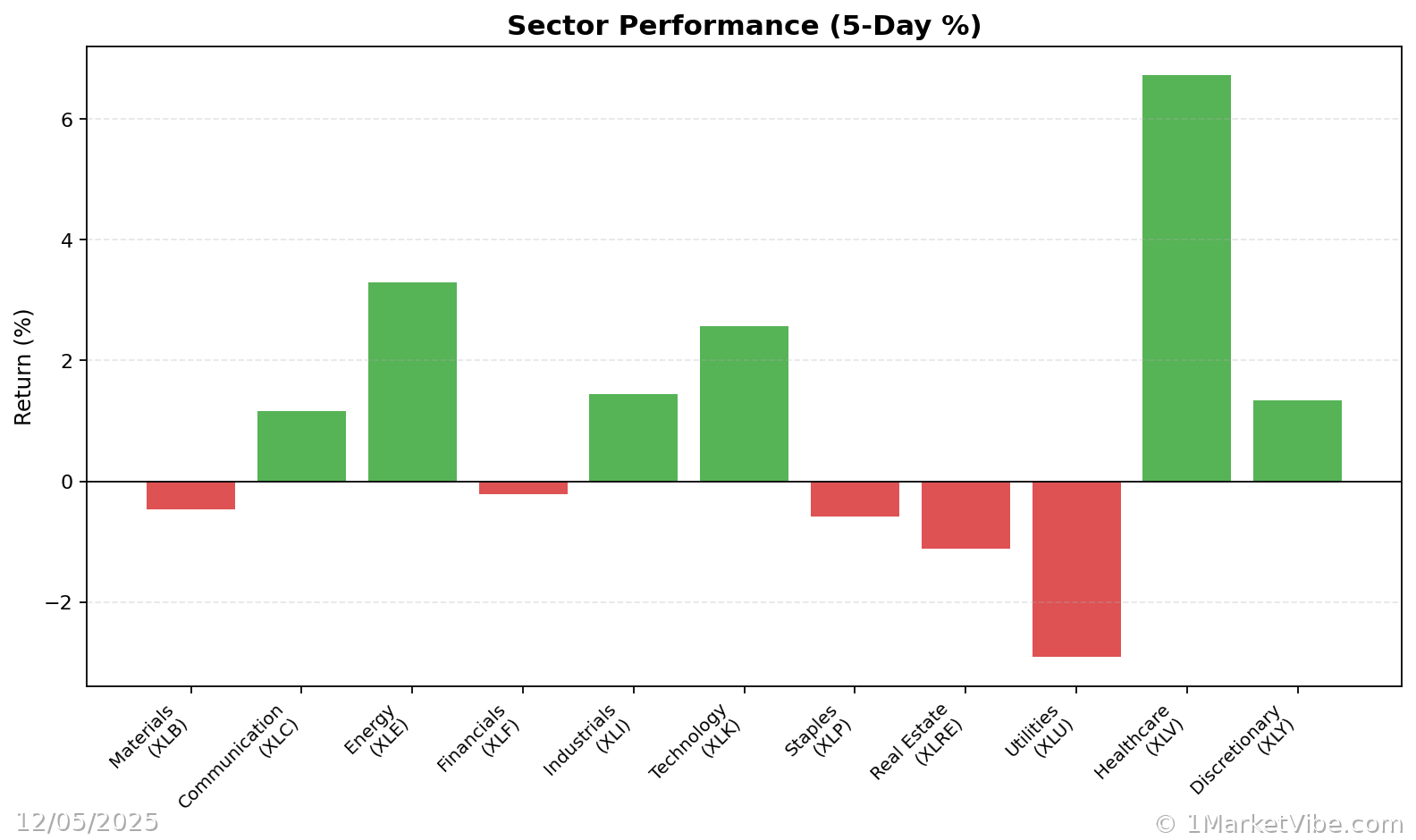

Recent market movements have been relatively stable, with major indexes showing modest gains. Investors are keenly observing economic indicators, such as jobless claims and upcoming Federal Reserve decisions, which could impact market stability. The current CW Index reading of 6.36 suggests that while the market is not in immediate danger, the potential for volatility remains, especially in light of significant corporate developments like PepsiCo's settlement with Elliott.

Learn more about how CW Index works at 1marketvibe.com.

Details of the Settlement

The settlement discussions between PepsiCo and Elliott Management reportedly focus on strategic changes that could enhance shareholder value. While specific terms are yet to be disclosed, such agreements typically involve board representation or strategic shifts that align with the activist's objectives. These changes could have profound implications for PepsiCo's strategic direction, potentially affecting its operational focus and financial performance.

Activist Investor Influence

Activist investors like Elliott Management have a history of influencing corporate policies to unlock shareholder value. Historical examples, such as Elliott's involvement with AT&T, demonstrate how activist settlements can lead to significant corporate restructuring and market reactions. These precedents suggest that PepsiCo's settlement could lead to similar strategic shifts, impacting its market position and investor sentiment.

Market Reactions

Investor sentiment surrounding the news of PepsiCo's settlement with Elliott has been cautiously optimistic. While the immediate market reaction has been muted, the long-term implications could be significant. MarketVibe's CW Index, with its gold flow component, provides a 4-6 week early warning, suggesting that investors should remain vigilant for any shifts in market dynamics that could arise from this settlement.

CW Index Analysis

The current CW Index reading of 6.36 is a critical indicator for investors. Historical patterns show that when the CW Index reached 7.1 in March 2023, markets experienced an 8.3% decline over the following month. This underscores the importance of monitoring the CW Index closely, especially if it approaches the 6.5 level, which could signal increased market risk.

MarketVibe Decision Edge™: Your Action Plan

MarketVibe's Decision Edge™ Method simplifies complex market signals into three clear steps: Glance → Learn → Act. This proprietary framework turns market intelligence into actionable decisions.

🔍 Glance (10-Second Takeaway)

- CW Index: Currently at 6.36, indicating moderate risk.

- Market Status: Yellow flag; cautious optimism.

- Key Metric: Watch for CW Index crossing 6.5.

📚 Learn (2-Minute Deep Dive)

The current situation with PepsiCo and Elliott highlights the influence of activist investors on market stability. Historically, similar settlements have led to strategic shifts that can affect market dynamics. For example, Elliott's previous engagements have resulted in significant corporate restructuring, impacting stock performance and investor sentiment. Monitoring the CW Index is crucial, as its gold flow component provides an early warning of potential market corrections. Investors should pay attention to any movements in the CW Index, especially if it trends towards the 7.0 threshold, which could indicate heightened market volatility.

⚡ Act (Specific Steps)

- Monitor Position Sizing: Adjust holdings based on CW Index levels.

- Risk Exposure: Reduce exposure in sectors directly affected by activist settlements.

- Hedging Strategies: Consider hedging if CW Index trends upward.

- Entry/Exit Criteria: Use CW Index movements as a guide for timing market entries and exits.

Access MarketVibe's full Decision Edge framework at 1marketvibe.com →

Conclusion

PepsiCo's settlement with Elliott Management underscores the significant role activist investors play in shaping corporate policies and market stability. While the current CW Index reading of 6.36 suggests moderate risk, investors should remain vigilant and leverage MarketVibe's tools to navigate potential market shifts. By understanding the implications of such settlements and monitoring key indicators, investors can make informed decisions to manage risk and capitalize on opportunities.

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Market conditions can change rapidly and unpredictably. Always conduct your own research before making investment decisions.

Charts