The Impact of JPMorgan's Apple Card on Financial Stability

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Introduction

JPMorgan Chase's acquisition of the Apple Credit Card is a significant development in the consumer credit market. As one of the largest financial institutions in the world, JPMorgan's move to take over the Apple Card could have far-reaching implications for consumers, the credit industry, and financial stability. This article explores the potential impacts of this acquisition, using MarketVibe's metrics to provide a structured analysis of the market environment and guide traders in understanding the broader implications.

Market Context

The consumer credit landscape has been evolving rapidly, with technological advancements and strategic partnerships reshaping how credit is offered and managed. Historically, credit card partnerships, such as those between banks and major retailers or tech companies, have been pivotal in expanding consumer access to credit. The acquisition of the Apple Card by JPMorgan is a continuation of this trend, potentially altering the competitive dynamics in the credit card market.

Current State of Consumer Credit

Currently, the consumer credit market is characterized by high levels of credit card debt and increasing interest rates. This environment poses challenges for consumers managing their finances and for financial institutions aiming to balance growth with risk management. MarketVibe's Crash Warning Index (CWI), which is currently reading at 5.5, suggests that the market is in a moderately elevated risk state. This index, which aggregates risk dimensions such as breadth, volatility, and defensive behavior, indicates that traders should be cautious about potential corrections.

Implications for Consumers

The acquisition could lead to changes in credit offerings and terms for Apple Card users. JPMorgan's extensive resources and expertise in financial services may enhance the benefits and features available to cardholders. However, there is also the possibility of stricter credit terms or increased fees, which could impact consumer behavior and spending patterns.

Impact on Consumer Behavior

Changes in credit card terms can significantly influence consumer spending. If JPMorgan introduces more competitive rewards or lower interest rates, it could encourage increased usage of the Apple Card. Conversely, if terms become less favorable, consumers might reduce their credit card spending, affecting overall consumer demand.

Financial Stability Concerns

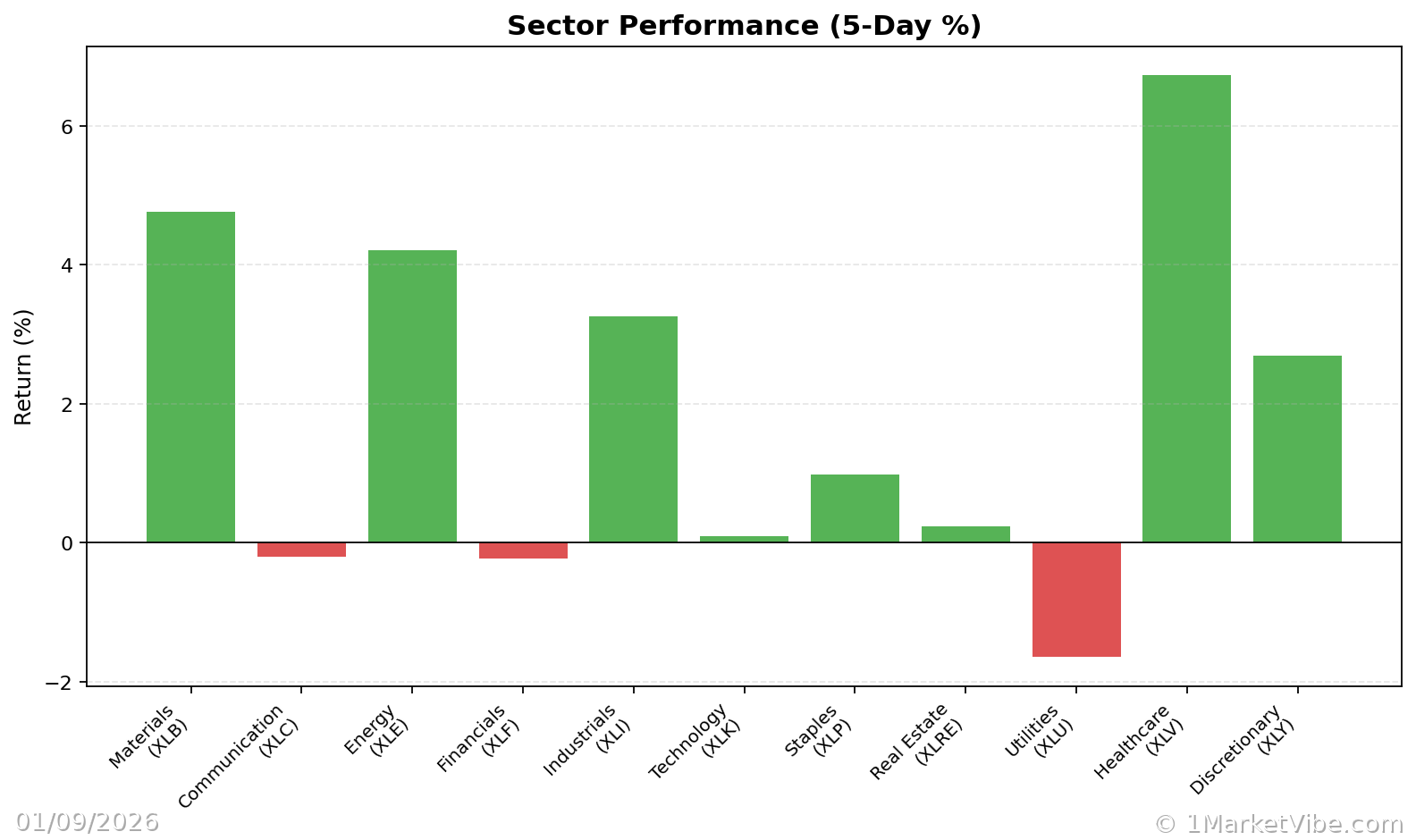

The concentration of credit offerings under large financial institutions like JPMorgan can have implications for financial stability. While such consolidations can lead to efficiencies and improved services, they also pose risks if the institution faces financial difficulties. The % Above 50-DMA metric, which measures the proportion of stocks trading above their 50-day moving average, can provide insights into market trends and health. A low percentage indicates market weakness, which, combined with high CWI readings, suggests heightened caution.

Risks of Concentrated Credit Offerings

Concentrated credit offerings can lead to systemic risks if not managed properly. In the event of an economic downturn, a large institution like JPMorgan could face significant challenges if a substantial portion of its credit portfolio becomes non-performing. This scenario underscores the importance of monitoring market breadth and volatility using tools like MarketVibe's ATR%, which measures volatility relative to price.

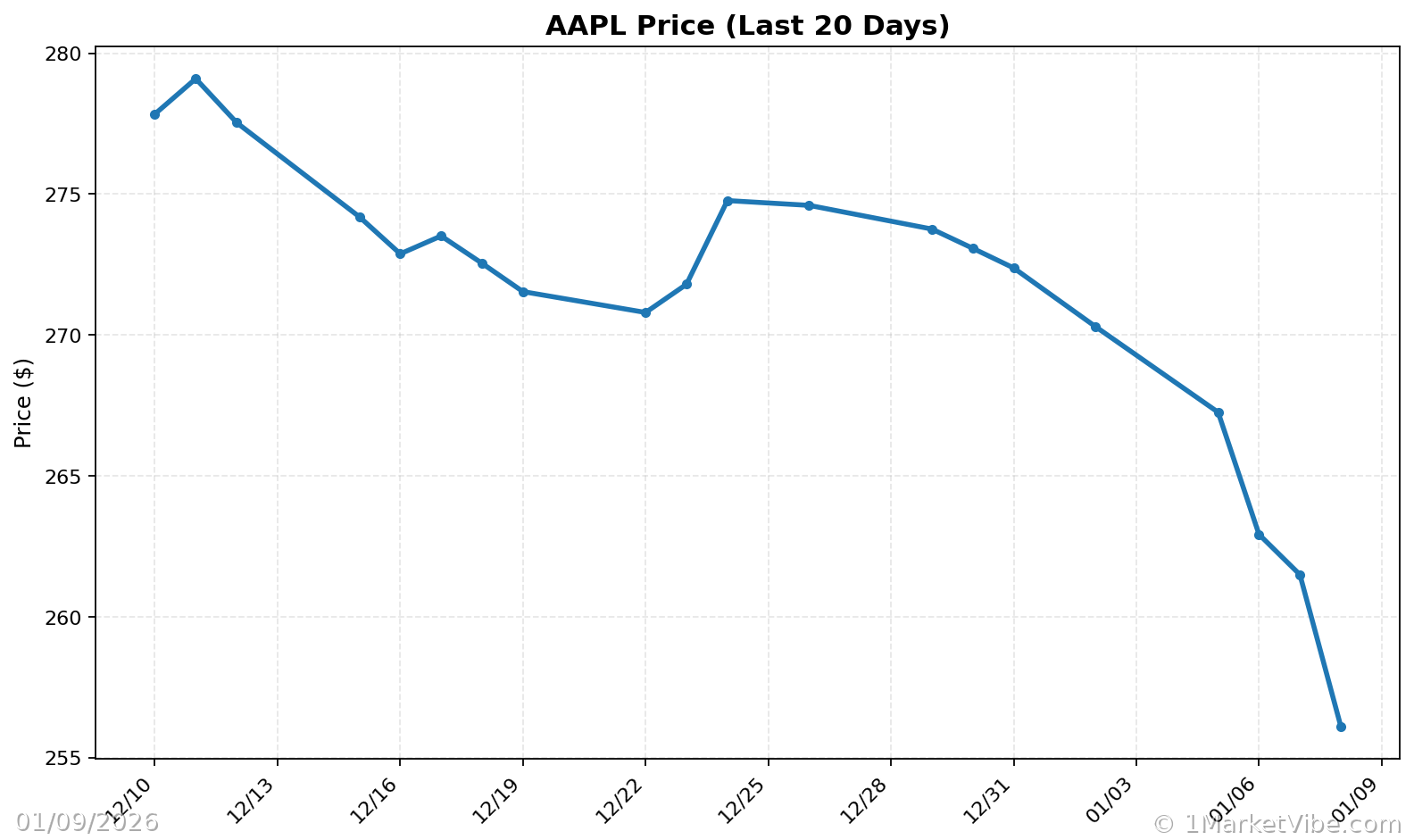

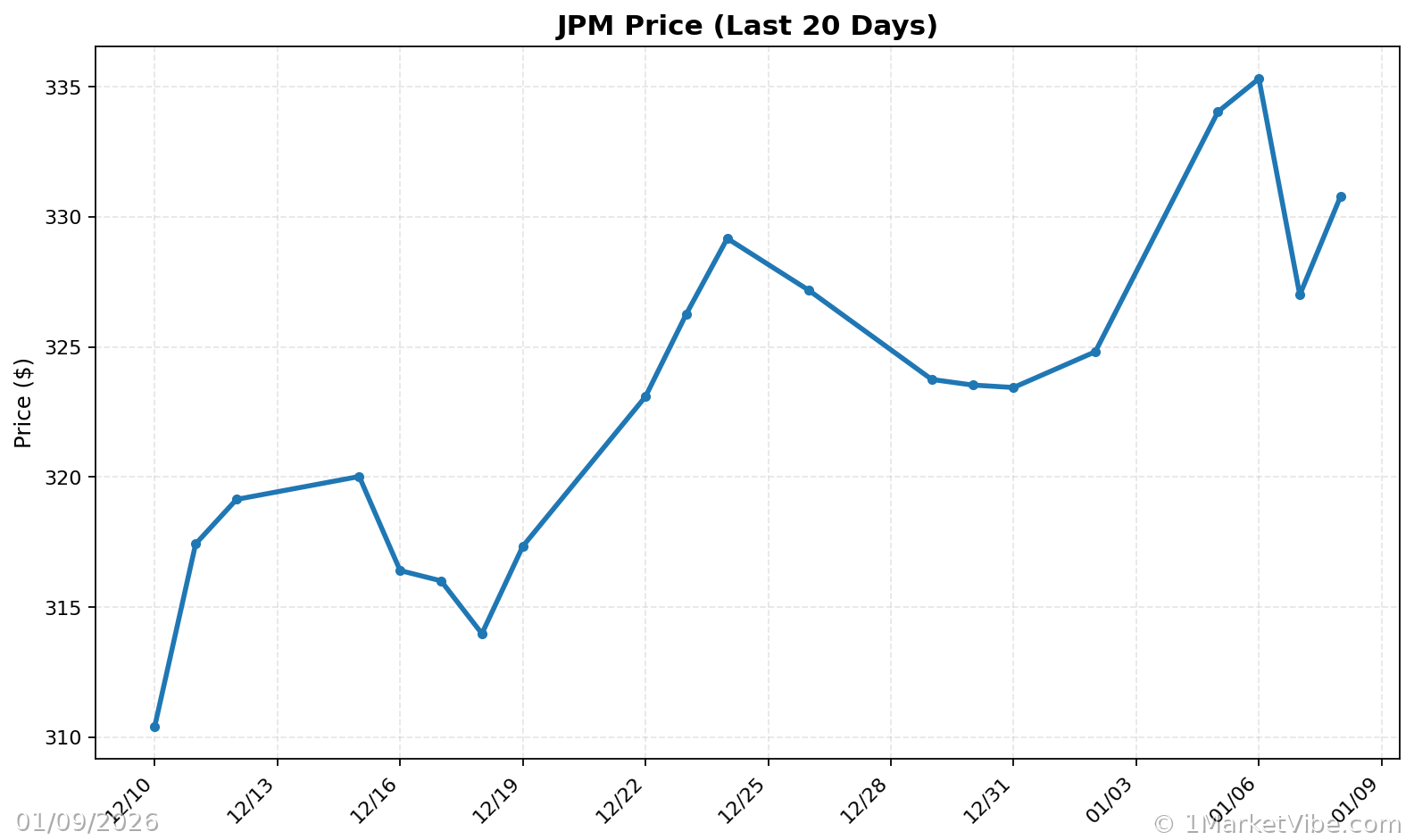

Market Reactions

Investor sentiment and market response to the acquisition will be crucial in determining its impact on financial markets. Historically, major shifts in the credit card market have led to fluctuations in stock prices and sector performance. Traders should pay attention to A/D Net, which gauges internal market strength, to assess how the market is reacting to this acquisition.

Comparison with Past Market Shifts

Past credit card market shifts have often led to increased volatility as investors reassess the competitive landscape. For example, when major partnerships or acquisitions occur, there can be initial uncertainty, followed by stabilization as the market adjusts to the new dynamics.

Regulatory Considerations

The acquisition may attract regulatory scrutiny, given the potential implications for competition and consumer protection. Government policies and regulations play a significant role in shaping the consumer credit market, and any changes could affect the strategic decisions of financial institutions.

Impact of Government Policies

Regulatory bodies may impose conditions on the acquisition to ensure fair competition and protect consumer interests. Traders should consider how potential regulatory changes could impact the credit market and adjust their strategies accordingly.

Future Outlook

In the short term, the acquisition may lead to increased competition and innovation in the credit card market. Over the long term, it could influence the strategic direction of both JPMorgan and Apple, as well as other financial institutions seeking to expand their presence in the credit space.

Considerations for Financial Institutions

Other financial institutions may need to reevaluate their strategies in response to this acquisition. This could involve exploring new partnerships, enhancing digital offerings, or adjusting risk management practices to remain competitive.

Conclusion

JPMorgan's acquisition of the Apple Credit Card is a pivotal event in the consumer credit landscape, with potential implications for financial stability and market dynamics. By using MarketVibe's metrics, traders can gain a deeper understanding of the risks and opportunities associated with this development. Monitoring the Decision Edge Dashboard can provide valuable insights into market conditions and help traders make informed decisions.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Market conditions can change rapidly, and past performance is not indicative of future results.

Charts