Nvidia's China Strategy and Its Impact on Global Tech Markets

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Nvidia's China Strategy and Its Impact on Global Tech Markets

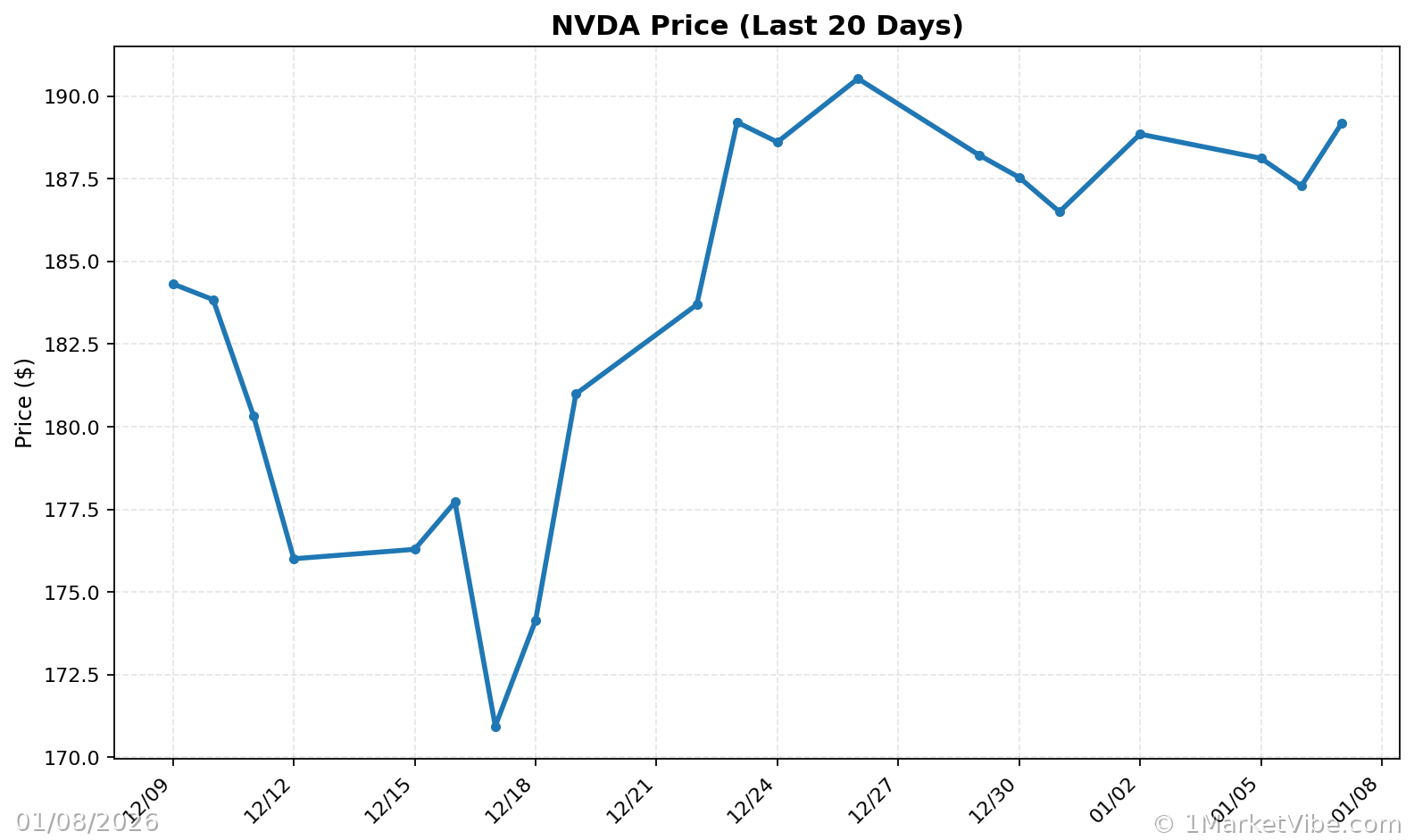

In recent years, Nvidia has become a pivotal player in the global technology landscape, particularly with its advancements in AI and semiconductor technology. As of January 2026, Nvidia's strategic decision to boost chip output for the Chinese market is poised to reshape the dynamics of the tech industry. This article explores how Nvidia's strategy could influence global tech markets, using MarketVibe's metrics to provide a deeper understanding of the potential impacts.

Market Dynamics Shift

Nvidia's increased production of the H200 chip for China is not just a business expansion; it's a strategic maneuver that could alter tech market competition. By ramping up production, Nvidia aims to solidify its presence in a market that is both vast and technologically demanding. This move is likely to have several implications:

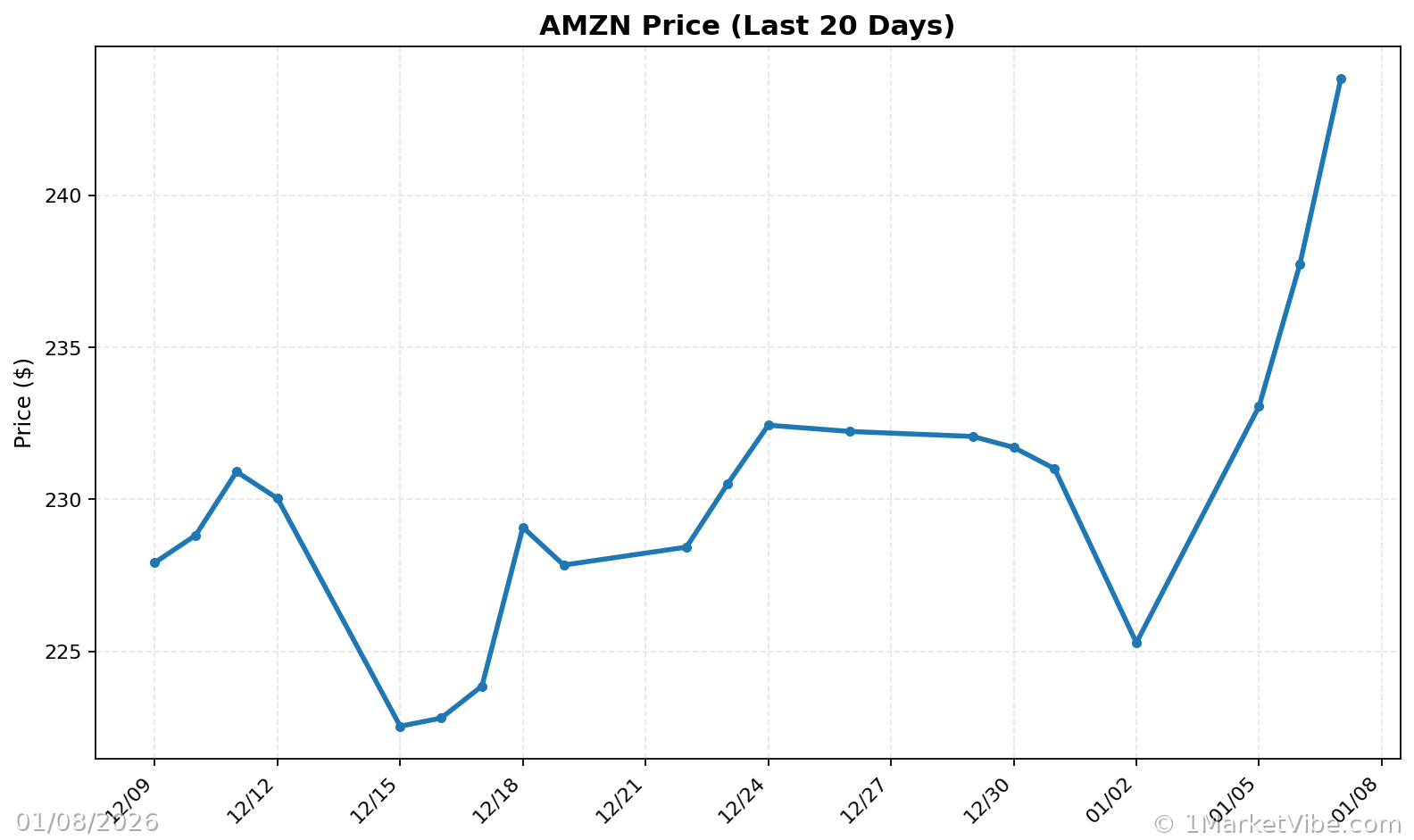

Increased Competition: As Nvidia strengthens its foothold in China, competitors such as Amazon and other tech giants may face heightened competition. This could lead to shifts in market share and spur innovation as companies strive to maintain their competitive edge.

Global Supply Chains: Nvidia's strategy could also impact global supply chains. By increasing output, Nvidia may influence the availability and pricing of semiconductors, which are critical components in a wide range of technologies.

Nvidia's Strategic Move

The decision to ramp up H200 chip production is a calculated move by Nvidia. The company's leadership has expressed confidence in finalizing deals with the White House to resume AI chip exports, which underscores the geopolitical dimensions of this strategy. Nvidia's focus on the Chinese market reflects its recognition of the region's importance in the global tech ecosystem.

Impact on Competitors

Nvidia's expansion in China could challenge its rivals in several ways:

- Market Share: Companies like Amazon, which have invested heavily in AI and cloud computing, may need to reassess their strategies to compete with Nvidia's growing influence in China.

- Innovation Pressure: As Nvidia pushes the envelope in chip technology, competitors may be compelled to accelerate their own innovation efforts to keep pace.

Economic Context

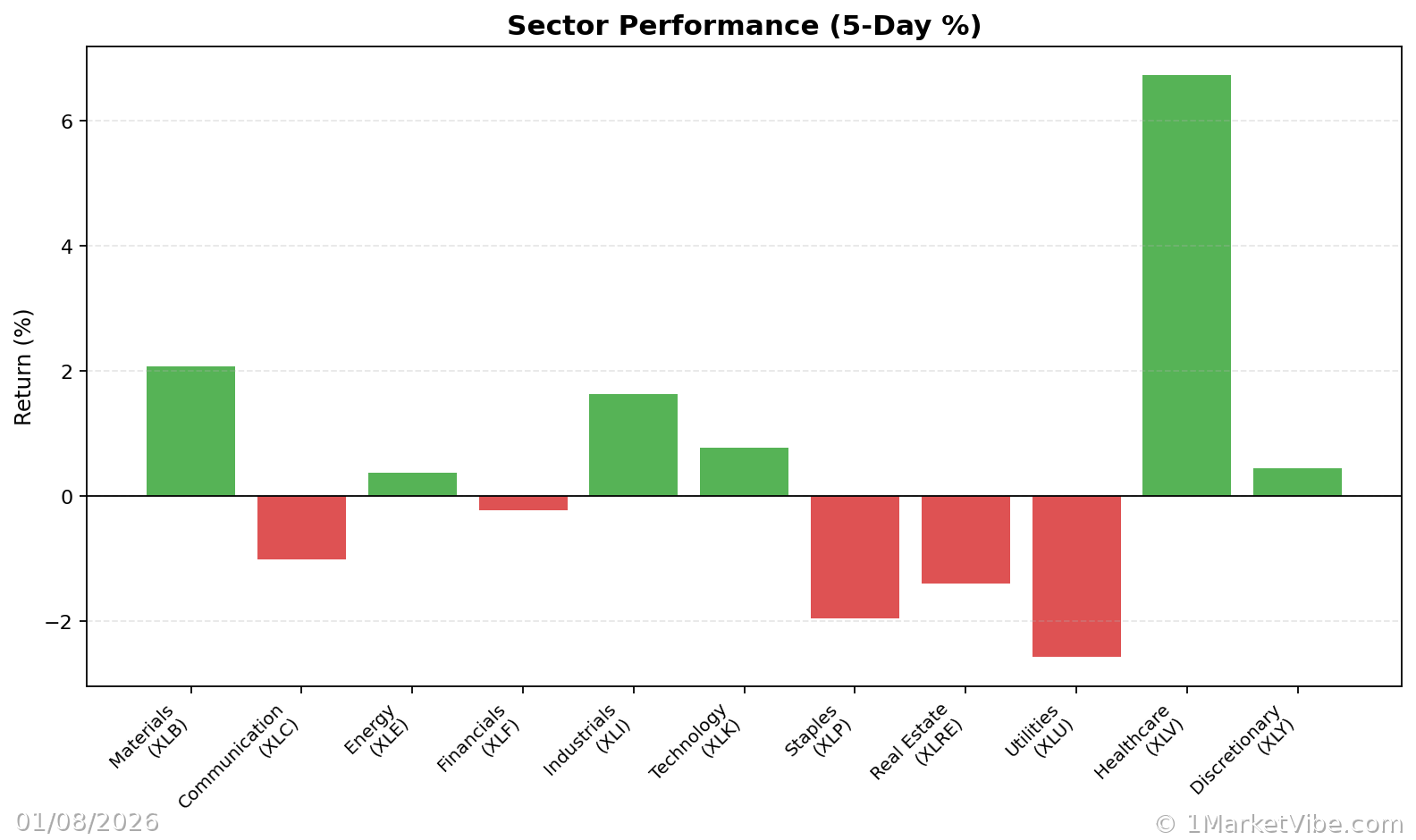

The broader economic context is also relevant. Recent trends in major indices like the S&P 500 and Dow Jones Industrial Average, which have reached new highs, suggest a robust market environment. However, Nvidia's actions could introduce new variables into this landscape, particularly if they lead to shifts in tech sector dynamics.

CW Index Connection

The Crash Warning Index (CWI) is a critical tool for understanding the risk landscape. Currently, the CWI stands at 6.1, indicating elevated risk levels. This reading suggests that Nvidia's strategic moves align with broader market signals of potential volatility. The CWI, which aggregates various risk dimensions such as breadth and volatility, provides an early warning capability that traders can use to anticipate market shifts.

Sentiment Analysis

Market sentiment regarding Nvidia's strategy appears neutral, reflecting a cautious optimism among investors. This sentiment is crucial as it influences trading behaviors and market reactions. A neutral sentiment suggests that while investors recognize the potential of Nvidia's strategy, they remain mindful of the associated risks.

Real-World Scenarios

To illustrate how these dynamics might play out, consider the following scenarios:

Topping Environment: Suppose Nvidia's expansion leads to increased competition, causing a deterioration in market breadth even as indices remain high. In this scenario, MarketVibe's metrics might show a high CWI and declining % Above 50-DMA, signaling caution.

Bull Market Leg: If Nvidia's strategy results in robust growth and innovation, we might see a surge in % Above 50-DMA, indicating strong market health. Traders could interpret this as a sign to increase exposure, provided their setups align.

Volatility Spike: Should Nvidia's actions introduce uncertainty, we might observe a spike in ATR%, reflecting increased market volatility. This would prompt traders to reassess risk exposure and consider defensive strategies.

How to Use This Insight in a Process

To effectively incorporate these insights into a trading process, consider the following guidelines:

- Risk Management: When market breadth is weak and CWI is high, emphasize defensive strategies and reduce new risk exposures.

- Opportunistic Exposure: When breadth and leadership broaden, be open to adding exposure, but ensure that your setups are robust.

- Dashboard Utilization: Use the Market Dashboard as a high-level regime label, then delve into internals for confirmation and deeper insights.

Common Misuses & Misconceptions

Traders often misuse metrics like the CWI by:

- Treating it as a Stand-Alone Signal: It's crucial to use the CWI in conjunction with other indicators, not as a sole decision-making tool.

- Ignoring Context: Consider sector rotations and broader market conditions when interpreting metrics.

- Overreacting to Daily Changes: Focus on trends rather than day-to-day fluctuations to avoid knee-jerk reactions.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Charts