Gold Surge Indicates Market Shift Insights from CW Index

- Authors

- Name

- MarketVibe Team

- @1marketvibe

Gold Surge Indicates Market Shift: Insights from the Crash Warning Index

Orientation – What Are We Explaining?

In this article, we delve into the Crash Warning Index (CWI) and its implications in the context of a recent surge in gold prices. The CWI is a composite metric that assesses market risk by integrating several dimensions, including breadth, volatility, and defensive behavior. Traders should pay attention to the CWI because it helps inform decisions about risk management and portfolio adjustments. By understanding the CWI, traders can reduce blind spots related to market shifts and enhance their structured decision-making process.

How It Works – Mechanics & Data

The Crash Warning Index (CWI) is constructed by analyzing multiple market indicators that collectively signal the level of risk in the market. These indicators include:

- Market Breadth: Evaluates the percentage of stocks above their 50-day moving average, indicating the health of the trend.

- Volatility: Measured by the Average True Range (ATR%) relative to price, indicating market stability or instability.

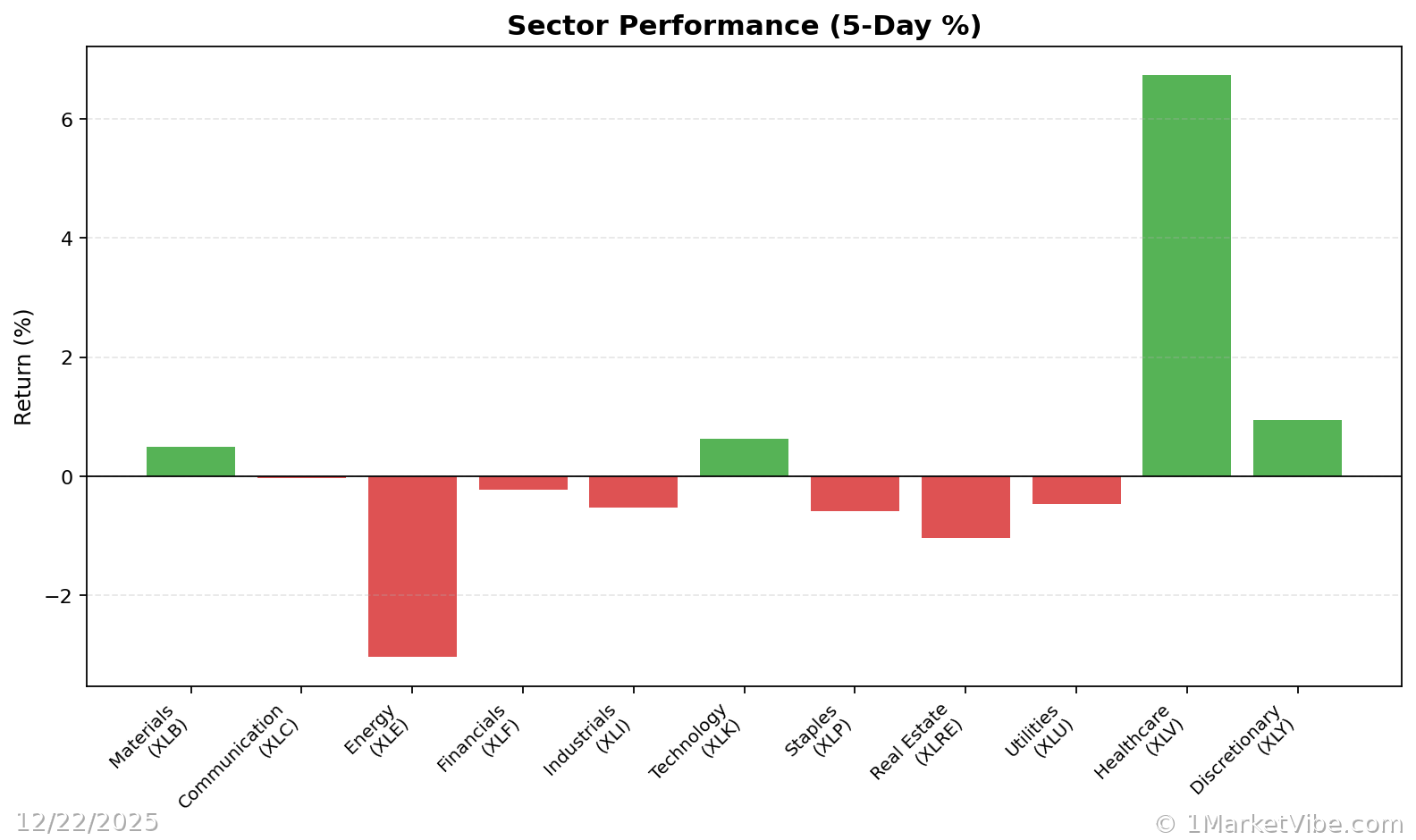

- Defensive Behavior: Observed through the performance of defensive sectors like utilities and consumer staples.

The CWI aggregates these factors to provide a single risk score. A higher CWI suggests elevated risk, while a lower score indicates a more stable market environment. Daily movements in the CWI are influenced by changes in these underlying indicators, such as shifts in market breadth or spikes in volatility.

Interpretation – What Different Levels Tend to Mean

CWI Ranges and Implications:

- Below 3: Generally indicates a stable market with low risk of correction. Traders might consider maintaining or increasing exposure.

- Between 3 and 6: Suggests a moderate level of risk. Caution is advised, and traders should monitor market conditions closely.

- Above 6: Signals high risk, often preceding market corrections. Defensive strategies and risk reduction are recommended.

Common Combinations:

- Strong Breadth + Low Volatility: Typically seen in healthy, trending markets.

- Weak Breadth + Rising Volatility: Often a precursor to market corrections or increased risk.

- Defensive Sectors Leading: Indicates a shift towards risk aversion, especially when CWI is elevated.

Real-World Scenarios – How This Shows Up in Markets

Topping Environment: The market index continues to rise, but breadth deteriorates as fewer stocks participate in the rally. The CWI may rise above 6, signaling increased risk. Traders might feel tempted to chase the rally, but a more informed view would suggest caution and potential profit-taking.

Strong Bull Leg: A surge in the percentage of stocks above their 50-day moving average, coupled with low ATR%, indicates a robust market trend. The CWI remains low, supporting increased exposure. Traders should focus on identifying strong setups to capitalize on the trend.

Volatility Spike: A sudden increase in ATR% and a rising CWI suggest heightened market instability. Traders might panic and sell indiscriminately, but a strategic approach would involve reassessing risk exposure and considering hedging strategies.

How to Use This Insight in a Process

- When Breadth is Weak and CWI is High: Emphasize defensive strategies, reduce new risk, and consider hedging existing positions.

- When Breadth and Leadership Broaden Out: Be open to adding exposure, provided your setups align with the broader market trend.

- Use the Market Dashboard: As a high-level regime label, then verify with internal metrics like the CWI for confirmation.

Common Misuses & Misconceptions

Treating CWI as a Stand-Alone Signal: The CWI should not be used in isolation for entry or exit decisions. Instead, integrate it with other market indicators and your overall strategy.

Ignoring Context: Failing to consider sector rotation or broader economic conditions can lead to misinterpretation of the CWI. Always contextualize the index within the current market environment.

- Overreacting to One-Day Changes: The CWI is more valuable as a trend indicator rather than reacting to daily fluctuations. Focus on sustained movements over several days.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Market conditions can change rapidly, and past performance is not indicative of future results.