Waymo's $100 Billion Valuation and Its Impact on Autonomous Vehicles

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Introduction

The autonomous vehicle industry is witnessing a significant milestone as Waymo, Alphabet's self-driving car division, eyes a valuation of $100 billion. This development is not just a testament to the growing confidence in autonomous technologies, but it also has the potential to reshape the landscape of the entire sector. For traders and investors, understanding the implications of this valuation surge is crucial for navigating the evolving market dynamics.

Current Valuation Landscape

Waymo's pursuit of a $100 billion valuation highlights the increasing investor interest in autonomous vehicles. This valuation is a reflection of both the technological advancements and the strategic positioning of Waymo in the market. Traders should care about this because such a valuation can influence market sentiment, sector performance, and investment flows within the technology and automotive sectors.

Funding Talks and Expansion Plans

Waymo is reportedly in talks to raise funds at this elevated valuation, with plans to expand its operations into major cities like London and New York. This expansion is indicative of the company's growth strategy and its confidence in the scalability of its technology. For traders, this means potential shifts in market leadership and sector rotation, which can be monitored using MarketVibe's Sector Scores to identify emerging opportunities.

Market Impact

The impact of Waymo's valuation on the autonomous vehicle market can be analyzed through several MarketVibe metrics:

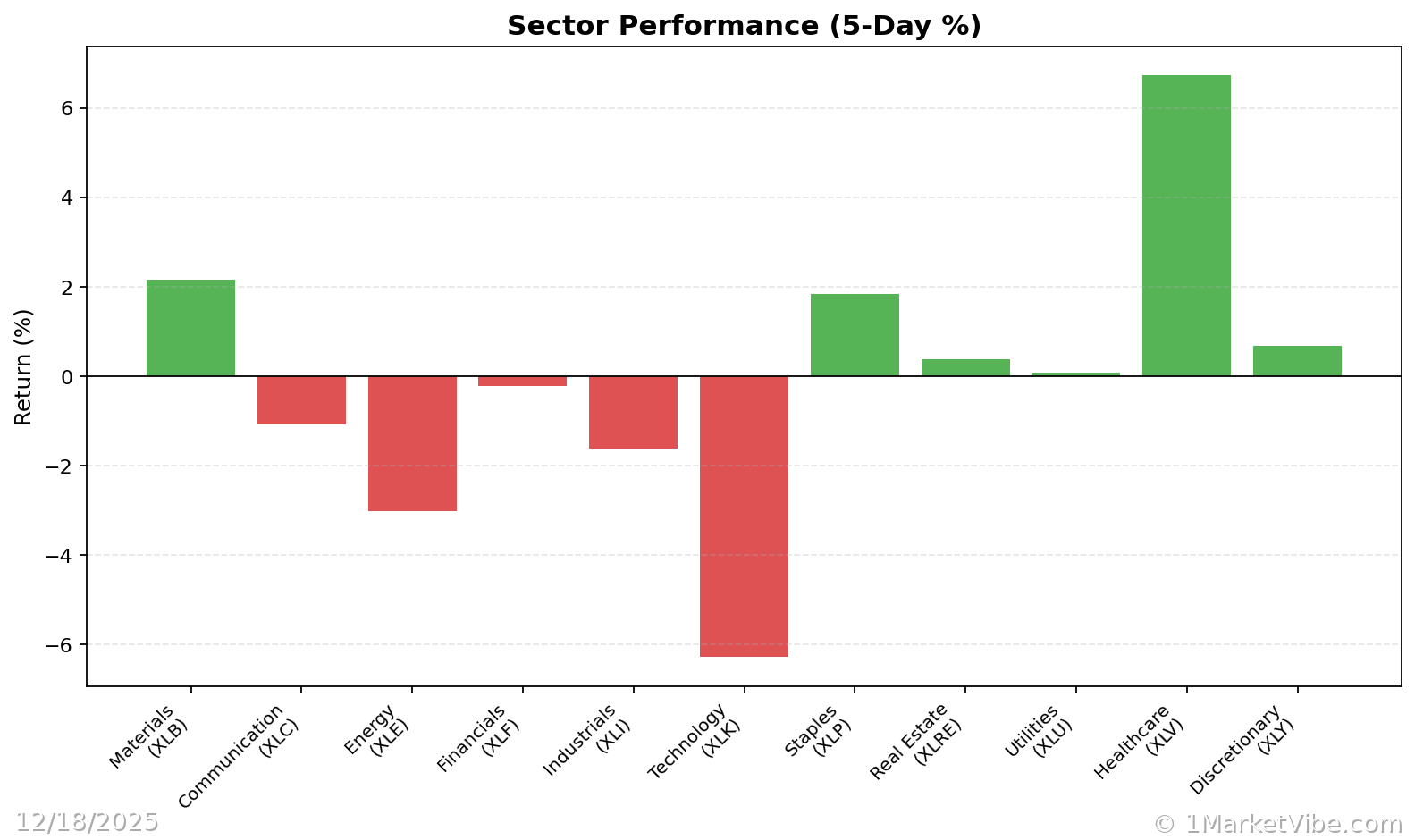

% Above 50-DMA: This metric measures the percentage of stocks trading above their 50-day moving average, providing insights into the trend health of the market. A surge in Waymo's valuation could lead to increased investor interest in the autonomous vehicle sector, potentially lifting the % Above 50-DMA for related stocks.

A/D Net: This indicator gauges the internal strength of the market by comparing advancing and declining stocks. A positive shift in sentiment due to Waymo's valuation could result in a higher A/D Net, signaling broader market participation.

- NH–NL (New High–New Low): The expansion of Waymo's operations might lead to an increase in new highs within the sector, suggesting a bullish momentum.

Investor Considerations

Investors should consider the broader implications of Waymo's valuation on their portfolios. Here are some practical guidelines:

Monitor Breadth and Volatility: Use the Decision Edge Dashboard to assess market breadth and volatility. If the % Above 50-DMA and A/D Net are strong, it may indicate a favorable environment for risk-taking in the autonomous vehicle sector.

Adjust Risk Exposure: If the Crash Warning Index (CWI) is elevated, indicating heightened risk, it might be prudent to reduce exposure to high-beta stocks within the sector.

Sector Rotation: Keep an eye on Sector Scores to identify shifts in leadership. If autonomous vehicles gain momentum, consider reallocating resources to capitalize on this trend.

Real-World Scenarios

Scenario 1: Bullish Momentum

Imagine a scenario where Waymo's valuation boost leads to a surge in investor interest across the autonomous vehicle sector. The % Above 50-DMA rises to 70%, indicating a strong trend, while the A/D Net shows a positive balance. Traders might feel tempted to increase exposure aggressively. However, a more informed approach would involve monitoring the CWI for any signs of elevated risk before making significant portfolio adjustments.

Scenario 2: Volatility Spike

In another scenario, Waymo's expansion plans face regulatory hurdles, leading to increased market volatility. The ATR% (Average True Range as a percentage of price) spikes, reflecting heightened uncertainty. Traders might panic and reduce positions indiscriminately. Instead, using MarketVibe's insights, they could focus on defensive sectors or employ hedging strategies to mitigate risk.

Scenario 3: Sector Rotation

Finally, consider a scenario where the autonomous vehicle sector begins to outperform, as indicated by rising Sector Scores. Traders might initially overlook this shift due to a focus on traditional automotive stocks. By leveraging MarketVibe's tools, they can identify this rotation early and adjust their portfolios to capture emerging opportunities.

How to Use This Insight in a Process

To effectively incorporate these insights into your trading process:

Emphasize Defense When Necessary: When breadth is weak and the CWI is high, prioritize defensive strategies and limit new risk exposure.

Be Open to Opportunities: When breadth and leadership broaden, consider increasing exposure, provided your setups align with market conditions.

Use the Market Dashboard: Leverage the Market Dashboard for a high-level view of market regimes, then delve into internals for confirmation.

Common Misuses & Misconceptions

Traders often misuse market metrics by:

Treating Metrics as Stand-Alone Signals: Avoid relying solely on one indicator for entry or exit decisions. Instead, use a combination of metrics for a comprehensive view.

Ignoring Context: Consider the broader market environment, including sector rotation and macroeconomic factors, before making decisions.

Overreacting to One-Day Changes: Focus on trends and sustained movements rather than reacting to daily fluctuations.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult with a financial advisor before making any investment decisions.

Charts