The Impact of BOJ's Rate Hike on Global Markets

The Bank of Japan's (BOJ) recent decision to hike interest rates marks a significant shift in global economic dynamics. As traders and investors, understanding the implications of such a move is crucial for navigating the complex landscape of global markets. This article will explore how the BOJ's rate hike impacts global investments, with a particular focus on MarketVibe's Crash Warning Index (CWI) and other key metrics that can help traders make informed decisions.

Current Economic Landscape

The BOJ's rate hike comes at a time when global markets are already grappling with various economic challenges. The current Crash Warning Index (CWI) reading of 6.21 indicates elevated risk levels, suggesting that traders should be cautious about potential market corrections. The CWI is a composite metric that incorporates several risk dimensions, including market breadth, volatility, and defensive behavior. A reading above 6 typically signals heightened risk, prompting traders to consider defensive strategies.

In contrast, the Bank of England is expected to cut interest rates, which could further complicate the global economic picture. Such divergent monetary policies highlight the importance of closely monitoring global central bank actions and their potential ripple effects on markets.

Impact on Global Investments

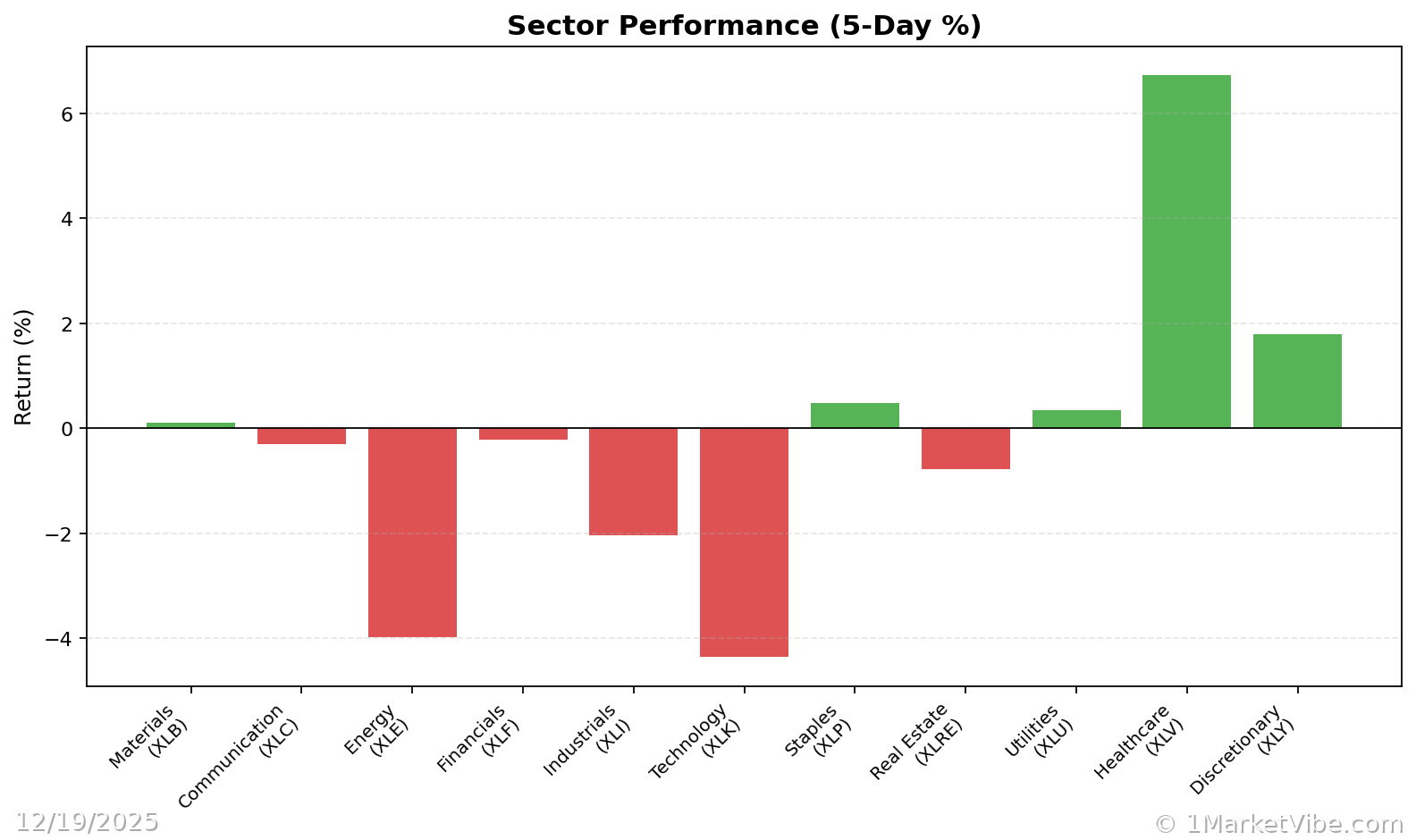

The BOJ's rate hike is likely to influence investment strategies across the globe. Historically, higher interest rates in Japan have led to shifts in capital flows, as investors seek higher returns in other markets. This could result in increased volatility and changes in sector performance.

Sectors Most Likely to be Affected

- Financials: Banks and financial institutions may benefit from higher interest rates, as they can charge more for loans.

- Exporters: Japanese exporters might face challenges due to a stronger yen, which could make their products less competitive abroad.

- Emerging Markets: These markets could experience capital outflows as investors seek safer, higher-yielding assets.

CWI Trends and Predictions

The correlation between the BOJ's rate hike and CWI trends is significant. As the CWI remains above 6, it suggests that the market is in a high-risk regime. Traders should be aware that this level of the CWI often precedes market corrections or increased volatility. The predictive capability of the CWI, with its 4-6 week early warning feature, can be a valuable tool for anticipating market shifts.

Market Sentiment Analysis

Despite the BOJ's rate hike, market sentiment remains relatively neutral. This could be due to a combination of factors, including expectations of further monetary policy adjustments by other central banks. However, traders should remain vigilant, as sentiment can quickly shift in response to new economic data or geopolitical events.

Comparative Analysis with Fed Actions

Drawing parallels with recent Federal Reserve rate decisions, we can see how central bank actions collectively shape market expectations. The Fed's decisions often have a significant impact on global markets, and the BOJ's actions are no exception. Understanding these dynamics can help traders anticipate potential market movements and adjust their strategies accordingly.

Risks and Considerations

The BOJ's rate hike introduces several risks that traders should consider:

- Currency Volatility: The yen's value may fluctuate significantly, affecting international trade and investment.

- Economic Uncertainty: Divergent monetary policies among major economies can lead to uncertainty and increased market volatility.

- Sector Rotation: Investors may rotate out of certain sectors in response to changing economic conditions.

Conclusion

The BOJ's rate hike is a pivotal event with far-reaching implications for global markets. By monitoring key metrics like the CWI and understanding the broader economic context, traders can make more informed decisions. It's essential to remain cautious and adapt strategies to the evolving market environment.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

DISCLAIMER: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a financial advisor before making investment decisions.