Kraft Heinz Sale and Its Market Implications

The recent announcement of a potential sale of Kraft Heinz shares by Warren Buffett's successor at Berkshire Hathaway has captured the attention of traders and investors alike. This move could signal a shift in market confidence and potentially trigger broader market reactions. In this article, we'll explore the implications of this sale through the lens of MarketVibe's metrics, helping traders understand the underlying market dynamics and how to incorporate these insights into their trading processes.

Background on Kraft Heinz

Kraft Heinz, a major player in the food and beverage industry, has been a significant investment for Berkshire Hathaway. With 325 million shares, Berkshire's stake represents a substantial portion of the company's equity. Recently, Kraft Heinz has faced challenges, including changing consumer preferences and increased competition, which have affected its market performance.

Significance of the Sale

The potential sale of Kraft Heinz shares by Berkshire Hathaway could have several implications:

- Market Reactions: Such a large-scale divestiture might lead to increased volatility in Kraft Heinz's stock price and potentially affect the broader market, especially if it signals a lack of confidence in the company's future prospects.

- Investor Confidence: The sale could influence investor sentiment, as Berkshire Hathaway's actions are often seen as a barometer for market confidence.

- Market Stability: Depending on how the market interprets this move, it could either stabilize or destabilize market conditions.

Market Context

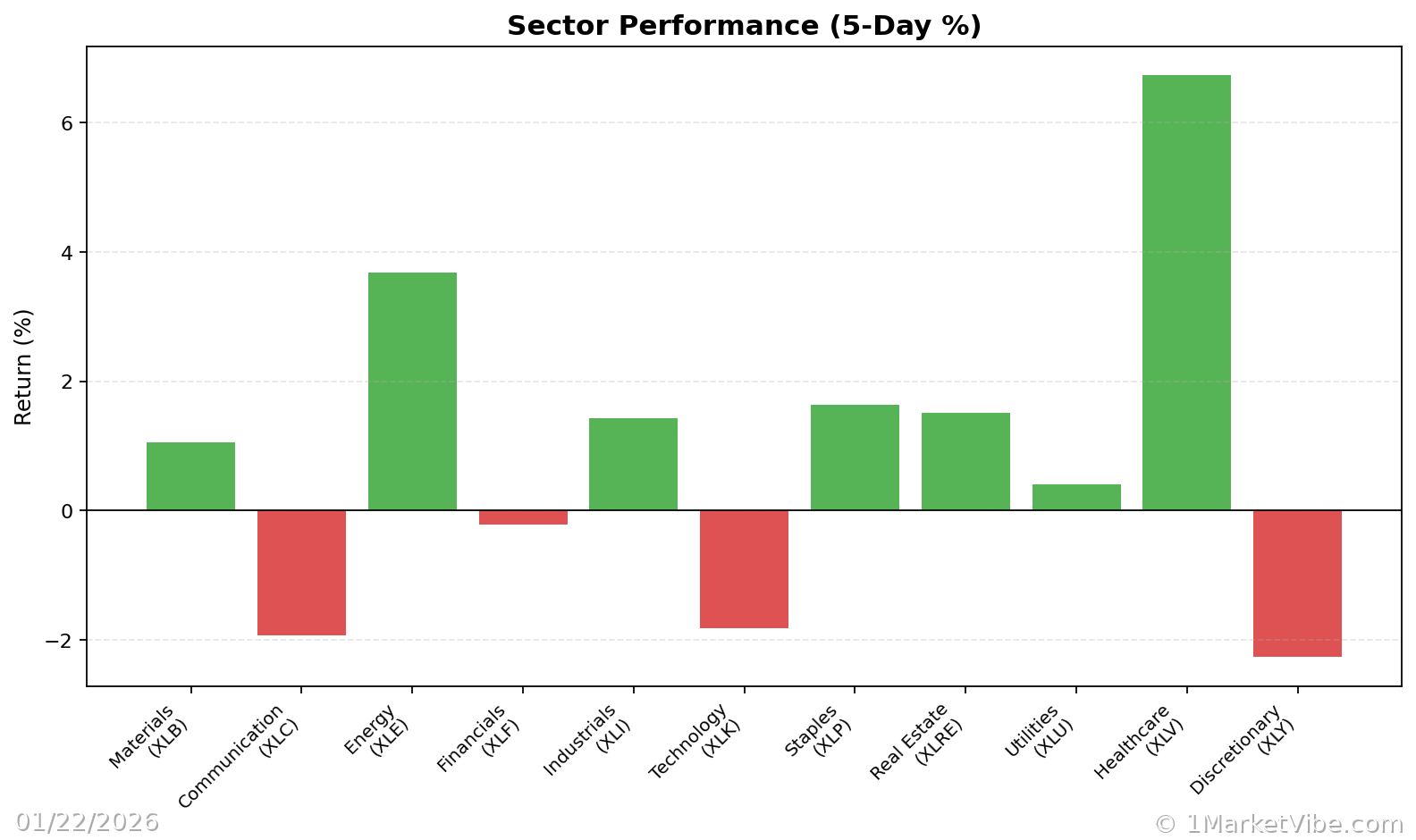

To understand the broader market implications, we need to consider recent trends in major indices like the S&P 500 and global debt markets. The S&P 500 has shown resilience, with futures advancing despite volatility in global debt markets. This context is crucial for interpreting the potential impact of the Kraft Heinz sale.

Analysis of CW Index Signals

The Crash Warning Index (CWI) is a composite metric that assesses market risk by considering factors such as breadth, volatility, and defensive behavior. Currently, the CWI stands at 5.4, indicating elevated risk but not yet at extreme levels. Historically, a CWI reading above 6 has been associated with increased likelihood of market corrections.

Why Traders Should Care: The CWI provides early warning signals about potential market downturns, allowing traders to adjust their risk exposure accordingly. It helps reduce blind spots by offering a structured view of market risk.

Potential Risks

Large-scale divestitures like the Kraft Heinz sale can introduce several risks:

- Market Volatility: The sale could lead to short-term price fluctuations, affecting not only Kraft Heinz but also related sectors.

- Investor Sentiment: A significant move by a major investor like Berkshire Hathaway might influence broader market sentiment, potentially leading to increased caution among investors.

Real-World Scenarios

Scenario 1: Topping Environment

Imagine a scenario where the broader market indices continue to rise, but the % Above 50-DMA metric shows declining breadth. This could indicate a topping environment, where fewer stocks are participating in the rally. In such a case, the CWI might also rise, signaling increased risk. Traders might feel tempted to chase the rally, but a more informed view would suggest caution and a focus on risk management.

Scenario 2: Strong Bull Leg

In a strong bull market, the % Above 50-DMA might surge and remain elevated, indicating robust market breadth. If this is accompanied by a low CWI, it suggests a healthy market environment. Traders could consider increasing exposure, provided their setups align with the broader market trend.

Scenario 3: Volatility Spike

A sudden increase in ATR% could indicate a volatility spike, often seen during market corrections or significant news events. If the CWI also accelerates, it suggests heightened risk. Traders might consider reducing exposure or employing hedging strategies to protect their portfolios.

How to Use This Insight in a Process

To effectively incorporate these insights into your trading process, consider the following guidelines:

- Risk Management: When breadth is weak and the CWI is high, emphasize defense and reduce new risk. This approach helps protect your portfolio during uncertain times.

- Exposure Adjustment: When breadth and leadership broaden out, be open to adding exposure if your setups align with the market trend. This strategy allows you to capitalize on favorable market conditions.

- Use Market Dashboard: Leverage the Market Dashboard as a high-level regime label, then check internals for confirmation. This structured approach helps refine your risk posture and expectations.

Common Misuses & Misconceptions

Traders often misuse or over-trust market metrics. Here are some common pitfalls and healthier alternatives:

- Stand-Alone Signal Misuse: Treating metrics like the CWI as stand-alone entry signals can lead to poor decisions. Instead, use them as part of a broader risk assessment framework.

- Ignoring Context: Failing to consider sector rotation or time frame can skew interpretations. Always contextualize metrics within the current market environment.

- Overreacting to One-Day Changes: Reacting to daily fluctuations can lead to unnecessary trading. Focus on trends and sustained signals for more reliable insights.

To see these breadth and risk metrics in one place each day, you can use the Decision Edge dashboard at 1marketvibe.com.

DISCLAIMER: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consult with a financial advisor before making investment decisions.